ID: PMRREP35396| 194 Pages | 7 Oct 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

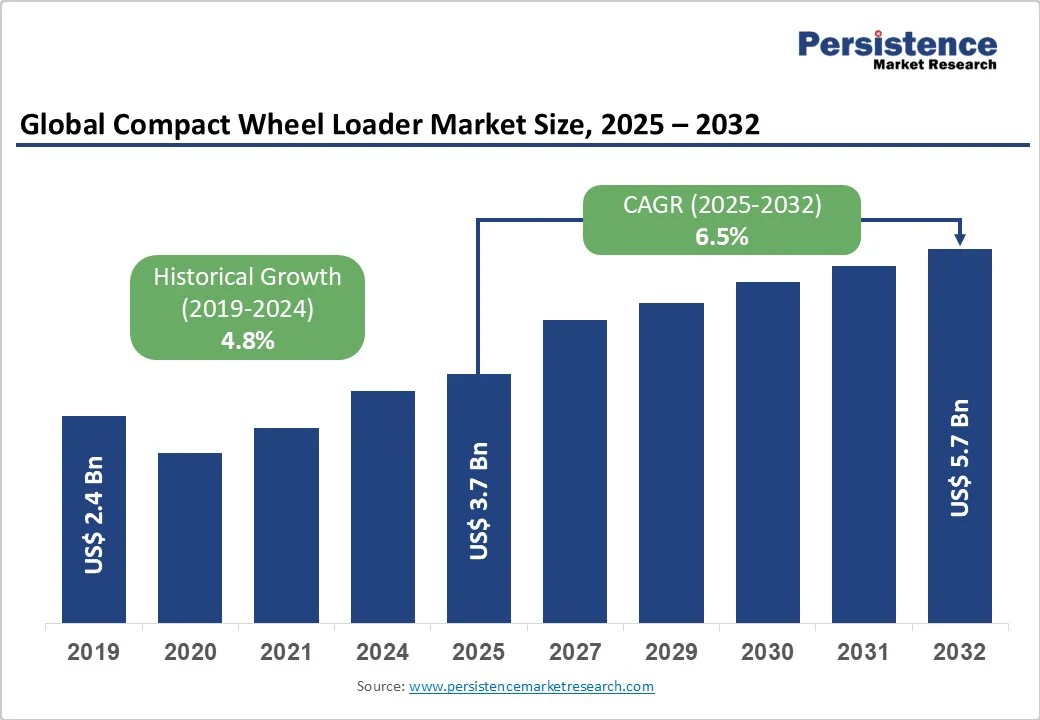

The global compact wheel loader market size is likely to value US$ 3,713.0 Mn in 2025 and is projected to reach US$ 5,749.8 Mn by 2032, growing at a CAGR of 6.5% from 2025 to 2032. The compact wheel loader is a heavy-duty machine used in construction and material handling, featuring a front-mounted bucket operated by hydraulic arms. Its primary functions include loading, lifting, transporting, and dumping bulk materials such as soil, gravel, sand, debris, agricultural products, and construction waste. In the construction industry, wheel loaders play a crucial role in earthmoving, site preparation, backfilling, and loading materials onto trucks.

| Key Insights | Details |

|---|---|

|

Compact Wheel loader Market Size (2025E) |

US$ 3,713.0 Mn |

|

Market Value Forecast (2032F) |

US$ 5,749.8 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.8% |

Manufacturers of loaders are adopting new technology to develop new products and compete in the market. Launching new and innovative products in the market has become a key strategy for manufacturers to gain competitive advantage.

Many market players in the construction vehicle industry are coming up with new compact and sustainable designs. Such new, innovative, and unique machines are boosting the revenue of these companies. Wheel Loaders have seen a significant change in the use of technology in machines over the past few years.

In the United States and Brazil, the adoption of compact wheel loaders is restrained by the presence of skid steer loaders and backhoe loaders, that are mostly preferred by construction contractors and fleet operators. These alternative machines offer greater versatility in tight urban environments and are often considered more cost-effective, especially for small- to mid-scale construction tasks. Skid steers, known for their maneuverability and adaptability with a wide range of attachments, dominate the compact equipment category in North America, limiting the demand for compact wheel loaders.

Backhoe loaders, on the other hand, offer dual functionality, excavation and material handling making them highly favored in infrastructure projects across Latin America, particularly in Brazil. Their multi-functional nature reduces the need for deploying multiple machines on-site, offering better value for budget-conscious contractors. As a result, compact wheel loaders often struggle to justify their standalone utility and higher acquisition costs in these competitive environments.

The rapid expansion of urban infrastructure and the rising trend of urban infill development present a strong growth opportunity for compact wheel loaders. In densely populated cities across Europe, North America, and parts of Asia, the construction focus is shifting inward, targeting previously underutilized or redeveloped urban plots. These job sites require highly maneuverable, space-efficient equipment capable of operating in narrow alleys, sidewalks, and residential zones without compromising on performance.

Compact wheel loaders meet these needs with smaller turning radii, lower operating noise, and multi-functionality through attachments. Their ability to combine lifting, grading, and material handling in tight spaces makes them ideal for road repairs, utility works, and landscaping within city limits. Additionally, municipalities increasingly prefer them for snow removal, park maintenance, and civic infrastructure development.

The 60HP to 80HP segment is expected to drive high demand for compact wheel loaders due to its ideal balance of power, productivity, and efficiency for diverse applications such as construction, landscaping, and agriculture. Leading manufacturers are focusing on this segment with innovative models to meet growing market needs.

This power range offers sufficient Powertrain Type for demanding tasks while maintaining fuel efficiency and maneuverability, making it popular among small and medium enterprises. Additionally, the integration of telematics, smart hydraulics, and electric powertrains is boosting adoption by reducing operational costs and emissions. Market forecasts project steady growth driven by urban infrastructure expansion, precision agriculture, and environmental regulations, positioning the 60HP to 80HP segment as a key growth driver in the compact wheel loader market.

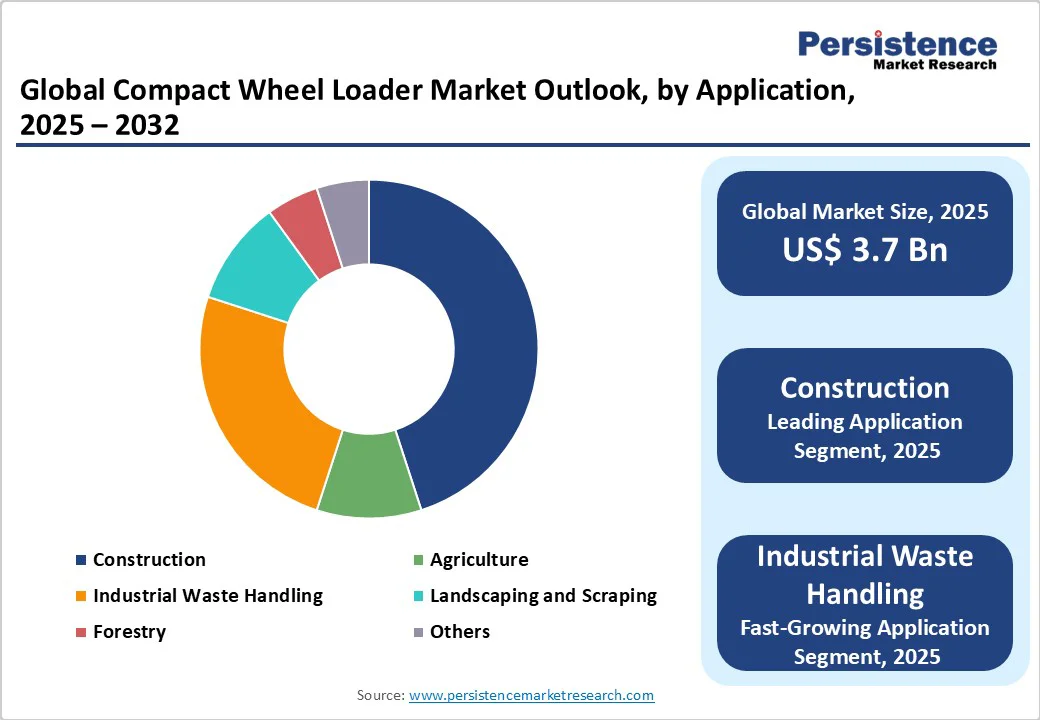

The construction segment holds a prominent share in the global wheel loader market, driven primarily by ongoing infrastructure development and urbanization worldwide. Wheel loaders are indispensable in construction for tasks such as excavation, material handling, site preparation, and loading, making them critical to project efficiency and timelines. The surge in government and private investments in roads, bridges, commercial buildings, and residential projects fuels demand for these machines. Medium-sized wheel loaders, offering a balance of power and maneuverability, are particularly favored in construction applications.

Several industries, including landscaping, forestry, industrial material handling, and mining are contributing to market expansion. For example, in July 2024, the Canadian Ministry of Energy and Natural Resources, together with the Ministry of Energy, Mines and Low Carbon Innovation and the Ministry of Transportation and Infrastructure, announced an investment of approximately USD 195 million to support infrastructure and highway development projects.

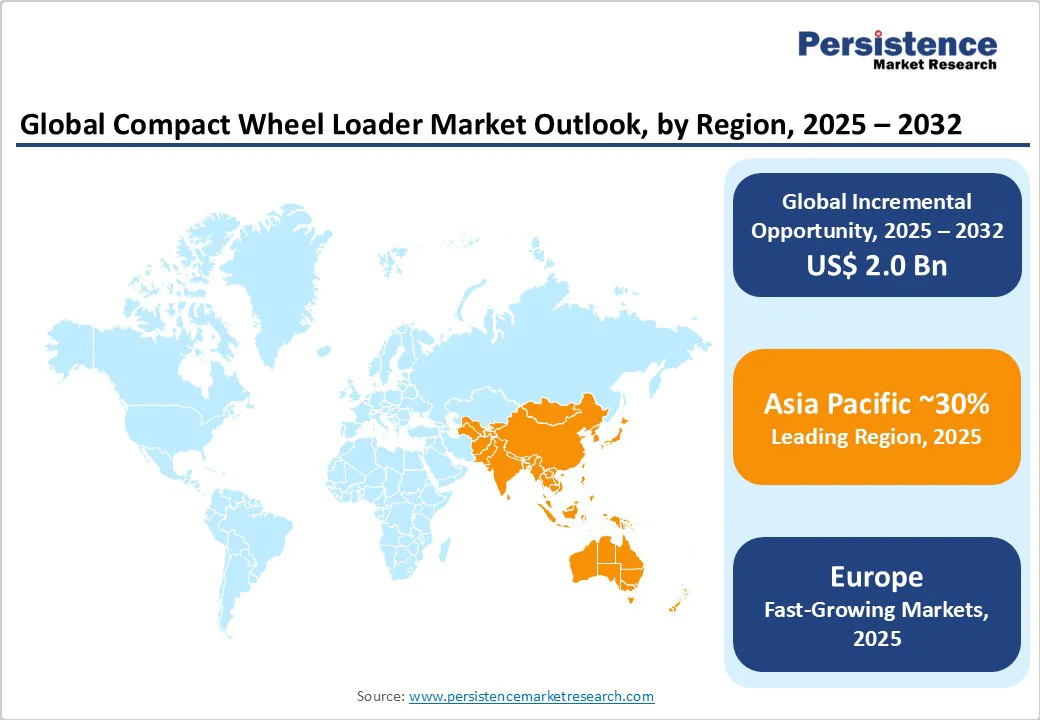

The demand for compact wheel loaders in North America is increasing due to several key factors. Rapid urbanization and extensive infrastructure development projects, especially the urgent need to upgrade aging road and bridge infrastructure in the U.S., are major growth drivers. According to U.S. government data, a significant portion of roads and bridges require repair, fueling demand for efficient, versatile machinery like compact wheel loaders in construction and maintenance. Additionally, the agriculture and mining sectors in North America are adopting compact loaders for their maneuverability and efficiency in handling bulk materials.

Manufacturers such as Bobcat and Caterpillar are responding with advanced models that emphasize fuel efficiency, operator comfort, and versatility. For instance, Bobcat’s compact loaders incorporate telematics and hybrid powertrains, aligning with stringent Environmental Protection Agency (EPA) emission regulations pushing for cleaner, electric, and hybrid equipment. Municipalities in cities like New York and Toronto are increasingly procuring electric compact wheel loaders to reduce carbon footprints, further driving market growth.

The development of the compact wheel loader market in Europe is characterized by the region's dedication to low-emission devices, precision farming, and infrastructure renewal. Cities are becoming more attractive for electric and hybrid compact loaders with Germany, France, and the UK being the largest adopters. Therefore, electric and hybrid compact loaders in urban job locations accounted for more than 18% of the new loader sales in Western Europe while it reflects the impact of the EU decarbonization goals.

Along with the trend of electric vehicles, the agricultural sector is also taking on wheeled loaders with the advanced telematics so that they are capable of tracking productivity, fuel use, and maintenance in real-time. The focus of OEMs lies on ergonomic cab design and automation-ready platforms as both operator comfort and smart farming initiatives are being addressed.

The demand for compact wheel loaders in the Asia Pacific region is rising rapidly due to accelerated infrastructure development, agricultural mechanization, and industrial expansion in countries such as China, India, and Southeast Asia. Urbanization and smart city initiatives are driving the need for versatile, compact, and fuel-efficient loaders suited for road repair, municipal works, and construction in congested urban areas. Local manufacturers are increasing production of affordable, rugged machines adapted to diverse terrains and climates, meeting the price-sensitive market demand, especially in India where diesel variants remain popular.

Technological advancements such as automation, remote diagnostics, and telematics are enhancing productivity, fueling the adoption of smart loader models. Major manufacturers like Komatsu and Hitachi are actively expanding their presence in the region, offering innovative, durable equipment tailored to local needs. Key factors driving growth include government infrastructure investments, urban construction, agricultural modernization, and rising demand for low-maintenance, efficient machines capable of operating in challenging environments

The global compact wheel loader market is highly consolidated, with organized players holding maximum market share, while regional and unorganized manufacturers hold the remaining. Leading OEMs dominate through technology, service, and global presence. Smaller players compete on price and local manufacturing. As demand grows, market expansion is expected through partnerships, new entrants, and increased production capacity, especially in emerging markets. Innovation and electrification remain key growth drivers.

Chinese companies such as SDLG, Liugong, and XCMG collectively account for over 30% of the market share, reflecting China’s stronghold in the wheel loader segment due to cost competitiveness, domestic demand, and efficient manufacturing capabilities.

Presence of Established OEMs like Wacker Neuson, Hitachi, Caterpillar, Volvo, maintain solid market positions. Their continued emphasis on technology innovation, durability, and global support networks ensures steady demand across developed regions.

The compact wheel loader market is set to reach US$ 3,713.0 Mn in 2025.

Growing Demand for compact and agile loaders in Urban Infrastructure and Municipal Projects are the major growth drivers.

The industry is estimated to rise at a CAGR of 6.5% through 2032.

Development of Emission-Free Compact Machinery, and Urban Infrastructure Growth & Infill Development are the key market opportunities.

SDLG, Liugong Machinery Co., Ltd, Hitachi Construction Machinery Co., Ltd, Schäffer Maschinenfabrik GmbH, Caterpillar are a few leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Powertrain Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author