ID: PMRREP26860| 200 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

The global ship searchlight market size is likely to be valued at US$1.1 billion in 2026 and is expected to reach US$1.7 billion by 2033, growing at a CAGR of 6.4% during the forecast period from 2026 to 2033, driven by continuous advancements in maritime safety and navigation equipment.

Market growth is supported by the shift toward LED-based and intelligent searchlight systems that lower energy use and maintenance needs. Increasing compliance with IMO safety standards, along with rising adoption in defense, offshore operations, and high-end leisure vessels, is further accelerating demand. The market serves commercial ships, naval fleets, yachts, fishing vessels, and offshore platforms.

| Key Insights | Details |

|---|---|

|

Ship Searchlight Market Size (2026E) |

US$1.1 Bn |

|

Market Value Forecast (2033F) |

US$1.7 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

6.4% |

|

Historical Market Growth (CAGR 2020 to 2025) |

6.1% |

Rising international trade volumes have led to greater demand for larger and more advanced vessels, including cargo ships, tankers, cruise liners, and container ships. These vessels require high-intensity searchlights to ensure safe navigation, especially in low-visibility conditions such as fog, storms, or nighttime operations. As shipping lanes become busier, shipping companies and port authorities are investing in reliable, energy-efficient lighting solutions to reduce operational risks and improve safety standards. The growing focus on fuel efficiency and operational cost reduction encourages the adoption of LED and smart searchlight systems that provide long-lasting performance.

Fleet expansion in both commercial and defense sectors fuels market demand. Many countries, particularly in Asia Pacific and North America, are modernizing their naval fleets and expanding offshore exploration activities, which increases the need for robust and durable searchlight systems. Regulatory compliance with international maritime safety standards, such as those set by the International Maritime Organization (IMO), compels operators to equip vessels with high-performance lighting systems. Growing investments in luxury yachts, ferries, and offshore service vessels contribute to rising market adoption.

Ship searchlights operate in harsh marine environments, making maintenance a major challenge for vessel operators. Continuous exposure to saltwater, humidity, strong winds, and extreme temperature changes accelerates corrosion and material wear, even in durable metals such as aluminum, brass, and stainless steel. Sea spray and severe weather can degrade lenses, reflectors, and housings, reducing light intensity and beam performance. Mechanical parts, including rotating mechanisms and motorized mounts, are especially prone to rust and fouling, increasing the risk of operational failure if not properly maintained.

In addition to environmental stress, growing technological complexity adds to maintenance requirements. Modern LED and HID searchlights incorporate advanced electronics, thermal management systems, and remote-control features that demand specialized expertise. Although these systems offer improved energy efficiency and longer service life, they remain vulnerable to thermal stress, electronic failures, and software issues in demanding maritime conditions. Maintenance crews must be adequately trained to manage calibration, component replacement, and firmware updates to ensure reliable performance.

Many commercial and naval vessels continue to rely on legacy halogen or xenon searchlights that consume more power and require frequent upkeep. Upgrading these systems with LED or high-intensity discharge (HID) searchlights helps operators cut energy use, extend equipment lifespan, and reduce operating expenses. Improved beam clarity and consistency also enhance visibility and navigational safety, particularly in low-light or harsh weather conditions. As global maritime trade grows and fleets expand, operators seek cost-effective upgrades without replacing the entire vessel.

Retrofitting also opens the door to technology-led innovation. Next-generation searchlights incorporate smart beam control, remote operation, and self-diagnostic capabilities that improve performance while simplifying maintenance. Demand is rising for corrosion-resistant materials, modular architectures, and marine-grade components that minimize downtime and improve durability. In parallel, regulatory pressure from organizations such as the International Maritime Organization (IMO) is accelerating the shift toward energy-efficient lighting. Together, these factors position retrofitting and energy-efficient upgrades as a high-value opportunity, enabling manufacturers and service providers to expand their footprint while supporting compliance, safety, and sustainability goals.

The LED segment is expected to lead the ship searchlight market in 2026, accounting for approximately 50% of total revenue, due to its superior energy efficiency, long lifespan, and reduced maintenance requirements compared to traditional lighting technologies such as halogen and xenon. LEDs provide consistent high-intensity illumination, which is critical for safe navigation in commercial vessels, naval ships, and leisure boats operating under low-visibility conditions.

Rising global demand for energy-efficient and low-maintenance solutions is driving the LED segment to also represent the fastest-growing segment in 2026. Advanced marine LED systems, such as the RCL-95 LED Searchlight, offer high-intensity illumination with significantly reduced power consumption, enhancing operational efficiency and durability in harsh maritime environments. Retrofit and new installations of LED searchlights support lower operational costs and improved safety, encouraging broader adoption across fleets.

Manufacturers such as TRANBERG, Hella Marine, and Luminell are increasingly supplying LED searchlights to commercial vessels and naval fleets, replacing older halogen and xenon models. TRANBERG has deployed LED searchlights across fleets in Europe and Asia, demonstrating significant energy savings and improved reliability. These LED solutions are designed to withstand saltwater corrosion and provide consistent long-range visibility, making them suitable for demanding shipping operations. The high adoption rate of LED technology is further supported by global regulatory frameworks promoting energy-efficient marine equipment and environmental sustainability.

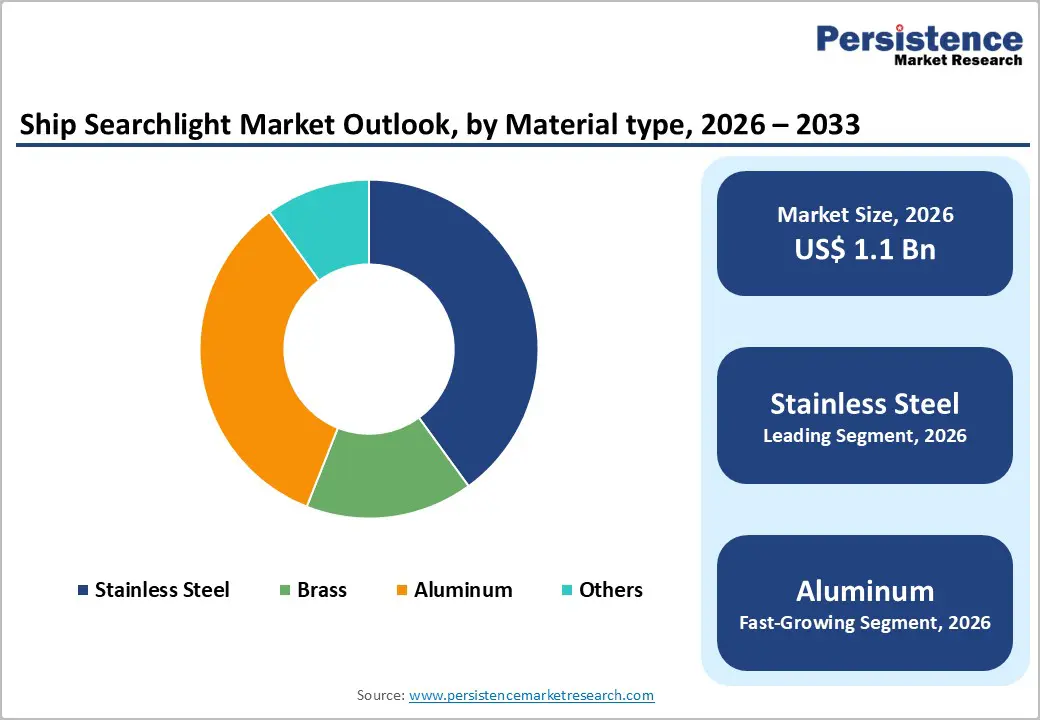

Stainless steel is projected to lead the market, capturing around 40% of the total revenue share in 2026, due to its exceptional corrosion resistance, durability, and ability to withstand harsh marine environments. Stainless steel housings protect the internal components of searchlights from saltwater, humidity, and high winds, ensuring long-term performance and minimal maintenance. For example, WISKA Hoppmann & Mulsow manufactures stainless steel marine searchlights widely used on naval and offshore vessels in Europe, demonstrating reliable performance under extreme weather conditions. The widespread adoption of stainless steel is supported by its compatibility with high-intensity lighting systems, including LEDs and HID lights, allowing manufacturers to produce robust, long-lasting searchlight solutions.

Aluminum is likely to be the fastest-growing material type, due to its lightweight properties, ease of installation, and cost-effectiveness, which are particularly important for modern commercial vessels and retrofit projects. Aluminum housings help reduce the overall weight of searchlight systems, contributing to improved fuel efficiency and simpler handling during both new installations and upgrades. For example, the marine-grade aluminum RCL-100 LED searchlight features a rugged aluminum housing designed for medium-size yachts, sport fish vessels, and commercial ships, offering enhanced corrosion resistance and reduced maintenance in harsh marine conditions. Advancements in aluminum alloys and marine-grade protective finishes have strengthened corrosion resistance, making aluminum a viable alternative to traditional materials such as stainless steel in many marine applications.

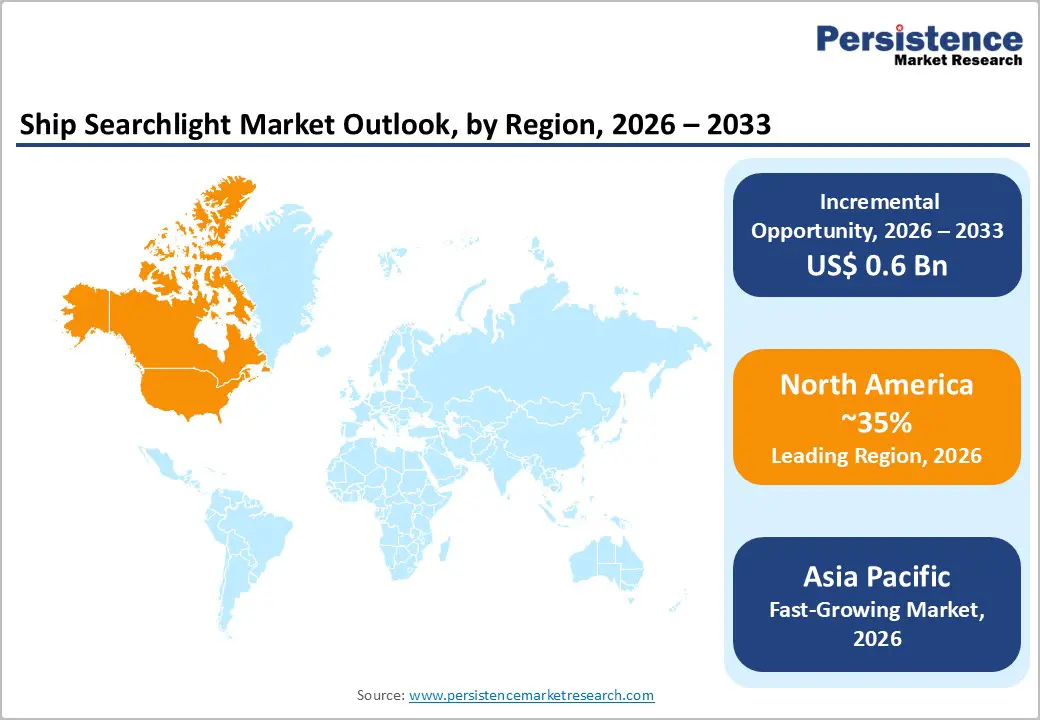

North America is expected to lead the market, holding a 35% share in 2026, driven by strong maritime activity, strict safety regulations, and consistent investment in commercial and defense fleets. Vessel owners and operators are increasingly adopting energy-efficient LED and smart searchlight systems to meet standards set by organizations such as the U.S. Coast Guard and the International Maritime Organization (IMO), which prioritize reliability, reduced power consumption, and enhanced navigational visibility. This adoption is further fueled by vessel upgrade cycles, where aging halogen systems are replaced with more durable, low-maintenance LED technology.

The region’s market growth is also supported by technological innovation and product diversification from both domestic and multinational manufacturers. For instance, the RCL-100 LED Searchlight has gained traction among commercial and leisure vessel operators for its high-intensity output, rugged marine-grade construction, and energy efficiency, reflecting the regional shift toward advanced lighting solutions. Ongoing retrofit programs, aimed at extending the service life of older fleets, and defense modernization initiatives in the U.S. and Canada, particularly for patrol, support, and naval vessels, are further driving the adoption of advanced searchlight systems to improve visibility and operational reliability.

Europe is likely to be a significant market for ship searchlights in 2026, supported by increasingly stringent maritime safety regulations and a strong focus on energy-efficient lighting technologies. European Union directives and oversight from organizations such as the European Maritime Safety Agency (EMSA) encourage the adoption of advanced solutions such as LED searchlights that reduce power consumption and improve reliability in harsh maritime conditions. Countries including Germany, the U.K., and the Netherlands lead the region’s demand due to well-established commercial shipping activities, offshore operations, and large recreational boating communities.

Europe has particularly noteworthy retrofit demand, as older vessels are frequently upgraded with modern searchlight systems to enhance navigational safety and operational efficiency. For example, regional industry involvement is Den Haan Rotterdam B.V., a Dutch maritime lighting manufacturer with a long history of producing navigation lights, searchlights, and related marine lighting equipment. Den Haan Rotterdam has developed LED searchlight products tailored to withstand challenging marine environments and meet European maritime standards, reinforcing the region’s trend toward durable and technologically advanced lighting systems.

The Asia Pacific region is likely to be the fastest-growing region in the ship searchlight market in 2026, driven by the rapid expansion of maritime trade, shipbuilding activity, and port infrastructure development. Countries such as China, Japan, South Korea, and India serve as major hubs for commercial shipping and naval modernization, which significantly boosts demand for advanced searchlight solutions to enhance navigational safety in busy sea lanes such as the South China Sea and Malacca Strait. Strategic investments in coastal infrastructure and upgrades of existing fleets are fostering continuous adoption of energy-efficient LED and smart lighting technologies that offer superior durability and lower maintenance compared to traditional systems.

The Asia Pacific region is witnessing growth driven by technological innovation and the expanding use of advanced searchlight systems across diverse applications. Rapidly growing offshore energy operations, expanding cruise tourism, and a rising recreational boating segment are fueling demand for dependable marine lighting solutions. For instance, major Chinese shipyards increasingly specify LED searchlights from established marine electronics suppliers for new commercial vessels, highlighting the region’s focus on energy efficiency and long-term performance. The adoption of smart, remote-controlled lighting systems also enables seamless integration with modern navigation and safety platforms, improving operational efficiency and situational awareness at sea.

The global ship searchlight market exhibits a moderately fragmented structure, driven by the presence of numerous established manufacturers and specialized regional suppliers catering to diverse maritime needs across commercial, defense, and recreational segments. Market participants vary in scale and focus, with manufacturers offering a range of solutions from traditional halogen and xenon units to advanced LED and smart searchlight systems that improve energy efficiency, durability, and navigational performance. Competitive differentiation is shaped by factors such as product quality, technological innovation, brand reputation, and distribution networks, with larger firms leveraging strong R&D capabilities.

With key leaders including WISKA Hoppmann & Mulsow, TRANBERG, The Carlisle & Finch Company, Perko, Den Haan Rotterdam, Hella Marine, and Aqua Signal, the competitive landscape reflects a blend of long-standing industry veterans and innovative lighting technology suppliers that serve global maritime markets. These players compete through continuous product development, strategic partnerships, and investments in energy-efficient LED and smart lighting technologies to address regulatory requirements and customer preferences for performance and sustainability.

The global ship searchlight market is projected to reach US$1.1 billion in 2026.

Increasing maritime trade and fleet expansion, stricter maritime safety regulations, and growing adoption of energy-efficient LED lighting solutions.

The ship searchlight market is expected to grow at a CAGR of 6.4% from 2026 to 2033.

Retrofitting aging vessels with energy-efficient LED systems, growing demand from naval modernization and offshore activities, and rising adoption of smart, remote-controlled lighting solutions.

WISKA Hoppmann & Mulsow, TRANBERG, and The Carlisle & Finch Company are the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Light Source

By Material Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author