ID: PMRREP33158| 175 Pages | 10 Dec 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

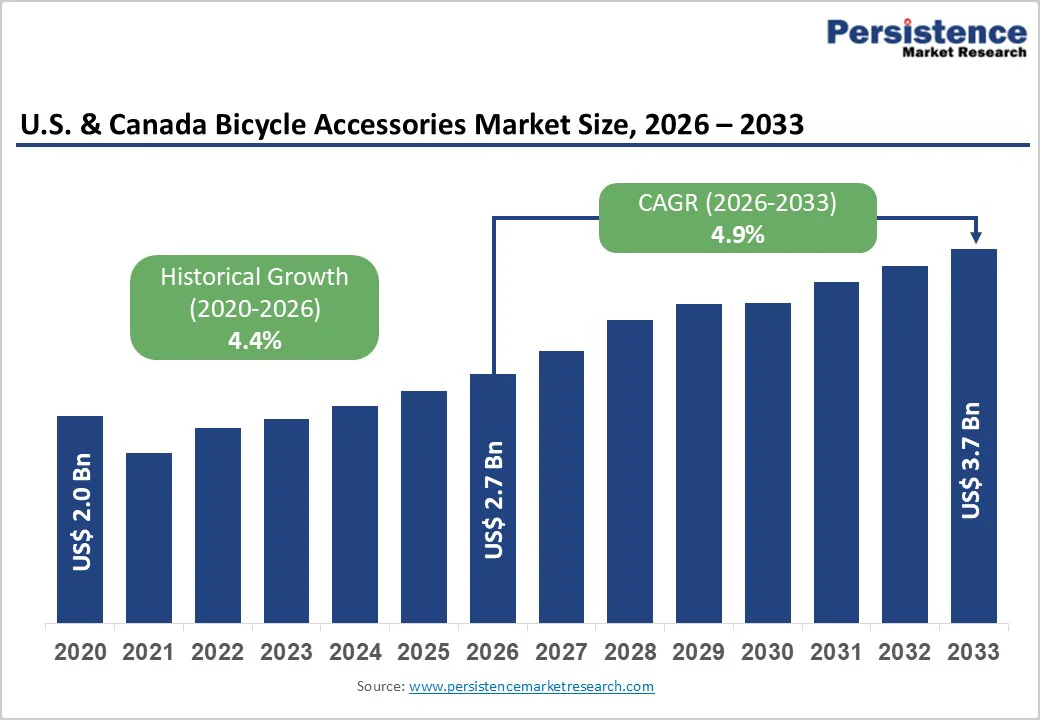

The U.S. & Canada bicycle accessories market size is likely to be valued at US$ 2.7 billion in 2026 and is projected to reach US$ 3.7 billion by 2033, registering a CAGR of 4.9% during the forecast period 2026-2033.

Growth is driven by expanding cycling infrastructure across major U.S. and Canadian cities, encouraging daily commuting and broader bicycle usage. Rising adoption of e-bikes and commuter bicycles, along with increasing consumer focus on fitness, outdoor recreation, and sustainable mobility, is further boosting demand for accessories. Strong e-commerce penetration and rapid product innovation are accelerating purchasing behavior and contributing to the overall market expansion.

| Key Insights | Details |

|---|---|

|

U.S. & Canada Bicycle Accessories Market Size (2026E) |

US$ 2.7 Bn |

|

Market Value Forecast (2033F) |

US$ 3.7 Bn |

|

Projected Growth CAGR(2026-2033) |

4.9% |

|

Historical Market Growth (2020-2025) |

4.4% |

The increasing engagement in fitness and recreational cycling across the U.S. and Canada is emerging as a major driver for the premium bicycle accessories market. In the U.S. alone, roughly 32% of Americans (around 42 million people) reported riding a bicycle in 2023. As more consumers adopt cycling for health improvement, endurance training, weight management, and outdoor recreation, their demand for advanced, specialized, and high-performance accessories continues to rise. Recreational riders often seek enhanced riding comfort, better safety, and improved performance, prompting them to invest in premium helmets with aerodynamic designs, high-luminosity smart lighting systems, GPS cycling computers, performance wearables, and ergonomic saddles. Long-distance riders and fitness enthusiasts also prioritize accessories that offer durability, weather resistance, and real-time ride analytics, pushing the market toward technologically enriched and top-tier products.

The growing participation in events such as community rides, charity cycling marathons, trail adventures, and weekend road tours further fuels repeat purchases and upgrades. The rise of social fitness trends, cycling clubs, influencer-driven training content, and fitness tracking apps has strengthened consumer interest in performance-enhancing gear. As disposable incomes increase and consumers become more willing to spend on quality equipment that elevates their cycling experience, the premium accessories segment is expected to witness sustained growth, making recreational and fitness cycling a key long-term market driver.

The rapid increase in e-bike and commuter bicycle adoption across the U.S. and Canada has become one of the strongest drivers of the bicycle accessories market. E-bikes, in particular, are transforming urban mobility by offering a faster, more convenient, and eco-friendly alternative for daily commuting. As more individuals switch to electric and commuter bicycles for work travel, short-distance trips, and leisure riding, the demand for high-quality accessories has risen sharply. E-bikes require specialized components such as heavy-duty lights, reinforced racks, battery-compatible chargers, motor covers, and advanced braking systems, which significantly expands the aftermarket opportunity.

Commuter cyclists also seek improved safety and comfort, investing in helmets, reflective gear, pannier bags, GPS navigation devices, and anti-theft locks. Moreover, the growing emphasis on sustainable transport and the expansion of dedicated cycling lanes in major cities are motivating people to use bicycles more frequently, increasing wear-and-tear and creating recurring replacement demand. As workplaces promote green commuting and governments support cycling infrastructure, the popularity of e-bikes is expected to continue rising. This shift toward commuter-oriented cycling not only broadens the consumer base but also drives higher accessory spending per rider, making it a major long-term growth driver for the market.

Bicycle safety remains a significant market restraint, with over 1,000 cyclists killed and approximately 46,000 severely injured in the U.S. in 2022, representing a 13% increase in preventable cyclist deaths year-over-year. The U.S. recorded 1,155 bicyclist fatalities in 2023, the highest number ever recorded, with bicycle deaths increasing 15% since 1975. Urban areas account for 83% of all bicycle fatalities, with 51% occurring during darker hours due to poor visibility, emphasizing the critical need for lighting and reflective accessories. However, helmet legislation fragmentation creates market inconsistencies, with only 22 states including the District of Columbia having statewide laws, mostly limited to children under 18, while 49 jurisdictions maintain all-ages laws.

In Canada, helmet requirements vary significantly, with five provinces mandating all-ages compliance (British Columbia, New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island) and three requiring helmets for minors only (Alberta, Manitoba, Ontario). This regulatory patchwork complicates market penetration strategies for safety accessory manufacturers, as consumer compliance expectations and enforcement mechanisms vary substantially across jurisdictions, creating distribution challenges and limiting standardized product development approaches.

The U.S. & Canada Bicycle Accessories Market is witnessing a strong opportunity in the development of smart and connected accessory ecosystems, driven by rising adoption of e-bikes, fitness-focused cycling, and increasing safety concerns among urban commuters. Consumers are increasingly demanding devices that offer real-time tracking, navigation, performance analytics, and integrated safety features, creating a high-value segment for manufacturers. Smart helmets with crash-detection alerts, GPS-enabled cycling computers, Bluetooth-equipped lighting systems, and app-connected security locks are gaining rapid traction.

As urban cycling grows, integration with smartphone apps, IoT platforms, and wearable technologies is expected to further enhance user experience, enabling brands to deliver subscription-based services, software upgrades, and personalized riding insights. This transition from basic mechanical accessories to tech-driven solutions significantly increases average revenue per user (ARPU) and supports premium pricing strategies. Partnerships with bike-sharing operators, micromobility players, and e-bike manufacturers can strengthen distribution channels and accelerate adoption. With North American consumers demonstrating high willingness to pay for convenience, safety, and smart features, the connected accessory segment represents one of the most lucrative long-term growth avenues for market participants.

The rapid evolution of retail and e-commerce ecosystems across the U.S. and Canada offers a major opportunity for bicycle accessory brands to expand distribution, improve customer engagement, and drive higher sales volumes. Online platforms, including Amazon, brand-owned D2C sites, and specialty cycling marketplaces, have transformed purchasing behavior by offering broader product visibility, easier price comparison, real-time customer reviews, and doorstep delivery. This shift especially benefits small and mid-sized brands that can now compete directly with established global players without heavy reliance on brick-and-mortar stores. Enhanced digital merchandising, virtual fit tools, subscription-based replenishment (for consumables like lubricants or lights), and influencer-driven marketing are further shaping consumer decision-making.

Physical retail channels such as big-box stores, specialty bike shops, and sporting goods outlets are increasingly adopting hybrid models, click-and-collect, in-store customization, and repair services, to complement digital growth. As cycling participation rises, retailers benefit from increased demand for bundled accessory packages, seasonal promotions, and premium product offerings. The integration of omnichannel retail strategies, combining online convenience with in-store product experience, creates a strong opportunity for brands to capture diverse customer segments and strengthen market penetration across urban, suburban, and rural areas.

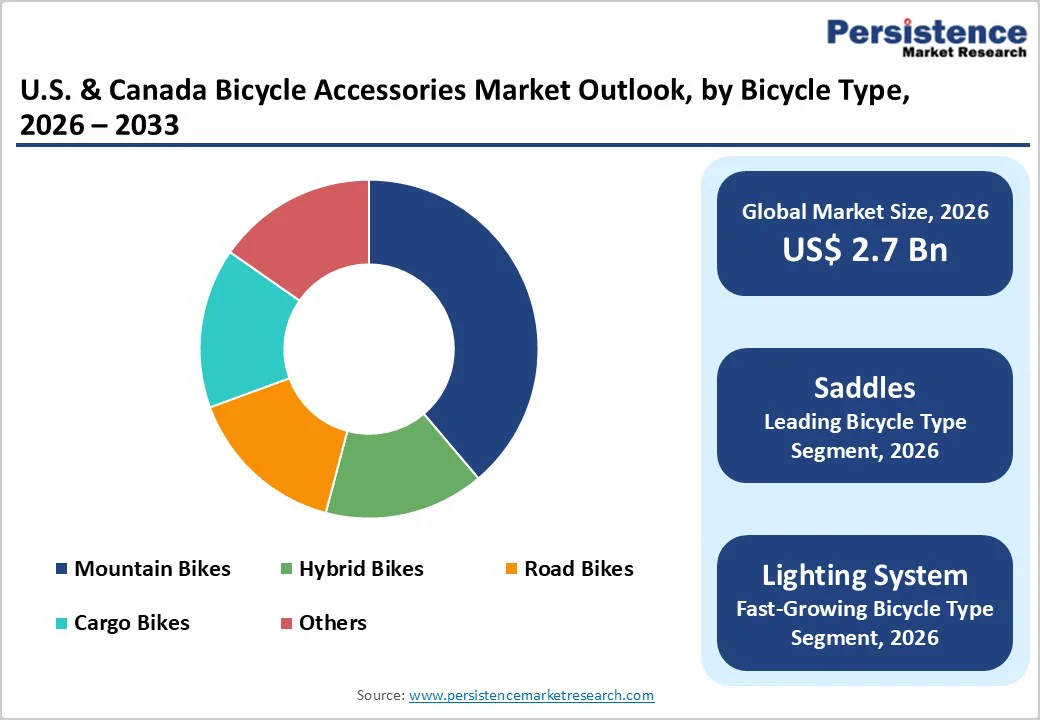

The saddles and pedals segment collectively holds the largest share within the product type categories, accounting for approximately 28% of the U.S. & Canada bicycle accessories market. This dominance is primarily driven by the high frequency of replacement cycles, as these components experience continuous wear and require periodic upgrading for optimal performance and safety. Consumers increasingly prioritize comfort, ergonomic design, and riding efficiency, making saddles and pedals among the first components riders choose to upgrade, especially fitness cyclists, commuters, and long-distance riders.

The rising adoption of premium cushioned saddles, gel-based designs, and lightweight or clipless pedals further strengthens segment growth. Additionally, the expansion of e-bikes and recreational cycling has pushed users to seek improved stability, shock absorption, and controlled power transfer, contributing to higher demand for advanced pedal and saddle technologies. These factors collectively reinforce the sustained market leadership of this category and its role in driving accessory purchases.

The mountain bike segment represents the leading category within bicycle types, holding an estimated 31% share of the U.S. & Canada bicycle accessories market. This strong position is largely supported by the growing popularity of recreational and adventure cycling, as more consumers participate in off-road riding, trail exploration, and outdoor fitness activities. North America’s expanding network of mountain biking parks, dedicated trail systems, and community-led riding groups has further boosted demand for mountain bikes and related accessories.

Riders typically invest more in performance-oriented gear, such as durable pedals, high-grip tires, protective helmets, shock-absorption accessories, and lighting solutions, due to the challenging terrains and safety requirements associated with mountain biking. Additionally, rising interest among younger demographics, coupled with increased tourism linked to mountain biking destinations, continues to fuel product upgrades and replacement purchases. Collectively, these factors reinforce the mountain bike segment’s dominance and its consistent contribution to overall market growth in the region.

The offline channel remains the dominant distribution platform in the U.S. & Canada bicycle accessories market, accounting for approximately 65% of total sales. This strong market position is driven by consumers’ preference for hands-on product evaluation, especially for items such as saddles, helmets, pedals, racks, and performance accessories that require physical inspection for comfort, fit, and durability. Brick-and-mortar stores, including specialty bike shops, sporting goods retailers, and local independent dealers, offer personalized guidance, expert recommendations, and professional fitting services, factors that significantly influence purchasing decisions.

Many buyers also value the ability to test products, compare alternatives, and receive immediate assistance for installation or adjustments. Instant product availability, after-sales services, and repair support further enhance the appeal of offline channels. Additionally, bike shops often serve as community hubs for cyclists, hosting events, workshops, and group rides, which strengthens customer loyalty and drives repeat purchases. These advantages collectively reinforce the offline channel’s leadership in the market.

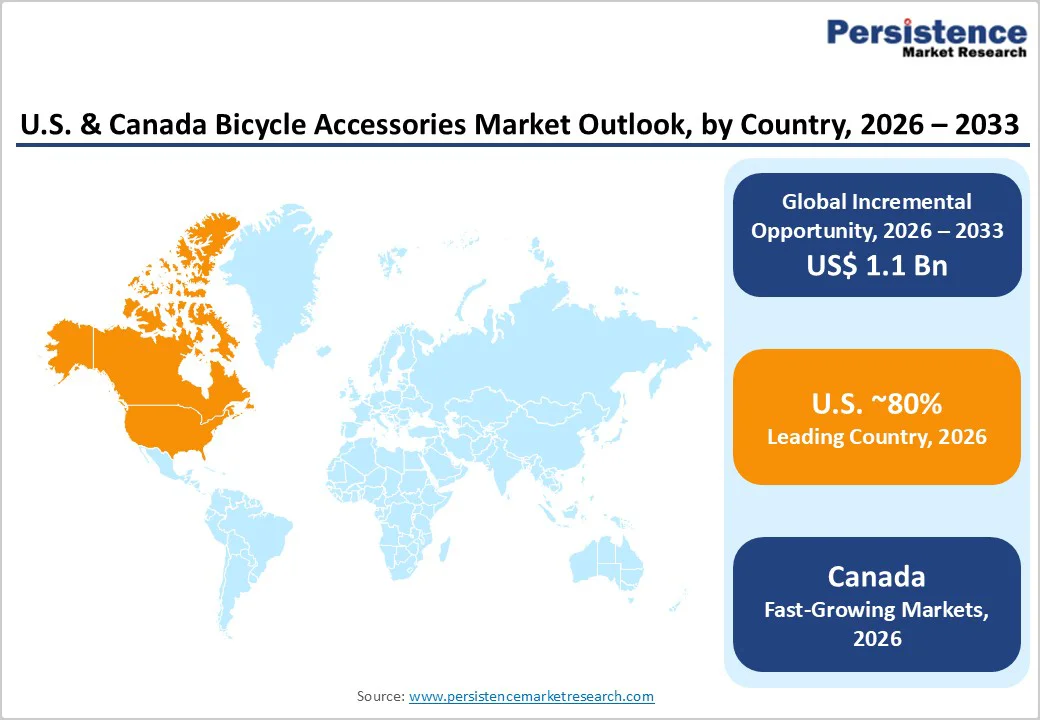

The United States dominates the North America bicycle accessories market, accounting for a substantial 79.3% share of the regional market value. This leadership position is primarily supported by the country’s large and rapidly expanding base of cyclists, along with strong demand for aftermarket parts and replacement accessories. High usage frequency across commuting, recreational riding, fitness cycling, and mountain biking contributes to faster wear-and-tear cycles, prompting consumers to invest regularly in upgraded saddles, helmets, pedals, tires, and smart accessories.

The strong presence of specialty bike shops, widespread e-bike adoption, and a well-developed distribution network further accelerates accessory purchases. The growing emphasis on outdoor fitness and eco-friendly mobility solutions encourages consumers to personalize and enhance their bicycles with performance-driven and comfort-oriented components. With continuous innovation, high spending capacity, and a mature cycling culture, the U.S. remains the primary growth engine for the North American bicycle accessories market.

Canada exhibits a robust growth trajectory in the bicycle accessories market, with projections indicating a steady CAGR of 5.1% through 2033. This momentum is fueled by rising cycling adoption across urban centers, where consumers increasingly turn to bicycles for commuting, fitness, and recreational activities. Government investments in cycling-friendly infrastructure, including dedicated bike lanes, trail expansions, and safer urban mobility corridors, are significantly enhancing bicycle usage and boosting demand for related accessories.

Canada’s growing interest in outdoor sports and adventure tourism is encouraging riders to upgrade their bicycles with durable, weather-resistant, and performance-enhancing components such as premium lights, protective gear, saddlebags, and advanced pedal systems. The rapid rise of e-bikes is further stimulating accessory sales, as riders seek specialized components and replacement parts tailored to electric mobility. With strong consumer awareness, supportive policies, and a thriving outdoor recreation culture, Canada is positioned to remain one of the fastest-growing bicycle accessory markets in North America.

The U.S. & Canada bicycle accessories market features a moderately fragmented competitive structure, characterized by the presence of numerous global brands, regional players, and specialized aftermarket manufacturers. Leading companies such as Trek Bicycle Corporation, Giant Manufacturing Co., Ltd., Shimano Inc., Garmin Ltd., and Accell Group together account for only 15% - 20% of the total market share, highlighting the wide distribution of market power among smaller and mid-sized competitors. This fragmentation is primarily driven by the diverse product landscape, ranging from essential components like saddles and pedals to premium accessories such as smart devices, protective equipment, and performance-enhancing gear.

Local brands frequently compete on affordability and niche product offerings, while established global players focus on innovation, technology integration, and premium product development. Strong retail networks, both offline and online, enable new entrants to reach consumers effectively, further intensifying competition. As a result, continuous product differentiation and brand positioning remain crucial for companies to sustain their market presence.

The U.S. & Canada bicycle accessories market is projected to reach US$ 3.7 Bn by 2033, growing at a CAGR of 4.9% from 2026 to 2033.

The primary factors driving demand for Bicycle Accessories include Rising adoption of bicycles for commuting, fitness, and recreational activities, growing e-bike usage, along with expanding cycling infrastructure, increasing consumer preference for premium and technologically advanced accessories supports strong market growth.

The saddles and pedals segment leads with estimated 28% combined market share, driven by frequent replacement cycles and comfort-oriented consumer preferences.

The United States leads the U.S. & Canada Bicycle Accessories market, holding the largest share, approximately 79.3% of the regional market value, driven by high cycling participation, strong aftermarket demand, and a well-developed distribution network.

Rapid expansion of smart and connected cycling accessories, driven by rising demand for safety, navigation, performance tracking, and anti-theft solutions.

Accell Group, Avon Cycles Ltd., Campagnolo S.R.L., Garmin Ltd., Shimano Inc., and Giant Manufacturing Co., Ltd., etc. are some of the key players in the U.S. & Canada Bicycle Accessories Market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Bicycle Type

By Sales Channel

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author