ID: PMRREP14743| 200 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

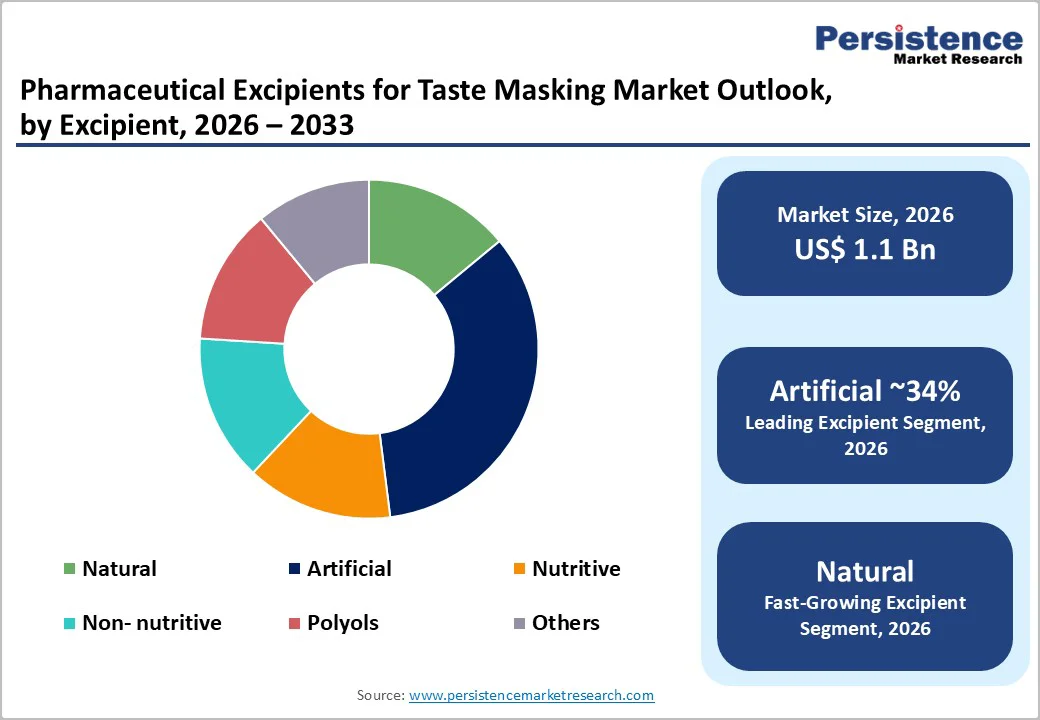

The global pharmaceutical excipients for taste masking market size is estimated to value at US$ 1.1 billion in 2026 and is projected to reach US$ 1.5 billion by 2033, growing at a CAGR of 4.8% during the forecast period from 2026 to 2033.

Taste-masking excipients are used to cover the bitter or unpleasant taste of medicines, especially in oral drugs. Medicines such as antibiotics, pain relievers, and anti-inflammatory drugs commonly use taste-masking to improve patient comfort.

Over time, the methods used for taste masking have changed. Recently, granulation has also become an important method. With continuous improvement in formulation technologies, the demand for advanced taste-masking excipients is increasing, and the overall market is expected to grow steadily in the coming years.

| Key Insights | Details |

|---|---|

| Pharmaceutical Excipients for Taste Masking Market Size (2026E) | US$ 1.1 Bn |

| Market Value Forecast (2033F) | US$ 1.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.8% |

| Historical Market Growth (CAGR 2020 to 2024) | 4.2% |

Any substance's flavour can be distinguished by its taste and odour. Any substance with a bitter taste finds it challenging to gain widespread acceptance. Thus, in order for patients such as elderly people and children, to take typical bitter medications orally, taste masking chemicals are now required.

Pharmaceutical excipients for taste masking play a crucial part in the final dosage of oral medications, unless the substances have no taste or have a bad taste. Pharmaceutical excipients for flavour masking help give many final medicine formulations a pleasing taste, potentially removing nausea brought on by drug taste.

The usage of various excipients for sweetening, ranging from synthetic to natural, has offered producers the viability they need to compete in the pharmaceutical excipients for flavour masking market in terms of price, availability, and accessibility. Chronic and lifestyle diseases are becoming more common everywhere in the world. For society's health, the prevalence of chronic diseases is a significant burden.

Diabetes, cardiovascular conditions, cancer, obesity, osteoporosis, and pulmonary conditions are examples of major chronic diseases. Lifestyle choices such as smoking, not exercising, and eating unhealthy foods all contribute to an increase in medicine demand, which eventually leads to a market expansion for pharmaceutical excipients that conceal flavour.

The procedures for approving generic drugs are essentially the same everywhere, with minor variations in undeveloped countries. This is due to the fact that the world is not obliged to complete a bioequivalence (BE) research in order to receive generic medicine approval. Medical professionals assert that governments must guarantee the uniform quality of all generic medications. Only then can physicians be content and confident in writing generic medicine prescriptions.

Physicians' (and even patients') lack of trust in generic drugs has been largely attributed to weak regulatory standards governing the number of generic drugs and the number of permitted contaminants. Controlling the manufacturing and distribution of excipients is now a priority for authorities and medication manufacturers because combining excipients has resulted in adverse patient outcomes.

The development of new excipients and delivery technologies has also increased the importance of greater control over the supply and quality of pharmaceutical excipients in the context of in vivo activity.

Excipient suppliers must satisfy the pharmaceutical industry's quality standards due to the excipients' crucial role in pharmaceutical dosage forms, and the pharmaceutical industry must work to ensure the product's safety. The supply chain's use or storage integrity. Therefore, it is anticipated that the expansion of the worldwide market will be constrained by the increasing regulatory requirements for the licensing of pharmaceuticals and excipients.

The growth of Contract Development and Manufacturing Organizations (CDMOs) and outsourcing models is creating new opportunities in the pharmaceutical taste-masking market.

Many pharmaceutical and nutraceutical companies now prefer to outsource the development and production of oral medicines to CDMOs that specialize in complex oral delivery systems. These CDMOs often invest in advanced taste-masking technologies such as hot melt extrusion, film coating, and microencapsulation. This creates a steady demand for high-performance taste-masking excipients.

As CDMOs aim to provide complete solutions from studying the active drug to designing patient-friendly doses, suppliers of excipients such as polyols, non-nutritive sweeteners, and co-processed materials have a chance to expand their business.

Their ingredients can be integrated into the proprietary platforms that CDMOs use for multiple clients and products. This trend not only increases the demand for innovative and high-quality excipients but also allows excipient suppliers to collaborate closely with CDMOs on new oral formulations. Overall, the expansion of outsourcing and CDMO models is a key opportunity for excipient manufacturers to grow and reach a wider range of pharmaceutical projects.

The artificial excipient segment is expected to lead the pharmaceutical excipients for taste masking market, capturing approximately 34% of the market share in 2025. This growth is largely driven by the extensive use of synthetic sweeteners, flavoring agents, and specialized polymers, which effectively mask the bitterness of drugs even at low concentrations.

Artificial sweeteners and flavor modulators deliver strong sweetness while contributing minimal calories, making them suitable for both adult and pediatric formulations where controlling sugar intake is important. Additionally, synthetic film-forming polymers and coating systems play a critical role in managing drug release and taste perception, particularly for high-dose bitter active pharmaceutical ingredients (APIs) in tablets and granules.

An effective oral dosage form must address bitterness reduction, and significant advances have been made in developing taste-masking compositions in recent years. Synthetic excipients also support tablet manufacturing by binding ingredients, reducing die-wall friction, maintaining pH balance, and ensuring proper disintegration in the stomach. These functionalities have significantly contributed to the expansion and adoption of artificial excipients in pharmaceutical formulations.

Solid dosage forms are expected to account for approximately 74% of the Pharmaceutical Excipients for Taste Masking market in 2025, highlighting the widespread use of tablets, capsules, and granules in global prescriptions. This segment is particularly significant in chewable tablets, orally disintegrating tablets (ODTs), and sprinkle formulations, where the direct interaction of the dosage form with taste buds requires advanced masking techniques.

Innovations in co-processed excipients and orally disintegrating platforms developed by companies such as SPI Pharma and Adare Pharma Solutions have strengthened the dominance of solid dosage forms, particularly in chronic therapies where patient compliance is critical.

Many active pharmaceutical ingredients (APIs) exhibit poor solubility and slow dissolution in aqueous environments, such as the fluids of the digestive tract, which can limit oral bioavailability. Excipients play a vital role in overcoming these challenges by contributing to the stability, drug release, taste, and texture of the final formulation. Their inclusion ensures that the medication is both effective and palatable, making excipients indispensable in solid dosage forms.

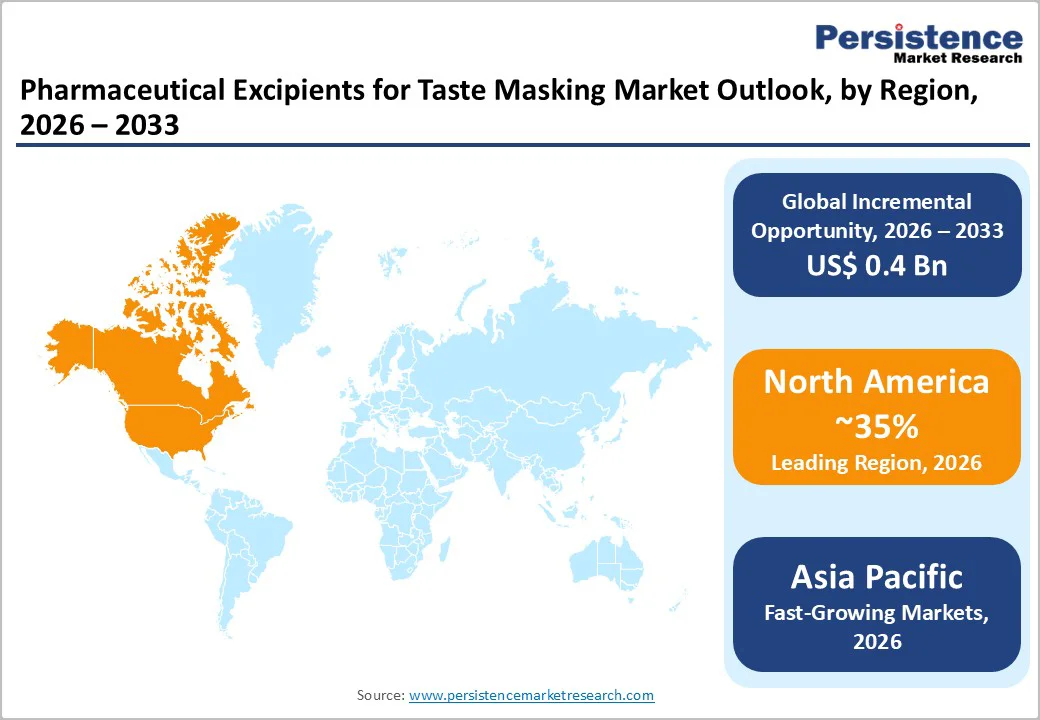

North America, led by the U.S., is projected to account for about 37% of the global Pharmaceutical Excipients for Taste Masking market in 2025. The region benefits from a large portfolio of oral prescription and over-the-counter products, creating strong demand for excipients that improve taste and patient compliance.

Innovation in excipient and formulation development is a key driver, with companies focusing on advanced platforms for orally disintegrating tablets (ODTs), chewables, and pediatric suspensions, especially for chronic and acute therapies.

Regulatory oversight by the U.S. FDA ensures high-quality standards, promoting the use of well-characterized excipients and discouraging untested flavors or sweeteners. Leading industry players, including SPI Pharma, DuPont de Nemours, and Dow Pharma Solutions, help accelerate the adoption of novel taste-masking excipients in both branded and generic drugs.

High acceptance of patient-centric dosage forms and the use of technologies like microencapsulation and coating further enhance market growth. Additionally, the increasing role of North American CDMOs in oral drug delivery supports consistent demand for high-performance taste-masking solutions across the region.

Europe represents a mature but steadily expanding market for pharmaceutical taste-masking excipients. Key contributors include Germany, the U.K., France, and Spain, where oral solid dosage forms remain central to pharmaceutical therapy.

Regulatory guidance from the European Medicines Agency (EMA) and national authorities emphasizes both benefit-risk balance and patient acceptability, encouraging manufacturers to improve palatability, particularly in pediatric medicines under EU pediatric regulations. This has driven the use of taste-masking excipients such as maltodextrins, polyols, and cyclodextrins, alongside optimized film-coating systems that meet regional regulatory expectations.

Harmonization through European Pharmacopoeia monographs allows cross-border commercialization of excipient systems, supporting consistent product portfolios from suppliers like Roquette Frères and Gattefossé. Strong R&D capabilities and collaborations between universities, research institutes, and industry have further advanced innovation in taste-masking technologies.

Examples include hot melt extrusion techniques applied to pediatric suspensions and oral granules. These developments enable manufacturers to create patient-friendly formulations while complying with strict quality standards. As a result, Europe serves as an important hub for both the development and adoption of sophisticated taste-masking excipients across diverse therapeutic areas.

Asia Pacific is emerging as one of the fastest-growing regions in the Pharmaceutical Excipients for Taste Masking market, driven by expanding pharmaceutical manufacturing in China, India, Japan, and ASEAN countries.

Increased healthcare access and rising penetration of generic medicines are fueling demand for patient-friendly oral formulations. Cost advantages and government incentives for local drug production in China and India have encouraged large-scale investments in oral solid and liquid dosage facilities, increasing the need for effective taste-masking excipients.

Companies in the region are adopting advanced technologies such as microencapsulation and coating to align products with regional taste preferences and improve patient compliance. Japan’s strong regulatory framework and high-quality standards support the use of high-purity excipients and innovative formulations. Meanwhile, ASEAN markets are witnessing growth in over-the-counter and pediatric medicines that rely heavily on taste and sweetness optimization.

Global excipient suppliers, including Roquette Frères and Asahi Kasei Corporation, have strengthened their regional presence through manufacturing facilities, technical support centers, and partnerships. These factors position Asia Pacific as a key growth driver for the taste-masking excipient market over the forecast period.

The pharmaceutical excipients for taste masking market is moderately fragmented, with a mix of global excipient majors and specialized technology providers offering differentiated solutions for oral dosage forms.

Leading companies such as SPI Pharma, Inc., Roquette Frères, Gattefose, Asahi Kasei Corporation, DuPont de Nemours, Inc., and Dow Pharma Solutions compete on functional performance, regulatory support, and formulation expertise rather than on commodity pricing alone.

Key strategies include development of proprietary taste-masking platforms (e.g., Actimask®, Microcaps®), investment in technical service centers, collaboration with CDMOs, and expansion of pediatric-focused excipient offerings, enabling suppliers to embed their materials into customers’ long-term product pipelines.

The global pharmaceutical excipients for taste masking market is projected to be valued at US$ 1.1 Bn in 2026.

The increasing focus on patient adherence, particularly in the pediatric and geriatric population are the key factor driving demand for pharmaceutical excipients for taste masking products.

The global pharmaceutical excipients for taste masking market market is poised to witness a CAGR of 4.8% between 2026 and 2033.

A key opportunity is embedding taste-masking excipients into CDMO platform technologies to accelerate development of patient-friendly oral formulations.

Prominent players include SPI Pharma, Inc., Adare Pharmaceutical Inc., Roquette Frères, Gattefose, Asahi Kasei Corporation, DuPont de Nemours, Inc., Dow Pharma Solutions, BASF SE, Evonik Industries AG, Colorcon Inc., Ashland Inc., among others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Excipient

By Technique

By Usage

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author