ID: PMRREP21625| 191 Pages | 7 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

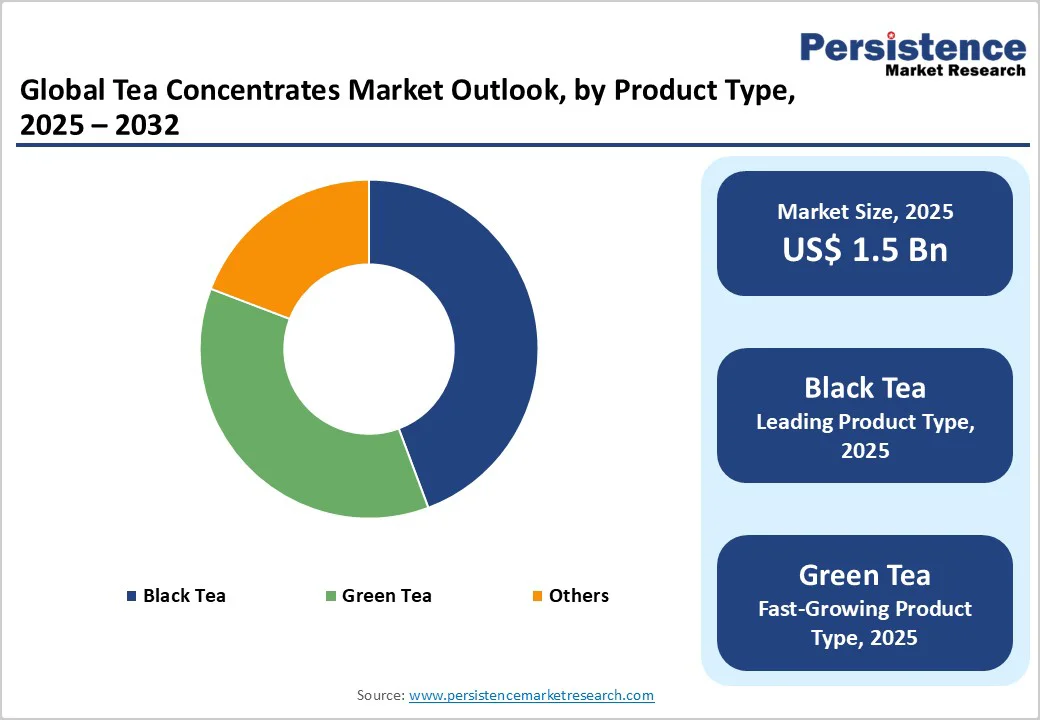

The global tea concentrates market size is likely to value US$ 1.5 billion in 2025 and projected to reach US$ 2.0 billion by 2032, growing at a CAGR of 4.3% during the forecast period from 2025 to 2032. The global tea concentrates market is growing steadily, driven by increasing demand for natural, convenient, and clean-label beverage options.

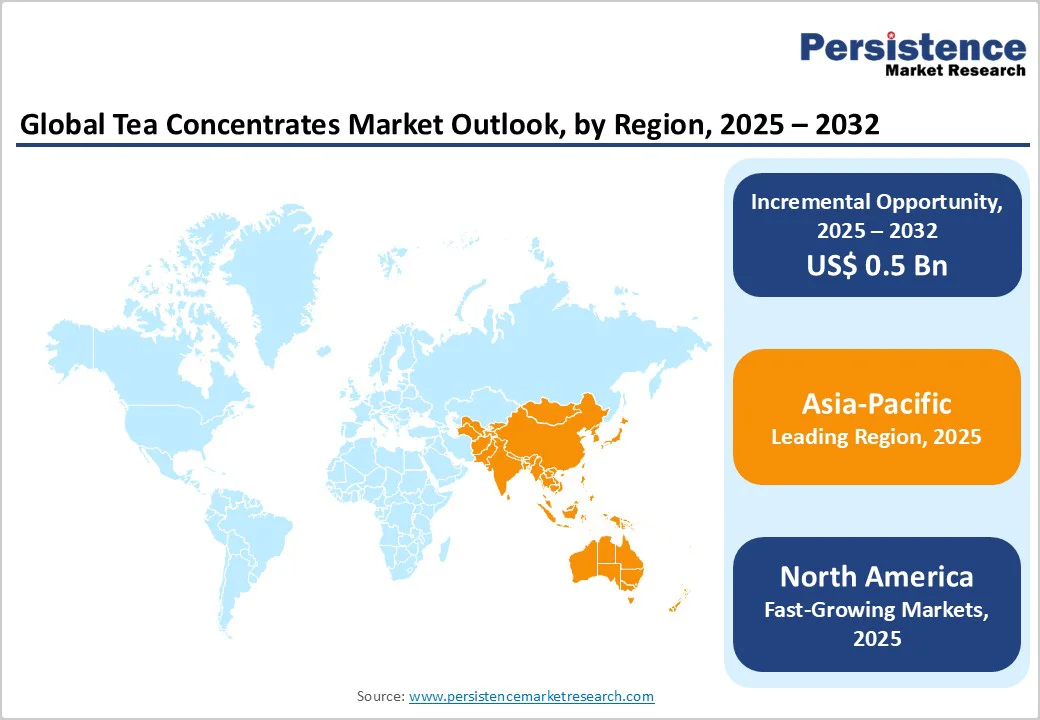

Asia Pacific leads the market, owing to its deep-rooted tea culture, growing café chains, urbanization, and rising disposable incomes in countries such as India, China, and Japan. North America follows closely, supported by consumer preference for functional and ready-to-drink beverages. Europe also shows strong growth, driven by the expanding organic beverage sector and sustainability-focused production. Overall, the market’s expansion reflects a global shift toward healthier, authentic tea-based product.

| Key Insights | Details |

|---|---|

|

Global Tea Concentrates Market Size (2025E) |

US$ 1.5 Bn |

|

Market Value Forecast (2032F) |

US$ 2.0 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.5% |

The expansion of foodservice and café chains is significantly driving the Tea Concentrates Market, as operators seek efficient, consistent beverage solutions. According to the National Restaurant Association of India, the sector employs over 7.3 million people and continues to expand rapidly, with increasing café penetration across Tier 1 and Tier 2 cities. India alone now hosts more than 290,000 cafés, reflecting strong consumer demand for tea-based beverages in urban areas. Similarly, the U.S. National Coffee Association notes a steady rise in tea consumption within foodservice outlets, where over 50% of consumers now order brewed or iced tea at least once a week. Global quick-service and specialty café brands are also expanding aggressively in Asia and the Middle East, further boosting institutional demand for tea concentrates. These products offer cafés operational efficiency, reduced waste, and flavor consistency key factors supporting growth in the fast-evolving foodservice landscape.

Tea concentrates and related products (like instant tea powders or brewed extracts) face significant quality degradation over time if not properly stored. Studies show that moisture, temperature, and packaging type heavily influence stability. For instance, a study from the Indian Institute of Technology, Kharagpur, found that instant green tea powder saw its moisture content increase from ~10% to ~13.4% when stored at ~38-? and ~90-91% relative humidity over 90 days. During the same period, water activity rose (which supports microbial growth), and both polyphenol and caffeine contents declined significantly.

Another example: in analyses of processed teas (black, green, white), antioxidant levels remain relatively stable for about 90-120 days, after which a marked decline begins. By the end of roughly a year, antioxidant activity can drop by 60-75% of its original level. These findings highlight that without precise control over storage, low moisture, cool temperatures, and impermeable packaging tea concentrates lose flavour, health-beneficial compounds, and safety over time. This limits shelf life, increases waste, and adds cost (e.g. refrigeration, better packaging), restraining market growth.

The adoption of tea concentrates in bakery, dairy, and dessert applications presents a significant opportunity for market growth, driven by evolving consumer preferences and industry trends. India's food processing industry is experiencing rapid expansion, with the bakery sector being a key contributor. According to the Ministry of Food Processing Industries, the bakery industry is witnessing increased demand for innovative products, including those incorporating tea flavors, to cater to changing consumer tastes.

In the dairy sector, there is a growing trend towards flavored dairy products, with tea-infused variants gaining popularity among consumers seeking novel taste experiences. The Food Safety and Standards Authority of India (FSSAI) has recognized the potential of incorporating tea extracts in dairy products, provided they comply with safety and quality standards.

Furthermore, the dessert industry is embracing tea-infused sweets and frozen desserts, aligning with the global trend of incorporating functional ingredients into indulgent treats. The FSSAI's guidelines on food additives and flavoring agents support the use of tea extracts in dessert formulations, ensuring consumer safety.

These developments indicate a promising avenue for tea concentrate manufacturers to diversify their product offerings and tap into the growing demand for tea-flavored bakery, dairy, and dessert products in India.

Black Tea dominates the market with 44.3% share in 2025 due to its widespread production, consumption, and established processing infrastructure. India, the world's largest tea producer, predominantly cultivates black tea, with regions like Assam, Darjeeling, and Nilgiri contributing significantly. The Tea Board of India reports that approximately 78% of the tea consumed globally is black tea, underscoring its global popularity. This preference is mirrored domestically, where black tea is integral to traditional tea blends and beverages. The robust demand for black tea in both domestic and international markets has led to a well-developed supply chain, encompassing cultivation, processing, and distribution, facilitating its dominance in the tea concentrates segment. Additionally, black tea's versatility in flavor and its health benefits further enhance its appeal in concentrate formulations.

Conventional holds a 68.6% share in the global market in year 2025, due to its widespread availability, established processing infrastructure, and cost-effectiveness. India, the world's largest tea producer, predominantly cultivates conventional tea, with regions like Assam, Darjeeling, and Nilgiri contributing significantly to its production. The Tea Board of India reports that the majority of the country's tea production is conventional, with organic tea accounting for a smaller fraction. This extensive conventional tea production supports a robust supply chain, encompassing cultivation, processing, and distribution, facilitating its dominance in the tea concentrates segment. Additionally, conventional tea offers consistent flavor profiles and is available at competitive prices, making it a preferred choice for large-scale beverage applications. While organic tea is gaining popularity, its limited availability and higher costs restrict its widespread adoption in the tea concentrates market.

The Asia Pacific market dominates the global tea concentrates market with 39.6% share in 2025, driven by its rich tea culture, high production volumes, and increasing consumer demand. The region accounts for a significant portion of global tea consumption, with countries like China, India, and Japan leading in both production and consumption. For instance, China and India together produce and consume over 60% of the world's tea. This widespread tea consumption has led to a well-established supply chain, facilitating the availability of tea concentrates. Additionally, the growing trend of health-conscious consumers in the region is driving the demand for ready-to-drink tea products, including tea concentrates. The combination of cultural significance, high production, and evolving consumer preferences positions Asia Pacific as a leader in the tea concentrates market.

Europe is a significant region in the market due to its strong tea consumption culture, established retail infrastructure, and increasing demand for convenient and health-conscious beverage options. In 2015, the European Union's apparent tea consumption amounted to 229,000 tonnes, representing approximately 4.6% of global tea consumption. Countries like the United Kingdom, Ireland, and Poland have high per capita tea consumption, with Ireland leading at 2.2 kg per person annually. The growing trend of on-the-go lifestyles and health awareness among European consumers is driving the demand for ready-to-drink (RTD) tea products, including tea concentrates. Additionally, the European Union's trade agreements with countries like Japan and Canada have facilitated smoother import processes, enhancing the availability and competitiveness of tea products in the European market.

North America is the fastest-growing region in the market, driven by increasing consumer demand for convenient, health-conscious beverage options. In 2021, Americans consumed nearly 85 billion servings of tea, totaling over 3.9 billion gallons, with black tea accounting for approximately 84% of this consumption. On any given day, more than half of the American population drinks tea, with the South and Northeast regions exhibiting the highest concentrations of tea drinkers. The U.S. Census Bureau reports that the U.S. imported $508 million worth of tea in 2022, up from $131 million 30 years ago, indicating a significant increase in tea consumption. These trends underscore North America's pivotal role in the global tea concentrates market.

The global tea concentrates market is growing as manufacturers use advanced techniques like cold extraction and enzymatic treatment to enhance flavor, aroma, and nutrition. Leading producers focus on natural, shelf-stable formulations, while emerging companies target clean-label and functional products. Innovations in roasting and blending expand applications in beverages, bakery, dairy, and desserts.

The global tea concentrates market is projected to be valued at US$ 1.5 Bn in 2025.

Rising demand for convenient, natural, and health-focused beverages drives the global tea concentrates market.

The global tea concentrates market is poised to witness a CAGR of 4.3% between 2025 and 2032.

Opportunities include functional beverages, e-commerce growth, bakery and dairy applications, sustainability, and specialty tea innovations.

Major players in the global are PepsiCo, Inc., Tata Global Beverages Ltd, A. Holliday & Company Inc., H&H Products Company, Cooper Tea Company LLC, Maya Tea Company, and Others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Nature

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author