ID: PMRREP35428| 175 Pages | 18 Jun 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

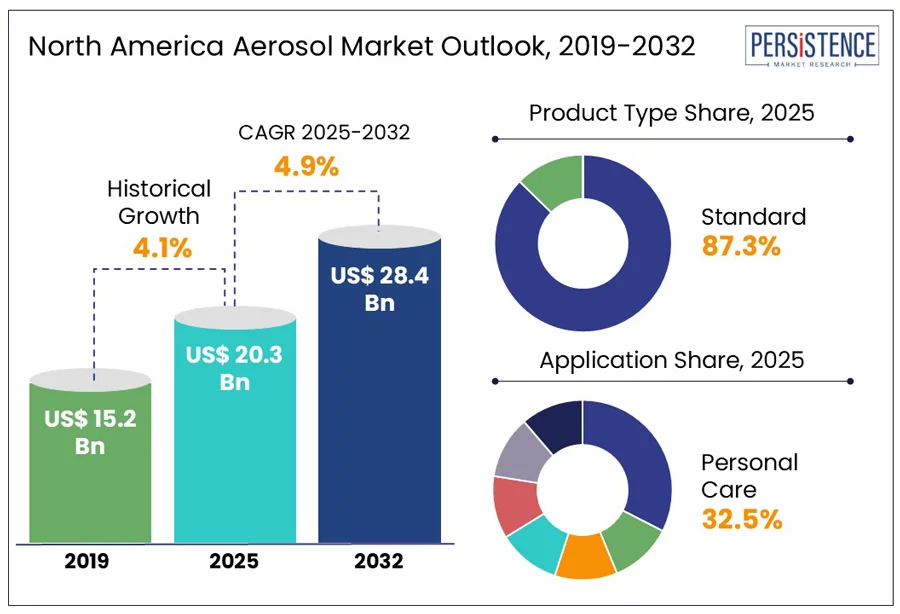

The North America aerosol market size is predicted to reach US$ 28.4 Bn in 2032 from US$ 20.3 Bn in 2025. It will likely witness a CAGR of around 4.9% in the forecast period between 2025 and 2032.

From household disinfectants to high-performance brake cleaners and gourmet whipped toppings, aerosol has become a backbone of North America’s consumer and industrial markets. The market is being reshaped by shifting consumer preferences, environmental regulations, and innovations spanning personal care, food, automotive, and medical sectors. As brands scramble to reformulate propellants and embrace recyclable canisters, North America’s aerosol industry is no longer just about convenience. It has instead become a convergence point for sustainability, compliance, and functionality.

Key Industry Highlights:

|

Market Attribute |

Key Insights |

|

North America Aerosol Market Size (2025E) |

US$ 20.3 Bn |

|

Market Value Forecast (2032F) |

US$ 28.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.1% |

The booming food and beverage industry is predicted to spur North America aerosol market growth in the foreseeable future. It is attributed to the rising popularity of spray-based food products, which deliver improved shelf stability, portion control, and convenience. A 2024 report by the Association for Packaging and Processing Technologies mentioned that the U.S. food packaging sector is surging in adoption of pressurized dispensing systems, specifically in flavorings, edible oils, and food-safe release agents used in commercial kitchens. It has further extended the functional scope of aerosols beyond traditional personal care and household products.

One of the key trends is the rise in aerosol whipped toppings, primarily in the dairy-free and plant-based segments. Several brands are coming up with almond and coconut-based whipped creams in conventional aerosol formats, capitalizing on the plant-based boom. These products have already gained significant shelf space across renowned retailers, including Whole Foods and Walmart, reflecting how aerosols are being repurposed to serve emerging dietary preferences. The delivery system ensures better aeration and a longer shelf life without preservatives, thereby catering to increased clean-label demands.

Tracheobronchial irritation and bronchospasm are emerging as key health-related concerns that are subtly restraining the North America aerosol market. A growing body of clinical and regulatory scrutiny has drawn attention to how certain Volatile Organic Compounds (VOCs), fragrances, and propellants used in aerosol sprays can trigger respiratory distress, especially in individuals with chemical sensitivities or asthma. A 2023 study published by the American Journal of Respiratory and Critical Care Medicine found that exposure to fragranced aerosol cleaning sprays increased the risk of acute bronchospasm episodes in asthmatic individuals by 22%.

The concern has prompted healthcare organizations, including the Asthma and Allergy Foundation of America (AAFA), to issue advisories. This discourages the use of heavily scented aerosol cleaning agents, deodorants, and air fresheners in enclosed public spaces, including office buildings, healthcare facilities, and schools. Additionally, the healthcare sector’s cautious stance on aerosol therapy formulations, mainly for non-inhalation therapies, is hampering its expansion into certain medical and institutional environments.

The automotive industry in North America is creating fresh demand for aerosol products by increasingly incorporating them into repair, maintenance, and detailing operations. Aerosol-based solutions are preferred due to their ease of application, portability, and precision, primarily in tire inflators, brake cleaners, rust inhibitors, and lubricants. Aerosol brake cleaners are among the most widely adopted products in garages and workshops. These products offer key benefits of high-pressure delivery that flushes out grime and oil from intricate components without dismantling the system.

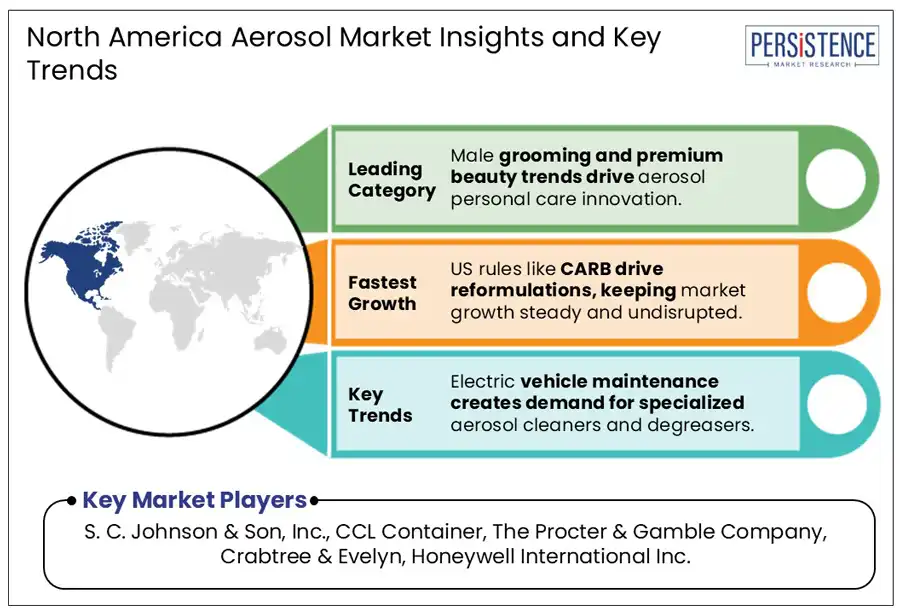

The push toward Electric Vehicles (EVs) is further creating lucrative opportunities in North America. As EVs require less engine maintenance but more electronic and thermal management care, specialized aerosol cleaners for sensors, connectors, and battery terminals are gaining popularity. Brands, including WD-40 Specialist, have launched non-flammable contact cleaners in aerosol format that are safe for EV components. Other brands are also capitalizing on the demand for non-conductive, quick-drying solutions in the emerging electric mobility ecosystem.

By product, the market is bifurcated into bag-in-valve and standard. Out of these, the standard segment will likely account for approximately 87.3% share in 2025 due to its cost efficiency, wide compatibility with diverse formulations, and extended supply chain infrastructure. Standard metal aerosol cans are ideal for a wide range of applications, right from hair sprays and deodorants to air fresheners and disinfectants. The consistent size and form factor of these cans also make them suitable for store shelves, warehouse stocking, and e-commerce packaging.

Bag-in-valve, on the other hand, is poised to exhibit a considerable CAGR from 2025 to 2032 with its unique functional and environmental advantages, mainly in premium and regulatory-sensitive applications. These systems separate the product from the propellant by enclosing the formulation in a multilayered bag inside the can. It enables 360-degree dispensing, precise dosing, and nearly complete product evacuation. The medical and pharmaceutical industries have spurred bag-in-valve demand in nasal sprays, topical anesthetics, and wound sprays.

In terms of application, the market is segregated into personal care, household, automotive and industrial, food, paints, and medical. Among these, the personal care segment is predicted to hold nearly 32.5% of North America aerosol market share in 2025 amid the strong consumer preference for convenience, portability, and hygienic application. Products, including body sprays, hair sprays, dry shampoos, and deodorants, benefit significantly from aerosols' ability to deliver fine misting without direct contact. The high brand penetration of aerosol-based personal care products in retail chains, including Walmart and Target, also ensures continuous volume sales.

The household segment has further emerged as a key application of aerosol owing to its association with consumer demand for ease, speed, and hygiene in everyday cleaning and air care routines. One of the most important growth areas in this segment is disinfectants. Brands such as Lysol have consistently launched aerosol variants targeting specific pathogens. Lysol introduced an aerosol disinfectant in the recent past that claimed 30-second virucidal action against RSV and norovirus, made for care homes and schools.

The U.S. is currently undergoing a significant transition propelled by regulatory shifts, evolving consumer demand, and sustainability mandates. According to CSPA, the country produced more than 4 Bn aerosol units in 2023 alone, showing a slight drop from previous years due to strict environmental norms and raw material inflation. Categories such as disinfectants and personal care, however, continue to perform well, supported by post-pandemic hygiene habits and lifestyle convenience.

A notable trend in the U.S. market is the rapid shift toward eco-friendly propellants. Companies, including Honeywell, have already introduced Solstice Propellant, a hydrofluoroolefin (HFO) that has zero ozone depletion potential and a Global Warming Potential (GWP) of less than one. It has been adopted in select aerosol formulations by reputed brands such as Reckitt and Unilever. Similar products are helping brands to meet California’s VOC compliance and prepare for the U.S. EPA's new SNAP regulations, which are phasing out high-GWP propellants by 2025.

In Canada, VOC emissions from consumer and commercial products such as aerosol sprays have been on the rise since 2018. Regulatory authorities are addressing this with the 2021 to 2028 Federal Agenda on VOC Reduction. It includes tightening VOC limits, monitoring, and potential product reformulation to comply with the best practices in the country’s jurisdictions. Compressed gases such as nitrogen and CO2, as well as low-GWP hydrofluoroolefins (HFOs) are gaining momentum as manufacturers shift from traditional hydrocarbons toward green alternatives.

Aluminum remains the primary domestic aerosol packaging material, holding the most prominent market share in 2025. Its dominance provides both weight and recycling advantages, complying with Canada’s broad packaging sustainability agenda. Leading chemical and packaging firms in the country are pushing innovation through commercial collaborations. The trend is expected to help manufacturers achieve zero-ozone-depletion and near-zero GWP locally.

The North America aerosol market is consolidated with the presence of leading companies focusing on regional expansion, sustainability, and product innovation. Renowned players are manufacturing aerosol cans, leveraging their robust research and development capabilities to launch recyclable and lightweight packaging solutions. They are collaborating with brands catering to consumer goods to co-develop eco-friendly aerosol packaging to help them comply with stringent VOC norms in the U.S. and Canada. Brands in personal care and household segments are striving to cater to evolving consumer preferences, including fragrance customization and natural ingredients, innovatively.

The North America aerosol market is projected to reach US$ 20.3 Bn in 2025.

Increasing demand for household disinfectants and rising use in personal care products are the key market drivers.

The North America aerosol market is poised to witness a CAGR of 4.9% from 2025 to 2032.

High popularity of spray-based food items and increasing demand for brake cleaners are the key market opportunities.

S.C. Johnson & Son, Inc., CCL Container, and The Procter & Gamble Company are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Material

By Product Type

By Application

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author