ID: PMRREP35453| 142 Pages | 27 Jun 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

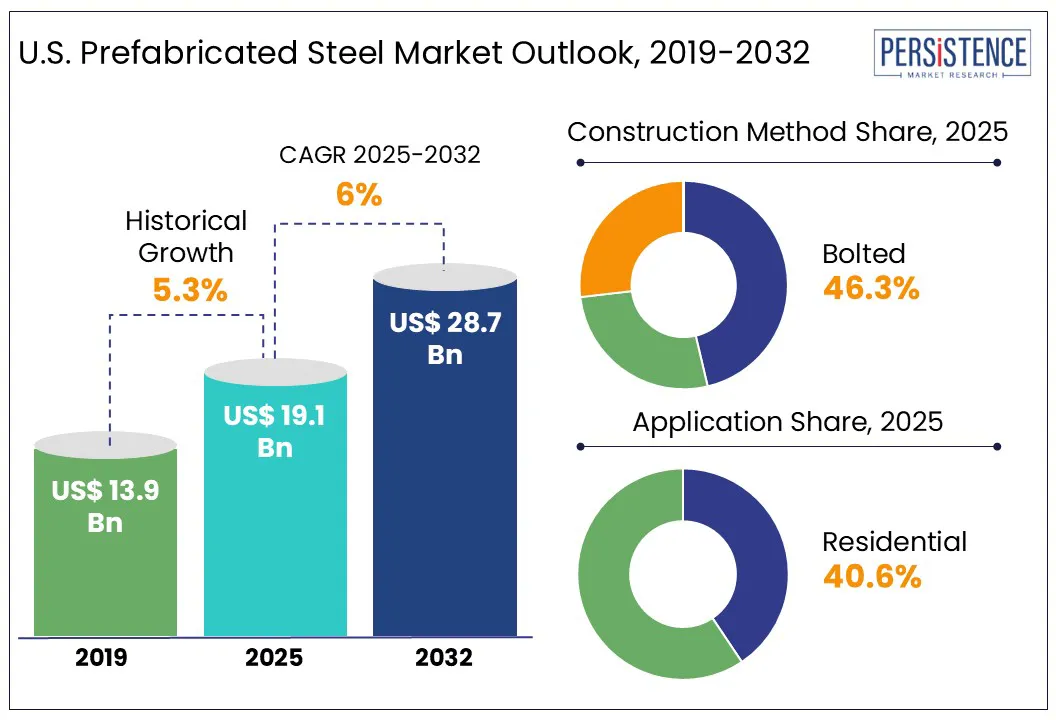

The U.S. prefabricated steel market size is likely to be valued at US$ 19.1 Bn in 2025 and is expected to reach US$ 28.7 Bn in 2032, growing at a CAGR of 6.0% in the forecast period between 2025 and 2032, reveals Persistence Market Research.

Prefabricated steel has rapidly evolved into a foundation of modern construction in the U.S. As developers race to meet rising demands for speed, sustainability, and seismic resilience, steel-framed prefab systems are quietly transforming skylines across the country. This shift is not just about quick builds, but it also reflects a deep rethinking of how buildings are designed, assembled, and optimized for performance. The U.S. prefabricated steel market is entering a new era where bolted efficiency and recyclable materials converge to redefine the limits of construction.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

U.S. Prefabricated Steel Market Size (2025E) |

US$19.1 Bn |

|

Market Value Forecast (2032F) |

US$28.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.3% |

The modular construction boom is boosting the U.S. prefabricated steel market growth owing to the material’s compatibility with off-site fabrication, structural flexibility, and rapid assembly benefits. Steel has emerged as a go-to material for load-bearing frames, floor systems, and roof trusses as more developers adopt modular approaches to reduce build times. Unlike concrete or wood, steel can be precision-cut and welded in factory conditions, which is associated with modular production lines aiming to produce stackable or relocatable units.

A key driver is the housing crisis in urban centers such as New York and Los Angeles, where modular steel structures are enabling quick deployment of affordable housing and transitional shelters. Apart from that, the expansion of healthcare and education facilities post-COVID has spurred the use of modular steel buildings. Temporary isolation units, vaccination centers, and classroom blocks are increasingly being built with steel modules due to their adaptability and compliance with seismic, hygiene, and fire standards.

Corrosion and fading remain key concerns that are limiting the widespread adoption of prefabricated steel in specific U.S. areas and applications. In coastal areas such as parts of California and Louisiana, high salinity and humidity accelerate corrosion, resulting in structural deterioration and costly maintenance. Despite protective coatings and galvanization, failures still occur when exposure levels are extreme or when maintenance is inconsistent.

Color fading is another hindrance, specifically in commercial or civic projects where aesthetics play an important role. A few sunbelt regions, including Nevada, experience intense UV exposure, which is anticipated to degrade painted or powder-coated steel finishes over time. This fading not only impacts visual appeal but also affects reflectivity and thermal performance in buildings using reflective coatings as part of energy efficiency strategies.

Increasing demand for green construction materials in the U.S. is creating lucrative opportunities for prefabricated steel. This is mainly because of its high recyclability, minimal site waste, and compatibility with energy-efficient building systems. Steel is one of the most recycled materials in the country as more than 90% of structural steel in U.S. buildings is made from recycled content, finds the American Institute of Steel Construction. This inherently sustainable property makes it attractive to developers aiming for LEED certification or compliance with state-level green building mandates.

Prefabricated steel also helps businesses comply with low-carbon construction goals as much of the fabrication occurs in controlled environments. Hence, it helps in reducing emissions, construction debris, and site disturbances from heavy machinery. Leading companies are leveraging these benefits to deliver steel-framed modular buildings that meet strict environmental standards. Their systems often incorporate integrated mechanical, electrical, and plumbing components that are pre-installed, enhancing both construction and energy performance outcomes.

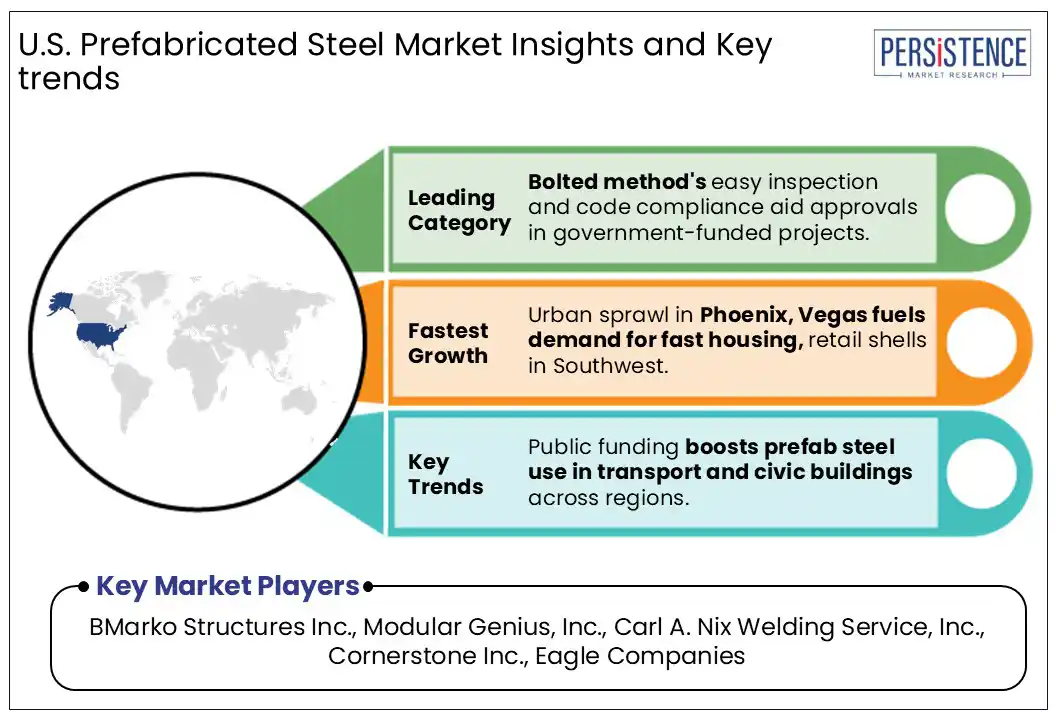

In terms of construction method, the market is trifurcated into bolted, welded, and modular. Among these, the bolted segment will likely account for approximately 46.3% of share in 2025 because of its superior on-site efficiency, adaptability for phased or modular project execution, and reduced labor intensity. Bolted connections allow steel structures to be assembled quickly with minimal welding, which is valuable in sectors where time-to-completion directly impacts profitability. Various Target and Costco warehouse expansions, for example, rely on bolted steel frameworks to complete projects within fixed retail roll-out cycles.

The welded construction method is poised to exhibit a steady growth rate through 2032 due to its structural continuity, high load-bearing capacity, and design flexibility in high-rise applications. Welding creates monolithic joints that are better suited for buildings subjected to dynamic loads such as wind-sensitive towers or urban mid-rises. One of the most significant advantages of welded prefabrication is the ability to create custom geometries and smooth architectural elements, thereby driving demand.

Based on application, the market is bifurcated into residential and non-residential. Out of these, the residential segment is predicted to hold about 40.6% of the U.S. prefabricated steel market share in 2025 amid shifting housing preferences and surging demand for resilient structures in disaster-prone areas. Homebuyers and developers are drawn to steel for its resistance to termites, mold, and fire, properties relevant in wildfire-prone areas. In addition, the emergence of Accessory Dwelling Units (ADUs) in Washington and Oregon, where state policies have been relaxed to address housing shortages, is creating new avenues.

The non-residential segment, on the other hand, is expected to witness a decent CAGR from 2025 to 2032 owing to the rising demand across warehousing, data centers, and institutional buildings. Government-funded infrastructure under the Infrastructure Investment and Jobs Act is further creating opportunities for prefabricated steel in transit stations, maintenance facilities, and utility buildings. These projects often face tight federal or municipal deadlines, where the predictability and efficiency of steel framing provide clear advantages.

The Southwest is seeing high demand for prefabricated steel structures, backed by investments in renewable energy and logistics infrastructure as well as rapid industrial growth. States, including New Mexico, Arizona, and Texas, are at the forefront due to their pro-business regulatory environment and availability of land. In Texas alone, the rise in warehouse construction to support e-commerce has significantly increased the uptake of prefabricated steel buildings. Amazon’s fulfillment centers in El Paso and San Antonio, for instance, have incorporated steel-based modular components to expedite construction timelines.

The zone’s solar and wind energy boom is also a key market driver. Prefabricated steel structures are extensively used for housing turbines, inverters, and maintenance equipment in large-scale renewable projects, mainly in southeastern New Mexico and West Texas. In addition, desert climates and seismic considerations in Arizona and New Mexico have encouraged the use of steel due to its durability and fire resistance. The expansion of semiconductor manufacturing in Arizona has also created high demand for prefabricated steel units in auxiliary buildings and warehousing.

The Southeast is primarily spurred by the booming manufacturing sector, infrastructure development, and population influx across Alabama, North Carolina, Florida, and Georgia. The zone is home to various automotive and aerospace clusters, with prefabricated steel buildings being favored for their cost-effectiveness in constructing production and assembly facilities. Florida’s vulnerability to hurricanes and humid climate has further made steel a preferred material over wood.

Steel’s resilience to mold, termites, and wind uplift gives it an edge, leading to a noticeable increase in demand for prefabricated commercial and municipal buildings in the state. Florida’s fast-growing data center market is pushing the adoption of modular steel structures owing to their requirement for secure, scalable shells with tight construction schedules. In North Carolina and Alabama, prefabricated steel is heavily used in agricultural and food processing infrastructure. The Southeast’s proximity to ports such as Savannah and Charleston also supports quick delivery of steel components from both domestic and imported sources.

The Midwest has long been a stronghold for prefabricated steel structures, backed by its deep-rooted manufacturing legacy and expansive agricultural economy. Iowa, Indiana, Illinois, and Ohio are experiencing high demand for steel buildings, particularly in warehousing, food processing, and agribusiness. In Iowa and Nebraska, prefabricated steel barns and grain storage buildings are a staple across large-scale farms. As per a 2023 online study, more than 40% of new farm storage facilities in the Corn Belt were steel based due to their high durability.

Midwest’s role in re-shoring of manufacturing is further augmenting demand for quickly deployable industrial spaces. In cold states such as Wisconsin and Minnesota, the thermal efficiency of insulated steel panels is an important draw, particularly for distribution centers and municipal buildings. Facilities are often designed with snow-shedding roof profiles and thermal breaks to handle sub-zero winters, making steel ideal for long-term maintenance savings. Also, regional fabricators in Chicago and Milwaukee are capitalizing on localized production to compete with national players, providing custom engineering for mid-sized clients.

The U.S. prefabricated steel market consists of several established manufacturers, regional players, and specialized firms that cater to niche sectors. Renowned companies hold significant share due to their vertically integrated operations, novel fabrication capabilities, and strong distribution networks. They often differentiate themselves through proprietary design systems, customizable offerings, and integrated project support, including design, engineering, and erection services. The surge of modular construction and demand for quick turnaround building solutions has further intensified competition. Key players are increasingly investing in automation to reduce lead times and improve precision.

The market is projected to reach US$ 19.1 Bn in 2025.

Increasing demand for energy-efficient buildings and rising emphasis of builders on housing cost reduction are the key market drivers.

The market is poised to witness a CAGR of 6.0% from 2025 to 2032.

Surging preference for termite-proof homes and increasing use of hybrid construction models are the key market opportunities.

BMarko Structures Inc., Modular Genius, Inc., and Carl A. Nix Welding Service, Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Construction Method

By Grade

By Application

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author