ID: PMRREP33187| 187 Pages | 10 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

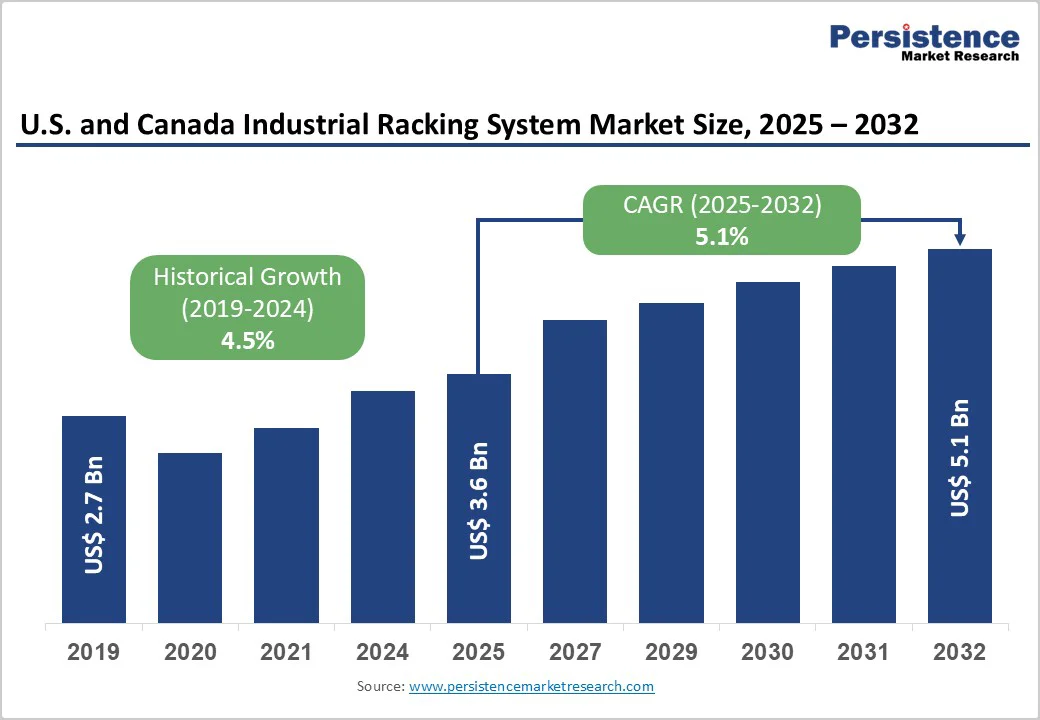

The U.S. and Canada industrial racking system market size is likely to value at US$ 3.6 Billion in 2025 and is projected to reach US$ 5.1 billion by 2032, growing at a CAGR of 5.1% between 2025 and 2032. This trajectory is underpinned by the accelerating expansion of e-commerce fulfilment infrastructure, with the global B2B eCommerce market demonstrating a robust 14.5% CAGR from 2017 to 2026, reaching $36,163 billion in projected GMV.

North America accounts for 13.7% of this global B2B eCommerce GMV, translating to substantial warehouse storage demand across distribution networks. The surge in online retail has fundamentally transformed warehousing requirements, as e-commerce operations demand 75% more storage capacity than traditional retail models to accommodate rapid inventory turnover and multi-channel fulfilment strategies.

| Key Insights | Details |

|---|---|

|

Industrial Racking System Market Size (2025E) |

US$ 3.6 Bn |

|

Market Value Forecast (2032F) |

US$ 5.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.5% |

The United States manufacturing sector announced 244,000 new jobs in 2024 through combined reshoring and foreign direct investment (FDI) activities, reflecting a strategic pivot toward domestic production capacity.

Since 2010, more than 2 million manufacturing jobs have been announced as U.S. companies and foreign investors relocate production closer to American customers, with 1.7 million positions already filled. This reshoring momentum has intensified across multiple industrial sectors, with transportation equipment manufacturing showing 139% growth in early 2025 compared to 2024 levels, driven by pending automotive tariffs that are shifting entire assembly operations domestically rather than solely importing components.

Food and beverage manufacturing expanded by 25%, medical equipment by 39%, and plastics and rubber by 126% during the same period, each requiring expanded warehouse storage infrastructure to support localised supply chains.

The high-tech industries account for 88% of 2024 reshoring jobs, rising to 90% in early 2025, particularly concentrated in computer and electronics, electrical equipment, including EV batteries and solar components, and transportation sectors.

This manufacturing renaissance necessitates sophisticated industrial racking systems capable of handling diverse product dimensions, weights ranging from medium-duty (0.25-1 ton) to heavy-duty (2-4 tons) classifications, and rapid inventory cycling to support just-in-time production methodologies that minimise working capital tied up in excessive stock holdings.

Canada's e-commerce market reached US$89.4 billion in 2024 and is projected to grow to approximately US$104 billion by 2029, while online retail now accounts for 6.1% of total Canadian retail sales as of December 2024.

The United States mirrors this trajectory, with e-commerce sales projected at $843.15 billion in 2021, representing a 14.3% year-over-year increase. Consumer expectations have fundamentally shifted toward same-day and next-day delivery standards, with 80% of American consumers now expecting same-day delivery options as of 2024, and 30% demanding these services at zero cost. To meet these demanding timelines, major logistics operators have dramatically expanded their distribution footprints. Amazon operates same-day service across more than 120 metropolitan areas, supported by an estate exceeding 624 million square feet distributed across roughly 2,500 facilities.

Walmart has responded by opening five automated fresh-food hubs, each processing twice the volume of conventional distribution buildings through advanced material handling systems and high-density storage configurations.

Rising land prices in urban centres have encouraged the development of multistory facilities, exemplified by Chicago's pioneering 1.2 million square foot vertical warehouse, requiring specialised racking systems engineered to support multi-level floor loadings and integrate with automated vertical transport mechanisms, including freight elevators and goods lifts.

The U.S. cold storage market is valued at US$ 39.6 billion in 2025 and is expected to reach US$ 91.4 billion, growing at a CAGR of 12.7% by 2032. This rapid growth is driven by shifting consumer preferences toward fresh, healthy, and locally sourced food products, including meal kits, organic produce, and dairy items requiring precise temperature control throughout the distribution chain.

Online grocery penetration is projected to account for 21.5% of total U.S. grocery sales by 2025, prompting retailers and logistics providers to retrofit or construct micro-fulfilment hubs in urban cores to shorten last-mile delivery times for perishable goods.

The pharmaceutical sector further supports expansion, with the pharmaceutical 3PL market expected to nearly double over the next decade due to rising demand for speciality therapeutics, personalised medicines, and biologics requiring strict temperature control. Cold storage facilities increasingly rely on compact industrial racking systems, such as drive-in, drive-through, push-back, and mobile racking, to maximise storage density, optimise energy efficiency, and reduce operational costs in temperature-controlled warehouses.

The deployment of advanced industrial racking systems, particularly automated and mobile configurations, requires substantial upfront capital expenditures that can create significant financial barriers for small to mid-sized warehouse operators.

Automated storage and retrieval systems (ASRS) integration with existing warehouse infrastructure demands careful planning, potential operational downtime during installation phases, and specialised technical expertise that may not be readily available in secondary markets or rural distribution centres.

Mobile racking systems, while offering up to 85% increase in storage capacity within existing footprints, necessitate precision floor preparation, including reinforced concrete slabs capable of supporting concentrated loads, installation of electromechanical rail systems, and integration with warehouse management software platforms, collectively representing investments that extend payback periods beyond 18-24 months in many applications.

Cold storage racking requires specialised materials, including galvanised or stainless-steel components resistant to corrosion in high-humidity, low-temperature environments, commanding premium pricing compared to standard warehouse racking installations.

The North America warehouse automation market has generated significant revenue in 2024. This rapid adoption of automation creates substantial opportunities for industrial racking manufacturers to develop systems specifically engineered for seamless integration with autonomous mobile robots (AMRs), automated guided vehicles (AGVs), robotic picking arms, and conveyor networks.

Modern racking configurations increasingly incorporate IoT sensors for real-time inventory tracking, RFID integration for automated stock counting, and smart lighting controls that activate only when aisles are accessed, reducing energy consumption by 30-40% in some applications.

Daifuku North America invested $35 million in 2024 to double U.S. production capacity, targeting growing automation demand amid labour shortages and Industry 4.0 transformation. The development of modular, reconfigurable racking systems allows warehouses to adapt storage layouts dynamically as product mix, order profiles, and fulfilment strategies evolve, addressing the critical need for operational flexibility in omnichannel distribution environments serving both B2B wholesale customers and direct-to-consumer e-commerce channels through unified inventory pools.

The 3PL segment in North America is expected to generate significant high-value revenue by 2032, driven largely by e-commerce, which now accounts for a major share of many 3PL operators’ business portfolios.

Businesses are increasingly outsourcing warehousing and distribution operations to specialised logistics providers to reduce capital expenditure, converting fixed asset investments into operational expenses while gaining access to advanced warehouse technologies and expansive geographic distribution networks. This structural shift creates strong demand for scalable and standardised industrial racking systems that 3PL operators can deploy across multiple client accounts within shared warehouse facilities.

Flexible configurations are essential to support diverse product categories, from small-parcel e-commerce fulfilment to full-pallet industrial distribution. The rental and leasing segment of industrial racking systems is among the fastest-growing ownership models, allowing 3PLs and seasonal businesses to access premium racking infrastructure without committing to full purchase, particularly valuable during peak retail seasons or pilot program implementations.

Pharmaceutical 3PL specialisation accelerates, driven by the need to handle speciality therapeutics and personalised medicines. This creates opportunities for racking manufacturers to offer GMP-compliant, temperature-controlled storage solutions integrated with environmental monitoring, automated documentation, and regulatory audit trail capabilities in line with FDA 21 CFR Part 211 and USP <1079> guidelines.

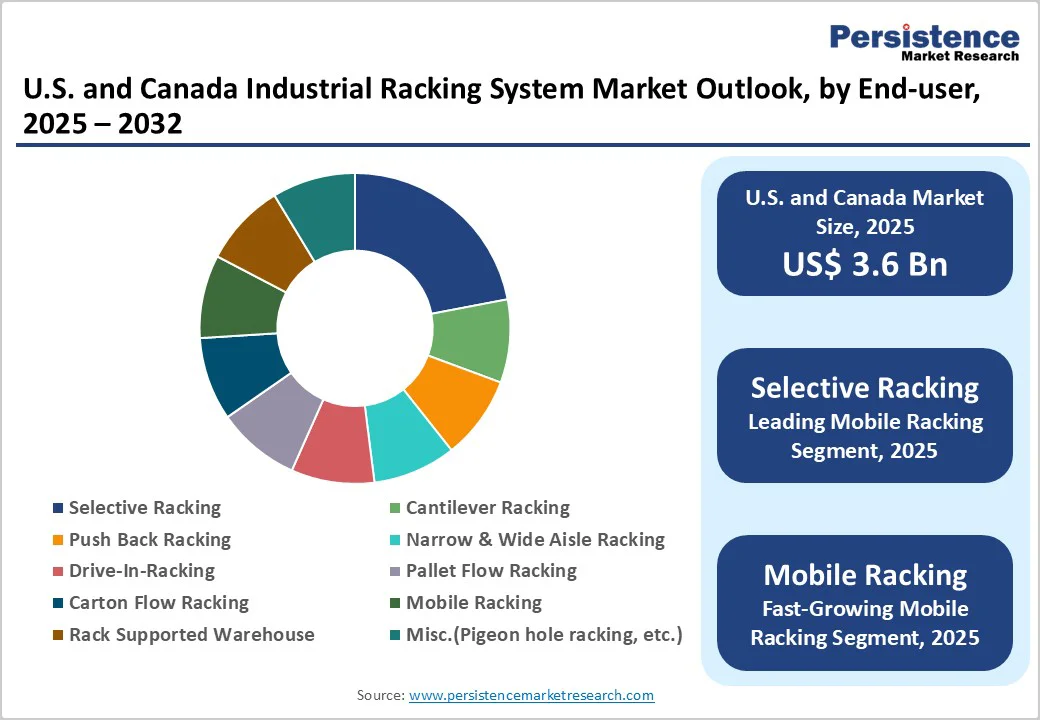

Selective pallet racking maintains market leadership with 23.4% share in 2025, commanding over 60% of the broader North American pallet racking segment according to multiple industry analyses. This dominance stems from selective racking's unparalleled versatility, offering direct access to every stored pallet without requiring specialised material handling equipment or complex inventory management protocols. The system's adjustable beam configurations accommodate diverse pallet dimensions, product weights, and storage heights, allowing warehouse operators to reconfigure layouts as inventory profiles evolve across seasonal demand cycles or client portfolio changes.

Mobile racking systems represent the market's fastest-growing product category, driven by their capacity to increase storage density by 45-85% within existing warehouse footprints while maintaining 100% pallet selectivity. These systems install pallet racks on motorised mobile bases guided by floor-mounted rails, with electronic controls opening access aisles only where and when needed while maintaining the remaining rack rows in compact, space-saving formations.

Medium-duty racking systems, supporting load capacities between 0.25 and 1 ton per pallet position, dominate the market with 75.4% share in 2025, reflecting the predominance of standard pallet configurations throughout North American distribution networks. This capacity range accommodates the majority of consumer-packaged goods, electronics, textiles, and light industrial components moving through e-commerce fulfilment centres, retail distribution operations, and third-party logistics facilities.

The ubiquity of GMA (Grocery Manufacturers Association) standard pallets measuring 48 inches by 40 inches and CPC (Consumer Products Code) pallets aligns with medium-duty beam and upright specifications, enabling warehouse operators to source standardised racking components from multiple manufacturers while maintaining interoperability across facility expansions and storage system modifications.

Medium-duty configurations optimize the balance between structural robustness and material economy, utilising roll-formed steel components that reduce weight and cost compared to heavy-duty structural alternatives while providing adequate safety factors for typical warehouse loading scenarios.

The U.S. flexible packaging industry alone generated $41.5 billion in sales in 2022, representing 21% of the country's $180.3 billion packaging market, with nearly 50% dedicated to food packaging categories predominantly stored on medium-duty racking systems throughout the supply chain from manufacturing through final-mile distribution.

Heavy-duty racking systems supporting 2-4 tons per pallet position represent the fastest-expanding capacity segment, propelled by growth in automotive component warehousing, industrial manufacturing supply chains, and bulk commodity distribution.

Direct ownership remains the predominant acquisition model with 73.4% market share in 2025, reflecting warehouse operators' preferences for long-term asset control, customisation flexibility, and depreciation tax benefits. Owned racking systems enable permanent installation optimised for specific facility characteristics, including floor loading capacities, ceiling clearances, column spacing, and integration with fixed building infrastructure such as sprinkler systems and fire suppression equipment.

The rental and leasing segment represents the fastest-growing sales channel, driven by expanding 3PL operations requiring flexible capacity scaling, seasonal businesses experiencing significant demand fluctuations, and companies testing new fulfilment strategies before committing to permanent infrastructure investments.

Rental models convert substantial upfront capital expenditures into predictable monthly operational expenses, preserving working capital for core business activities while accessing contemporary racking technologies that might otherwise exceed budget constraints.

E-commerce operations represent the leading end-user segment with 21.2% market share in 2025, driven by sustained double-digit growth in online retail adoption across consumer categories. The sector's dominance reflects e-commerce fulfillment's intensive storage requirements, with online operations demanding 3-5 times more warehouse capacity per dollar of sales compared to traditional retail models due to individual item picking, multi-SKU inventory breadth, and returns processing infrastructure.

Amazon's network, exceeding 624 million square feet across 2,500-plus facilities, exemplifies this capacity intensity, with the company continuously expanding its distribution footprint to support same-day and next-day delivery promises across 120-plus metropolitan markets.

Walmart's deployment of five automated fresh-food hubs, each processing twice the conventional building volume through advanced automation and high-density racking configurations, demonstrates how traditional retailers are transforming their supply chain infrastructure to compete in omnichannel environments. E-commerce warehouses typically deploy selective racking for high-velocity, fast-moving SKUs requiring frequent access; push-back or pallet flow systems for medium-velocity inventory supporting batch picking; and drive-in or drive-through racking for slow-moving, seasonal, or promotional items stored at higher densities with reduced accessibility requirements.

The integration of automated picking technologies, including goods-to-person robotic shuttles, autonomous mobile robots (AMRs), and conveyor-based sortation systems, necessitates racking configurations engineered for seamless mechanical interface, featuring standardised dimensional tolerances, electrical conduit routing, and structural reinforcement supporting suspended conveyor installations.

The industrial racking system market in the U.S. and Canada is moderately fragmented, with a mix of large, established manufacturers and smaller regional players catering to diverse end-use industries such as e-commerce, cold storage, and manufacturing. While no single company dominating, several key players maintain a strong presence and brand recognition, driving product innovation and customised solutions. Leading companies in North America include North American Steel, Steel King Industries, Ridg-U-Rak, SSI SCHAEFER, Hannibal Industries, and Frazier Industrial Company.

The market’s fragmented nature encourages competitive pricing, regional specialisation, and technological differentiation, while large players often secure major contracts with e-commerce and 3PL operators. The landscape reflects a balance between established manufacturers and emerging niche suppliers, supporting steady growth in both traditional and automated warehouse solutions.

The U.S. and Canada Industrial Racking System Market is projected to be valued at US$ 3.6 Bn in 2025.

The Selective Racking segment is expected to hold approximately 23.4% market share in 2025, driven by its versatility, cost-effectiveness, and widespread adoption across e-commerce, manufacturing, and 3PL warehouses.

The U.S. and Canada market is poised to witness a CAGR of 5.1% from 2025 to 2032.

The industrial racking system market growth in the U.S. and Canada is driven by reshoring and manufacturing capacity expansion, surging e-commerce infrastructure and last-mile distribution demand, and the rapid expansion of cold chain and temperature-controlled storage sectors requiring specialised, high-density racking solutions tailored for evolving supply chain complexities.

The key market opportunities for the U.S. and Canada Industrial Racking System Market lie in developing automation-compatible, modular, and reconfigurable racking systems; capitalising on the growing third-party logistics (3PL) sector and rental models; expanding specialised cold chain storage solutions; and advancing sustainable, energy-efficient warehouse designs that meet evolving supply chain demands and regulatory standards.

The key market players in the U.S. and Canada Industrial Racking System Market include North American Steel, Steel King Industries, Ridg-U-Rak, SSI SCHAEFER, Hannibal Industries, and Frazier Industrial Company.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Region Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

By Product Type

By Carrying Capacity

By Sales

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author