ID: PMRREP35685| 193 Pages | 7 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

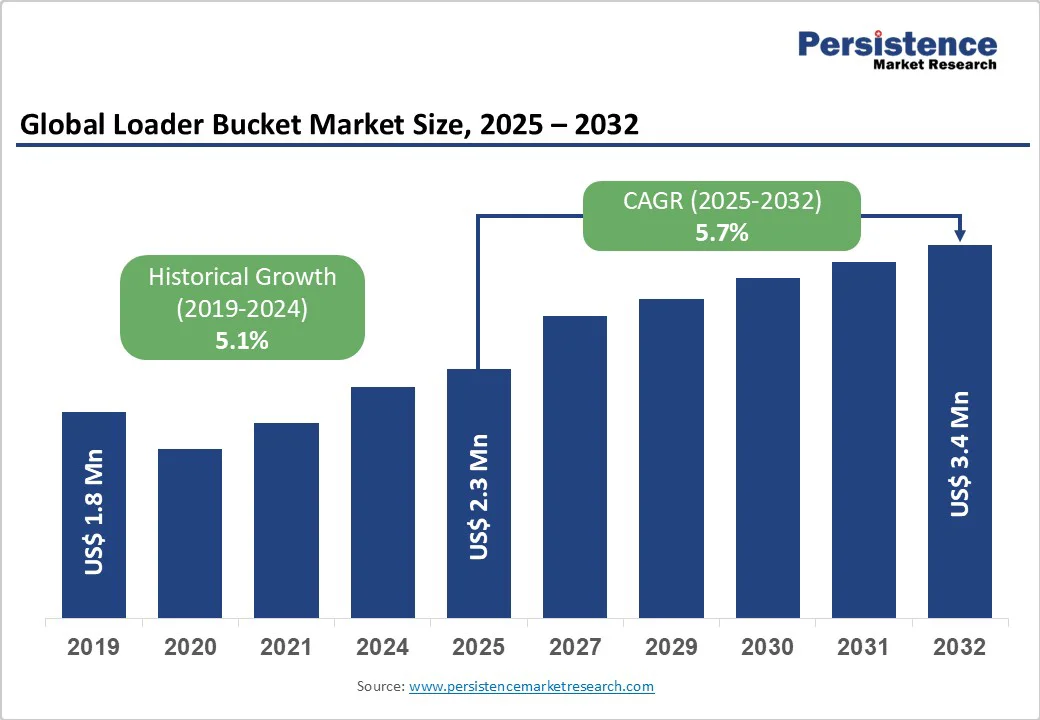

The global loader bucket market size is likely to value at US$2.3 Billion in 2025 and is projected to reach US$3.4 Billion by 2032, growing at a CAGR of 5.7% during this period 2025 - 2032. The market has shown steady historical growth, increasing from US$1.8 billion in 2019, which reflects a CAGR of 5.1%. This growth is primarily driven by stringent environmental regulations aimed at reducing methane emissions.

| Key Insights | Details |

|---|---|

|

Loader Bucket Market Size (2025E) |

US$ 1.8 Bn |

|

Market Value Forecast (2032F) |

US$ 2.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.7% |

Infrastructure development remains one of the most significant long-term drivers for the loader bucket market. According to the Global Infrastructure Outlook by the OECD and G20, global infrastructure investment requirements are expected to surpass US$ 94 trillion by 2040, with more than half allocated to transportation, energy, and urban development. These projects necessitate massive volumes of earthmoving and materials handling, where loader buckets serve as critical attachments for excavators, backhoes, and wheel loaders.

In the United States, the Bipartisan Infrastructure Law allocates US$ 1.2 trillion through 2030, directly targeting the renewal of roads, bridges, airports, and water systems. Similarly, India’s National Infrastructure Pipeline and China’s Belt and Road Initiative are expanding large-scale projects requiring efficient construction equipment. Loader buckets—particularly general-purpose and heavy-duty variants enable contractors to handle aggregates, soil, sand, and debris efficiently, making them indispensable for project execution.

The mining industry is undergoing a significant resurgence, fueled by the global shift toward renewable energy and electrification. The International Energy Agency (IEA) projects that demand for critical minerals such as lithium, copper, and cobalt will grow by nearly 60% by 2035 to support clean energy technologies, including electric vehicles and grid storage. In addition, coal and metal mining remain vital for industrial production, particularly in Australia, China, South Africa, and Latin America, where resource extraction underpins economic growth.

Loader buckets, especially heavy-duty and coal-handling designs, play a central role in digging, hauling, and handling large ore volumes under extreme operating conditions. Mining companies are modernizing fleets to improve efficiency, safety, and output, leading to increased adoption of specialized buckets with enhanced durability. Equipment maintenance is also a major consideration, with aftermarket bucket replacements forming a key portion of ongoing capital expenditure.

Loader buckets, particularly those designed for heavy-duty operations such as rock handling, mining, and large-scale construction, involve high upfront investment. Their specialized design, reinforced materials, and advanced welding techniques add to procurement costs compared to standard attachments. Beyond acquisition, these buckets are subject to constant wear due to abrasive materials like gravel, coal, or demolition debris, which accelerates deterioration of edges, teeth, and liners. Frequent replacement of wear parts and welding maintenance further increases lifecycle expenses.

According to the U.S. Bureau of Labor Statistics, construction equipment repair and maintenance costs have risen at an annual rate of 7.5% since 2020, reflecting inflation in spare parts, labor charges, and material prices. For small and medium enterprises (SMEs), especially in construction, waste recycling, and small-scale mining, these recurring costs reduce profitability and cash flow flexibility. Many operators therefore delay procurement of new loader buckets, extend the usage cycle of existing attachments, or turn to refurbished or used alternatives.

Although regulations primarily target engine emissions, they indirectly influence the adoption of loader buckets by increasing the total compliance cost of fleet operations. Standards such as the EU Stage V emission norms and the U.S. EPA Tier 4 Final rules demand investment in advanced loader models equipped with emission-control systems. Since loader buckets are dependent on fleet upgrades, companies may postpone bucket replacement to prioritize regulatory compliance with loaders themselves.

Moreover, environmental oversight extends to waste handling and landfill operations, where buckets are frequently used. Improper bucket use, such as spillage of hazardous waste or overloading, may result in fines, penalties, or safety liabilities. Operators must therefore adopt specialized buckets (e.g., waste-handling or high-capacity models with sealing systems) to meet compliance standards. These buckets typically cost more and require precision manufacturing, increasing the burden on customers.

Emerging markets, particularly in Asia Pacific and Africa, are projected to play a pivotal role in loader bucket demand over the next decade. Rapid urbanization, population growth, and industrialization are fueling large-scale investments in housing, transport, and energy infrastructure.

India’s National Infrastructure Pipeline (NIP) outlines more than US$ 1.4 trillion in investments through 2030, spanning roadways, railways, airports, and urban development projects. Each of these sectors heavily relies on excavators, backhoe loaders, and wheel loaders equipped with robust bucket systems.

Africa’s mining boom in copper, cobalt, and rare earths, particularly in Zambia, the Democratic Republic of Congo (DRC), and South Africa, is accelerating the requirement for heavy-duty loader buckets designed for ore extraction and haulage. Since mining equipment undergoes significant wear, aftermarket replacement demand is particularly strong in these regions.

The surge in waste generation and the global pivot toward sustainable practices are creating strong opportunities for loader bucket applications in the waste management and recycling sector. The World Bank projects global waste generation will rise to 3.4 billion tons annually by 2050, nearly double current levels. Municipal governments are prioritizing waste segregation, transfer, and recycling infrastructure, driving demand for specialized loader buckets such as high-dump, light-material, and waste-handling buckets.

These attachments are engineered for handling bulk but lighter-density materials such as woodchips, recyclables, paper, and biomass, which are increasingly processed in circular economy models. Growth in municipal solid waste (MSW) projects across North America, Europe, and the Asia Pacific adds momentum to adoption. For instance, the EU Waste Framework Directive mandates recycling targets of at least 55% of municipal waste by 2025, ensuring greater reliance on mechanized waste handling equipment.

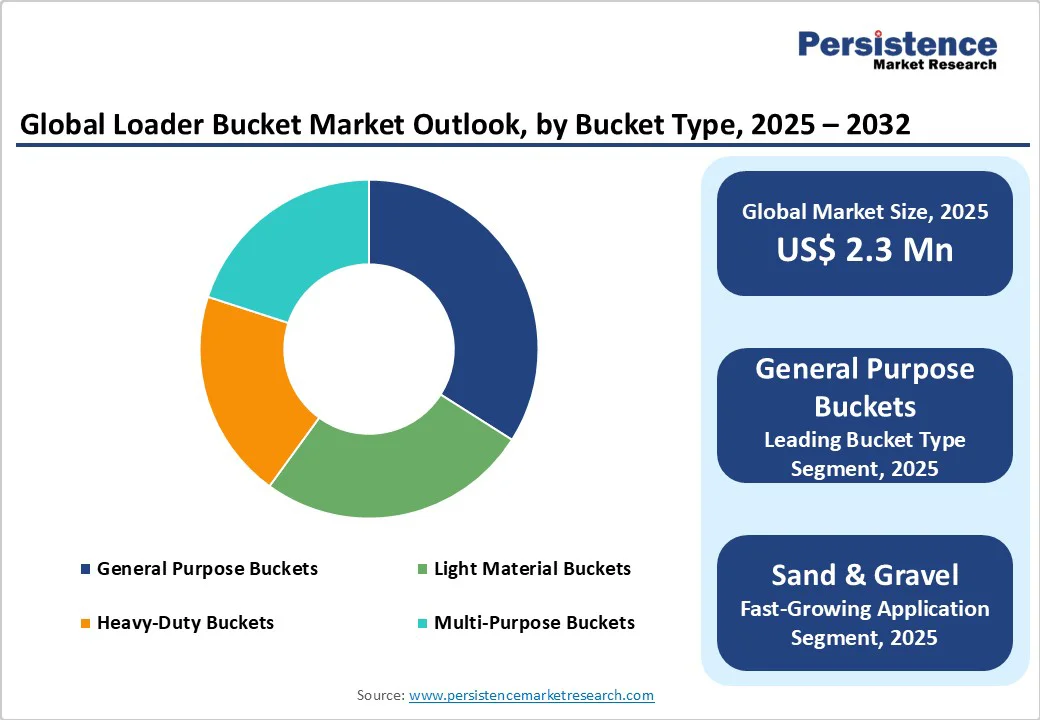

General purpose buckets remain the backbone of the loader bucket market, accounting for over 35% share in 2025. Their widespread use in construction, landscaping, and small-scale material handling stems from cost-efficiency, durability, and compatibility with a wide range of loaders. Contractors, particularly small to medium-sized firms, prefer these buckets because they strike the right balance between price and performance for common tasks like earthmoving, backfilling, and aggregate handling.

Growth is further reinforced by the steady rise in public infrastructure projects and housing developments worldwide. The simplicity of their design ensures lower maintenance and reduced downtime, keeping them attractive in cost-sensitive markets. General-purpose buckets are expected to remain dominant through 2032, supported by both OEM sales and aftermarket replacement demand.

First-fit loader buckets represented 60% sales in 2025, supported by strong OEM partnerships and equipment bundling strategies. Customers purchasing new loaders generally prefer manufacturer-supplied buckets, which ensure compatibility, warranty coverage, and reliable performance. The construction and mining industries, where equipment downtime can be extremely costly, continue to favor OEM-first-fit options.

Manufacturers are leveraging this trend by offering integrated sales packages, which combine loaders with purpose-built buckets. Furthermore, government-funded infrastructure projects, such as the U.S. Bipartisan Infrastructure Law and large-scale construction in China and India, drive high demand for new machinery sales, reinforcing first-fit bucket adoption.

The construction industry accounted for over 45% revenues in 2025. Infrastructure development projects such as highways, railways, airports, and residential complexes heavily depend on loaders for material excavation and handling.

Government-driven investment programs such as India’s National Infrastructure Pipeline and the U.S. Infrastructure Investment and Jobs Act fuel sustained demand for construction buckets. General-purpose and multi-purpose buckets dominate this sector due to their broad usability across tasks such as earthmoving, grading, and aggregate handling. As global construction output continues to grow, this segment is expected to maintain dominance well into the next decade.

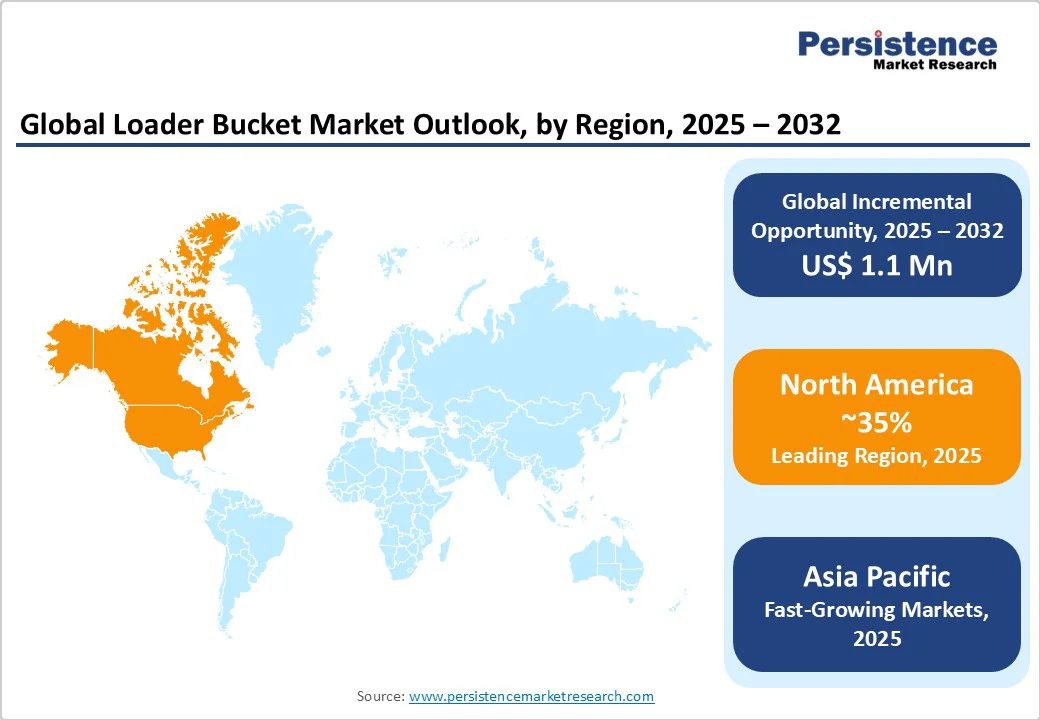

North America represented 25% of the global loader bucket market in 2025, with the U.S. as the largest contributor. The U.S. construction sector, valued at US$ 2.1 trillion in 2024 (U.S. Census Bureau), exponentially drives growth. Mining operations in coal and aggregates further support equipment sales.

The EPA’s emission rules push manufacturers to innovate in bucket design for compliance and efficiency. Competitive intensity is high with Caterpillar and John Deere dominating. Investment trends highlight growth in waste-handling buckets, supported by state-level recycling initiatives.

Europe accounted for 20% of global share in 2025, with Germany, the U.K., and France as key contributors. Demand is driven by infrastructure modernization and EU-funded green transition projects. The EU Circular Economy Action Plan stimulates demand for recycling and waste-handling buckets. Germany leads in adoption due to its strong construction and industrial base, while Spain and France are experiencing infrastructure renewal in transport networks. Regulatory harmonization under EU Stage V standards impacts loader usage but also accelerates the adoption of efficient, compliant equipment. Market concentration is moderate, with JCB and Volvo prominent.

Asia Pacific dominated the global market with over 40% share in 2025, led by China, India, and Japan. China’s construction output, estimated at US$4.5 trillion, National Bureau of Statistics of China, 2024, underpins demand for heavy-duty and general-purpose buckets. India’s infrastructure pipeline adds significant momentum, while ASEAN markets benefit from mining activity. Manufacturing advantages, including low-cost steel production, enable competitive pricing. Regulatory frameworks are more flexible compared to Europe and North America, facilitating rapid adoption. Komatsu, Hitachi, and local Chinese firms maintain strong market positions.

The global loader bucket market is moderately consolidated, with the top five players, Caterpillar, Komatsu, Deere & Company, Volvo CE, and JCB, collectively accounting for around 55% of market share in 2025. These companies benefit from strong OEM integration, global distribution networks, and continuous investment in product innovation.

Their dominance is further reinforced by bundling strategies, where buckets are sold as part of complete loader systems. However, the market remains competitive at the regional level, with smaller and specialized manufacturers serving aftermarket demand. These regional players often provide cost-effective re-fit buckets and niche designs, ensuring a balance between global consolidation and local flexibility.

The loader bucket market is likely to value at US$ 2.3 billion in 2025; US$ 3.4 billion by 2032 (CAGR 5.7%).

Global infrastructure investments exceeding US$ 94 trillion by 2040 and mining sector expansion driven by 60% growth in critical minerals demand for clean energy technologies.

Wheeled loaders (40% share) due to their versatility in construction, material handling, and compatibility with various bucket types.

Asia-Pacific (40% share), driven by China's US$ 4.5 trillion construction output and India's US$ 1.4 trillion infrastructure pipeline.

Waste management and recycling applications growing at 6.4% CAGR, fueled by circular economy programs and global waste generation rising to 3.4 billion tons by 2050.

Caterpillar, Komatsu, Deere & Company, Volvo CE, and JCB (collectively holding 55% market share).

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Bucket Type

By Loader Type

By Fit Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author