ID: PMRREP36114| 199 Pages | 12 Feb 2026 | Format: PDF, Excel, PPT* | Industrial Automation

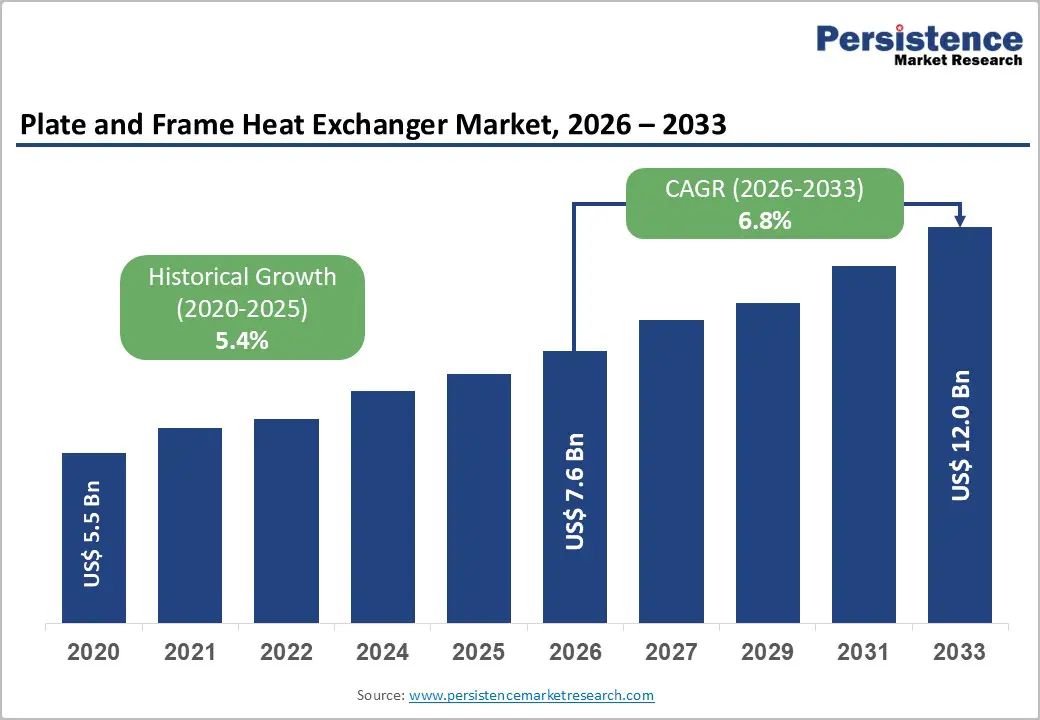

The global plate and frame heat exchanger market size is likely to be valued at US$ 7.6 Billion in 2026 and is expected to reach US$ 12.0 Billion by 2033, growing at a CAGR of 6.8% during the forecast period from 2026 to 2033. This expansion is primarily driven by rising industrial demand for energy-efficient thermal management and by stricter environmental regulations that compel industries to adopt compact, high-performance heat-transfer equipment.

| Key Insights | Details |

|---|---|

|

Plate and Frame Heat Exchanger Market Size (2026E) |

US$ 7.6 Billion |

|

Market Value Forecast (2033F) |

US$ 12.0 Billion |

|

Projected Growth CAGR (2026–2033) |

6.8% |

|

Historical Market Growth (2020–2025) |

5.4% |

A major driver of the plate and frame heat exchanger market is the growing global focus on energy-efficient thermal systems across industrial, commercial, and residential sectors. Regulatory bodies such as the European Commission, the U.S. Department of Energy, and national energy agencies in China are enforcing stricter efficiency standards for heating, cooling, and process systems. These policies are encouraging industries to replace outdated equipment with high-performance solutions.

Plate and frame heat exchangers provide higher heat-transfer efficiency, compact design, and lower energy consumption compared with traditional shell-and-tube systems. Their ability to deliver strong thermal performance with reduced pumping power helps facilities lower operating costs and carbon emissions. In HVAC and refrigeration applications, these exchangers are widely used in chillers, heat pumps, and district cooling networks, where even small efficiency improvements yield substantial energy savings. As sustainability goals rise, adoption continues to accelerate.

The steady growth of chemical, petrochemical, oil and gas, and food processing industries is another major factor driving demand for plate and frame heat exchangers. These sectors depend heavily on efficient heating, cooling, and condensation systems for daily operations. Industry data indicate that global chemical production has been growing by approximately 3–4% annually, with Asia-Pacific and the Middle East leading the expansion.

In food processing, rising demand for packaged, pasteurized, and UHT products has increased the need for hygienic and easy-to-clean heat exchange systems. Plate and frame designs are ideal due to their modular structure, quick maintenance, and sanitation compatibility. Gasketed and semi-welded models allow flexible capacity adjustments without replacing entire systems. As manufacturing facilities expand in emerging economies and industrial output increases globally, the installation of plate heat exchangers is expected to grow steadily across multiple processing industries.

One of the key challenges in the plate and frame heat exchanger market is the higher upfront cost compared to traditional shell-and-tube exchangers. These systems require precision-engineered plates, durable frames, and high-quality gaskets, which increase initial investment. While they offer superior efficiency and space savings, many budget-conscious industries hesitate to adopt them due to cost concerns.

Maintenance can also be complex, as gaskets may wear over time, plates may corrode in harsh environments, and fouling necessitates regular cleaning. This is especially common in chemical processing, marine operations, and wastewater treatment. Frequent inspections and part replacements raise long-term operating expenses. In regions with limited technical expertise or service support, these challenges become more significant. As a result, some companies continue to use conventional exchangers unless regulatory requirements or efficiency gains strongly justify the transition.

Fluctuations in raw-material prices and supply-chain disruptions pose another major restraint for the plate and frame heat exchanger market. Key materials such as stainless steel, titanium, and nickel alloys are essential for manufacturing corrosion-resistant and high-performance units. However, global commodity markets have seen frequent price changes due to geopolitical tensions, energy costs, and trade policies. Rising metal prices directly increase production costs and can delay investment decisions for large industrial projects.

Titanium and specialty alloys, commonly used in chemical processing and offshore applications, are especially vulnerable to price instability. Additionally, logistics issues such as shipping delays, port congestion, and regional trade restrictions can disrupt delivery schedules. These challenges affect project timelines and overall plant economics. Together, material cost uncertainty and supply-chain risks slow down new installations and limit market growth in capital-intensive industries.

The expansion of renewable-energy-based heating and cooling systems presents a strong growth opportunity for the plate and frame heat exchanger market. Governments worldwide are investing in geothermal, biomass, solar thermal, and waste-heat recovery projects to reduce carbon emissions. Initiatives such as the European Green Deal and national clean-energy policies are driving the development of district heating and cooling networks, which require highly efficient thermal-transfer equipment.

Plate and frame heat exchangers are well-suited for these applications because they perform efficiently at low temperature differences and occupy minimal space. Many projects in Scandinavia, Germany, and China already use these exchangers to integrate renewable heat sources into urban energy systems. Their flexibility and high efficiency make them ideal for future smart energy infrastructure. As cities pursue carbon neutrality, demand for plate exchangers in renewable thermal networks will continue to increase rapidly.

Another major opportunity lies in the increasing use of advanced materials and welded-plate heat exchanger designs for demanding industrial applications. Industries such as oil and gas, chemical processing, and power generation increasingly require equipment capable of withstanding high pressure, high temperature, and corrosive fluids. Materials such as titanium, nickel alloys, and specialized corrosion-resistant metals offer longer service life and improved safety.

Welded and semi-welded plate exchangers eliminate gasket leakage risks and allow operation under extreme conditions. Leading manufacturers, including Alfa Laval, Kelvion, and SPX Flow, have introduced laser-welded plate systems with modular structures to improve reliability and facilitate maintenance. These high-performance solutions are gaining popularity in critical processes where safety and efficiency are priorities. As industries modernize and comply with stricter environmental standards, demand for advanced plate exchanger technologies is expected to grow strongly.

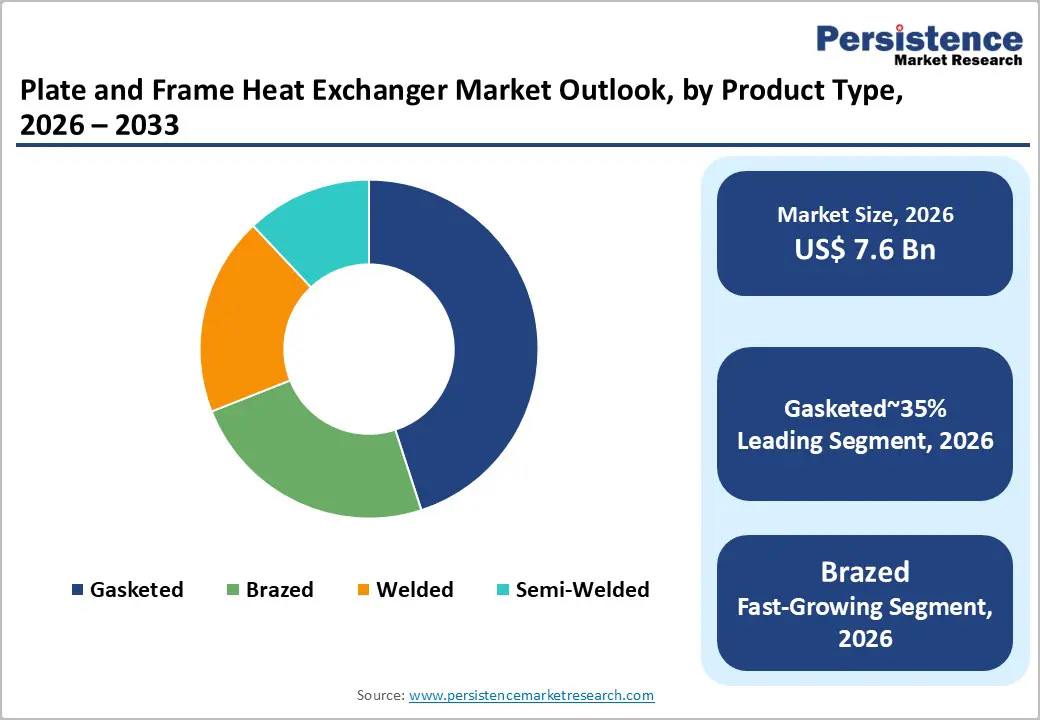

The gasketed plate and frame heat exchanger segment holds the largest share of the global market, accounting for approximately 45% by value. This strong position is driven by its high flexibility, ease of maintenance, and broad applicability across industries such as chemicals, food and beverage, pharmaceuticals, and HVAC systems. Operators can easily adjust capacity by adding or removing plates, making these exchangers ideal for processes with changing thermal requirements.

In food processing, hygienic gasket materials allow safe handling of sensitive products while supporting frequent cleaning. Industry publications consistently highlight gasketed designs as the preferred solution for low to medium-pressure operations where efficiency and adaptability are essential. While welded and brazed models are gaining traction in extreme conditions, gasketed exchangers remain the most widely used due to their affordability, operational convenience, and proven reliability across standard industrial processes.

Stainless steel dominates the material segment of the plate and frame heat exchanger market, representing nearly 60% of global demand. This popularity stems from its excellent balance of corrosion resistance, durability, ease of fabrication, and cost-effectiveness. Grades such as 304 and 316 stainless steel are widely used in HVAC systems, food-processing plants, chemical facilities, and power-generation units. These materials perform well in environments involving moderate acids, salts, and temperature variations without requiring expensive specialty metals.

Engineering standards consistently recommend stainless steel as the default choice for most industrial heat exchange applications. While titanium and nickel alloys are essential for highly corrosive processes, their higher cost limits widespread use. As long as stainless steel continues to meet safety, performance, and economic requirements, it is expected to remain the primary material for plate and frame heat exchangers worldwide.

The chemical and petrochemical industry represents one of the largest end-user segments in the plate and frame heat exchanger market, contributing roughly 25% of global demand. These industries rely heavily on heat exchangers for cooling, heating, condensation, and heat recovery throughout production processes. Plate and frame designs are preferred due to their high efficiency, compact footprint, and ability to improve energy utilization in complex plant layouts.

They help reduce space requirements and simplify piping systems, which is especially valuable in facility expansions and retrofits. Industry reports show strong adoption in refineries, specialty chemical plants, and wastewater treatment systems within industrial complexes. Tightening environmental regulations and rising energy costs are further encouraging the adoption of efficient heat-transfer technologies. With continued growth in chemical manufacturing across the Asia Pacific and the Middle East, this segment will remain a key driver of market demand.

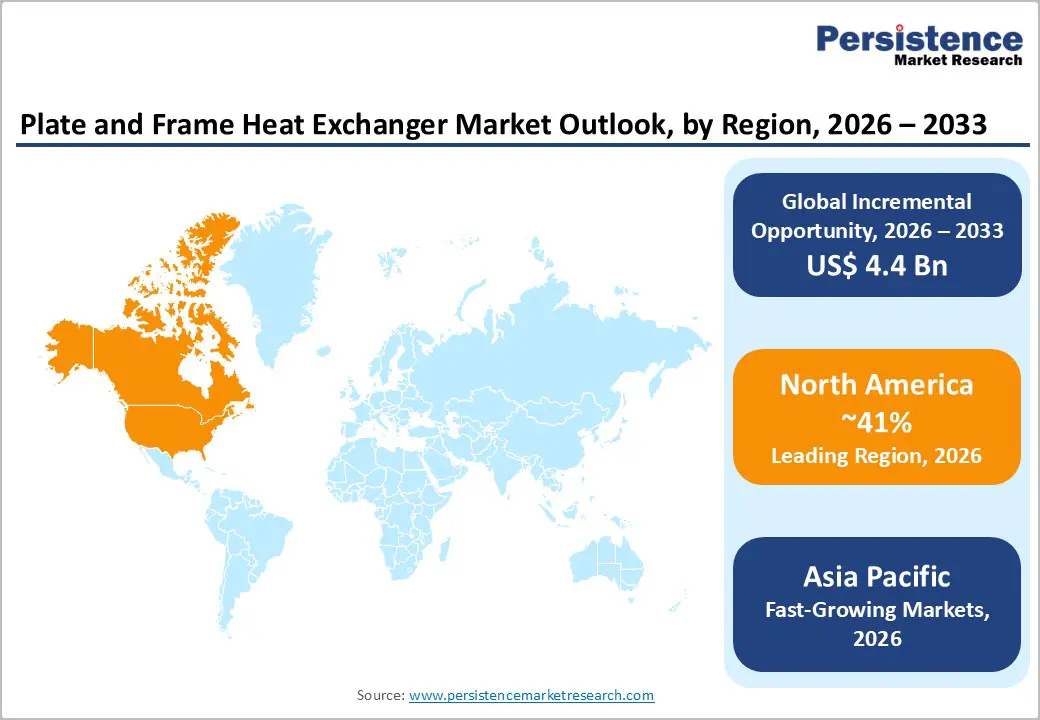

The North American market is supported by well-established industries, strong regulatory standards, and ongoing technological innovation. The United States leads regional demand, driven by chemical plants, refineries, power stations, and large commercial HVAC systems. Government initiatives, such as the Department of Energy's efficiency guidelines and environmental emission rules, are encouraging industries to upgrade outdated heating and cooling systems.

Plate and frame heat exchangers are increasingly replacing traditional equipment due to their higher efficiency and compact design. In addition, district heating and cooling projects in major cities are integrating waste-heat recovery and renewable energy sources using plate exchangers. These systems help reduce fuel consumption and improve sustainability performance. With continued focus on energy conservation and infrastructure modernization, North America is expected to maintain steady growth in demand for plate and frame heat exchanger technologies.

Europe’s market is shaped by strict environmental policies, strong energy-efficiency targets, and advanced industrial standards. Countries such as Germany, the United Kingdom, France, and Spain are actively implementing EU regulations on building energy performance and industrial emissions. These initiatives promote the adoption of efficient heat transfer technologies across HVAC systems, manufacturing facilities, and district energy networks.

Scandinavian and German projects widely use plate exchangers in geothermal heating and waste-heat recovery systems to support decarbonization goals. Standardized engineering codes across Europe ensure high equipment reliability and quality consistency. The European Green Deal further accelerates investments in renewable heating infrastructure, where plate heat exchangers play a critical role. As sustainability becomes central to industrial planning, Europe is expected to remain a leading market for advanced plate and frame heat exchanger solutions.

Asia Pacific is witnessing rapid growth in the plate and frame heat exchanger market, driven by industrial expansion, urban development, and rising energy efficiency initiatives. China, India, Japan, and Southeast Asian nations are investing heavily in chemical plants, power generation, food processing, and commercial infrastructure. Government policies that promote green manufacturing and reduce energy intensity are encouraging industries to adopt high-efficiency heat-transfer equipment.

Plate exchangers are increasingly used in HVAC systems, pharmaceutical plants, and industrial cooling applications. Additionally, strong local manufacturing capabilities in China and India provide cost-competitive products, supporting widespread adoption. Growing investments in smart cities, district cooling networks, and industrial parks further boost demand. With continuous infrastructure development and industrialization, the Asia Pacific is expected to remain the fastest-growing regional market for plate and frame heat exchangers globally.

The global plate and frame heat exchanger market is moderately consolidated, with several multinational companies holding significant market share alongside numerous regional manufacturers. Leading players such as Alfa Laval, Danfoss, Kelvion, SPX Flow, API Heat Transfer, Hisaka Works, Tranter, and Barriquand Group compete through product innovation, engineering expertise, and global service networks. These companies invest heavily in research and development to improve plate designs, enhance heat-transfer efficiency, and introduce corrosion-resistant materials.

Digital monitoring systems, predictive maintenance tools, and performance-based service contracts are becoming common business strategies. At the same time, regional manufacturers, particularly in the Asia Pacific and Latin America, are gaining traction by offering cost-effective solutions for standard industrial applications. This intensifying competition is driving technological improvements while placing downward pressure on prices. Overall, the market remains dynamic, with innovation and service quality shaping long-term competitiveness.

The global plate and frame heat exchanger market is projected to reach US$ 12.0 Billion by 2033, growing at a CAGR of 6.8% from 2026 to 2033, driven by rising industrial demand, energy‑efficiency regulations, and expansion of renewable‑based heating and cooling infrastructure.

Key demand drivers include increasing need for energy‑efficient thermal systems, stringent environmental regulations, growth in chemical & petrochemical and food‑processing industries, and expansion of HVAC & refrigeration and district heating networks, all of which favor compact, high‑performance plate and frame heat exchangers.

The gasketed plate and frame heat exchanger segment dominates the type category, accounting for around 45% of global demand due to its flexibility, ease of maintenance, and broad applicability in chemical, food & beverage, and HVAC applications.

North America leads the plate and frame heat exchanger market in terms of installed capacity and value, supported by mature industrial infrastructure, stringent energy‑efficiency standards, and widespread use in chemical, oil & gas, and HVAC sectors.

A key growth opportunity lies in the integration of plate and frame heat exchangers into renewable‑based heating and cooling networks, including geothermal, biomass, and waste‑heat‑to‑district‑heating systems, as governments push for decarbonization of urban energy systems.

Leading players include Alfa Laval, API Heat Transfer, Danfoss, Kelvion Holding GmbH, SPX Flow, Hisaka Works, Ltd., Tranter Inc., Barriquand Group, WCR, Inc., Gooch Thermal Systems, Inc., Shineheat Corp., Elanco Heat Transfer Systems, HFM, and Kinam Engineering Pvt. Ltd., among others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Material

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author