ID: PMRREP35661| 186 Pages | 25 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

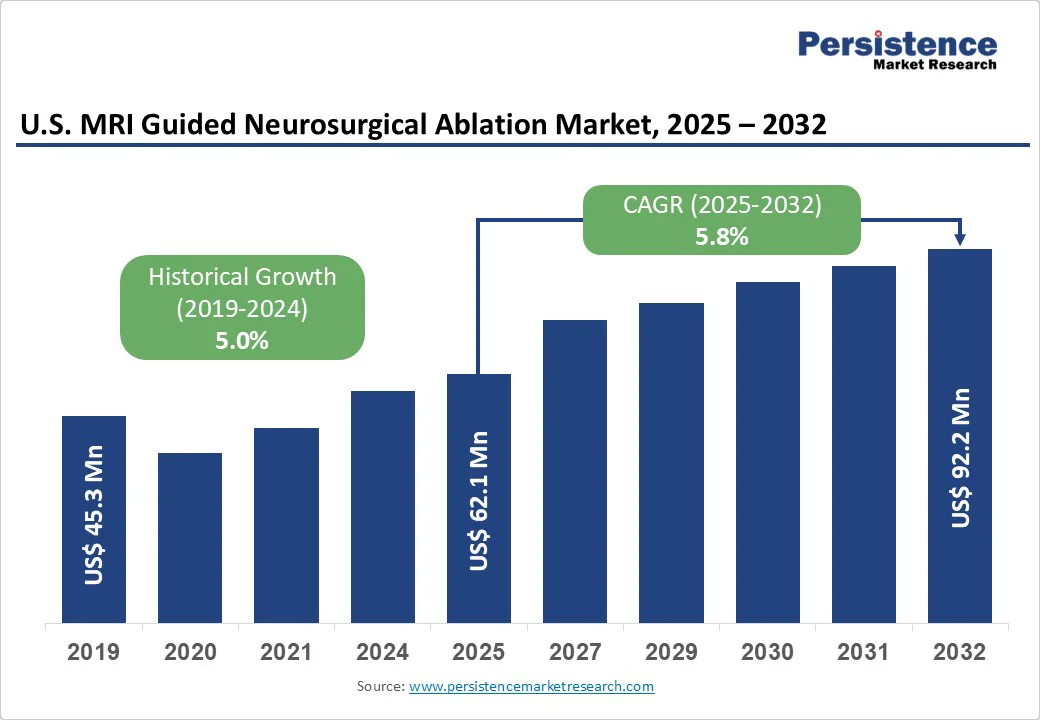

The U.S. MRI guided neurosurgical ablation market is likely to value at US$ 62.1 Mn in 2025 and reach US$ 92.2 Mn by 2032 growing at a CAGR of 5.8% during the forecast period from 2025 to 2032.

The U.S. MRI-guided neurosurgical ablation market is driven by rising cases of brain tumors, epilepsy, and movement disorders, alongside demand for minimally invasive procedures with real-time MRI precision. FDA clearances, aging population, and advanced laser and focused ultrasound systems supports growth. AI integration, portable MRI-compatible devices, and clinical training programs are key trends shaping adoption across hospitals and neurosurgical centers.

| U.S. MRI Guided Neurosurgical Ablation Market Attribute | Key Insights |

|---|---|

| U.S. MRI Guided Neurosurgical Ablation Market Size (2025E) | US$ 62.1 Mn |

| Market Value Forecast (2032F) | US$ 92.2 Mn |

| Projected Growth (CAGR 2025 to 2032) | 5.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.0% |

In the U.S., brain and other central nervous system (CNS) tumors occur at an overall age-adjusted annual incidence rate of ≈ 25.34 per 100,000 people for both malignant and non-malignant tumors (2020-2024); non-malignant cases make up the majority. That translates into tens of thousands of new diagnoses each year, i.e., ~24,820 new malignant brain and spinal cord tumors are estimated in 2026.

At the same time, epilepsy affects about 1.1% of U.S. adults, roughly 2.9 million people with “active epilepsy” (having seizures in the past year or ongoing treatment), who are stable but represent a persistent, sizable patient pool.

Because both brain tumors and drug-resistant or active epilepsy often require precise targeting in sensitive brain areas, MRI-guided ablation (laser, focused ultrasound) becomes highly relevant. The large and stable prevalence of epilepsy, plus the consistent incidence of brain tumors, ensures a continuing demand for minimally invasive, MRI-guided neurosurgical treatment options.

Installing and operating MRI-guided neurosurgical ablation technologies, such as high-field MRI suites for laser interstitial thermal therapy (LITT) or focused ultrasound, is very capital-intensive. For example, building an MRI suite including equipment and infrastructure often costs $3-5 million. A single high-field MRI scanner alone may cost between US$1 and US$3 million or more, plus additional costs for installation, shielding, cooling, and facility modifications.

Beyond capital costs, the per-procedure cost of LITT is substantial: a study of MRgLITT for epilepsy estimated total procedure costs (disposables, hospitalization, imaging, physician fees) with median values around $21,800, with wide variation between approximately. $11,000 and $32,800. These large upfront and operational expenditures restrict adoption to large hospitals or specialized centers, making access and scalability more difficult, especially in smaller or rural facilities with tighter capital budgets.

The insurance policy updates and regulatory approvals have been improving access to MRI-guided neurosurgical ablation procedures. In 2021, Health Care Service Corporation (HCSC), a major insurer, began covering Laser Interstitial Thermal Therapy (LITT) for epilepsy and brain tumors for ~16 million members in states including Texas, Illinois, Oklahoma, New Mexico, and Montana.

Medicare has also broadened state-level coverage. MR-guided focused ultrasound (MRgFUS) for essential tremor is now covered by Medicare in 16 U.S. states, with positive draft Local Coverage Determinations proposed in dozens more. Blue Cross Blue Shield of North Carolina and other private payers also updated policies to cover MRgLITT for neurological indications.

FDA clearance already exists for systems like Visualase™, giving neurosurgeons a minimally invasive option for treating epileptic foci and brain tumors.

Together, these developments reduce financial barriers and signal to providers and patients that these technologies are increasingly accepted within payor networks, thus supporting wider adoption in the U.S.

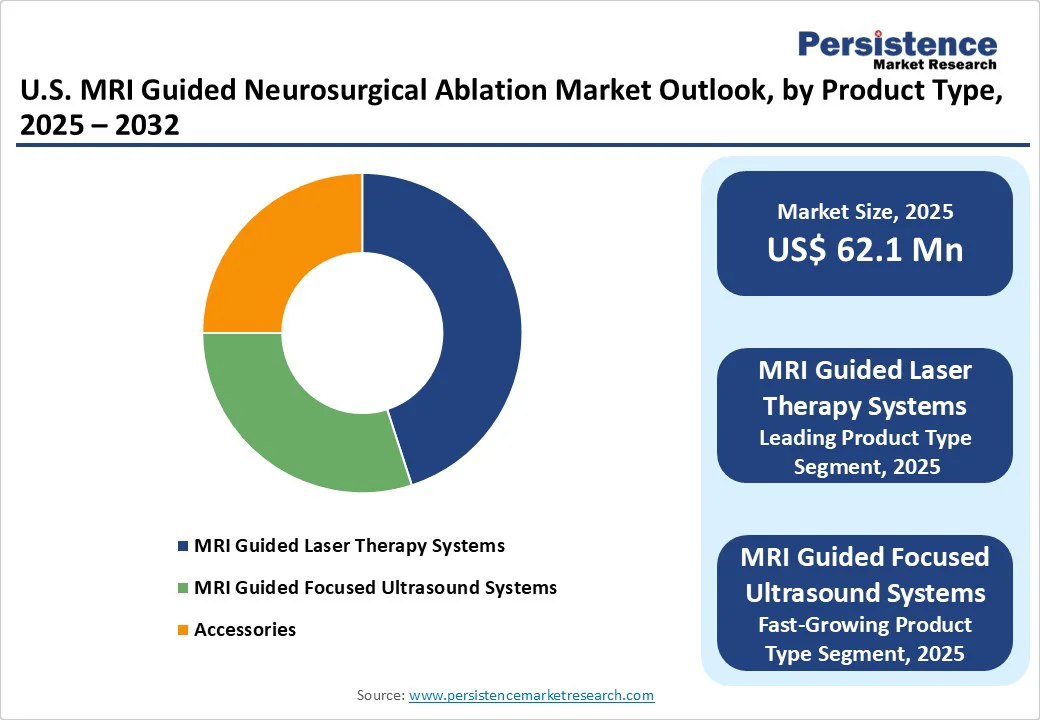

MRI guided laser therapy systems lead the market with approximately 45.6% share in 2025. MRI-guided laser therapy has established primacy because it is FDA-cleared for indications like ablating epileptic foci, brain tumors, and radiation necrosis, and has accumulated strong clinical usage over time.

According to Medtronic, over 11,000 neurosurgical laser ablation procedures have been performed globally, with more than 110 centers in the U.S. offering the Visualase™ system.

Clinically, outcomes are favorable: in an 11-center U.S. study of 234 patients who underwent MRI-guided laser ablation for epilepsy, researchers refined targeting strategies and demonstrated seizure control comparable to more invasive surgeries but with less collateral damage.

These factors, such as regulatory clearance, insurance coverage, procedural volume, and robust clinical outcomes, combined to make MRI-guided laser therapy the leading product type in this market.

Brain and CNS tumors have a substantial incidence and burden in the U.S., making them the leading indication for MRI-guided ablation. According to CBTRUS data for 2017-2021, the average annual age-adjusted incidence rate (AAAIR) for all primary malignant and non-malignant brain and other CNS tumors was 25.34 per 100,000 population.

In 2025, the American Cancer Society estimates ~ 24,820 new malignant brain/spinal cord tumors will be diagnosed (excluding benign tumors), with ~18,330 deaths.

Brain tumors lead the market because they represent a high-need clinical area where traditional open surgery often poses significant risks. Many tumors are located deep in the brain or close to eloquent regions, making complete resection difficult without causing neurological deficits.

MRI-guided laser ablation offers a minimally invasive alternative, allowing surgeons to precisely target and destroy tumor tissue while preserving surrounding healthy structures. Patients also benefit from shorter recovery times and fewer complications.

The U.S. MRI guided neurosurgical ablation market is competitive, led by players such as Medtronic, Insightec, Monteris Medical, Philips, and Siemens Healthineers.

These companies focus on system precision, real-time MRI guidance, integration with surgical workflows, and advanced laser or focused ultrasound technologies, while emerging players emphasize affordability, compact MRI-compatible solutions, AI-assisted treatment planning, and improved safety features to cater to hospitals, academic centers, and specialty neurosurgical clinics, targeting both oncology and neurological disorder applications.

The U.S. MRI Guided Neurosurgical Ablation Market is projected to value at US$ 62.1 Mn in 2025.

Rising brain tumor and epilepsy prevalence, minimally invasive procedures, FDA approvals, AI integration, and advanced laser and focused ultrasound technologies.

The U.S. market is poised to witness a CAGR of 5.8% between 2025 and 2032.

Growing insurance coverage, regulatory approvals, AI-assisted planning, portable MRI-compatible systems, expanding hospital adoption, and rising demand for minimally invasive neurosurgical procedures.

Major players in the U.S. are Medtronic plc, Monteris Medical, Insightec, Philips Healthcare, GE Healthcare, Siemens Healthineers and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Indication

By End-user

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author