- Executive Summary

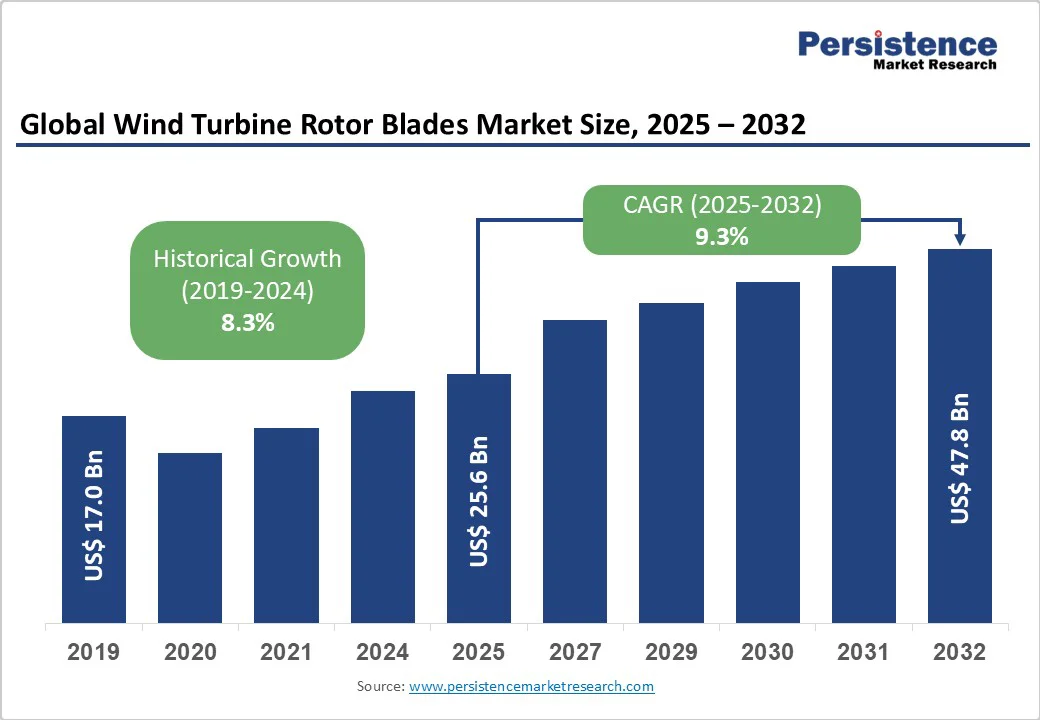

- Global Wind Turbine Rotor Blades Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Key Trends

- Macro-economic Factors

- Global Sectoral Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Tool Adoption Analysis

- Regulatory Landscape

- Value Chain Analysis

- PESTLE Analysis

- Porter’s Five Force Analysis

- Price Analysis, 2024A

- Key Highlights

- Key Factors Impacting Deployment Costs

- Pricing Analysis, By Blade Length

- Global Wind Turbine Rotor Blades Market Outlook

- Key Highlights

- Market Volume (Units) Projections

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) and Volume (Units) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2019-2024

- Current Market Size (US$ Bn) Analysis and Forecast, 2025 - 2032

- Global Wind Turbine Rotor Blades Market Outlook: Location

- Introduction / Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Location, 2019 - 2024

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Location, 2025 - 2032

- Onshore

- Offshore

- Market Attractiveness Analysis: Location

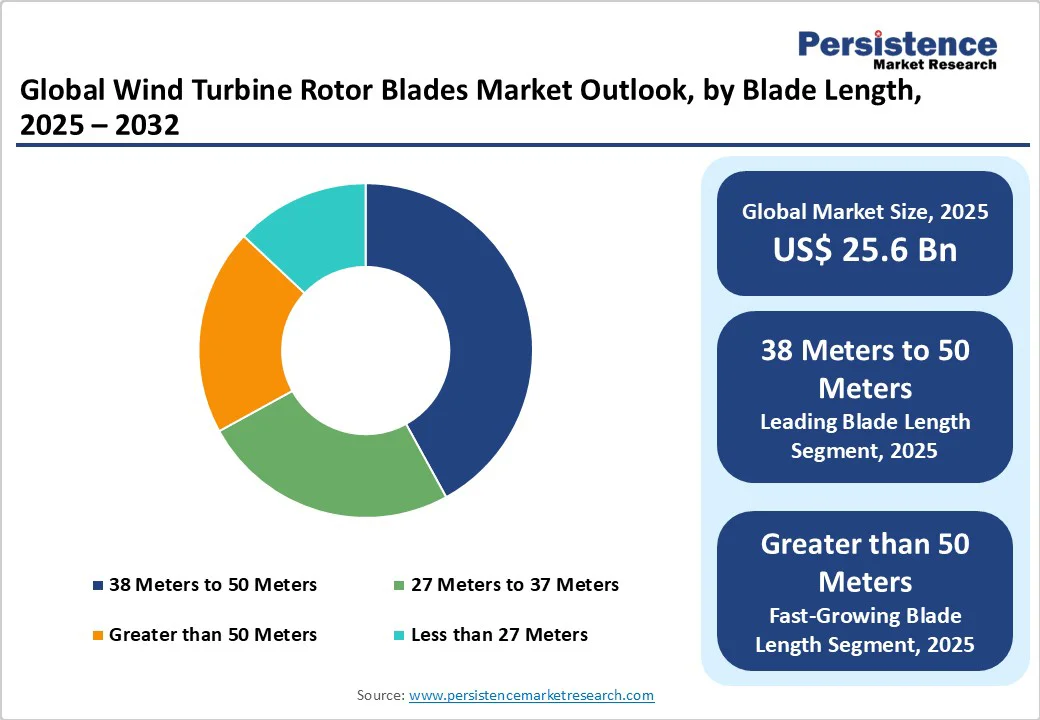

- Global Wind Turbine Rotor Blades Market Outlook: Blade Length

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Blade Length, 2019 - 2024

- Current Market Size (US$ Bn) Analysis and Forecast, By Blade Length, 2025 - 2032

- Less than 27 Meters

- 27 Meters to 37 Meters

- 38 Meters to 50 Meters

- Greater than 50 Meters

- Market Attractiveness Analysis: Blade Length

- Global Perlite Market Outlook: Material

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Material, 2019 - 2024

- Current Market Size (US$ Bn) Analysis and Forecast, By Material, 2025 - 2032

- Carbon Fiber

- Glass Fiber

- Others

- Market Attractiveness Analysis: Material

- Key Highlights

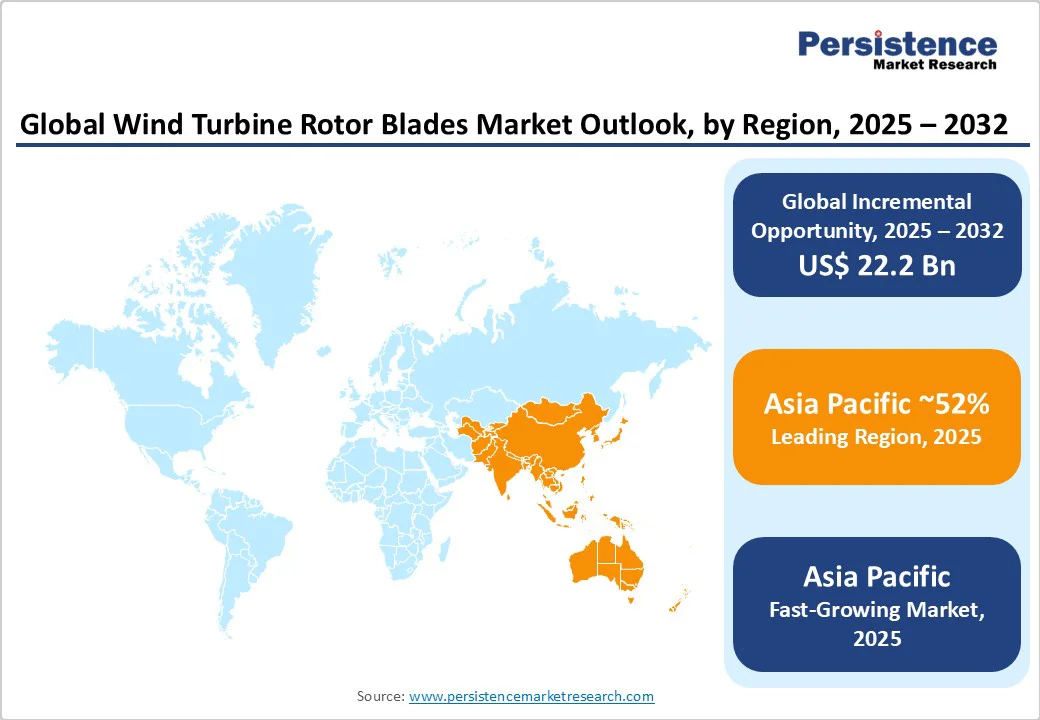

- Global Wind Turbine Rotor Blades Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis, By Region, 2019 - 2024

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Region, 2025 - 2032

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Wind Turbine Rotor Blades Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Location

- By Blade Length

- By Material

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- U.S.

- Canada

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Location, 2025 - 2032

- Onshore

- Offshore

- Current Market Size (US$ Bn) Analysis and Forecast, By Blade Length, 2025 - 2032

- Less than 27 Meters

- 27 Meters to 37 Meters

- 38 Meters to 50 Meters

- Greater than 50 Meters

- Current Market Size (US$ Bn) Analysis and Forecast, By Material, 2025-2032

- Carbon Fiber

- Glass Fiber

- Others

- Market Attractiveness Analysis

- Europe Wind Turbine Rotor Blades Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Location

- By Blade Length

- Material

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Location, 2025 - 2032

- Onshore

- Offshore

- Current Market Size (US$ Bn) Analysis and Forecast, By Blade Length, 2025 - 2032

- Less than 27 Meters

- 27 Meters to 37 Meters

- 38 Meters to 50 Meters

- Greater than 50 Meters

- Current Market Size (US$ Bn) Analysis and Forecast, By Material, 2025-2032

- Carbon Fiber

- Glass Fiber

- Others

- Market Attractiveness Analysis

- East Asia Wind Turbine Rotor Blades Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Location

- By Blade Length

- By Material

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- China

- Japan

- South Korea

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Location, 2025 - 2032

- Onshore

- Offshore

- Current Market Size (US$ Bn) Analysis and Forecast, By Blade Length, 2025 - 2032

- Less than 27 Meters

- 27 Meters to 37 Meters

- 38 Meters to 50 Meters

- Greater than 50 Meters

- Current Market Size (US$ Bn) Analysis and Forecast, By Material, 2025-2032

- Carbon Fiber

- Glass Fiber

- Others

- Market Attractiveness Analysis

- South Asia & Oceania Wind Turbine Rotor Blades Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Location

- By Blade Length

- By Material

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Location, 2025 - 2032

- Onshore

- Offshore

- Current Market Size (US$ Bn) Analysis and Forecast, By Blade Length, 2025 - 2032

- Less than 27 Meters

- 27 Meters to 37 Meters

- 38 Meters to 50 Meters

- Greater than 50 Meters

- Current Market Size (US$ Bn) Analysis and Forecast, By Material, 2025-2032

- Carbon Fiber

- Glass Fiber

- Others

- Market Attractiveness Analysis

- Latin America Wind Turbine Rotor Blades Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Location

- By Blade Length

- By Material

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Location, 2025 - 2032

- Onshore

- Offshore

- Current Market Size (US$ Bn) Analysis and Forecast, By Blade Length, 2025 - 2032

- Less than 27 Meters

- 27 Meters to 37 Meters

- 38 Meters to 50 Meters

- Greater than 50 Meters

- Current Market Size (US$ Bn) Analysis and Forecast, By Material, 2025-2032

- Carbon Fiber

- Glass Fiber

- Others

- Market Attractiveness Analysis

- Middle East & Africa Wind Turbine Rotor Blades Market Outlook

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market, 2019 - 2024

- By Country

- By Location

- By Blade Length

- By Material

- Current Market Size (US$ Bn) Analysis and Forecast, By Country, 2025 - 2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Current Market Size (US$ Bn) and Volume (Units) Analysis and Forecast, By Location, 2025 - 2032

- Onshore

- Offshore

- Current Market Size (US$ Bn) Analysis and Forecast, By Blade Length, 2025 - 2032

- Less than 27 Meters

- 27 Meters to 37 Meters

- 38 Meters to 50 Meters

- Greater than 50 Meters

- Current Market Size (US$ Bn) Analysis and Forecast, By Material, 2025-2032

- Carbon Fiber

- Glass Fiber

- Others

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Siemens AG

- Overview

- Segments and Deployments

- Key Financials

- Market Developments

- Market Strategy

- Vestas Wind Systems A/S

- Suzlon Energy Limited

- Gamesa Corporacion Tecnologica

- General Electric Company

- Acciona S.A.

- Enercon GmbH

- Nordex SE

- Powerblades GmbH

- SGL Rotec GmbH & Co. KG

- EnBW

- MHI Vestas Offshore Wind

- Hitachi Power Solutions

- Aeris Energy

- Sinoi GmbH

- Siemens AG

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment