ID: PMRREP35546| 199 Pages | 4 Aug 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

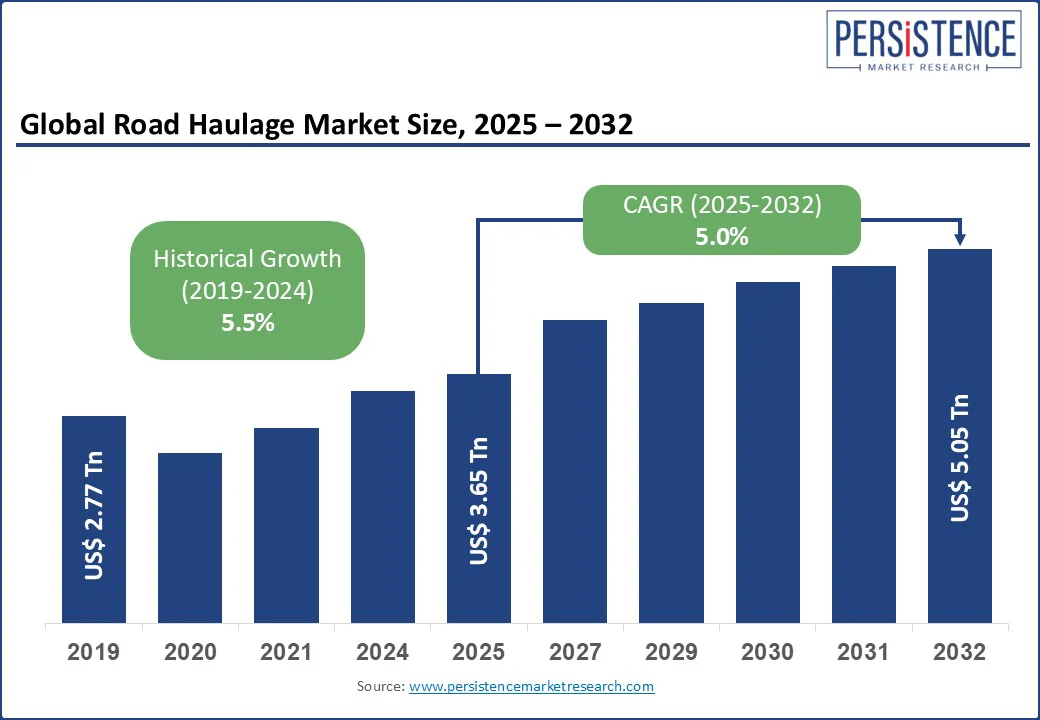

The global road haulage market size is likely to be valued at US$ 3.65 trillion in 2025, and is estimated to reach US$ 5.05 trillion by 2032, growing at a CAGR of 5.0% during the forecast period 2025−2032. The advent of electric and LNG-powered trucks, coupled with intelligent telematics and real-time fleet management systems, is creating tailwinds for sustainable and data-driven logistics solutions.

Road haulage comprises the physical movement of goods over land via light, medium, and heavy-duty commercial vehicles. Road freight operations are the backbone of the global logistics & transportation industry, accounting for over 70% of total inland cargo transport worldwide. With economies becoming intricately interconnected and supply chains experiencing extreme time-sensitivity, road cargo transport will continue to evolve in both scale and complexity.

A unique confluence of factors, ranging from e-commerce proliferation in Tier-II and Tier-III cities to the demand surge for temperature-controlled trucking services in pharmaceuticals and perishable foods, is charting the growth trajectory of the road haulage market. Large economies such as India and Vietnam have witnessed an astronomical rise in road freight demand due to large-scale infrastructure programs such as the PM Gati Shakti plan and Vietnam’s Road Master Plan 2030. For market stakeholders, investing in multi-modal logistics parks, developing customized less-than-truckload (LTL) solutions for small and medium enterprises (SMEs), and adopting AI-based route optimization platforms, especially in the fast-growing trade corridors across Southeast Asia, Eastern Europe, and Latin America, will deliver highly profitable returns over the next several years.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Road Haulage Market Size (2025E) |

US$ 3.65 Tn |

|

Market Value Forecast (2032F) |

US$ 5.05 Tn |

|

Projected Growth (CAGR 2025 to 2032) |

5.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.5% |

The rapidly expanding adoption of digital freight matching (DFM) platforms, which are fundamentally changing the sourcing, scheduling, and delivery of loads, is fueling the road haulage market growth. Traditionally plagued by inefficiencies, such as empty miles, fragmented networks, and long load-matching times, road freight transport is today undergoing a paradigm shift through AI-powered freight marketplaces. For instance, platforms such as Convoy, BlackBuck, and TIMOCOM have empowered shippers to match with verified carriers in real time, reducing deadhead miles by up to 35% and improving truckload capacity utilization, according to company-released performance benchmarks and third-party logistics reports.

The result is a more agile, transparent, and cost-effective road haulage ecosystem, particularly in the LTL and last-mile delivery segments, where responsiveness and margin optimization are critical. What is evident is that DFM is being considered as not just a tech upgrade but as a fulcrum to build logistics agility and enhance fleet productivity, giving rise to a smarter, more dynamic road freight transport market.

A persistent roadblock facing the road haulage market is the acute shortage of skilled commercial drivers, which is disrupting fleet capacity planning, delivery schedules, and impacting supply chain resilience in general. According to the International Road Transport Union (IRU), over 2.6 million truck driver positions went unfilled globally in 2023, with shortages projected to worsen as the average driver age in developed markets surpasses 50 years. In the European Union (EU), for instance, nearly a third of all road freight companies report being forced to decline new contracts due to labor constraints. In India, the All India Motor Transport Congress warns that only one in four trained drivers continues in the profession due to low social status, erratic working hours, negligible financial security, and poor road infrastructure.

This driver crunch is a systemic bottleneck for the scaling of less-than-truckload operations, expanding cross-border trucking, and improving on-time delivery key performance indicators (KPIs). The impact is especially pronounced in regions pursuing just-in-time logistics, where even minor delays cause a cascading effect across production and retail cycles. While automation technologies such as driver-assist systems and autonomous trucking pilots (such as Aurora and TuSimple) offer long-term solutions, their commercial viability is still several years away. In the interim, stakeholders in the road freight transport market must grapple with rising wage pressures, shrinking talent pools, and the urgent need for driver welfare reforms to ensure service reliability and meet the soaring demand for efficient freight operations.

The emergence of green freight corridors is paving the way for lucrative opportunities for players in the road haulage market. Designed as dedicated low-emission trucking routes enabled by infrastructure investments in electric vehicle (EV) charging, alternative fuels, and smart logistics hubs, these corridors are gaining traction as both governments and private entities pursue the decarbonization of supply chains, especially in high-volume trade routes across Europe, North America, and Southeast Asia. For example, the EU's AFIR directive mandates the deployment of charging stations every 60 km along the Trans-European Transport Network (TEN-T) by 2026, a move that will catalyze the adoption of battery-electric heavy-duty trucks (BEHDTs) and hydrogen fuel cell vehicles in long-haul freight.

As infrastructure-led strategy to materialize countries’ net-zero ambitions, green freight corridors present a high-value growth opportunity for fleet operators, original equipment manufacturers (OEMs), and energy providers. Companies such as DHL Freight and Maersk have already begun piloting zero-emission trucking corridors between Germany and the Netherlands, supported by solar-powered logistics hubs and real-time route optimization. In India, both the central and state governments are exploring similar models through initiatives such as PM Gati Shakti and building EV-focused freight pilot zones along national highways. Seen as a way to reduce Scope 3 emissions, these corridors have proven to lower the total cost of ownership (TCO) and improve the performance of logistics companies in terms of environmental, social, and governance (ESG) metrics.

The short haul sub-segment, which is anticipated to dominate the road haulage distance market with an estimated 83% share in 2025, is being propelled by a mix of factors revolving around the high demand for urban logistics, heightening e-commerce delivery fulfillment pressures, and the growing popularity of just-in-time inventory systems. With hyperlocal delivery models gathering momentum in densely populated urban clusters, short-haul freight is increasingly characterized by frequent, time-sensitive movements across distances under 300 km. A McKinsey study found that last-mile delivery volumes have grown by over 20% annually in major metropolitan areas since 2020, exerting pressure on fleet operators to invest in smaller, faster, and more agile trucking solutions. Interestingly, this has spurred the adoption of electric light commercial vehicles (eLCVs) and digital route optimization software as a way to reduce costs, emissions, and turnaround time.

Although long-haul transport holds a much smaller portion, it presents strategic opportunities for road freight carriers operating across regional trade corridors. The revival of transcontinental infrastructure programs, such as the African Continental Free Trade Area (AfCFTA) highway initiative, the Pan-Asian Highway, and China’s Belt and Road Initiative (BRI), is elevating the economic feasibility of cross-border road freight, especially in landlocked countries. In Europe, the TEN-T Core Network Corridors are being upgraded to support high-volume, long-distance trucking with harmonized vehicle regulations and smart border controls. Meanwhile, long-haul operators are leveraging platooning technologies, driver swap hubs, and multimodal freight consolidation points to offset fuel and labor costs and fill driver shortage gaps. For example, Maersk and Hapag-Lloyd are implementing intermodal long-haul road transport strategies in Eastern Europe to move goods inland from congested seaports such as Rotterdam and Gdansk.

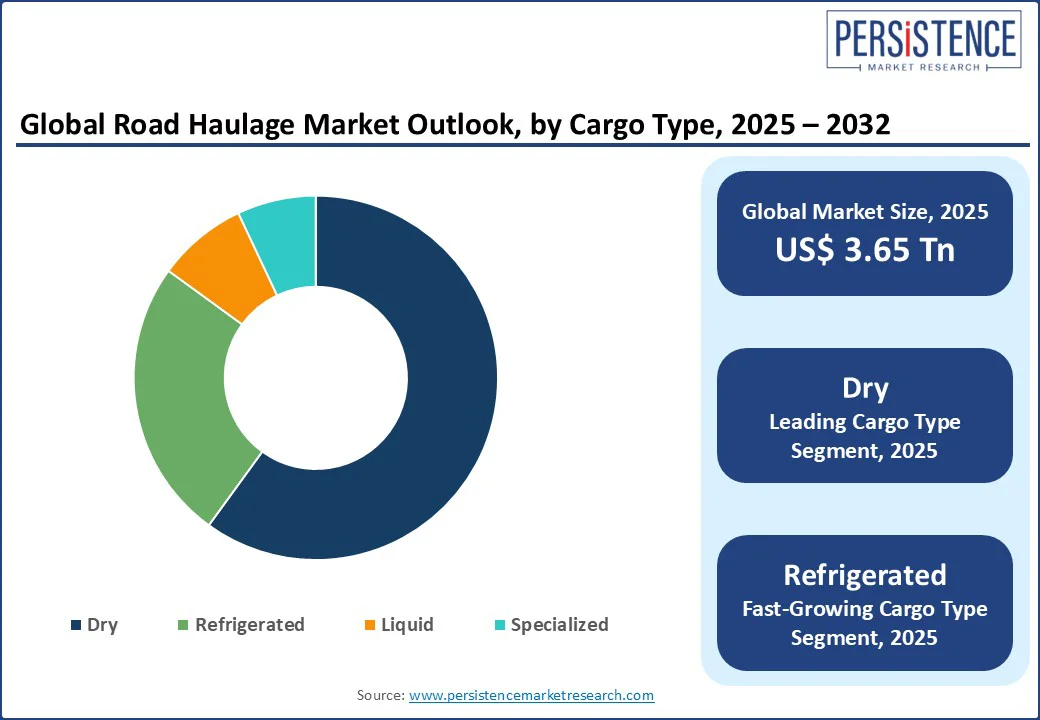

The dry cargo sub-segment is expected to command approximately 60% of the market revenue share in the cargo segment in 2025. Dry cargo remains the most commercially profitable cargo type due to its broad applicability across retail, manufacturing, and construction logistics. A major driver is the expansion of omnichannel retail models, where companies such as Walmart, Flipkart, and Carrefour increasingly rely on high-frequency, short-haul deliveries for consumer goods, electronics, and non-perishable FMCG products. The rising intensity of construction activity across developing economies is fueling the employment of bulk dry freight, such as cement, steel coils, and prefabricated materials, delivered to urban and peri-urban sites via heavy-duty trucks. The adoption of digital freight brokerage platforms is also widening the utilization of dry cargo, with AI-based load consolidation and real-time tracking becoming a standard in high-density freight corridors across Southeast Asia and Latin America.

Conversely, the refrigerated, liquid, and specialized cargo sub-segments are projected to experience new growth frontiers owing to fast-evolving needs of the logistics & transportation industry and changing compliance regimes. Refrigerated (reefer) trucking is receiving a strong push from the pharmaceutical cold chain and global food trade. The formulation of biologics and temperature-sensitive vaccines, especially during and after COVID-19, has triggered regional investment in GPS-monitored, multi-temperature reefer trucks with capabilities meeting the standards set by the World Health Organization (WHO) and those under good distribution practice (GDP). On the other hand, liquid cargo transport is benefiting from a stable demand in petrochemicals, edible oils, and bulk beverages, with new safety regulations, such as ADR in Europe and PESO in India, mandating upgrades in tanker specifications.

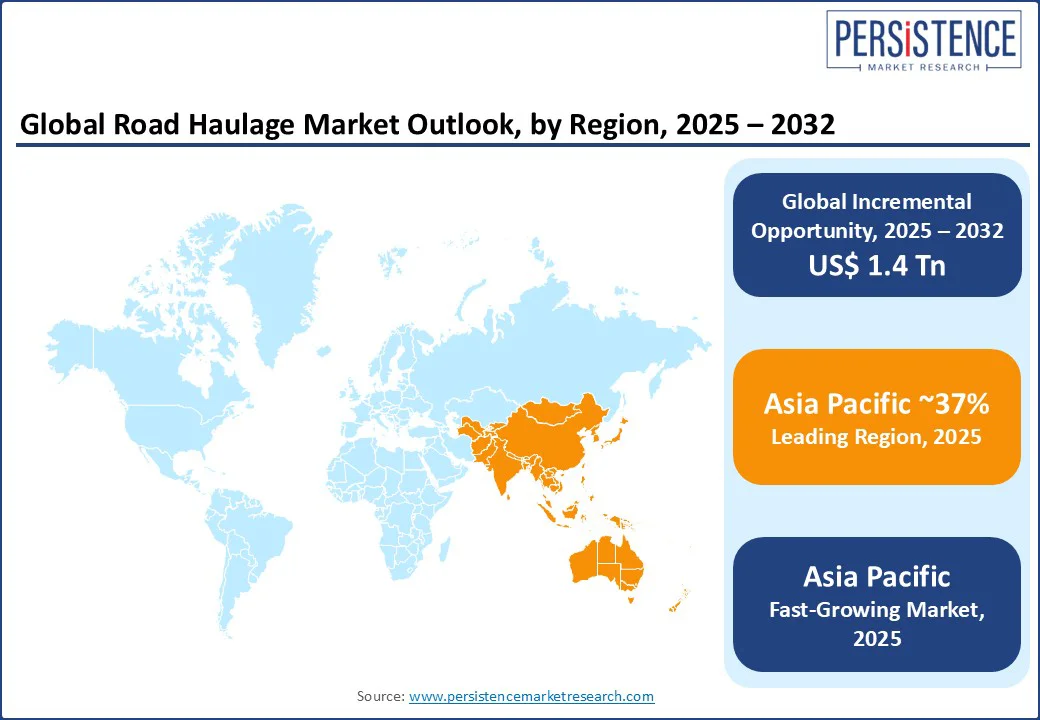

Asia Pacific is projected to hold around 37% of the road haulage market share in 2025, with the market here being aided by massive investments in large-scale infrastructure projects, robust road networks, and a steady transition to digital freight ecosystems. India, China, Indonesia, and Vietnam are funneling huge amounts of capital into expanding road networks, developing logistics parks, and creating new freight corridors under initiatives such as China’s Belt and Road Initiative (BRI) and India’s PM Gati Shakti Master Plan. India alone added over 10,000 km of highways in FY24, bringing down intercity freight transit times by more than 25%. This, in turn, is accelerating the demand for full truckload (FTL) and less-than-truckload services across the speedily industrializing Tier-II and Tier-III cities in the country.

Europe is estimated to hold 34% share in 2025, occupying the second-largest position in the road haulage market. Well-integrated transport policies, cross-border harmonization, and considerable strides in low-emission freight logistics are the prime factors powering the market in Europe. The EU’s Mobility Package I, which are a set of new rules for the road transport sector that came into effect in 2023, has overhauled regulations around cabotage, driver rest periods, and tachograph usage. The idea behind these rules is to enforce a unified road haulage standard that increases fleet transparency and safety across member states. The Trans-European Transport Network is a foundational pillar for intra-regional haulage, connecting major logistics hubs such as Rotterdam, Hamburg, and Milan with fast-tracked road infrastructure upgrades. According to Eurostat, road transport continues to dominate EU freight transport, with over 75% of inland cargo moved using trucks. LTL operations are particularly strong in Central and Eastern Europe, where nearshoring activities are spurring high-frequency road shipments between low-cost manufacturing zones and Western European consumption centers.

Europe is also at the vanguard of green road freight innovation. Germany, the Netherlands, and Sweden are spearheading overhead electrification, termed eHighways, for long-haul trucks and urban low-emission zones (LEZs) to curb diesel-engine-powered last-mile deliveries. Scania and Volvo Trucks have begun serial production of battery-electric long-haul trucks, while large-scale 3PLs (Third-Party Logistics) such as DHL Freight are deploying green corridors between Germany and the Benelux region. The introduction of road tolling based on carbon emissions across several EU countries is pushing carriers to modernize their fleets with low-emission vehicles and telematics for carbon tracking. The emphasis on multimodal freight integration, combining road, rail, and inland waterways, is also reducing the cost per ton-kilometer for fleet operators and optimizing sustainability KPIs on the continent.

The North America road haulage market is set to make significant gains from a trifecta of factors in the form of cross-border trade expansion across the length and breadth of the continent, scaling of e-commerce activities, and the proliferation of smart technologies in freight operations. The ratification of the United States-Mexico-Canada Agreement (USMCA) has bolstered cross-border freight volumes, with more than 70% of trade among the three countries being moved by road. This surge in the physical movement of cargo is upping the demand for digitized customs clearance, fleet visibility platforms, and LTL consolidation hubs along high-traffic corridors such as Laredo, Detroit, and Tijuana. Trade data substantiates these claims.

The American Trucking Associations (ATA) reports that the U.S. truck freight market alone generated US$940 billion in revenue in 2023. Platforms such as Convoy, Uber Freight, and Project44 are transforming traditional freight brokering with real-time pricing, empty mile reduction, and automated freight tendering. On the sustainability front, road freight transport companies in North America are readily pioneering battery-electric and hydrogen-powered heavy-duty trucks, especially in California, British Columbia, and Ontario. Fleet operators such as Schneider National and PepsiCo have already deployed Tesla Semi trucks for short-haul routes, while Nikola Corporation has begun deliveries of hydrogen fuel cell trucks in select U.S. states.

The global road haulage market is experiencing a tectonic shift in its competitive landscape on account of the digitalization of freight operations, regional consolidation in the logistics & transportation sector, and growing compliance with ESG mandates. Having been fragmented for several decades, the road freight industry is now being characterized by the increasing presence of tech-driven freight integrators and cross-border logistics conglomerates.

In North America, for example, Uber Freight’s $2.25 billion acquisition of Transplace in 2021 garnered industry-wide attention from a digital brokerage standpoint. For Europe, DFDS’s acquisition of ICT Logistics and Maersk’s expansion into inland trucking through its Logistics & Services division was a testament to how ocean carriers can contribute towards building and expanding road haulage capabilities to offer unified supply chain solutions. Across the ocean, India’s Delhivery has transitioned from a parcel delivery startup to a full-spectrum freight solution provider with its acquisition of Spoton Logistics.

The road haulage market is projected to reach US$ 3.65 trillion in 2025.

The expanding adoption of digital freight matching (DFM) platforms and proliferation of e-commerce operations are driving the market.

The road haulage market is poised to witness a CAGR of 5.0% from 2025 to 2032.

The emergence of green freight corridors and government-led decarbonization of supply chains are key market opportunities.

DHL Freight, XPO Logistics, and FedEx Freight are some key market players

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Load Type

By Distance

By Vehicle Type

By Industry

By Cargo Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author