ID: PMRREP35885| 188 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

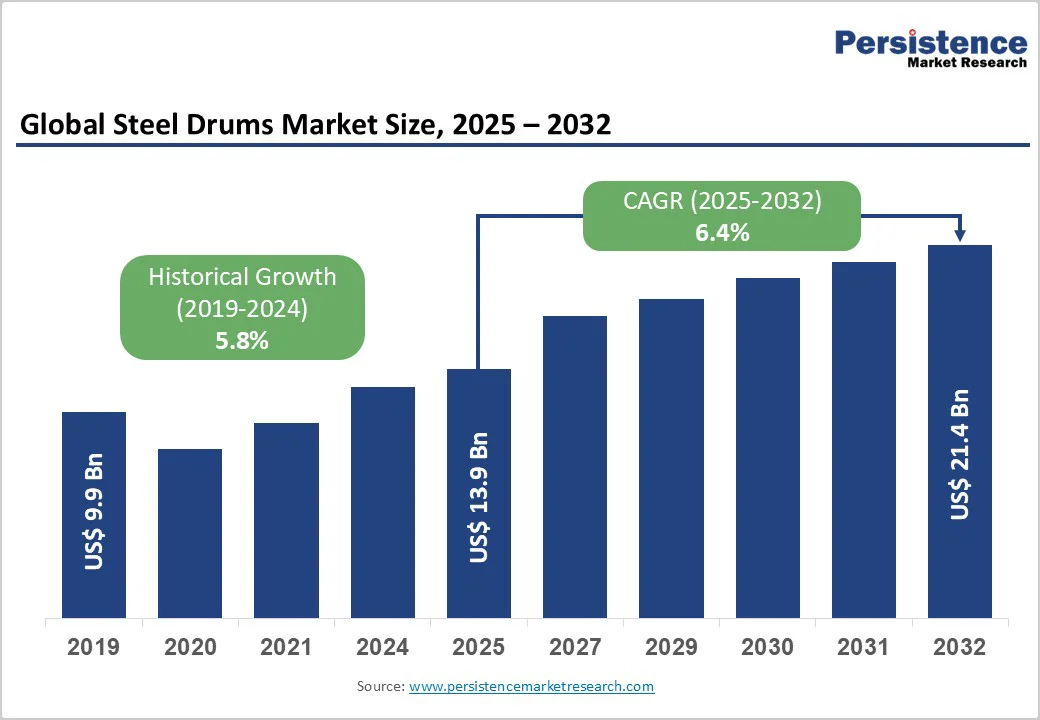

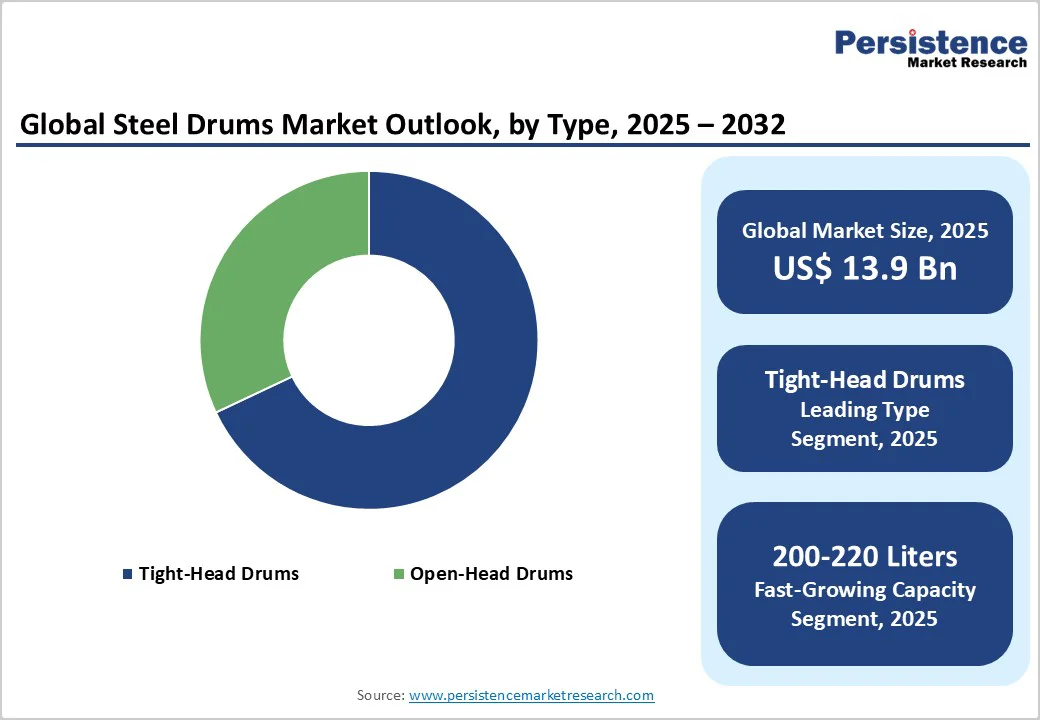

The global steel drums market size is likely to be valued at US$13.9 billion in 2025 and is projected to reach US$21.5 billion, growing at a CAGR of 6.4% between 2025 and 2032.

This robust expansion is primarily driven by escalating demand from the chemical and petrochemical industries for durable, corrosion-resistant containers to transport hazardous and non-hazardous materials across global supply chains.

The structural integrity, reusability, and regulatory compliance capabilities of steel drums make them indispensable packaging solutions for industries that prioritize safety, longevity, and operational efficiency in bulk liquid and solid transportation applications.

| Key Insights | Details |

|---|---|

| Global Steel Drums Market Size (2025E) | US$13.9 Bn |

| Market Value Forecast (2032F) | US$21.5 Bn |

| Projected Growth CAGR (2025 - 2032) | 6.4% |

| Historical Market Growth (2019 - 2024) | 5.8% |

Global chemical production surpassed 4.6 billion metric tons in 2024, with steel drums accounting for more than 46% of all liquid chemical packaging worldwide. The chemical and petrochemical industries consumed a significant number of these steel drums, underscoring their vital role in ensuring safe and compliant industrial transport.

Steel drums are valued for their excellent strength and corrosion resistance, making them ideal for transporting base oils, solvents, flammable liquids, and hazardous materials across borders.

The adoption of UN-rated drums exceeded globally, driven by strict international regulations for transporting dangerous goods. These regulations mandate comprehensive safety testing, including drop, hydraulic, and airproof tests, to ensure that drums remain leak-proof and durable during transit.

As a result, the implementation of these mandatory standards has significantly increased the use of certified steel drums in chemical manufacturing and logistics operations worldwide.

Rapid industrialisation in emerging economies is driving significant demand for bulk storage, as evidenced by major packaging companies scaling up their regional presence. For instance, Balmer Lawrie & Co. Ltd. inaugurated a new steel-drum manufacturing plant in Vadodara, Gujarat, to serve the rapidly expanding chemical hubs of Dahej, Bharuch and Kutch, where the 210 L MS-drum market is growing at over 21% CAGR.

Mauser Packaging Solutions has opened a new production facility in China targeting 230- and 250-litre drums to meet rising industrial-packaging needs in chemical-, petrochemical- and food-processing zones near Shanghai.

Similarly, Greif, Inc. operates multiple manufacturing plants across Southeast Asia (Singapore, Malaysia, and Vietnam) to respond to regional logistics growth and chemical-industry storage requirements. Collectively, these moves highlight how emerging-market industrial expansion is translating into increased demand for regulatory-compliant bulk drums and intermediate containers.

In 2024, hot-rolled coil prices rose by 11.6% year over year, significantly increasing drum production costs across North America, Europe, and Southeast Asia. Energy costs alone accounted for over 19% of total manufacturing expenses per drum in regions with older steelmaking facilities. Around 43,000 small-scale steel drum producers worldwide reported shrinking profit margins due to unpredictable raw material prices and rising utility costs.

These fluctuations discourage smaller manufacturers from expanding capacity or investing in innovation, especially in cost-sensitive emerging markets. The ongoing instability in steel and coking coal prices continues to squeeze margins, limiting reinvestment in advanced technologies and sustainability initiatives within the global industrial packaging sector.

The steel drum market faces growing competition from plastic drums, intermediate bulk containers (IBCs), and flexible packaging solutions that offer lighter weight and lower transport costs. Many manufacturers are developing hybrid drum models that combine plastic materials with steel reinforcements to reduce weight while maintaining compliance with transport safety standards. These alternatives are increasingly attractive for companies seeking to lower logistics expenses.

Stricter environmental regulations promoting recyclability and circular economy practices are compelling producers to invest in drum reconditioning systems. However, smaller companies without recycling or reconditioning capabilities face challenges in meeting these standards. As the Global Industrial Chemical Packaging Market expands from USD 63.78 billion in 2024 to USD 96.15 billion by 2035, end users are diversifying their packaging choices, balancing durability, safety, and cost efficiency.

The pharmaceutical industry is rapidly adopting stainless steel drums that meet FDA standards under 21 CFR Part 175.300 for food contact and GMP (Good Manufacturing Practice) requirements. These drums offer superior hygiene, chemical resistance, and compatibility with sterilization processes compared to carbon-steel alternatives, making them ideal for transporting pharmaceutical ingredients, bulk syrups, and edible oils.

Steel drums can be recycled multiple times without losing quality, and reconditioning processes, including cleaning, recoating, and structural testing, significantly extend their lifecycle. For instance, in June 2025, Mauser Packaging Solutions launched a new reconditioning facility at BASF’s site in Tarragona, Spain, showcasing investments in closed-loop systems.

Reconditioned drums cost 30-40% less than new ones and help reduce the carbon footprint of manufacturing operations. Companies implementing collection and refurbishment networks are tapping into a growing customer base of cost-conscious and sustainability-driven firms. Developed regions with strong recycling infrastructure lead this trend, while emerging markets are quickly catching up through industrial modernization and environmental compliance initiatives.

Tight-head steel drums lead the market with around 68% share, primarily due to their superior containment efficiency for liquid chemicals and petroleum products. These drums feature fixed tops with small bung openings, ensuring strong protection against leakage and contamination during handling and transport. Their design aligns with stringent UN certification requirements for hazardous goods, promoting their global adoption.

In 2024, UN-rated tight-head drums surpassed 78 million units, reflecting strong compliance with international safety standards. Major producers like Mauser Packaging Solutions and Greif Inc. also supply food-grade variants that meet 21 CFR 177.1520 and 177.2600 standards, expanding their use across the pharmaceutical and food sectors.

Carbon steel dominates the material segment with about 62% share, owing to its cost-effectiveness, structural strength, and widespread availability across manufacturing regions. It offers high durability against impact, corrosion, and temperature variations, making it ideal for chemical and petrochemical applications. Compatibility with epoxy phenolic or zinc-based coatings enhances its resistance to various substances.

Cold-rolled steel, valued for its precision and smooth finish, is well-suited to industries requiring tight tolerances. Meanwhile, stainless steel, growing at an 8.8% CAGR through 2034, serves pharmaceutical and high-purity chemical applications that require superior hygiene and corrosion resistance. Manufacturers like North Coast Container Corp emphasize 304 SS and 316 SS variants to meet stringent FDA and GMP compliance standards.

The 200-220 liter capacity range accounts for nearly 48% of the total market share, serving as the global standard for industrial packaging. This range aligns with UN codes 1A1 and 1A2, supporting compatibility with international logistics and transport systems. The format maximizes container space efficiency while remaining practical for forklift and warehouse handling.

Over 124 million drums of this size were used in the chemical and petrochemical sectors in 2024. Standardized dimensions of approximately 570 mm in diameter and 852 mm in height enable stable stacking and efficient storage. Larger drums above 55 gallons are preferred for bulk petrochemical use, while smaller ones are used in laboratories and for specialty chemical distribution, ensuring flexibility across operations.

The chemical industry remains the largest consumer, accounting for nearly 42% of global demand. Steel drums are essential for safely transporting acids, solvents, and adhesives across supply chains, ensuring containment and chemical resistance. The petrochemical and oil & gas sector follows closely, using drums for lubricants, fuels, and crude derivatives, with China, India, and GCC plants increasing drum usage by 9.2 million units in 2024.

The food and beverage segment relies on FDA-compliant drums for edible oils, syrups, and concentrates. The pharmaceutical sector demands the highest-grade GMP-approved stainless steel drums with validated cleaning and traceability systems to maintain product integrity and regulatory compliance.

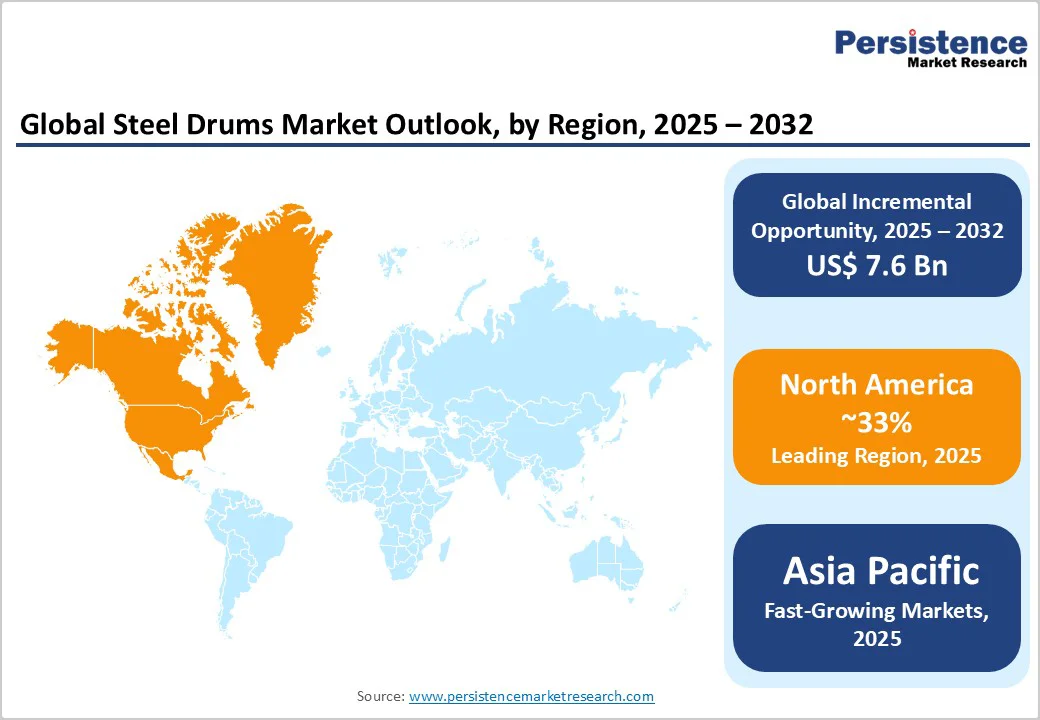

North America shows a mature and well-regulated steel drums market, supported by strict industrial packaging and hazardous material transport standards.

The United States leads regional growth due to its strong chemical manufacturing base and compliance with Department of Transportation (DOT) regulations requiring UN-certified packaging. Innovation is a key focus, highlighted by Greif Inc.’s EcoBalance™ Low Carbon Emission Steel Drums developed with ArcelorMittal, reducing carbon output in production.

The market is also seeing consolidation, with Greif closing its Merced, California, facility in September 2025 for operational efficiency. The U.S. industrial packaging sector continues to grow, driven by demand from the chemical, automotive, and construction industries.

North Coast Container Corp also plays a major role, providing FDA-compliant drums to the food and pharmaceutical sectors. The region’s strong reconditioning network supports circular economy practices, reducing waste and optimizing cost efficiency.

Europe maintains a strong regulatory environment guided by EU standards for food-grade and chemical packaging under (EC) 1935/2004 and UNECE regulations.

Major markets such as Germany, France, the UK, and Spain benefit from large chemical and pharmaceutical industries requiring compliant packaging. Leading players like Mauser Packaging Solutions and Greif Inc. dominate the market through extensive manufacturing and reconditioning operations that support circular economy initiatives.

In June 2025, Mauser opened a new reconditioning and recycling facility at BASF’s Tarragona site in Spain, strengthening closed-loop sustainability efforts. Manufacturers increasingly focus on recyclable, eco-friendly drum designs to meet EU sustainability goals. Despite strong demand, producers face challenges from Asia-Pacific imports and rising compliance costs, prompting them to innovate and offer higher-quality, certified packaging solutions.

Asia Pacific is the fastest-growing region, driven by rapid industrialization, expanding chemical output, and major infrastructure projects across China, India, Japan, and Southeast Asia. The region held 31.4% of the global market in 2024 and is expected to maintain its lead through 2032. Growth is supported by India’s rising steel capacity, which reached 205 MTPA in FY2024-25, and by China’s large-scale expansion of its chemical industry.

Key players such as Nippon Steel Drums Co. Ltd., PT Rheem Indonesia, Sicagen India Limited, and Balmer Lawrie & Co. Limited are meeting strong demand from the petrochemical and industrial sectors. The region benefits from low production costs, abundant raw materials, and pro-industry policies. However, varied regulatory standards across countries pose challenges, encouraging investment in compliance and quality certification to support export-driven growth.

The global steel drums market is moderately consolidated, with Mauser Packaging Solutions, Greif Inc., and SCHÜTZ GmbH & Co. KGaA holding around 35-40% combined market share. These leaders operate over 250 facilities in 37 countries, ensuring proximity to key industrial hubs and cost-efficient logistics. Their competitive edge lies in vertical integration, offering drum reconditioning, technical support, and customized coatings for chemical compatibility.

Emerging players compete through flexible pricing and smaller order volumes, targeting mid-sized manufacturers. Industry innovation focuses on sustainability, using recycled steel, low-carbon production, and lightweight designs, supported by collaborations like Greif’s partnership with ArcelorMittal on eco-efficient steel drum solutions.

The global steel drums market is projected to reach US$ 21.5 billion by 2032, growing at a 6.4% CAGR from 2025.

Market growth is driven by rising global chemical production, UN transport regulations, and rapid industrialization in Asia Pacific.

The 200-220 liters capacity segment dominates with about 48% market share due to its logistics efficiency and universal industry adoption.

North America leads the market, while Asia Pacific is the fastest-growing region driven by industrial and chemical sector expansion.

Pharmaceutical and food-grade stainless steel drums and reconditioned drum initiatives offer major growth opportunities through 2034.

Key players include Mauser Packaging Solutions, Greif Inc., SCHÜTZ GmbH & Co. KGaA, and regional firms like Balmer Lawrie & Sicagen India.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Type

By Material

By Capacity

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author