ID: PMRREP3251| 210 Pages | 12 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

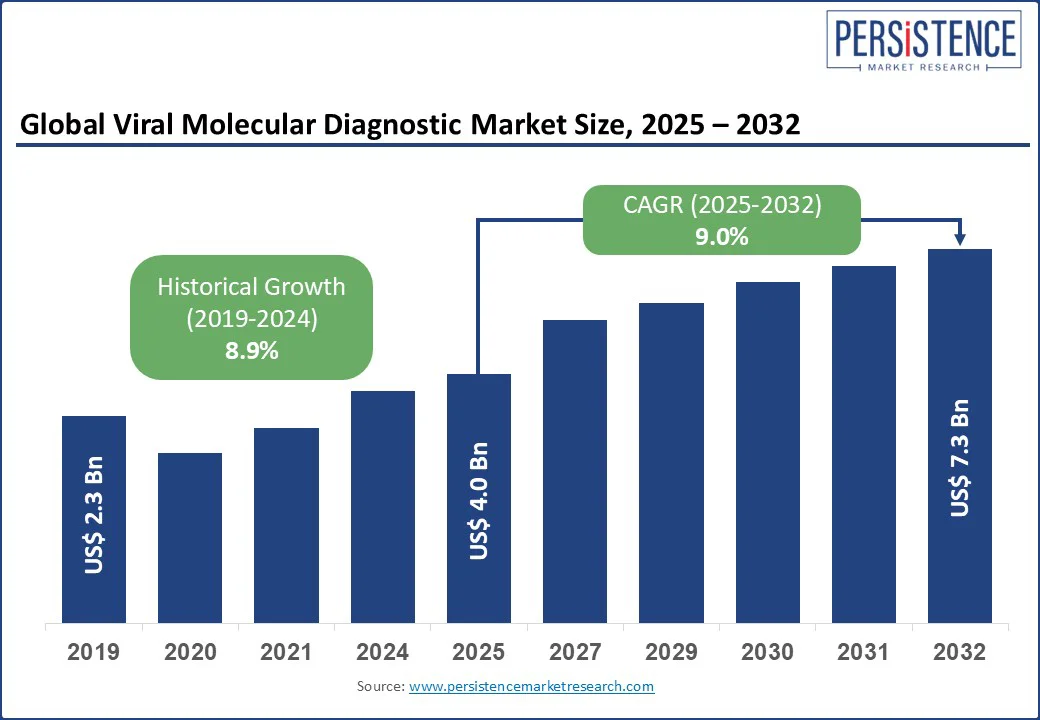

The global viral molecular diagnostic market size is likely to be valued US$ 4.0 Bn in 2025 and projected to US$ 7.3 Bn in 2032, at a CAGR of 9.0% during the forecast period 2025-2032.

Market driven by demand for PCR-based pathogen detection and viral nucleic acid amplification test (NAAT) adoption. The viral molecular diagnostic market is rapidly growing due to the proliferation of technologies such as real-time PCR, viral genome sequencing, and CRISPR-based molecular diagnostics that are transforming, and offers a rapid yet precise solutions for viral pathogen detection.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Viral Molecular Diagnostic Market Size (2025E) |

US$ 4.0 Bn |

|

Market Value Forecast (2032F) |

US$ 7.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.9% |

The Viral Molecular Diagnostic Market is driven by the increasing global burden of viral infections, such as COVID-19, influenza, hepatitis B and C, and HIV. The World Health Organization (WHO) reports over 1.5 million new hepatitis C cases annually, boosting demand for hepatitis B and C RNA testing and PCR-based pathogen detection. The molecular diagnostics for COVID-19 and influenza have seen significant adoption, with global testing volumes exceeding 2 billion tests during the pandemic.

Technological advancements in real-time PCR, next-generation sequencing (NGS), and isothermal nucleic acid amplification technology (INAAT) enhance diagnostic accuracy and speed. For instance, CRISPR-based molecular diagnostics achieve a 95% sensitivity rate for SARS-CoV-2 detection, while the real-time PCR market is expected to grow fastest. Government investments, such as the U.S.’s US$ 10 billion allocation for COVID-19 testing infrastructure in 2021, further drive viral nucleic acid amplification test (NAAT) adoption.

The high cost of PCR test and NGS platforms, with some instruments priced above US$500,000, limits accessibility in low-resource settings. Stringent regulations for CE-IVD and FDA-approved viral assays increase development timelines and costs, posing barriers to market entry. Additionally, the shortage of skilled professionals for viral genome sequencing and isothermal amplification restricts adoption in developing regions. Without sufficient human resources and technical training infrastructure, even the most advanced tools remain underutilized. Together, these factors slow the global expansion of viral molecular diagnostic solutions, especially in underserved markets.

The rise of CRISPR-based molecular diagnostics and isothermal amplification offers opportunities for cost-effective, rapid testing solutions, projected to capture a 10% market share by 2032. Expanding healthcare infrastructure in Asia Pacific and Latin America drives demand for molecular virology test kits and diagnostic reagents and kits.

The integration of artificial intelligence in software and services enhances diagnostic efficiency, creating new growth avenues. AI-driven analytics support clinical decision-making, reduce errors, and streamline laboratory workflows, especially in high-volume settings. Collectively, these advancements position the industry for significant expansion and innovation in the coming years.

The sector is segmented into Instruments, Reagents and Kits, and Software and Services. Reagents and Kits lead with a 55% market share in 2025, driven by their recurring use in PCR-based pathogen detection and viral nucleic acid amplification test (NAAT) adoption. Their versatility in laboratory-based molecular testing ensures dominance.

Software and Services are the fastest-growing segment, fueled by advancements in diagnostic analytics and integration with real-time PCR market platforms. These tools enhance data interpretation, automate result analysis, and improve diagnostic accuracy, enabling faster clinical decision-making. Cloud-based platforms and AI-powered algorithms further streamline workflows in high-throughput labs, reducing manual errors and turnaround time.

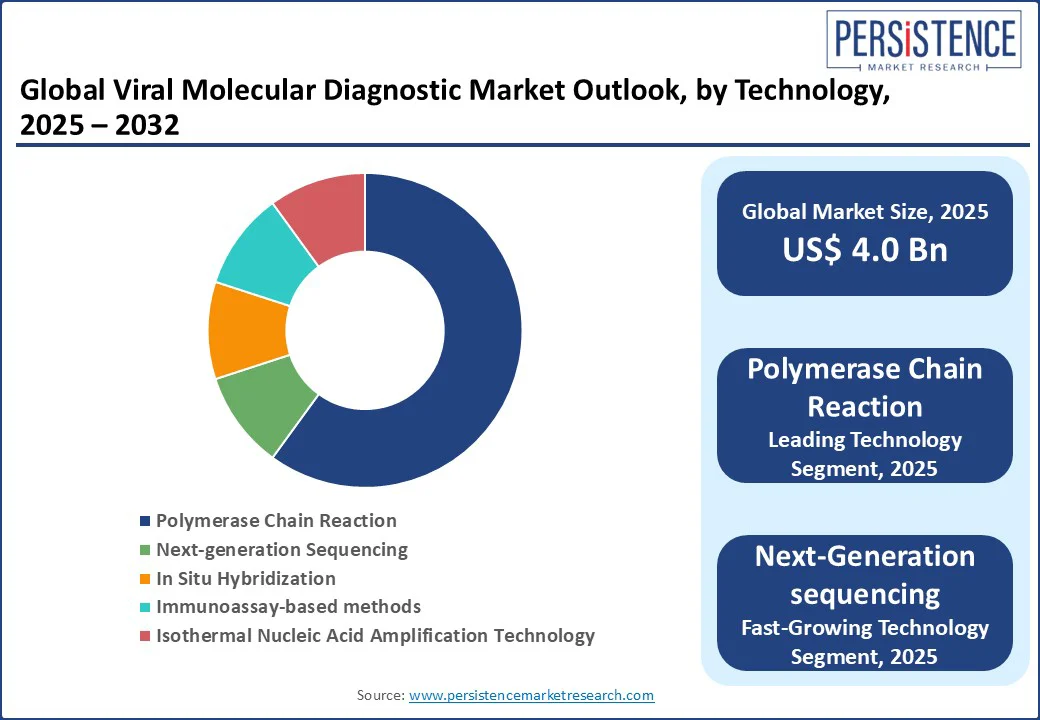

Polymerase Chain Reaction (PCR), particularly RT-PCR, holds a 60% market share in 2025 due to its reliability in molecular diagnostics for COVID-19 and influenza and hepatitis B and C RNA testing. Its ability to deliver accurate results rapidly makes it the gold standard for clinical diagnostics, supporting its continued dominance across both developed and emerging healthcare systems.

Next-Generation Sequencing (NGS) is the fastest-growing technology, driven by its application in viral genome sequencing and genetic viral testing for personalized medicine. NGS enables precise identification of viral mutations, strain variations, and resistance markers, making it invaluable in outbreak tracking and tailored therapeutic strategies. Its expanding use in chronic infections and emerging viral threats enhances clinical decision-making.

Infectious Diseases Diagnosis dominates with a 45% market share, supported by global demand for PCR-based pathogen detection and pathogen surveillance. The surge in testing for diseases such as COVID-19, influenza, HIV, and hepatitis has highlighted the importance of molecular tools in early diagnosis and containment. Increasing investments in global pathogen surveillance programs and public health initiatives continue to fuel demand for reliable diagnostic technologies in this segment.

Oncology is the fastest-growing application, driven by NGS applications in detecting viral-related cancers, such as HPV-associated cervical cancer. This technology supports early detection, risk assessment, and personalized treatment strategies. As awareness of virus-induced malignancies grows and precision oncology advances, demand for viral diagnostic tools in cancer screening and management continues to rise rapidly.

Hospitals lead with a 40% market share, serving as primary centers for laboratory-based molecular testing and point-of-care (POC) settings. They conduct high-throughput PCR and NGS testing for a wide range of conditions, including respiratory and blood-borne viruses. The integration of rapid molecular platforms in emergency and outpatient settings further strengthens hospitals' central role in diagnostic service delivery.

Point-of-Care (POC) Settings are the fastest-growing segment, driven by demand for rapid viral pathogen detection in decentralized healthcare settings. Portable molecular platforms using isothermal amplification or CRISPR-based technologies are increasingly adopted for their ease of use, speed, and minimal infrastructure requirements. The growing focus on early intervention, infectious disease control, and pandemic preparedness accelerates POC adoption globally.

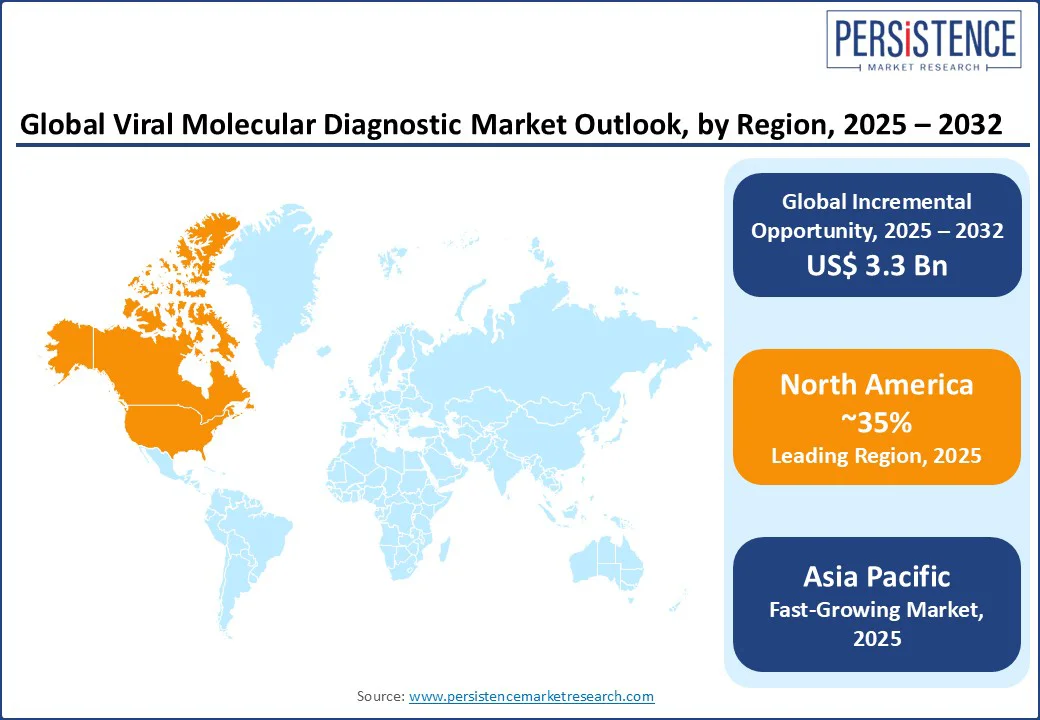

North America holds a 35% market share in 2025, with the U.S. leading due to its advanced healthcare infrastructure and high adoption of molecular diagnostics for COVID-19 and influenza. The U.S. real-time PCR market is supported by government funding for pathogen surveillance and blood screening. The demand for CE-IVD and FDA-approved viral assays ensures regulatory compliance, while CRISPR-based molecular diagnostics gain traction in research settings. Consumer interest in rapid diagnostics and genetic viral testing drives market growth. Adoption of rapid point-of-care molecular platforms (e.g., Abbott ID NOW, Cepheid GeneXpert) is accelerating, especially for decentralized testing across urgent care clinics, pharmacies, and remote settings.

Europe accounts for a 30% market share, led by the United Kingdom, Germany, and France. The region benefits from stringent regulations and collaborations between governments and private enterprises, fostering innovation in viral genome sequencing. Germany’s investment in NGS for genetic viral testing. These efforts enable early detection of viral mutations and resistance patterns, crucial for managing outbreaks and chronic infections such as hepatitis and HIV. The 2024 EU AI Act and investments in diagnostic infrastructure enhance the adoption of molecular virology test kits.

Asia Pacific is the fastest-growing region holds the 25% market share, driven by China and India. India’s expanding healthcare infrastructure and China’s focus on pathogen surveillance and hepatitis B and C RNA testing boost viral nucleic acid amplification test (NAAT) adoption. India’s diagnostic market is projected to double by 2035, supported by government initiatives and private investments. In Southeast Asia, countries such as Thailand and Vietnam are adopting PCR-based pathogen detection to address rising viral infection rates. Support from international health organizations and regional collaborations further enhances diagnostic capabilities. Together, these developments make Asia Pacific a critical hub for future growth in viral molecular diagnostics.

The Viral Molecular Diagnostic Market is highly competitive, with key players focusing on innovation, partnerships, and market expansion. Companies such as Abbott, Roche, and Thermo Fisher Scientific dominate through extensive portfolios in diagnostic reagents and kits and real-time PCR market solutions. Regional players and new entrants are leveraging isothermal amplification and CRISPR-based molecular diagnostics to gain market share. The rise of AI-integrated diagnostics adds a new layer of competition.

The viral molecular diagnostic market is projected to reach US$ 4.0 Bn in 2025.

Rising viral infection rates, advancements in real-time PCR and NGS, and government investments in pathogen surveillance are key drivers.

The viral molecular diagnostic market is expected to grow at a CAGR of 9.0% from 2025 to 2032.

CRISPR-based molecular diagnostics, expansion in emerging markets, and AI integration in software and services offer significant growth opportunities.

Abbott, Roche, Thermo Fisher Scientific, Qiagen, Bio-Rad Laboratories, Cepheid, Gen-Probe, and Becton, Dickinson and Company are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Technology

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author