ID: PMRREP35579| 193 Pages | 2 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

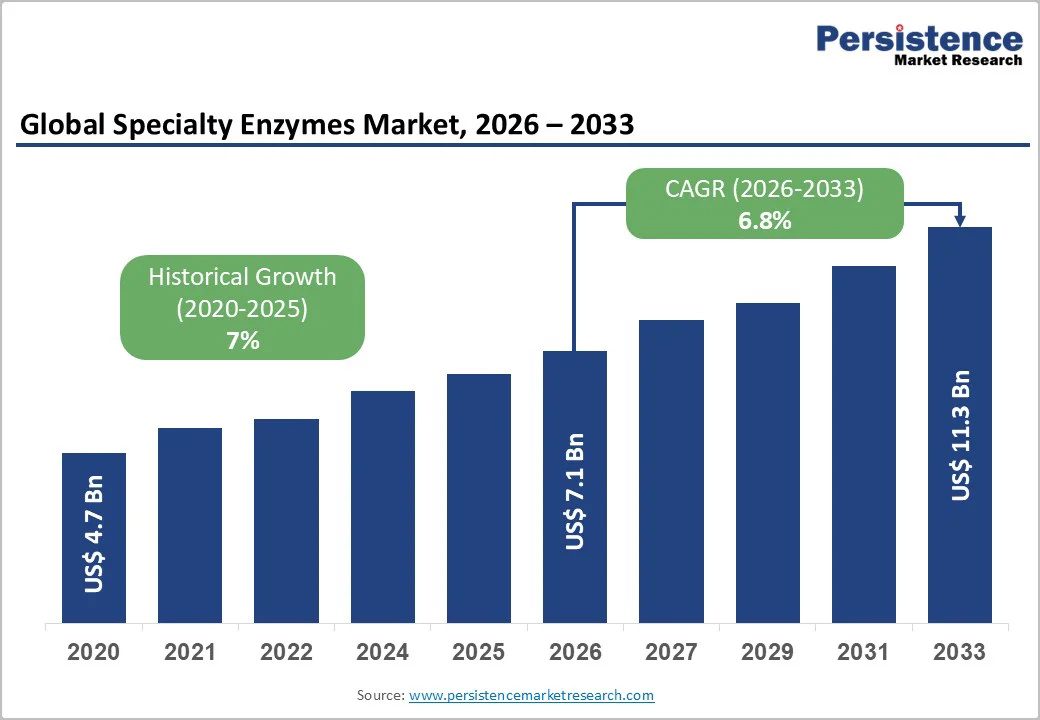

The global specialty enzymes market size is likely to be valued at US$7.1 billion in 2026. It is expected to reach US$11.3 billion by 2033, growing at a CAGR of 6.8% during the forecast period from 2026 to 2033, driven by the expanding use of specialty enzymes as high-value biocatalysts across pharmaceuticals, diagnostics, fine chemicals, food processing, agriculture, and various industrial processes.

Market growth is reinforced by rising enzyme use in biologics manufacturing, expanding diagnostic workflows that require high-purity enzymes, and the shift toward enzymatic processes as sustainable alternatives to chemical catalysts. Advances in enzyme engineering, directed evolution, immobilization technologies, and customizable enzyme platforms further accelerate demand.

| Key Insights | Details |

|---|---|

| Specialty Enzymes Market Size (2026E) | US$7.1 Bn |

| Market Value Forecast (2033F) | US$11.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 6.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 7% |

Specialty enzymes are increasingly vital in the production of modern biologics and nucleic-acid-based therapeutics. The rapid expansion of gene therapy, mRNA vaccines, oligonucleotide therapeutics, and cell-engineering workflows requires polymerases, ligases, nucleases, and other engineered enzymes for upstream and downstream bioprocessing.

Engineered enzymes that improve fidelity, yield, and processing speed are gaining traction in commercial contracts, reflecting a cycle where R&D-grade enzyme innovations translate into GMP-scale demand.

The regulatory landscape increasingly supports enzyme-based methods in molecular diagnostics, clinical assays, and process validation. Clinical diagnostic systems rely heavily on high-purity polymerases, reverse transcriptases, ligases, and sample-prep enzymes.

Post-pandemic infrastructure investments have created long-term installed capacity for PCR, isothermal amplification, and sequencing workflows that depend on robust enzyme supply chains. Suppliers are expanding validated production capability to meet clinical-grade documentation, traceability, and lot-to-lot reproducibility standards.

Across food processing, fine chemicals, textiles, pulp and paper, and specialty ingredients, specialty enzymes are replacing conventional chemical catalysts due to advantages in energy consumption, waste reduction, and reaction specificity.

Modern enzyme engineering has improved thermal stability, substrate tolerance, and scale-up productivity, enabling industrial adoption in processes previously unsuitable for biological systems. Corporate sustainability commitments and policy incentives for green manufacturing support expanded use of enzymes as environmentally aligned alternatives.

Developing, scaling, and qualifying specialty enzymes, especially those intended for clinical or GMP use, requires substantial investment in R&D, strain engineering, purification technologies, quality systems, and regulatory documentation.

Complex validation cycles extend development timelines, often lasting one to two years before commercial approval. Specialized infrastructure and compliance needs concentrate capability in larger, well-capitalized firms and limit the ability of smaller players to enter high-value markets. Capital expenditures for dedicated fermentation and purification lines frequently reach tens of millions of dollars, constraining speed, flexibility, and competitive diversity.

Specialty enzyme manufacturing depends on fermentation media, advanced resins, chromatography materials, and cold-chain logistics. Disruptions in upstream feedstocks or global shipping can significantly affect margins and delivery reliability.

Enzyme producers often face challenges related to resin shortages, inflation in fermentation media, or logistical disruptions that result in production delays. The concentration of advanced fermentation and downstream capacity in a limited set of global facilities heightens vulnerability to outages or regulatory interventions.

The growing need for highly tailored enzymes is creating a significant opportunity for contract enzyme engineering and development services. Demand spans pharmaceuticals, diagnostics, industrial biotechnology, and emerging nucleic-acid therapeutics.

Contract development and manufacturing service models support clients from early discovery through scale-up, creating recurring revenue streams through licensing, royalties, or long-term supply agreements. Companies offering rapid directed evolution, computational enzyme design, and scalable fermentation platforms are well-positioned to capture premium margins and form strategic partnerships with biopharma and diagnostic innovators.

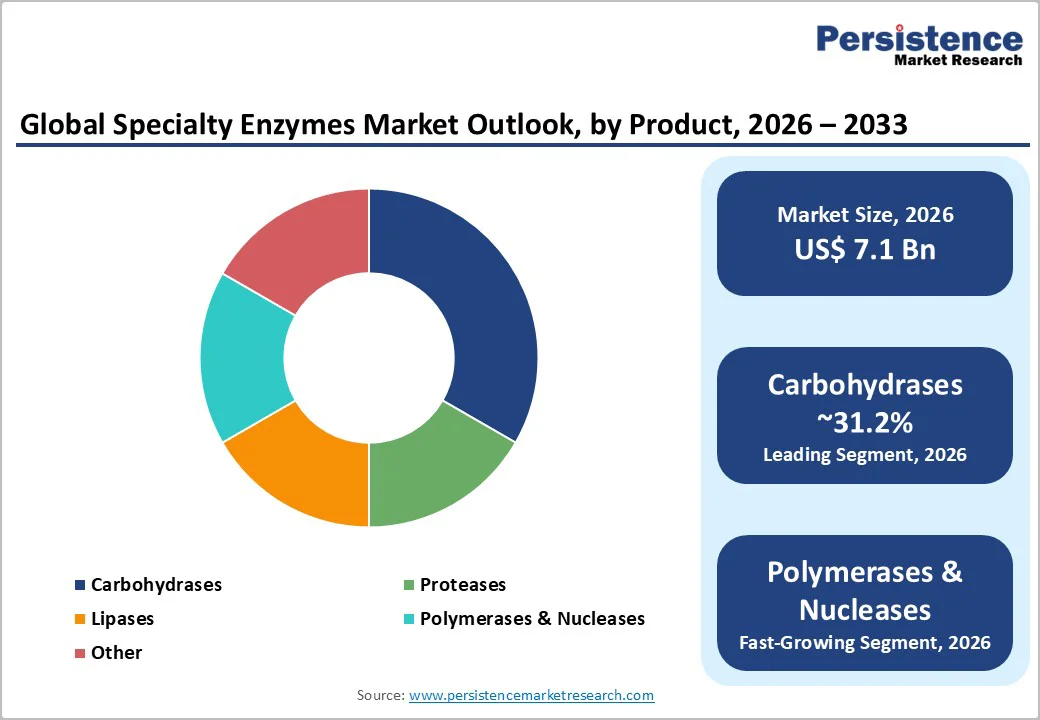

Carbohydrases are expected to hold the largest share of the specialty enzymes market, accounting for 31.2% in 2026, owing to their broad industrial relevance and high-volume applications. This category includes amylases, cellulases, xylanases, and other carbohydrate-degrading enzymes essential in food processing, brewing, baking, grain conversion, and starch modification.

Carbohydrases are also vital to biofuel production, particularly in enzymatic hydrolysis steps for corn ethanol and emerging cellulosic ethanol pathways. Their long-standing commercial maturity enables large-scale, cost-efficient fermentation, making them suitable for both commodity and specialized uses.

Growing adoption of clean-label processing, sustainability initiatives, and enzyme-enabled efficiency improvements continues to strengthen demand. Leading enzyme producers maintain extensive carbohydrase portfolios tailored to global food and industrial clients, for example, bake-stable amylases designed to enhance fermentation control and support reduced-sugar formulations.

Polymerases and nucleases are likely to be the fastest-growing product segment, driven by expanding needs in molecular diagnostics, sequencing, synthetic biology, and nucleic-acid-based therapeutics. High-fidelity DNA polymerases, reverse transcriptases, ligases, CRISPR-associated nucleases, and specialized proofreading enzymes are essential for PCR testing, genomic workflows, infectious disease surveillance, and RNA-based drug development.

Rapid growth is fueled by rising requirements for GMP-grade, ultrapure, and high-performance enzyme variants. Next-generation sequencing and gene-editing platforms increasingly rely on engineered enzymes optimized for fidelity, processivity, thermostability, and low off-target activity, supporting broader integration into advanced analytical and biomanufacturing systems.

Manufacturers are investing in enzyme engineering to improve fidelity, thermostability, and reaction speed, enabling broader use in multiplex assays and high-throughput analytical systems.

Microbial systems, primarily bacteria, yeast, and filamentous fungi, are anticipated to account for 59.6% of the market share in 2026, due to their scalability, reliability, and economic advantages. Fermentation-based microbial production supports both commodity-scale enzyme supply, such as carbohydrases and proteases for food and industrial processes, and highly purified enzymes for diagnostics and therapeutics.

Microbial hosts are preferred as they allow rapid genetic improvements, predictable yields, and efficient downstream purification. Large fermentation facilities across the U.S., Europe, China, and India rely on microbial platforms to meet global demand for technical, food-grade, and pharma-grade enzymes.

Examples of widely used microbial enzyme systems include Bacillus-derived proteases used in detergents, Aspergillus-derived carbohydrases for starch conversion, and yeast-expressed recombinant enzymes used in PCR reagents.

Engineered microbial platforms, spanning synthetic biology hosts, optimized secretion strains, and precision-designed recombinant systems, are expected to be the fastest-growing source category. Advances in metabolic engineering, AI-driven enzyme design, and CRISPR-based strain development enable the production of enzymes with enhanced stability, specificity, and therapeutic suitability.

These platforms support high-value applications, including gene-editing components, designer polymerases, and next-generation biomanufacturing enzymes. Recombinant E. coli, yeast, and engineered fungal systems are widely used to generate therapeutic-grade nucleases and industrial biocatalysts. At the same time, synthetic biology companies continue expanding custom enzyme libraries for specialized and low-carbon processes.

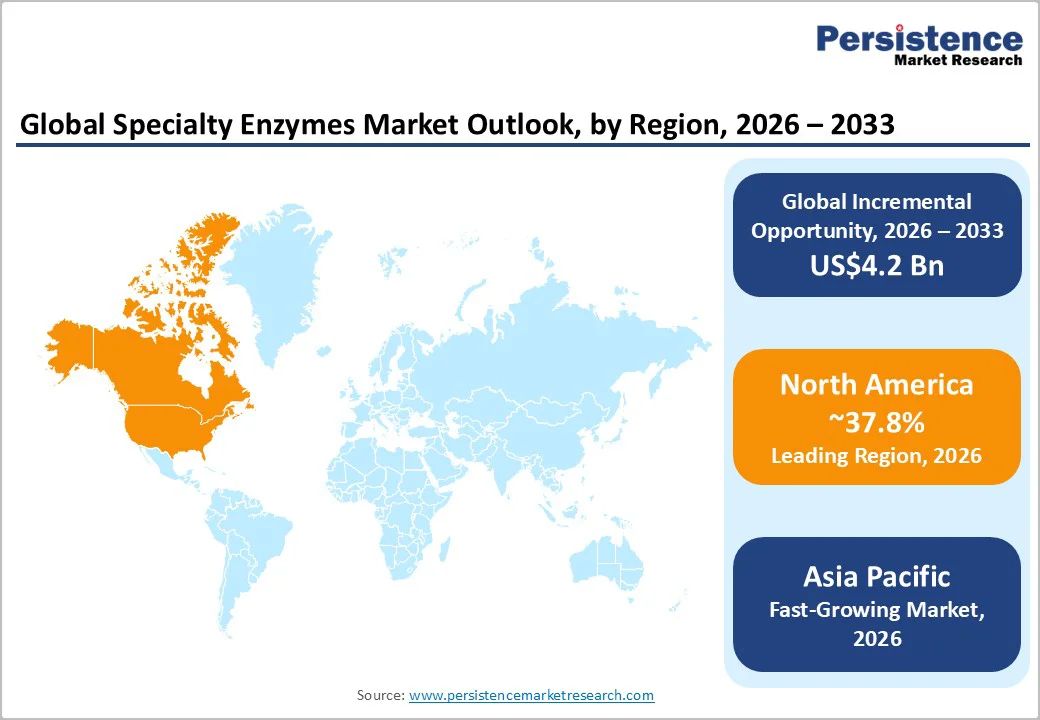

North America is projected to be the largest regional market, holding a market share of 37.8% in 2026, driven primarily by the U.S., which anchors global demand for high-purity enzymes used in pharmaceuticals, biotechnology, and diagnostics.

Large clusters of biopharmaceutical manufacturers, clinical diagnostics companies, reagent suppliers, and contract development organizations contribute to concentrated purchasing power. North America also hosts many of the world's most advanced academic and private research institutions, creating persistent demand for research-grade enzymes.

The U.S. market benefits from high investment in biologics, mRNA therapeutics, gene-editing platforms, and next-generation sequencing. These segments rely on enzymes with precise activity, validated supply chains, and strong regulatory documentation.

The country’s dense innovation ecosystem, spanning the West Coast, East Coast, and emerging hubs in Texas and Colorado, drives ongoing enzyme consumption in both R&D and commercial settings. Canada contributes additional demand through its specialty diagnostics sector and growing biomanufacturing footprint. Regulatory expectations in the region are stringent.

The U.S. FDA guidance for molecular diagnostics and biologics manufacturing necessitates high-fidelity, traceable enzyme production. Compliance with GMP, ISO standards, and supply-chain validation requirements protects qualified suppliers while raising barriers to entry.

This environment supports premium pricing for validated enzymes and encourages long-term supply agreements. Capital expenditures in fermentation capacity, purification suites, and QC laboratories are rising, reflecting demand for secure, high-quality supply chains.

North America’s combination of innovation density, regulatory clarity, and commercial demand will keep it the leading region for specialty enzyme consumption and technology advancement through the next decade.

Europe is projected to be the second-largest regional market in 2026, supported by strong enzyme manufacturing capabilities and deep expertise in industrial biotechnology, pharmaceuticals, and clinical diagnostics.

Germany, Denmark, France, Spain, and the U.K. anchor both regional demand and production capacity. Europe typically accounts for roughly one-quarter to one-third of global specialty enzyme revenues, reflecting a balanced mix of applications across food processing, industrial biocatalysis, and healthcare.

Germany plays a pivotal role through its advanced chemical and biotech sectors and extensive fermentation infrastructure, while Denmark remains a global hub for industrial enzyme innovation. France contributes through its strong pharmaceutical and CDMO ecosystem, and the U.K. maintains significant demand through its leadership in diagnostics and molecular biology.

Europe’s specialty enzymes market benefits from sustainable industrial biotech policies, circular economy initiatives, and green manufacturing incentives. Strong demand in pharmaceuticals and diagnostics, supported by advanced healthcare and testing infrastructure, combined with harmonized regulations, high-quality standards, and legacy manufacturing capabilities, ensures Europe remains a leading regional player.

Asia Pacific is likely to be the fastest-growing region in 2026, led by China, India, Japan, and emerging ASEAN economies. Rapid industrialization, competitive manufacturing costs, and expanding biotechnology infrastructure position APAC as a key global growth engine. China is rapidly expanding enzyme production capacity with domestic firms scaling fermentation facilities for both industrial and specialty enzyme applications.

The country’s growing pharmaceutical industry and investments in molecular diagnostics accelerate demand for high-purity enzymes, while industrial sectors adopt enzymatic processes to improve efficiency and sustainability. China’s regulatory system is evolving quickly, with streamlined approvals enabling growth in clinical and industrial manufacturing.

India is a major producer of industrial and specialty enzymes with strong R&D, particularly in food processing, nutraceuticals, and pharmaceutical applications. Domestic enzyme manufacturers are expanding both export-oriented production and custom enzyme development services. India’s regulatory framework supports manufacturing competitiveness while gradually strengthening quality requirements for clinical-grade products.

Japan remains a global center for high-value specialty enzyme innovation, especially in food, beverage, and industrial formulations. Japanese companies are known for their precise manufacturing standards and advanced enzyme solutions, which command significant global market influence.

Recent regional developments include expansions of fermentation capacity, formation of local joint ventures, and integrated production facilities designed to supply pharmaceuticals, diagnostics, and industrial biotechnology companies.

The global specialty enzymes market is moderately concentrated, with a few large multinational firms dominating high-value segments such as diagnostics, pharmaceuticals, and industrial biotechnology. These leaders leverage extensive fermentation infrastructure, advanced enzyme engineering platforms, and global distribution networks.

Numerous small and mid-sized companies focus on niche enzyme development, custom solutions, and regional applications. Top firms capture most clinical-grade and high-purity enzyme value, while smaller players drive innovation and flexibility. Market competitiveness relies on enzyme engineering expertise, GMP manufacturing, IP-backed platforms, CDMO partnerships, and specialized, application-specific solutions.

The global specialty enzymes market size is estimated at US$7.1 Billion in 2026.

By 2033, the specialty enzymes market is projected to reach US$11.3 Billion.

Key trends include rising adoption in biopharmaceutical manufacturing, especially for RNA, DNA, and gene-editing therapies, and expansion of molecular diagnostics and high-throughput sequencing workflows requiring polymerases and nucleases.

Within the product type, carbohydrases remain the leading segment due to their broad use across food processing, industrial biotechnology, and biopharmaceutical workflows.

The specialty enzymes market is expected to grow at a CAGR of 6.8% from 2026 to 2033.

Major players include Novonesis, Thermo Fisher Scientific, Codexis, Inc., BASF SE, and Merck KGaA.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Source

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author