ID: PMRREP35609| 194 Pages | 12 Sep 2025 | Format: PDF, Excel, PPT* | Consumer Goods

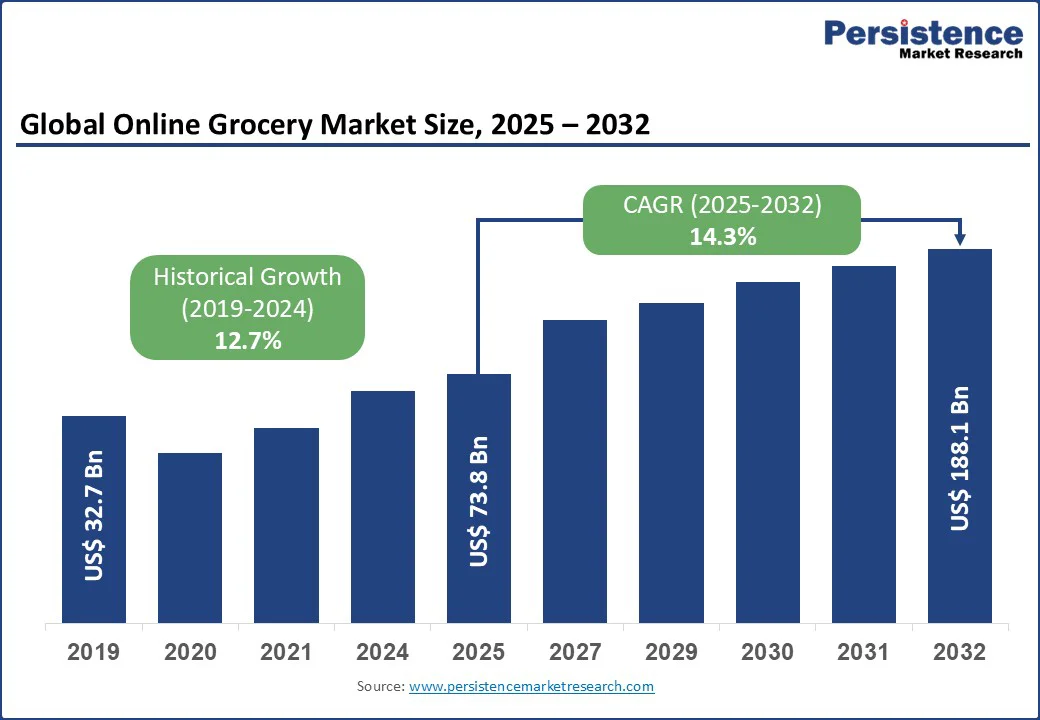

The online grocery market size is likely to be valued at US$ 73.8 Bn in 2025 and is estimated to reach US$ 188.1 Bn in 2032, growing at a CAGR of 14.3% during the forecast period 2025 - 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Online Grocery Market Size (2025E) | US$ 73.8 Bn |

| Market Value Forecast (2032F) | US$ 188.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 14.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 12.7% |

The online grocery market growth is being spurred by rising demand for speed, flexibility, and safety. Platforms are investing heavily in automation, dark stores, and micro-fulfillment centers to ensure same-day or ultra-fast delivery.

The environmental angle is becoming a key factor for online grocery adoption. A single delivery van can replace dozens of individual car trips to the supermarket, lowering fuel use and carbon emissions. Retailers are using this as a selling point.

For example, Ocado in the U.K. and Coles in Australia highlight their electric delivery fleets and optimized routing systems as greener alternatives to personal shopping. This appeals to eco-conscious consumers who want convenience without feeling guilty about their carbon footprint.

The reduced impulse buying is another reason why several households are shifting online. When shopping in stores, people are exposed to end-aisle promotions and physical displays that trigger unplanned purchases. Online platforms allow users to filter and search directly for what they require, keeping the basket more controlled. These factors create a perception that online grocery is not only more efficient but also healthier for both the planet and household budgets.

Extra fees are one of the main barriers slowing online grocery platform adoption. Various platforms charge service fees, delivery charges, or require minimum order values, which makes small and frequent purchases less attractive. Fresh produce quality is another sticking point. Consumers often prefer to handpick fruits, vegetables, or meat cuts based on ripeness and appearance. This is something online shopping cannot replicate easily.

The hesitation is visible in markets such as Germany, where Aldi and Lidl limit fresh produce selection online, knowing customer trust is difficult to build digitally. In India, Blinkit and BigBasket have had to introduce ‘no-questions-asked’ return policies on fresh items. This is because a single bad experience with wilted greens or bruised fruit can drive customers away from reordering.

Smooth digital experiences are opening new ways for online grocery platforms to improve customer loyalty. Voice search, for example, is making ordering quick and natural. Walmart integrated voice shopping with Google Assistant and Siri, allowing users to add milk or bread to their cart simply by speaking. In India, BigBasket has started testing regional language voice ordering, which brings in first-time online grocery users who may not be comfortable typing in English.

This hands-free shopping reduces friction and makes reordering staples effortless.

Multiple payment options are another driver of engagement. Shoppers can now pay through digital wallets, BNPL (buy now, pay later), or pay-on-delivery. Instacart recently introduced Apple Pay and Klarna integration in the U.S., while Blinkit in India accepts UPI and instant pay-later schemes. These flexible options appeal to young consumers who prefer digital-first payments as well as old consumers who want security and choice.

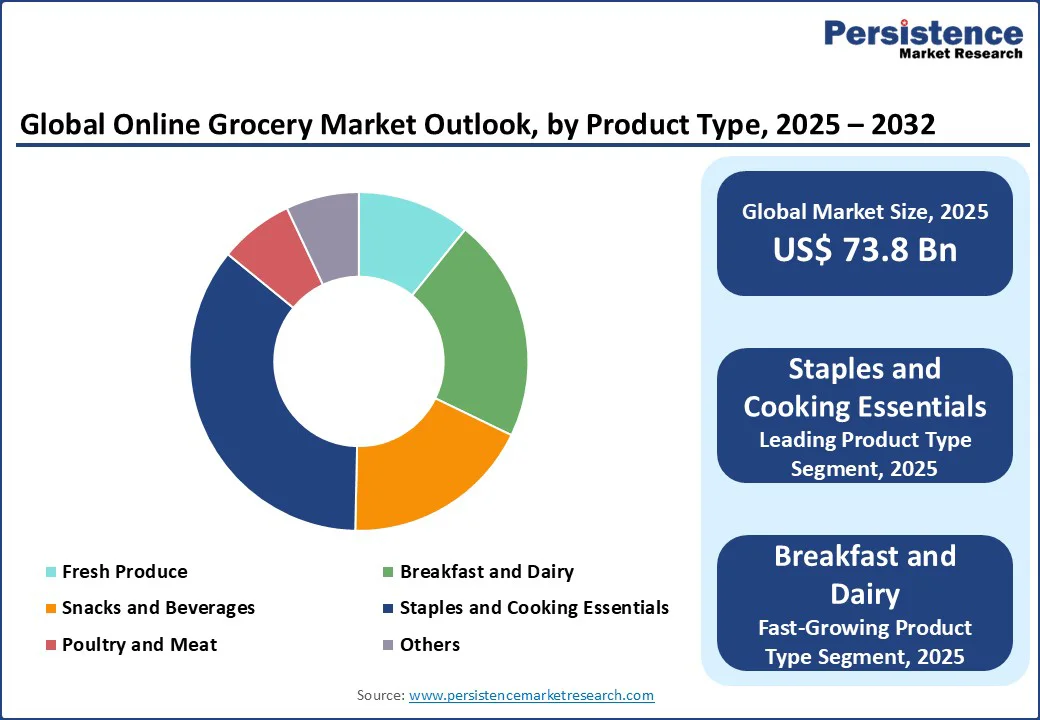

By product type, the market is divided into fresh produce, breakfast and dairy, snacks and beverages, staples and cooking essentials, poultry and meat, and others. Among these, staples and cooking essentials are expected to hold nearly 35.6% of share in 2025 as they are predictable and repetitive purchases.

Consumers know exactly what brands of rice, flour, or cooking oil they use every month, so there is little need to browse in-store. This predictability makes them ideal for subscription models. For instance, Amazon Fresh in the U.S. and BigBasket in India both promote ‘subscribe and save’ for pantry staples, reducing the hassle of reordering.

The breakfast and dairy segment will likely exhibit considerable growth as it fits into daily consumption habits and has high repeat purchase cycles. Items such as milk, yogurt, bread, and cereals run out quickly in most households, which makes them a natural fit for recurring online orders.

These products are also tied closely to health and wellness trends, which makes them more appealing online. Demand for plant-based dairy alternatives is rising. Hence, brands are using online grocery channels to push limited editions and new flavors before they hit physical stores.

In terms of delivery, the market is bifurcated into home delivery and click and collect. Out of these, home delivery is poised to account for around 59.3% of share in 2025 as it removes the burden of carrying bulky and heavy items, which is a big pain point for groceries.

Families ordering packs of bottled water, rice bags, or cooking oil find it easier to have them dropped at the doorstep. It also saves time, specifically in urban areas where traffic and long checkout lines are common. Shoppers can order within minutes and have items arrive the same day, freeing up time for work or family.

Click and collect is emerging as a key delivery mode because it gives shoppers flexibility without the delivery fees or waiting times associated with home delivery. Customers can place an order online, reserve their preferred pickup slot, and collect it on their way home from work or school.

A few retailers have invested heavily in drive-through collection points, letting shoppers stay in their cars while staff load groceries directly into the trunk. This hybrid model combines online convenience with the immediacy of in-store shopping.

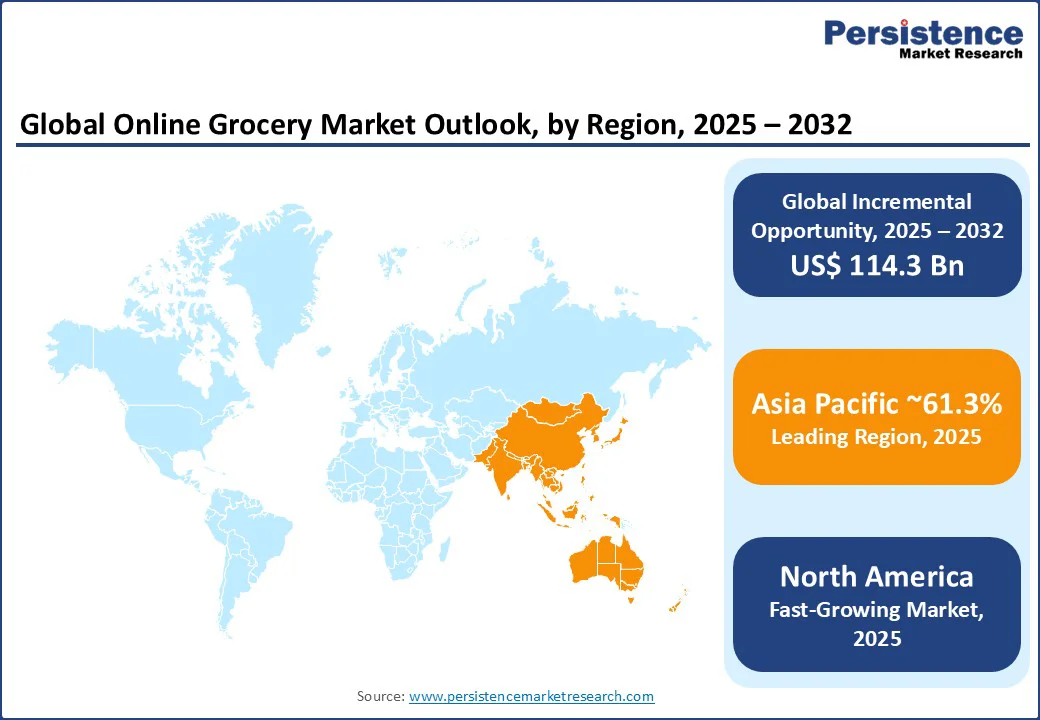

Asia Pacific is estimated to account for approximately 61.3% of share in 2025 with India becoming the testing ground for quick commerce. Companies such as Blinkit, Instamart, Zepto, and BigBasket Now are battling to deliver groceries in 10 to 20 minutes.

Blinkit crossed 1,000 dark stores in December 2024 and is planning to double that by the end of 2025, while Instamart is also adding fulfillment centers. The model is surging in popularity, but profitability is still a key concern. Blinkit and Instamart have been experimenting with inventory-led models where they control stock directly instead of relying on partner stores.

In China, the old community group-buying model has largely collapsed. Companies, including Alibaba and Meituan, tried to expand it but found it unsustainable. Now the focus is firmly on instant delivery and more efficient fulfillment.

Alibaba’s Freshippo supermarket chain reported its first annual profit in 2025 and is broadening into small cities. It shows that the market is maturing from growth at any cost to sustainable operations. In Southeast Asia, Grab recently acquired Malaysia’s Everrise supermarket chain to strengthen its grocery network and boost micro-fulfillment.

In North America, online grocery is being influenced by how large retailers blend their physical stores with digital platforms. Walmart has been turning its stores into fulfillment hubs, using them for curbside pickup and same-day delivery.

This hybrid model has given it a supremacy in serving both urban and suburban shoppers who want speed without paying high delivery fees. Amazon, on the other hand, is reworking its grocery strategy by streamlining Whole Foods and Amazon Fresh. It recently started providing free grocery delivery to Prime members in select U.S. cities.

In the U.S. online grocery market, domestic players are experimenting with automation and robotics to cut costs. Kroger’s partnership with Ocado is a key example, where robotic warehouses handle order picking and reduce errors. These facilities are being expanded across the U.S., exhibiting how automation is no longer a pilot but a serious investment to support growth.

At the same time, shoppers are mixing bulk online orders with in-store visits, and many are moving to subscription services for essentials. Hence, consumer behavior is becoming value driven.

Online grocery is evolving around convenience, automation, and sustainability across Europe. Retailers such as Carrefour and Auchan in France are using dark stores and automated warehouses to speed up fulfillment. Carrefour recently partnered with Uber Eats to expand 15-minute delivery slots in Paris. This shows how grocery and food delivery platforms are merging operations to serve urban demand efficiently. In the U.K., consolidation is spurring the market.

Ocado has doubled down on its robotics-based model, supplying not only its own online store but also powering Marks & Spencer’s grocery delivery. Tesco is focusing on its Whoosh quick delivery service, promising 30-minute drop-offs.

Similarly, Sainsbury’s has expanded its standalone app Chop Chop, folding fast services into its main platform to streamline costs. In Germany, Gorillas, once a headline disruptor, was acquired by Getir, and now Getir itself has pulled back from several countries due to profitability struggles.

The online grocery market is highly competitive with big retailers, tech platforms, and local specialists battling for share. Amazon is pushing deeper by linking Whole Foods to its Prime ecosystem, providing quick delivery and wide assortments.

Walmart is taking a different path by turning some of its physical stores into mini fulfillment hubs to speed up online orders, showing how traditional retailers are using their store networks as an advantage. On the platform side, Instacart is trying to reduce its reliance on grocery delivery margins by moving into retail media and technology partnerships.

The online grocery market is projected to reach US$ 73.8 Bn in 2025.

Rising demand for convenience and increasing smartphone penetration are the key market drivers.

The online grocery market is poised to witness a CAGR of 14.3% from 2025 to 2032.

Expansion of dark stores and integration of sustainability initiatives are the key market opportunities.

Walmart Inc., Amazon.com, Inc., and Target Corporation are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Delivery

By Purchasers

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author