ID: PMRREP35692| 172 Pages | 8 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

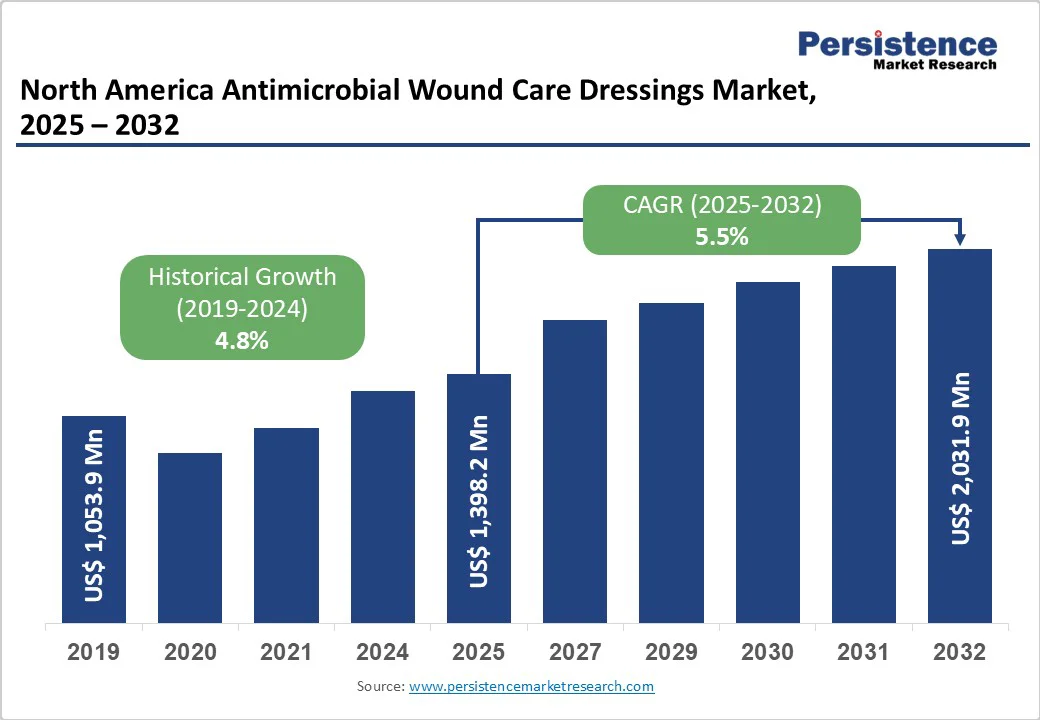

North America antimicrobial wound care dressings market size is likely to value US$ 1,398.2 Million in 2025 and projected to reach US$ 2,031.9 Million by 2032, growing at a CAGR of 5.5% during the forecast period from 2025 to 2032. The North American antimicrobial wound care dressing market is expanding rapidly, driven by rising chronic wounds, increasing surgical procedures, and growing awareness of infection prevention. Advanced dressings, including foam, hydrogel, and silver-based products, are widely adopted across hospitals, long-term care facilities, and home healthcare settings.

| Key Insights | Details |

|---|---|

|

North America Antimicrobial Wound Care Dressings Market Size (2025E) |

US$ 1,398.2 Mn |

|

Market Value Forecast (2032F) |

US$ 2,031.9 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.8% |

North America is experiencing a sharp rise in chronic wounds due to aging populations, higher obesity rates, and a diabetes epidemic, with an estimated 6.7 million Americans treated annually. Conditions such as diabetic foot ulcers, venous leg ulcers, and pressure injuries require prolonged care and frequent antimicrobial dressing changes, driving significant market demand.

Annually, $20–50 billion is spent in the U.S. on chronic wound treatment. Approximately 80% of infected chronic wounds contain bacterial biofilms, which disrupt healing and make bacteria highly resistant to antibiotics, increasing the demand for advanced antimicrobial dressings that can prevent infection and support effective wound healing.

Simultaneously, surgical volumes are increasing with more elective procedures, trauma care, and cancer-related surgeries, where post-operative infections remain a major cause of readmissions. This dual burden encourages hospitals, long-term care facilities, and home healthcare providers to adopt advanced antimicrobial solutions that combine infection prevention, biofilm management, and healing support. Rising wound prevalence and surgical interventions firmly establish infection control as a key market growth driver.

Despite the widespread adoption of antimicrobial dressings, long-term safety concerns remain a significant restraint in the North America antimicrobial wound care dressings market. Prolonged exposure to silver, iodine, and other antimicrobial agents has raised questions about potential cytotoxicity, where these agents may damage surrounding healthy tissue and slow the healing process.

Clinicians are also cautious about the possibility of bacterial resistance developing from extended use, similar to challenges faced with antibiotics. Regulatory bodies and wound care experts recommend antimicrobial dressings primarily for infected or high-risk wounds rather than routine application.

These clinical concerns limit broad adoption and slow reimbursement approvals, particularly for chronic wound patients requiring months of care. Adding to this, a recent study highlighted the considerable financial burden of wound care, with Medicare expenditures ranging from USD 28.1–96.8 billion, including USD 9.9–35.8 billion for outpatient services and USD 5.0–24.3 billion for inpatient care, further constraining adoption and market growth.

The North American antimicrobial wound care dressings market is witnessing rapid innovation through bioactive and next-generation technologies. Bioactive agents derived from natural polymers, peptides, or plant extracts are emerging as safer alternatives with lower risks of cytotoxicity and resistance.

Nanotechnology is enabling controlled release systems, allowing nanoparticles—such as silver or carbon-based materials—to deliver antimicrobial agents directly to the wound bed, improving efficacy and minimizing resistance.

Antimicrobial peptides (AMPs) are also being explored for their microbicidal activity against bacteria, fungi, and viruses, with several FDA-approved peptide-inspired products already in clinical use. Major players, including Smith & Nephew, are leveraging nanocrystalline silver technology in products such as ACTICOAT to enhance infection control.

Recent research has also introduced low-cost, electronics-free dressings generating healing electrical fields via safe metal-ion reactions, demonstrating the potential of combining bioactive materials and innovative delivery systems. These advancements support tissue regeneration, infection prevention, and targeted antimicrobial therapy, offering both clinical and market differentiation opportunities.

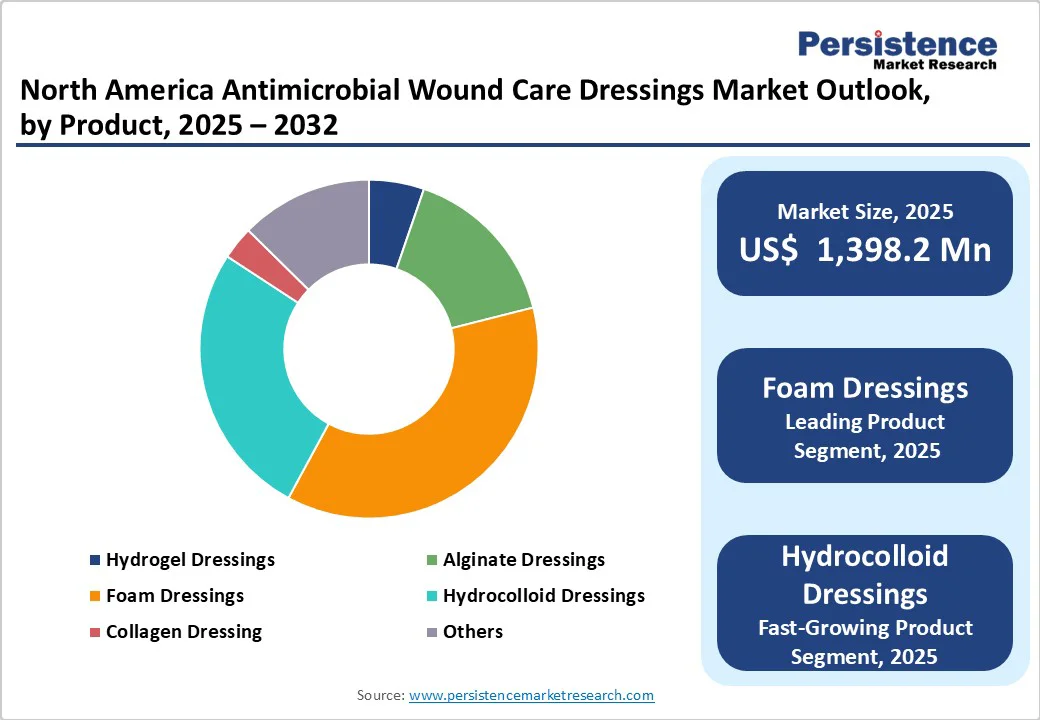

Foam Dressings is projected to lead the North America antimicrobial wound care dressings market with nearly one-third revenue share in 2025. Their high absorbency, versatility, and compatibility with antimicrobial agents like silver or PHMB make them preferred for managing chronic wounds.

Widely used in hospitals and long-term care facilities, foam dressings offer infection control, exudate management, and patient comfort across inpatient and home settings. Emphasis on reducing hospital-acquired infections and readmissions further drives adoption, making antimicrobial foam dressings a cost-effective, high-demand solution.

Silver-based dressings are likely to maintain their dominance in the North America antimicrobial wound care dressings market, with a projected value share of around 40% in 2025. Their broad-spectrum efficacy against bacteria, fungi, and antibiotic-resistant strains has made silver-based dressings the gold standard in antimicrobial wound management.

Clinicians rely on silver-based products for both acute and chronic wounds, particularly in high-risk patients. Additionally, the wide availability of silver dressings across various formats—foams, alginates, and hydrogels—makes them adaptable to multiple wound types. While newer agents such as PHMB and iodine are gaining traction, silver’s proven safety profile, extensive clinical evidence, and established reimbursement coverage solidify its dominant market share.

Chronic wounds, including diabetic foot ulcers, pressure ulcers, and venous leg ulcers, account for the majority of wound care expenditures in North America. Their prevalence is rising due to increasing rates of diabetes, obesity, and age-related immobility.

Nearly 7 million Americans live with chronic wounds, including 2 million with diabetic foot ulcers, and with 1 in 4 families having a member affected. Globally, the International Diabetes Federation (IDF) estimates that 6.3% of adults with diabetes suffer from diabetic foot ulcers, and in the U.S., approximately 1.6 million people develop a DFU annually.

Unlike acute wounds, chronic wounds require prolonged treatment, frequent dressing changes, and advanced infection-preventive solutions, resulting in higher per-patient spending and sustained demand for antimicrobial dressings. Increasing focus from hospitals and insurers on reducing complications and preventing amputations further drives adoption, ensuring chronic wounds remain the largest revenue contributor in the North American antimicrobial wound care dressing market.

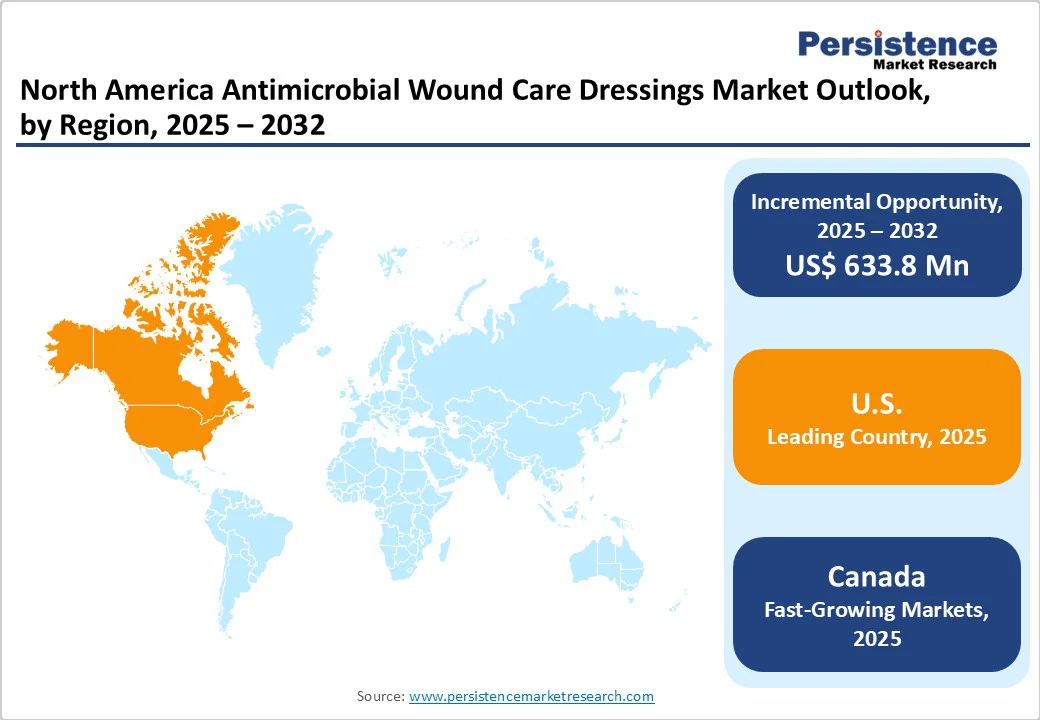

The U.S. antimicrobial wound care dressing market is expanding rapidly, driven by technological innovation and evolving clinical needs. A major development is the growing research into digital solutions, particularly the integration of smart sensors within dressings. These sensors allow real-time monitoring of wound temperature, pH, and moisture—critical early indicators of infection. When combined with antimicrobial properties, such innovations enable early detection of complications while simultaneously preventing bacterial growth.

Another key trend is the rising demand for silver-based foam dressings, especially in hospitals managing chronic wounds and post-surgical care. Under value-based care models, hospitals increasingly prefer these dressings because silver impregnation ensures reliable infection control, lowers the risk of hospital-acquired infections, and reduces readmission rates. At the same time, they strike an optimal balance between efficacy, cost-effectiveness, and patient comfort.

Together, these dynamics reflect a U.S. market that prioritizes both high-tech innovation and proven antimicrobial effectiveness, fostering adoption of dressings that deliver clinical reliability alongside smart functionality.

The Canadian wound care sector is increasingly adopting digital and AI-driven solutions to enhance treatment outcomes. Swift Medical, in collaboration with DIGITAL, introduced AI technologies such as SmartTissue™, AutoDepth™, and HealingIndex™ in March 2024, to standardize wound assessments and improve care precision. Additionally, the Telewound Care Canada project, led by Swift Medical, SE Health, and AlayaCare, focuses on enabling patients to access wound care remotely, reducing the need for in-person visits during the pandemic.

In parallel, the Government of Canada is addressing antimicrobial resistance through the Antimicrobial Economic Incentives Pilot Project, running from 2024 to 2027. This initiative aims to improve access to new antimicrobials that address unmet health priority needs, ensuring sustainable access to effective treatments for Canadians. Together, these digital innovations and government initiatives position Canada antimicrobial wound care dressings market for improved patient outcomes, broader antimicrobial access, and sustainable growth.

The competitive landscape in the North America antimicrobial wound care dressings market is shifting toward next-generation antimicrobial dressings that integrate dual functionalities such as infection control and pain management. Recent FDA clearances reflect growing innovation in bioresorbable, multifunctional products, strengthening market differentiation and intensifying competition in advanced wound care.

The North America Antimicrobial Wound Care Dressings Market is projected to be valued at US$ 1,398.2 Mn in 2025.

Rising chronic wounds, increasing surgical procedures, and demand for infection-preventive antimicrobial dressings drive North America antimicrobial wound care dressings market.

The North America Antimicrobial Wound Care Dressings market is poised to witness a CAGR of 5.5% between 2025 and 2032.

Key opportunities include innovation in bioactive agents, nanotechnology-enabled dressings, and digital wound care solutions.

Major players in North America Antimicrobial Wound Care Dressings market are Convatec, B. Braun SE, 3M, Smith+Nephew, Cardinal Health, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Antimicrobial Agent

By Application

By End User

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author