ID: PMRREP35641| 181 Pages | 22 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

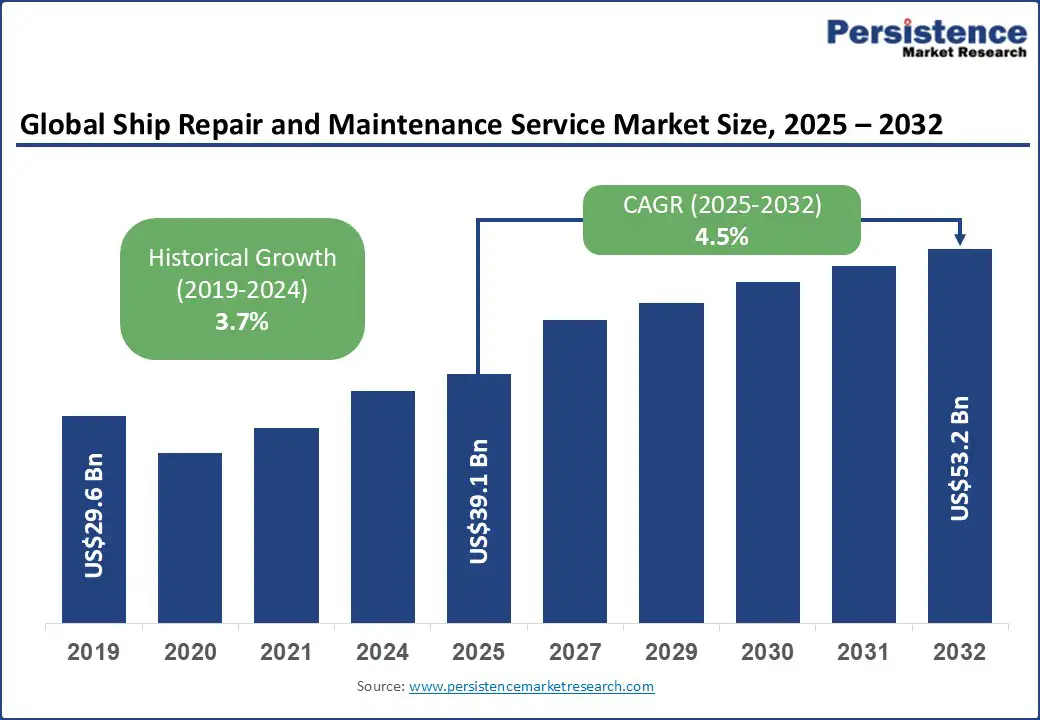

The global ship repair and maintenance service market size is likely to be valued at US$39.1 Bn in 2025 and is expected to reach US$53.2 Bn by 2032, growing at a CAGR of 4.5% during the forecast period from 2025 to 2032, due to the growing reliance on shipping for international trade. Ship repair and maintenance services cover both scheduled and unscheduled activities, forming a vital part of vessel operations.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Ship Repair and Maintenance Service Market Size (2025E) | US$39.1 Bn |

| Market Value Forecast (2032F) | US$53.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.7% |

The maritime transport sector handles nearly 80% of global trade, making it the backbone of international commerce. Its efficiency and the liberalization of global markets continue to drive sea trade, offering consumers cost benefits through competitive freight rates.

This growing reliance on shipping is a major factor fueling demand for ship repair and maintenance services. For instance, traffic on the Northern Sea Route is projected to reach 80 million tons annually by 2025, signaling increasing activity in Arctic shipping.

Shipbuilding trends also highlight market dynamics. In 2021, non-OECD Council Working Party (WP6) economies accounted for 47.4% of global ship deliveries, leading at 41.1% of completions worldwide.

Supported by policy initiatives and expanded facilities, China has solidified its position as the world’s top shipbuilder. According to UNCTAD (October 2023), maritime trade volumes are expected to grow 2.4% in 2023, with ton-mile growth around 4%, reflecting a strong rebound in seaborne trade.

A major restraint for the ship repair and maintenance services market is the high costs associated with repair activities. Ship repair involves extensive labor, specialized expertise, advanced equipment, and costly materials, all of which significantly increase expenses for operators.

Regular dry-docking, hull treatment, engine overhauls, and compliance-driven retrofits, particularly those related to emissions regulations, require substantial capital outlay. The growing integration of advanced technologies, such as energy-efficient propulsion systems and digital monitoring tools, further adds to the cost burden.

For small and medium-sized ship operators, these high expenses can act as a deterrent, leading to delayed maintenance or reliance on low-cost alternatives, which raises operational risks.

Additionally, volatile raw material prices and supply chain disruptions inflate costs, making repairs less predictable and harder to budget. As shipping companies strive to balance profitability with regulatory compliance, the significant cost of repair and maintenance remains a key challenge limiting market growth.

Systematic maintenance management in the maritime industry involves the adoption of a Planned Maintenance System (PMS), which helps operators schedule, document, and execute maintenance tasks in line with regulatory requirements. A PMS maintains a comprehensive database of ship machinery and equipment, enabling risk assessments and ensuring timely servicing to optimize asset performance.

Increasingly, data analytics and machine learning are transforming maintenance practices by analyzing historical data to predict equipment failures. This shift from fixed schedules to condition-based predictive maintenance allows operators to optimize repair timelines, minimize downtime, reduce costs, and extend vessel lifespans.

Governments also play a significant role by awarding tenders for shipyards and maintenance services, driving competition among companies to enhance service efficiency.

For example, in February 2024, Babcock International Group PLC secured a five-year contract with the U.K. Ministry of Defence to provide in-service support for the Royal Navy’s Ships Protective System (SPS), employing technologies such as degaussing and cathodic protection to reduce hull corrosion and vessel vulnerability.

In 2025, container ships are likely to represent nearly 40% of the ship repair and maintenance services market, underscoring their critical role in global logistics. As international trade expands and e-commerce surges, containerized shipping has become indispensable, driving heightened demand for modernized and efficient repair solutions.

The complexity of container vessels necessitates specialized services such as hull maintenance, engine overhauls, and electrical system repairs. Moreover, stricter environmental regulations and rapid technological advancements require frequent upgrades to ensure compliance and operational efficiency.

Compared with other vessel types such as oil and chemical tankers, bulk carriers, and general cargo ships, container ships face greater operational intensity and regulatory pressures. This results in a higher frequency of repairs and technological retrofits, making them the primary contributor to market growth.

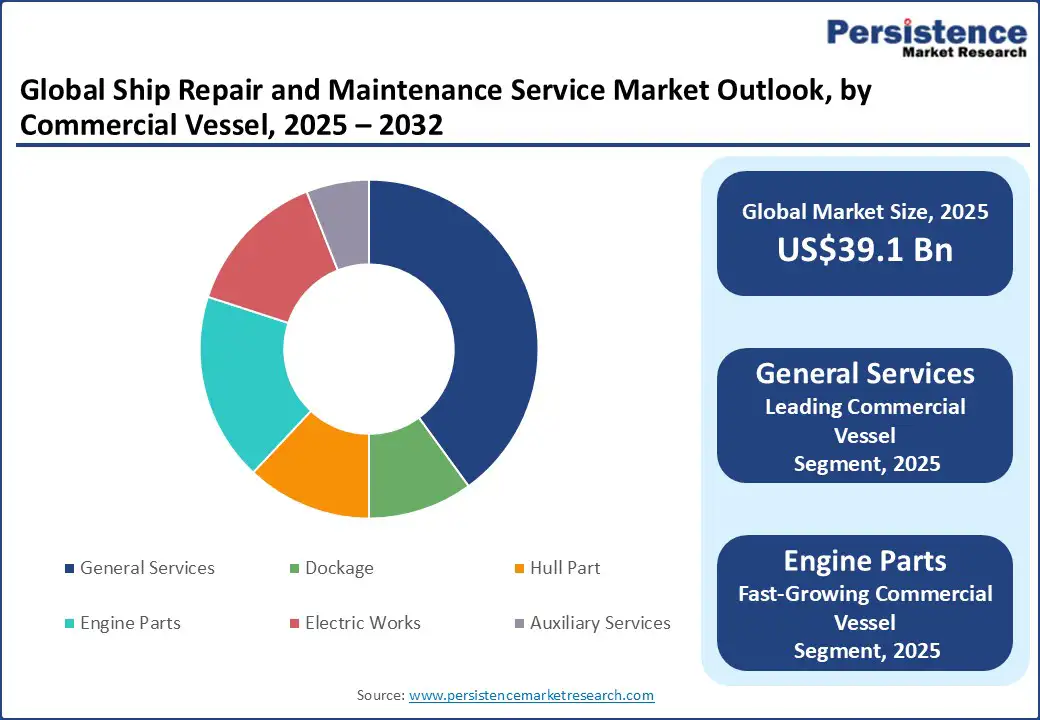

The general services segment is expected to remain the leading growth driver in the ship repair and maintenance service market. Encompassing routine maintenance, inspections, and minor repairs, this segment plays a critical role in ensuring vessel reliability and operational efficiency. With the global fleet size steadily increasing, demand for regular maintenance continues to rise, fueling consistent market growth.

As ships become more technologically advanced, specialized repairs for engines, electrical systems, and propulsion units are gaining prominence. However, general services remain indispensable, particularly as the maritime industry faces mounting pressure to enhance energy efficiency and comply with stringent environmental regulations.

In contrast, other service categories, such as dockage and auxiliary services, are expanding at a slower pace due to their specialized scope. The general services segment benefits from broader, recurring demand across diverse vessel types, reinforcing its dominant position within the market.

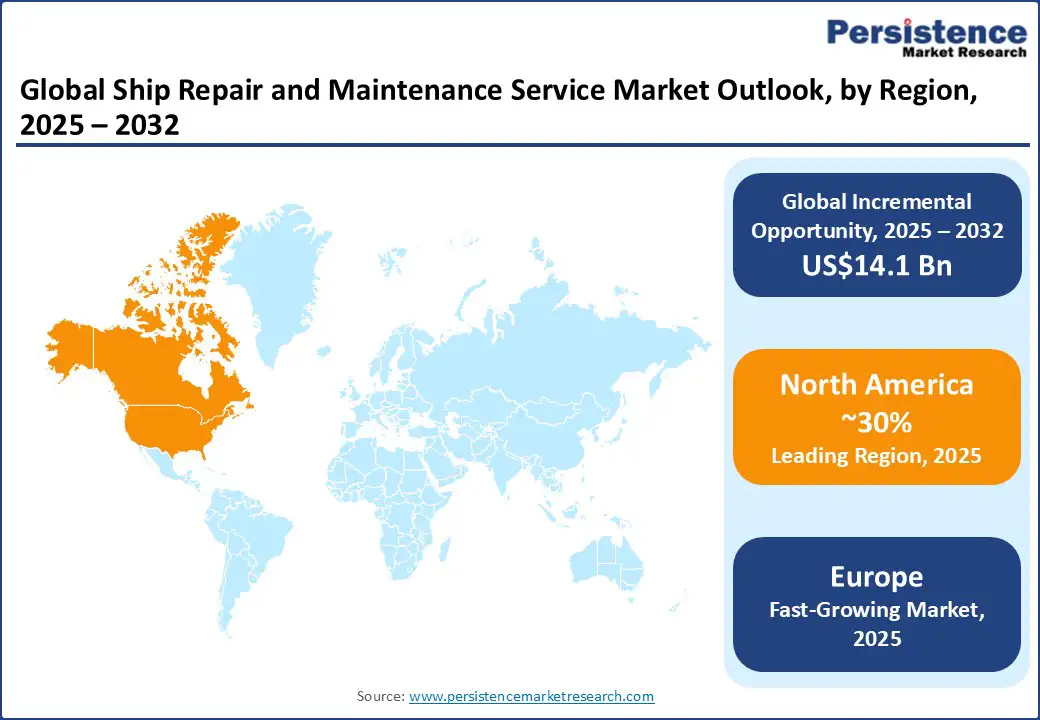

North America holds the largest market share, with countries such as the U.S. and Canada expanding their naval fleet. As per the statistics published by the U.S. Naval History and Heritage Command, the U.S. owns 275 active warships, including surface combatants and auxiliary vessels.

Furthermore, the expansion of international trade via newer and faster shipping routes has opened up broader market opportunities, leading to a notable increase in the deployment of commercial vessels, particularly general cargo carriers and container ships.

The industry developments in North America are characterized by strict regulatory standards enforced by authorities such as the U.S. Coast Guard (USCG). These regulations ensure compliance with safety and environmental protocols, compelling shipowners to invest in maintenance services that meet these standards. North American participants are expected to set up new shipyards and repair centers in other regions as well.

For instance, in July 2024, Larsen & Toubro Limited Kattupalli shipyard, situated close to Chennai, received a Master Shipyard Repair Agreement (MSRA) from the U.S. Navy for the maintenance of ships. The shipyard has received approval from the Indian Navy and the Coast Guard.

Rising concerns such as illegal immigration and drug trafficking in Italy, Spain, and Albania are increasing the demand for stronger naval capabilities across the region. Furthermore, compliance with the U.N. Convention on the Law of the Sea (UNCLOS) III, which requires patrols within Exclusive Economic Zones (EEZs) extending 200 miles offshore, further supports the need for robust vessel maintenance.

The region also benefits from leading shipbuilding and repair hubs, including United Shipbuilding Corporation and Damen Ship Repair Rotterdam (DSR). In the U.K., the market plays a vital role across commercial shipping, offshore energy, fishing, and naval operations.

British shipyards provide comprehensive repair services for container ships, ferries, offshore support vessels, and naval fleets. The U.K.’s strategic position along the North Sea and English Channel reinforces its role as a key hub for maritime trade, naval activity, and offshore operations.

The global ship repair and maintenance service market is characterized by a competitive landscape led by a few dominant players, including Sembcorp Marine Ltd., Garden Reach Shipbuilders and Engineers Limited, BAE Systems, and Damen Shipyards Group.

These companies are actively expanding their dry dock facilities and service capabilities to meet the rising demand for vessel repair, particularly in the aftermath of the COVID-19 pandemic. Alongside these leaders, numerous shipyards, repair facilities, and specialized service providers contribute to the market with expertise across diverse vessel maintenance requirements.

Competition is shaped by factors such as technological innovation, service quality, geographic presence, and pricing strategies. Partnerships and collaborations are increasingly common, especially for large-scale and specialized projects. Furthermore, evolving regulatory requirements, technological advancements, and shifting customer expectations continue to define the dynamics of the global ship repair and maintenance services industry.

The ship repair and maintenance service market is estimated to be valued at US$39.1 Bn in 2025.

The key demand driver for the ship repair and maintenance service market is the increasing age of global marine fleets, which creates a continuous need for upkeep, overhauls, and system upgrades to ensure operational efficiency and compliance.

In 2025, the North America region will dominate the market with an exceeding 30% revenue share in the global ship repair and maintenance service market.

Among vessel types, the container ships represent the largest market share, accounting for over 40% of the total market revenue in 2025.

The key players in the ship repair and maintenance service market include Sembcorp Marine Ltd, Damen Shipyards Group, BAE Systems, General Dynamics NASSCO, and Larsen & Toubro Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Vessel Type

By Commercial Vessel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author