ID: PMRREP35874| 178 Pages | 19 Nov 2025 | Format: PDF, Excel, PPT* | Consumer Goods

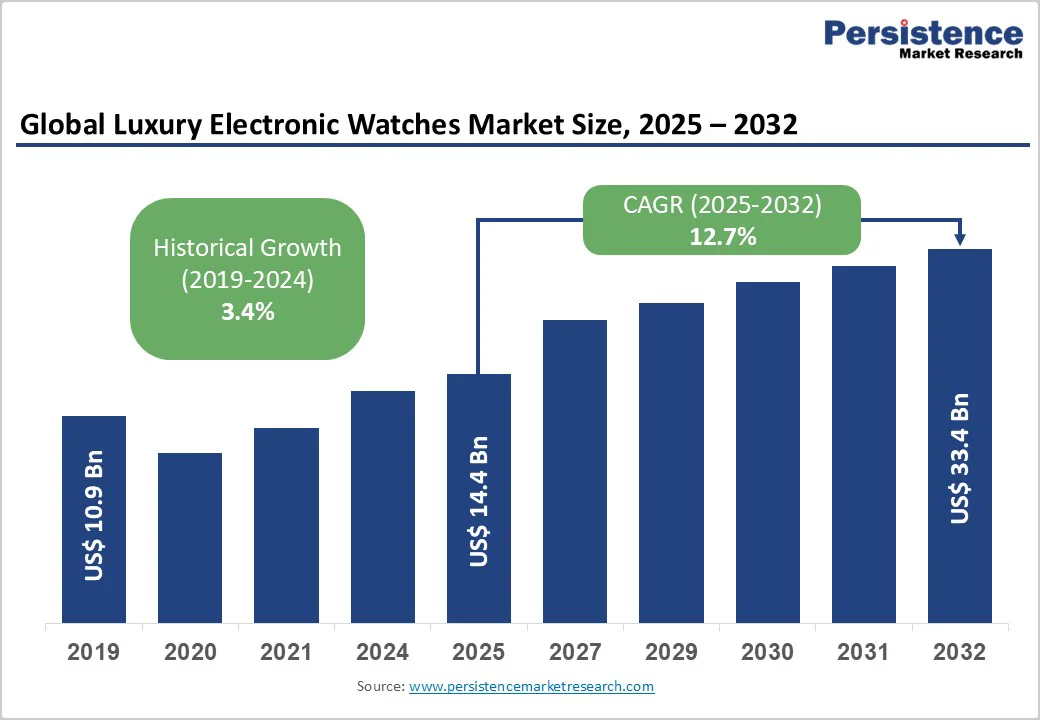

The global luxury electronic watches market size is likely to be valued at US$14.4 Billion in 2025, and is estimated to reach US$33.4 Billion by 2032, growing at a CAGR of 12.7% during the forecast period 2025 - 2032, driven by the rising consumer demand for premium smartwatches integrating advanced health monitoring features, alongside the strategic entry of heritage watchmakers and fashion brands into the smartwatch domain.

Rising health-focused features and the fusion of luxury craftsmanship with advanced technology are driving growth, while expansion into emerging markets and mature smartwatch OSs boost the luxury wearable footprint.

| Key Insights | Details |

|---|---|

| Luxury Electronic Watches Market Size (2025E) | US$14.4 Bn |

| Market Value Forecast (2032F) | US$33.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 12.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.4% |

Personalization is becoming a pivotal driver for growth in the market, with consumers increasingly valuing unique products tailored to their preferences and lifestyle. High-net-worth individuals (HNWIs) have been openly expressing their preference for customizable luxury watches that allow modifications in case materials, strap options, and digital watch faces.

This trend extends beyond aesthetics into software personalization, such as customizable complications and health monitoring dashboards, fostering deeper user engagement and brand loyalty. The availability of quick-release straps and modular components is facilitating a shift toward bespoke experiences.

From a manufacturing perspective, brands are leveraging advanced digital supply chains and additive manufacturing technologies to support small-batch customization without significant cost increases.

The unprecedented sophistication of health and behavioral data collected by luxury smartwatches is triggering increased scrutiny from data privacy regulators globally, creating structural challenges for product innovation and market growth.

Laws such as the European Union (EU)’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose strict requirements for user consent, data anonymization, and cross-border data transfers, which luxury electronic watch manufacturers must rigorously comply with.

These regulations often lengthen product development cycles due to the need for extensive legal reviews and secure infrastructure investments, both of which are infamous for spiking R&D budgets.

Privacy compliance costs and user concerns over tracking and data misuse constrain the rollout of advanced features such as continuous health analytics and behavioral biometrics in sensitive regions, impacting premium market acceptance and potentially limiting consumer trust.

Non-compliance could lead to heavy fines, posing significant financial and reputational risks to brands. This data privacy environment demands that luxury smartwatch makers balance innovation with stringent governance, increasing operational complexity, and slowing time-to-market for new health-related functionalities.

Blockchain adoption in the luxury electronic watches presents an emerging opportunity centered on enhancing product authenticity and ownership verification through immutable digital records.

Luxury brands are increasingly partnering with blockchain service providers to embed non-fungible tokens (NFTs) as digital certificates of authenticity, linking tangible smartwatches to secure, tamper-proof digital identities. This initiative is being driven by consumer demand for provenance assurance amid rising counterfeit risks and supports the circular luxury market by facilitating transparent secondhand transactions.

Blockchain’s decentralized ledger supports innovative ownership experiences, including fractional ownership, limited edition releases with verifiable scarcity, and exclusive access rights tied to NFTs. The deployment of blockchain technology is anticipated to foster trust and engagement, potentially increasing brand equity and opening new revenue streams such as digital collectibles and experiential services.

As a nascent yet lucrative avenue, early adopters investing in blockchain integration are positioned to capture substantial competitive advantage and cater to digitally native luxury consumers.

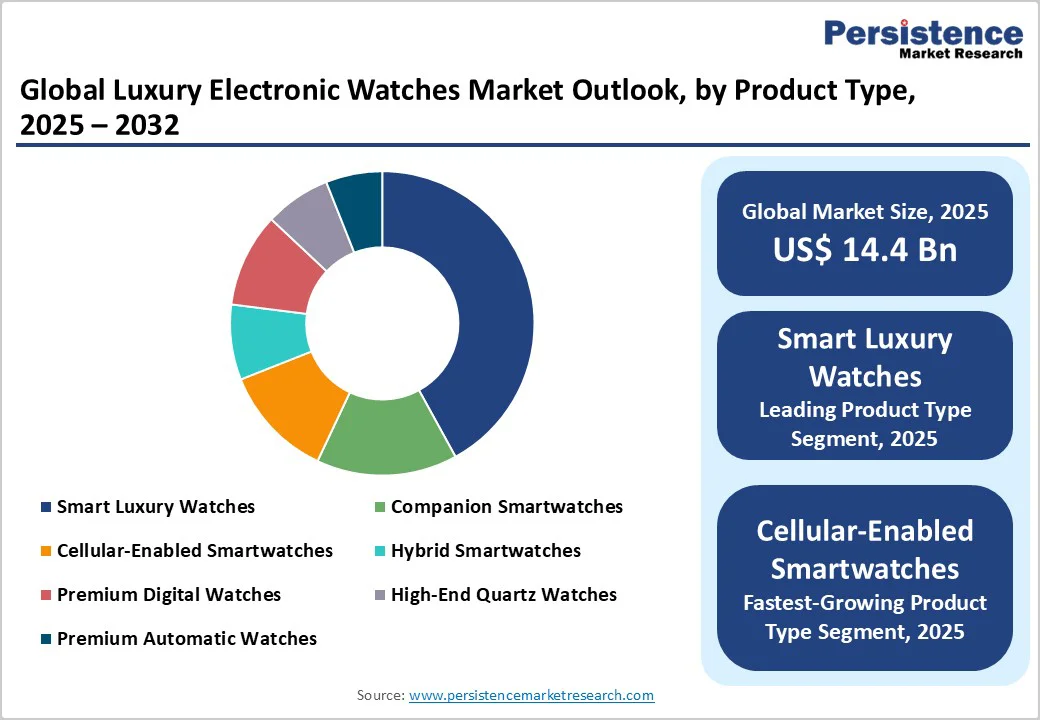

Smart luxury watches are foreseen to decisively lead in 2025, commanding an estimated 45% of market revenues, attributable to their comprehensive feature sets and premium positioning. These watches integrate full-fledged operating systems, allowing standalone functionality, including cellular connectivity and advanced biometric sensors.

Their appeal lies in the seamless blend of traditional luxury watchmaking craftsmanship with cutting-edge technology, attracting affluent consumers who prioritize prestige alongside utility. Recent innovation in customizable watch faces and interchangeable bands further reinforces their dominance, catering to high personalization demand.

Cellular-enabled smartwatches are anticipated to be the fastest-growing segment from 2025 to 2032. Growth drivers include enhancements in 5G technology, enabling smoother, more reliable decentralized connectivity, and emerging use cases for professionals and fitness enthusiasts requiring uninterrupted access regardless of smartphone proximity.

The segment’s rapid expansion reflects shifting consumer preferences toward increased autonomy and richer communication features in luxury wearable tech.

The cardiovascular monitoring segment is poised to maintain its apex position with an approximate 40% of the luxury electronic watches market revenue share in 2025, driven by widespread regulatory approvals facilitating clinical-grade ECG and heart rate tracking functionalities. Consumer adoption is further propelled by increasing awareness of cardiovascular health, especially among aging high-net-worth populations.

The advanced health metrics segment is expected to exhibit the highest CAGR during 2025 - 2032, encompassing innovations in non-invasive glucose monitoring, biological age estimation, and mental health analytics.

These features are gaining traction through integration with AI-enabled health platforms, delivering highly personalized wellness insights and preventative health management. The expanding ecosystem of healthcare providers and insurance incentives further catalyzes this growth, as luxury smartwatch technology evolves from consumer gadgets to adjuncts in medical care.

Apple’s watchOS is predicted to secure approximately 54% of the luxury electronic watches market share in 2025, leveraging the company’s deep integration across devices and its robust ecosystem of health and fitness applications, ensuring a seamless user experience and high brand loyalty.

HarmonyOS emerges as the fastest-growing operating system between 2025 and 2032, primarily due to its rapid adoption within China’s domestic luxury market. Huawei’s aggressive ecosystem development, aligned with national digital sovereignty goals and supportive government policies, is facilitating this growth by enhancing local luxury smartwatch appeal.

Android/Wear OS sustains a steady share, estimated at 30% in 2025, benefiting from wide geographic distribution and developer support, but faces challenges in luxury positioning against more curated ecosystems and proprietary platforms emphasizing exclusivity.

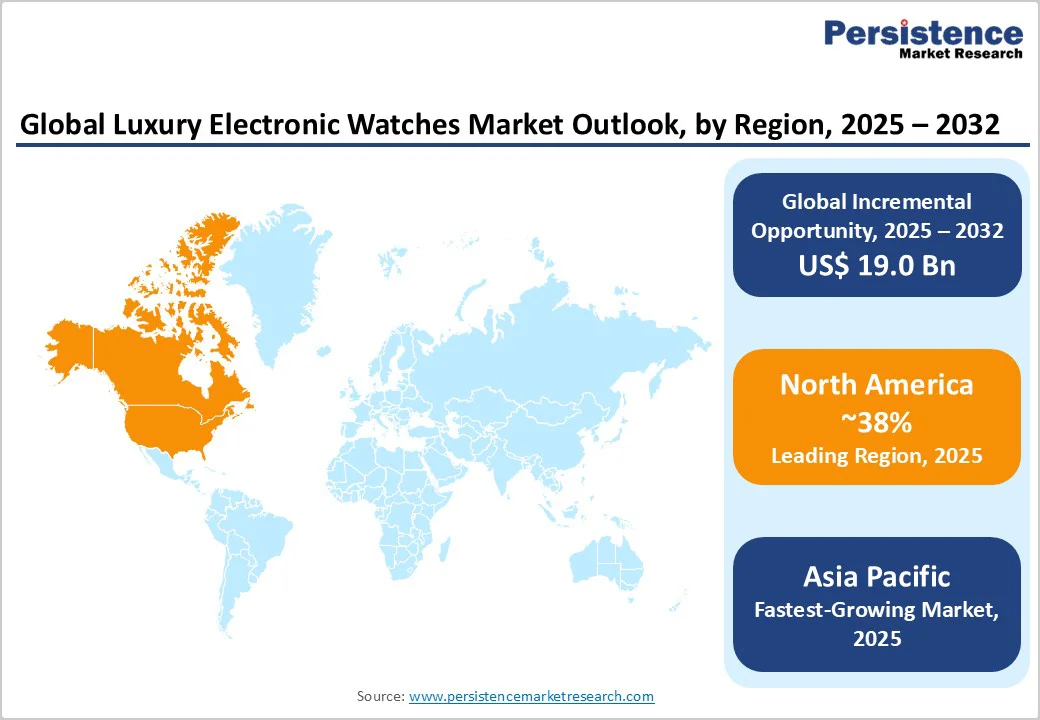

North America is well-positioned to hold a commanding 38% of the luxury electronic watches market share in 2025. The U.S. dominates the regional market, supported by a mature digital health ecosystem and favorable regulatory frameworks such as FDA approvals for digital health applications, which accelerate product launches for advanced biometric smartwatch features.

The region’s innovation-driven marketplace fosters robust R&D investment, with companies such as Apple and Garmin pioneering health-centric smartwatch functionalities and cellular-enabled devices.

Consumer preference trends reveal an increasing inclination toward premium smartwatches with AI capabilities related to health and productivity. Investment activity includes substantial venture capital influx into wearable health startups, partnership-driven product co-development, and expansion of retail touchpoints focusing on experiential luxury shopping environments.

Regulatory vigilance continues to influence feature deployment speed, but overall creates an innovation-conducive environment for luxury watchmakers.

Europe is set to capture approximately 27% market share in 2025, anchored by harmonized regulations under the EU’s MDR, which provides a unified compliance framework, reducing market entry complexity for advanced health-functional smartwatches. Growth drivers include an aging population increasingly adopting connected health technology and a strong heritage watch industry presence, driving hybrid luxury smartwatch innovation.

Europe is home to some of the oldest and high-value luxury watch brands, whose products are coveted by consumers and enthusiasts around the world. These brands are now emphasizing the incorporation of sustainable materials, eco-friendly manufacturing, and craftsmanship, aligning with increased consumer environmental consciousness.

Swiss watch firms are deploying hybrid analog-smart designs and digital exclusives to retain relevance. The expanding presence of digital health applications tied to smartwatch platforms, and backed by governmental health IT initiatives, is fostering ecosystem maturation conducive to premium pricing, making the regional competitive milieu highly vibrant.

The Asia Pacific market is anticipated to be the fastest-growing through 2032. China leads regional growth due to government initiatives such as Made in China 2025, which are bolstering local manufacturing of advanced smartwatch components, combined with soaring demand from younger, digitally savvy consumers prioritizing luxury and innovation.

India and ASEAN nations contribute to expanding middle classes, burgeoning online luxury retail channels, and increasing health and lifestyle awareness.

Regulatory environments vary but are gradually moving toward enhanced digital health governance, facilitating growing market access. Competitive landscapes showcase increasing regional innovation hubs and manufacturing partnerships. Investment flows are directed toward localized product development, retail presence expansion, and ecosystem partnerships with global brands, optimizing for regional preferences and price sensitivity.

The global luxury electronic watches market structure exhibits moderate concentration. Apple, Samsung Electronics, TAG Heuer SA, Garmin Ltd., and Huawei Technologies control approximately 68% of the market share. Apple leads decisively with around 33%, propelled by the deep consumer loyalty to its ecosystem and innovation leadership in health and connectivity features. This degree of market concentration underlines significant brand equity advantages and ecosystem-driven consumer lock-in.

The rest of the market is fragmented among traditional watchmakers integrating smart features, tech-native fitness-focused specialists, and emerging regional players. The balance between consolidation and fragmentation fosters a competitive environment where differentiated technology adoption, design innovation, and strategic partnerships are critical for sustained growth. The market structure necessitates continuous investment in R&D, integration of AI and health features, and agile global-local operational models.

The global luxury electronic watches market is projected to reach US$14.4 Billion in 2025.

Strong consumer demand for premium smartwatches integrating advanced health monitoring features, and the strategic entry of heritage watchmakers and fashion brands into the smartwatch domain, are driving the market.

The luxury electronic watches market is poised to witness a CAGR of 12.7% from 2025 to 2032.

Growing adoption of health and wellness functionalities, accelerated technological convergence of luxury craftsmanship with high-tech capabilities, and the maturation of smartwatch operating systems are key market opportunities.

Apple Inc., Samsung Electronics Co. Ltd., TAG Heuer SA, and Garmin Ltd. are some of the key players in the luxury electronic watches market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Health & Wellness Features

By Operating System

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author