ID: PMRREP35748| 193 Pages | 17 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

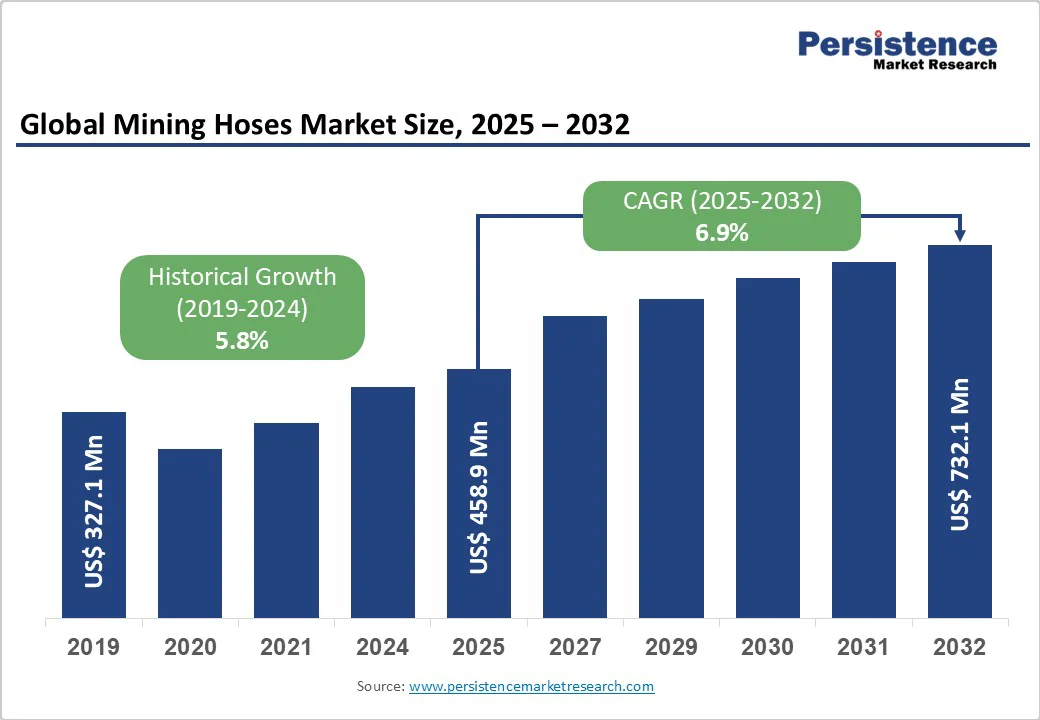

The global mining hoses market size is likely to be valued at US$458.9 Mn in 2025 and is projected to reach US$732.1 Mn by 2032, growing at a CAGR of 6.9% between 2025 and 2032.

The rise in mining activities worldwide and the expansion of infrastructure projects in emerging economies, coupled with stringent safety regulations demanding high-quality, durable hose systems.

The market benefits from continuous technological advancements in hose materials and manufacturing processes, enabling the production of specialized hoses designed for specific mining applications.

| Key Insights | Details |

|---|---|

| Mining Hoses Market Size (2025E) | US$458.9 Mn |

| Market Value Forecast (2032F) | US$732.1 Mn |

| Projected Growth (CAGR 2025 to 2032) | 6.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.8% |

The global surge in mining activities serves as a fundamental driver for the Mining Hoses Market. According to the World Mining Data 2024, global mineral production has experienced substantial growth, with Asia accounting for 61.7% of total mining production in 2022.

The U.S. Geological Survey's 2024 report indicates that total mineral production exceeded US$105 billion in 2023, reflecting increased mining activities that require advanced equipment, including mining hoses. The International Council on Mining and Metals reported that global mineral demand is expected to grow by 25% by 2030, highlighting the pressing need for efficient transportation systems within mining operations.

This growth is particularly pronounced in emerging economies where infrastructure projects drive demand for minerals, metals, and aggregates, subsequently increasing the need for reliable mining hose systems for slurry transportation, dust suppression, and dewatering applications.

The mining industry's ongoing digital transformation is significantly propelling the Mining Hoses Market forward. Automation technologies and Internet of Things (IoT) integration have revolutionized mining equipment requirements, with the global mining automation market expected to grow from US$4.25 billion in 2024 to US$7.54 billion by 2032, exhibiting a CAGR of 7.21%.

Modern mining operations increasingly demand hoses that can integrate with automated systems, featuring enhanced durability and monitoring capabilities. Technological advancements in manufacturing techniques have enabled the production of specialized hoses tailored for specific mining applications, with precise control ensuring that hoses meet demanding specifications.

Innovations in hose materials, including those with wear-resistant and flexible designs, provide mining companies with more efficient solutions to meet operational demands while enhancing safety standards.

Environmental restrictions and compliance costs present significant challenges to the mining hoses market. Governments worldwide are imposing increasingly stringent regulations on mining activities to mitigate ecological impact, requiring mining companies to implement sustainable practices, including efficient waste management and the use of environmentally friendly equipment.

These regulations necessitate manufacturers to invest in creating hoses that adhere to strict environmental requirements, raising production costs and extending development timelines. The requirement for additional testing and certifications adds operational expenses, while potentially discouraging investments in new mining projects, which indirectly affects mining hose demand.

Fluctuations in raw material prices for mining hoses, including rubber, synthetic polymers, and metals, significantly impact market growth. These price variations, influenced by supply-demand dynamics, geopolitical tensions, and natural disasters, lead to increased production costs for manufacturers.

According to the World Bank, natural rubber prices increased by 17% in 2021, which may impact market growth. Unpredictable pricing creates uncertainty in budgeting for mining projects, affecting long-term planning and procurement decisions while straining financial resources, particularly for smaller companies competing in the market.

The growing focus on sustainable mining practices presents significant opportunities for growth. Companies increasingly seek eco-friendly solutions, driving demand for hoses made from recycled or biodegradable materials. The development of 100% recyclable hydraulic hoses, such as GAIA hoses featuring chlorine-free rubber compounds, represents innovative solutions meeting sustainability criteria.

This shift toward environmentally conscious operations allows manufacturers to develop new products that contribute to improved Environmental, Social & Governance (ESG) performance while reducing end-of-life disposal costs. Mining companies that adopt green technologies create new market segments for specialized, sustainable hose solutions.

Rapid industrialization in the Asia Pacific, particularly China, India, and Indonesia, presents substantial growth opportunities for mining hose manufacturers. The region's abundant mineral resources, including bauxite, gold, copper, iron ore, and coal, drive significant investment in mining operations.

China's Belt and Road Initiative (BRI) has facilitated substantial investments in regional mining projects, while favorable mining regulations and economic opportunities attract foreign direct investment. Infrastructure development projects worldwide create additional demand for mining hoses, as construction activities require efficient material handling systems.

Government initiatives promoting domestic mining capabilities and critical mineral supply chain security further enhance market opportunities.

The Rubber Mining Hoses segment dominates the market with approximately 42% market share, driven by its superior flexibility, chemical resistance, and temperature tolerance properties. Natural rubber and synthetic rubber blends offer varying levels of durability and performance characteristics essential for mining applications.

Trelleborg Group manufactures specialty mining hoses from high-quality rubber compounds, including NR, SBR, NBR, EPDM, and silicone, specifically designed for use in slurry, water, and chemical applications. These rubber hoses offer excellent abrasion resistance and can withstand harsh mining environments, providing flexibility for easy installation and maneuverability. The segment benefits from continuous material innovations, which improve wear resistance and extend operational life.

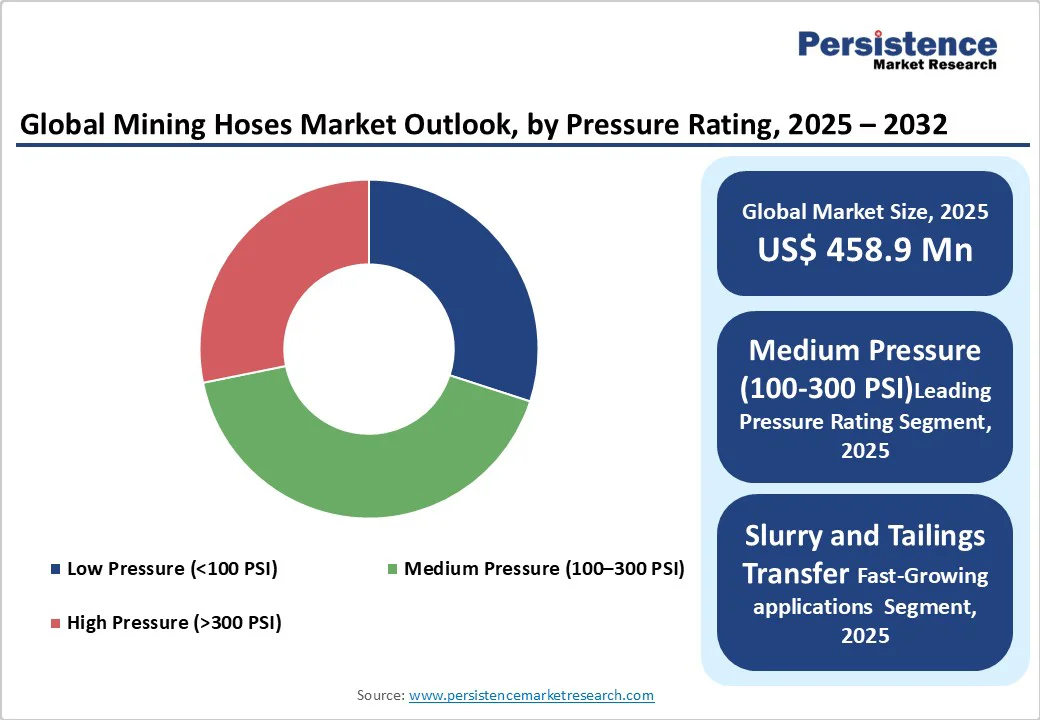

The Medium Pressure (100-300 PSI) segment holds the largest market share at approximately 46%, representing the optimal balance between performance and cost-effectiveness for most mining applications. This pressure range suits various mining operations, including slurry transportation, dewatering systems, and dust suppression applications.

The Continental Group and Weir Group PLC offer comprehensive medium-pressure hose solutions designed to enhance the reliability of mining equipment. The segment's dominance reflects the preference of mining operations for versatile hose systems that can handle multiple applications while maintaining operational safety standards and reducing inventory complexity.

Synthetic Rubber materials command approximately 38% market share, offering enhanced chemical resistance, temperature stability, and durability compared to natural alternatives. Synthetic rubber compounds, including Ethylene Propylene Diene Monomer (EPDM), Nitrile Rubber (NBR), and Styrene-Butadiene Rubber (SBR) provide excellent performance in harsh mining environments.

Metso Corporation's slurry hose systems utilize various rubber compounds depending on slurry type, ensuring optimal performance across different mining applications. These materials excel in applications that require resistance to oils, chemicals, and extreme temperatures, while maintaining flexibility and mechanical strength.

Slurry and Tailings Transfer applications dominate, with an approximate 35% market share, reflecting the critical need for efficient transportation of abrasive materials in mining operations. Mining operations require specialized hoses that can handle highly abrasive slurries containing particles up to 10mm in size while maintaining structural integrity.

Trelleborg's T-FLEX product line offers ultra-high abrasion-resistant ceramic-lined hoses specifically designed for arduous slurry applications. The segment's growth is driven by increasing mineral processing activities and the need for environmentally responsible slurry management systems that minimize pipeline erosion and leakage risks.

Mining Companies represent the largest end-user segment, with approximately 45% market share, encompassing major global mining corporations that require comprehensive hose solutions for their diverse operations. Leading companies, including Rio Tinto, BHP, and regional mining operators, demand high-performance hoses capable of withstanding extreme operational conditions.

Novaflex Group supplies material handling, slurry, and oil sand transfer hoses up to 36 inches in diameter to serve large-scale mining operations. This segment drives innovation in hose technology, demanding customized solutions that improve operational efficiency while meeting stringent safety and environmental standards.

North America maintains a significant market position, driven by the adoption of advanced mining technology and increased production activities. The United States leads regional growth with mining production valued at over US$105 billion in 2023, according to the U.S. Geological Survey.

Government initiatives, including the CHIPS Act's funding reallocation to domestic mining projects and the Department of Energy's nearly US$1 billion commitment to advancing mining technology, support market expansion. The region benefits from stringent safety regulations under MSHA standards, which require high-quality hose systems for both underground and surface operations.

Canada is a significant contributor as the fourth-largest mining nation globally, producing over 60 different metals and minerals. The country's abundant mineral resources, including cobalt, nickel, copper, and platinum, are essential for renewable energy technology, driving continuous demand for mining hoses. Continental Group's established presence in North American markets provides comprehensive hydraulic and industrial hose solutions meeting MSHA and BCS standards for mining applications.

European markets emphasize regulatory harmonization and sustainability initiatives, driving innovation in mining hoses. Germany, the United Kingdom, France, and Spain lead regional demand due to their advanced manufacturing capabilities and strict environmental compliance requirements. The region's focus on reducing carbon emissions and achieving net-zero targets by 2050 influences the specifications of mining equipment, including environmentally friendly hose solutions.

European Union regulations promote circular economy principles, encouraging the adoption of recyclable and sustainable mining equipment. Trelleborg Group's extensive European manufacturing and service network supports regional market growth through localized production and technical support services. The region's emphasis on Industry 4.0 and digital transformation drives demand for smart hose solutions that can integrate with automated mining systems.

The Asia Pacific region emerges as the fastest-growing, driven by rapid industrialization and infrastructure development across key markets. China dominates regional mining activities, accounting for 80% of natural graphite production and 60% of mined magnet rare earth elements, according to the International Energy Agency. The country's extensive mining operations and Belt and Road Initiative investments create substantial demand for mining hose systems.

India presents significant growth opportunities through the expansion of coal, iron ore, and bauxite extraction activities. The Indian mining equipment market reached US$6.4 billion in 2024 and is expected to grow at a CAGR of 6.05% through 2033.

Indonesia's substantial nickel and bauxite reserves, combined with favorable mining regulations, attract foreign investment and drive regional market expansion. The region's cost competitiveness and growing domestic production capabilities position it as the most dynamic growth hub for mining hoses.

The global mining hoses market exhibits a moderately consolidated structure with several key players holding significant market shares through diverse product portfolios and global distribution networks. Market leaders focus on strategic expansion through acquisitions, research and development investments, and technological innovations.

Metso Corporation recently acquired Q&R Industrial Hoses in September 2025, enhancing its slurry handling portfolio and in-house manufacturing capabilities. Companies employ differentiation strategies including custom-engineered solutions, wear indicator technologies, and comprehensive service offerings to maintain competitive advantages.

The market witnesses emerging business model trends toward integrated service solutions combining equipment supply with maintenance and monitoring services.

The global mining hoses market was valued at US$ 458.9 million in 2025 and is projected to reach US$ 732.1 million by 2032, growing at a CAGR of 6.9% during the forecast period.

The key drivers include expanding mining activities worldwide, infrastructure development in emerging economies, technological advancements in mining automation, and stringent safety regulations requiring high-performance hose systems.

Rubber Mining Hoses dominate the market with approximately 42% share due to their superior flexibility, chemical resistance, and temperature tolerance properties essential for diverse mining applications.

Asia Pacific exhibits the fastest growth rate, driven by rapid industrialization, abundant mineral resources, and significant infrastructure investments, particularly in China, India, and Indonesia.

Key opportunities include sustainable mining practices adoption, emerging market expansion, digital transformation integration, and development of environmentally friendly hose solutions meeting ESG requirements.

Major market players include Trelleborg Group, Metso Corporation, Continental Group, Weir Group PLC, Eaton, Novaflex Group, TESS, Goodall, ALFAGOMMA Spa, and Hose Solutions Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Hose Type

By Pressure Rating

By Material Type

By Application

By End-user

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author