ID: PMRREP33204| 250 Pages | 23 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

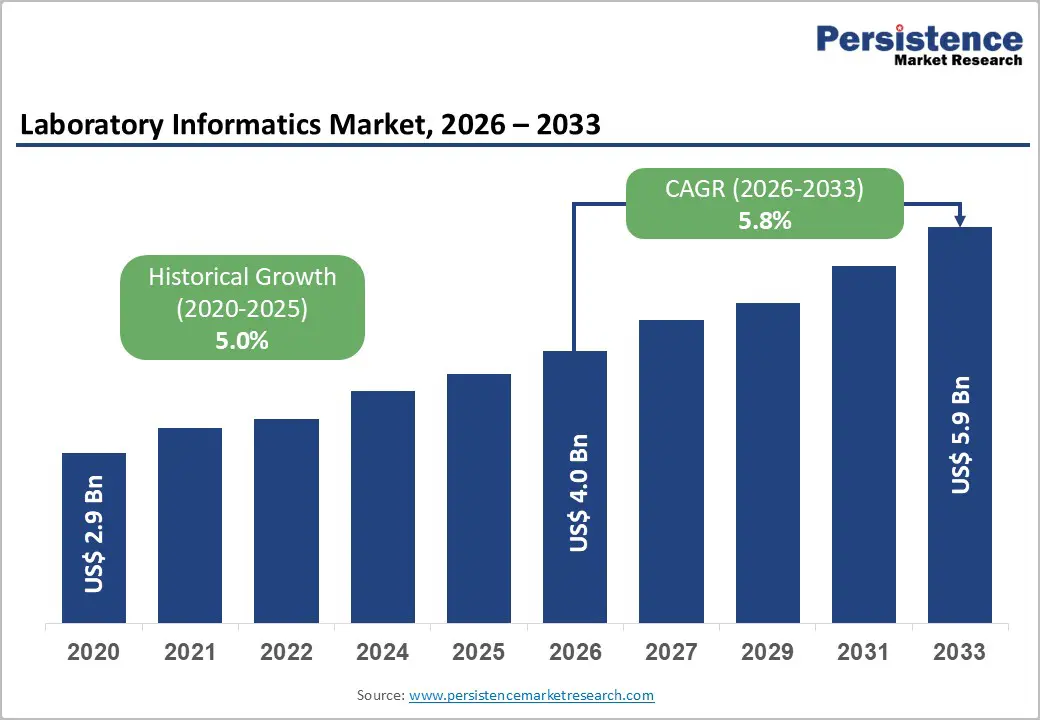

The global laboratory informatics market is estimated to grow from US$ 4.0 Bn in 2026 to US$ 5.9 Bn by 2033. The market is projected to record a CAGR of 5.8% during the forecast period from 2026 to 2033.

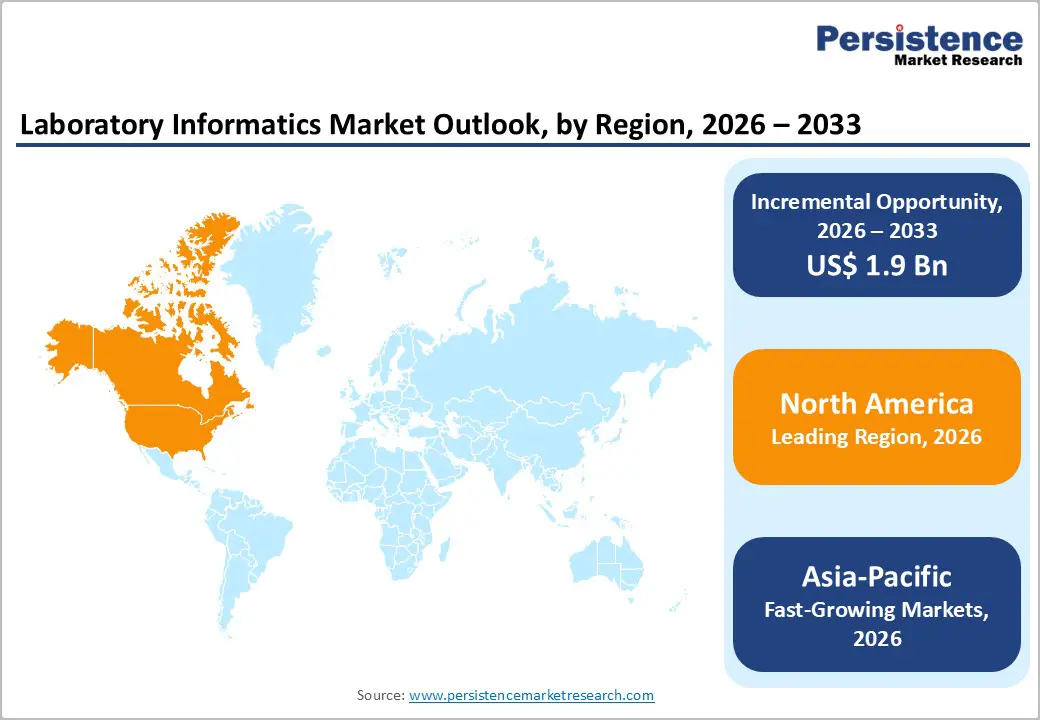

The global laboratory informatics market is growing steadily, fueled by digital healthcare adoption, telehealth, and advanced analytics. North America leads due to strong infrastructure, stringent regulations, and high laboratory standards. Asia-Pacific is the fastest-growing region, driven by expanding healthcare facilities, government digital initiatives, increasing patient awareness, and rising investments in diagnostic software, services, and interoperable solutions.

| Global Market Attributes | Key Insights |

|---|---|

| Global Laboratory Informatics Market Size (2026E) | US$ 4.0 Bn |

| Market Value Forecast (2033F) | US$ 5.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.0% |

Driver: Increasing adoption of digital laboratory solutions and automation

The increasing adoption of digital laboratory solutions and automation is a primary driver in the Laboratory Informatics Market because laboratories worldwide are transitioning from manual, paper?based processes to digital workflows to improve efficiency and accuracy. Surveys and industry data indicate that digital tools such as cloud?based Laboratory Information Management Systems (LIMS) and electronic lab notebooks (ELNs) are being widely implemented, with industry sources suggesting over 75% of new lab informatics contracts in 2024 were cloud?based and digital platforms now replace traditional methods in many facilities. Automated systems enable real?time data access, minimize human error, and integrate compliance features, which are essential for modern laboratory operations across life sciences and clinical diagnostics.

Empirical data underscore the pace and impact of this shift: industry reporting shows that over 60% of laboratories globally have adopted automation and digital data management tools to streamline workflows and enhance regulatory compliance, particularly in pharmaceutical and biotechnology sectors. Automation technologies can reduce manual data handling and error rates while improving throughput and data reliability. Adoption of cloud LIMS is expanding rapidly, with forecasts projecting cloud?based LIMS to grow at ~9.8% CAGR through the next decade, reflecting strong preference for scalable, efficient digital systems. This convergence of automation and informatics is reshaping laboratory infrastructure and accelerating digital transformation across research and clinical settings.

Restraints: Data security and privacy concerns

One of the significant restraints on the laboratory informatics market is data security and privacy concerns, particularly because these systems store and process highly sensitive patient and laboratory data that fall under stringent regulatory regimes. Healthcare data breaches are both frequent and costly: for example, healthcare remains the costliest sector for data breaches worldwide, with an average cost of approximately USD 7.42 million per incident in 2025. In 2024, U.S. healthcare organizations reported hundreds of breaches, with data compromises affecting tens of millions of records, driven by hacking and unauthorized access. This elevated risk environment deters some labs from fully embracing digital informatics due to fear of financial and reputational damage.

Real?world statistics underscore the scale of this challenge for laboratories integrating digital informatics. In 2024 alone, over 520 healthcare data breaches were officially resolved in the United States, and protected health information stored on network servers was frequently targeted by cyberattacks. In addition, global analysis indicates that over 305 million patient records were exposed in 2024, with ransomware affecting nearly two?thirds of healthcare organizations and 77?% targeted by attacks overall. These breaches often result in long detection and containment cycles sometimes averaging over 200 days, amplifying operational disruption and regulatory risk for informatics deployments.

Opportunity: Cloud-based and SaaS laboratory informatics solutions

The rise of cloud?based and SaaS (Software?as?a?Service) laboratory informatics solutions presents a significant opportunity for the Laboratory Informatics Market because laboratories increasingly require scalable, cost?efficient platforms capable of handling vast data volumes and collaborative workflows. In the broader healthcare sector, SaaS accounted for nearly half (approximately 49–70 %) of all cloud computing deployments in 2024–2025, driven by the ease of implementation and reduced dependency on internal IT infrastructure. These cloud?hosted systems enable laboratories to access state?of?the?art informatics tools without heavy capital expenditure, improve version control and compliance readiness, and streamline multi?site operations by centralizing data and workflows.

Empirical data from the healthcare cloud computing domain further underscore this opportunity for lab informatics: the global healthcare cloud computing market was valued at over USD 60 billion in 2025 and is projected to grow substantially in the coming decade, reflecting widespread institutional acceptance of cloud platforms to manage clinical, research, and operational data. Cloud computing adoption in healthcare has enabled greater interoperability, improved performance, and remote accessibility, with surveys showing that a large majority of health systems report enhanced performance and workforce collaboration by adopting cloud technologies. These broader digital health trends signal robust demand for SaaS?based informatics solutions in laboratory environments.

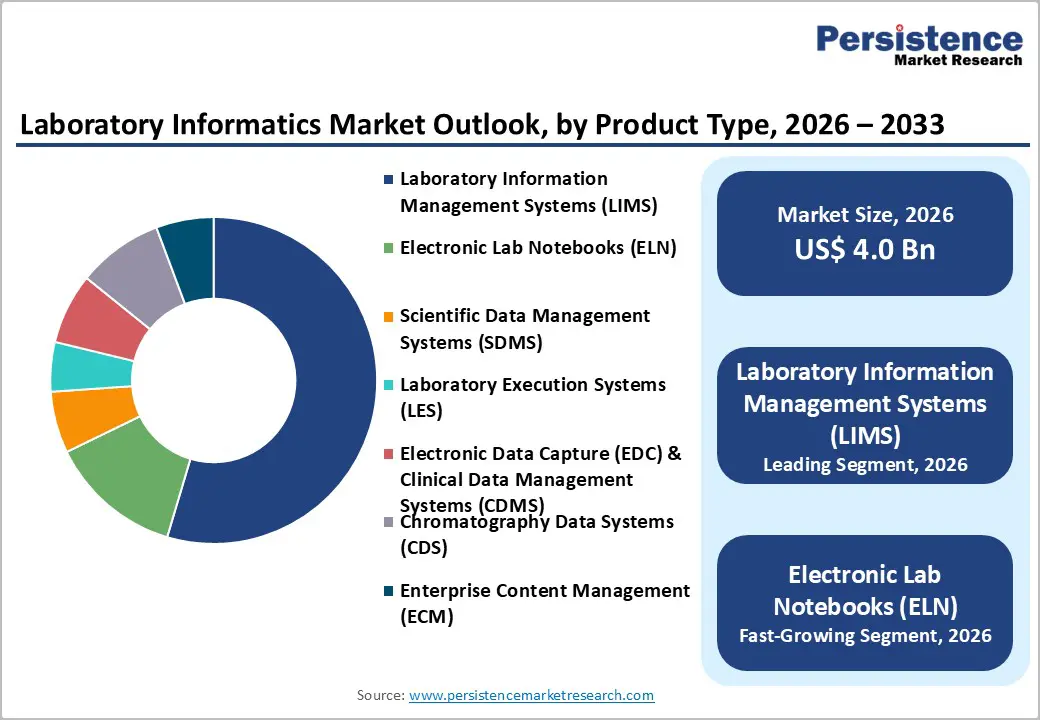

By Product Type, Laboratory Information Management Systems (LIMS) Dominates the Laboratory Informatics Market

Laboratory Information Management Systems (LIMS) occupies 54.6% share of the global market in 2025, because they serve as the central data backbone for modern laboratories, automating core functions such as sample tracking, data acquisition, workflow management, and reporting. This centralization addresses the high volume and complexity of laboratory data more effectively than standalone tools, significantly reducing manual errors and improving data integrity, which is critical in regulated environments. LIMS also help laboratories comply with stringent international standards such as ISO/IEC?17025 and CLIA, which govern testing competence and clinical diagnostics, respectively, driving adoption among accredited labs globally. Compliance with these standards (over 10,000 labs accredited under ISO frameworks) reinforces the need for automated management systems like LIMS. Consequently, LIMS are the preferred product type for laboratories seeking reliability, scalability, and regulatory readiness.

By Deployment Mode, Cloud-based deployment dominates laboratory informatics by offering scalability, remote access, collaboration, and efficient, secure data management

Cloud?based deployment dominates the laboratory informatics market because it delivers scalability, accessibility, interoperability, and cost advantages that on?premise systems cannot match. In healthcare settings, including diagnostic laboratories and research facilities, cloud technology enables real?time access to data and applications from multiple locations, enhancing collaboration across teams and reducing dependence on outdated hardware. For instance, surveys in the wider healthcare industry report that 95?percent of hospitals adopting cloud solutions see reduced reliance on legacy systems and 94?percent report improved performance and availability after cloud implementation. Cloud platforms also simplify integration with electronic records and analytics tools, helping laboratories share, analyze, and securely manage data efficiently. These capabilities make cloud the preferred deployment mode for modern laboratory informatics.

North America Laboratory Informatics Market Trends

North America dominates the laboratory informatics market with 47.3% share in 2025, due to its advanced healthcare IT infrastructure, high digital adoption, and strong biomedical research ecosystem. In the United States, 96?percent of non?federal hospitals had implemented certified electronic health records (EHRs) by 2021, and nearly 80?percent of office-based physicians used EHRs, reflecting widespread digital integration that supports laboratory informatics deployment. Laboratories benefit from seamless electronic workflows, interoperability, and automated data management, which improve accuracy and regulatory compliance.

Moreover, robust research funding drives innovation: the U.S. NIH’s annual budget of ~$48?billion fuels advanced laboratory technologies and informatics solutions. Combined with a skilled workforce and regulatory support, these factors make North America the leading region for laboratory informatics adoption and expansion.

Europe Laboratory Informatics Market Trends

Europe is a key region in the laboratory informatics market because of its strong healthcare infrastructure, advanced research ecosystem, and stringent regulatory standards. The EU has emphasized digital healthcare and interoperability, with initiatives ensuring that most citizens can access electronic health records across member states, facilitating seamless data exchange. Laboratories benefit from this environment, as digital systems improve accuracy, traceability, and collaboration between clinical and research facilities, supporting more efficient and compliant operations.

Additionally, Europe’s public research and innovation programs, supported by national governments, drive demand for informatics solutions in laboratories. Regulations such as the EU Clinical Trials Regulation and In Vitro Diagnostic Medical Devices Regulation require structured electronic documentation and secure data handling, making laboratory informatics systems essential for compliance and operational efficiency.

Asia-Pacific Laboratory Informatics Market Trends

Asia Pacific is the fastest-growing region in the laboratory informatics market due to rapid digital health adoption, expanding healthcare infrastructure, and rising demand for efficient laboratory data management. Internet penetration in the region exceeded 70?% by 2024, enabling widespread use of electronic health records, telemedicine, and remote diagnostics. Countries like India, China, and Japan are actively promoting digital healthcare initiatives, which drive the implementation of LIMS, ELNs, and other informatics platforms to manage clinical and research data efficiently.

The region also faces a growing burden of chronic diseases, including diabetes, cancer, and cardiovascular disorders, which require systematic laboratory monitoring and predictive analytics. WHO data indicate that noncommunicable diseases account for a significant portion of deaths in Asia Pacific, intensifying the need for laboratory informatics solutions to improve patient outcomes and streamline workflows across clinical and research laboratories.

Leading laboratory informatics market companies focus on advanced assays, scalable platforms, and regulatory compliance. Investments in AI analytics, high-throughput testing, and workflow optimization improve accuracy and reproducibility. Collaborations with research institutions, standardized protocols, quality control, and integrated supply chains drive innovation, supporting adoption in clinical diagnostics, preventive care, and biomarker-based research.

Key Industry Developments:

The global laboratory informatics market is projected to be valued at US$ 4.0 Bn in 2026.

Rising digital adoption, regulatory compliance, AI integration, workflow automation, and growing healthcare and research demand.

The global laboratory informatics market is poised to witness a CAGR of 5.8% between 2026 and 2033.

Cloud-based solutions, AI analytics, IoT integration, multi-site data management, personalized medicine, and emerging healthcare markets.

LabWare, Thermo Fisher Scientific, Inc., PerkinElmer, Inc., Abbott, LabLynx, Inc., Agilent Technologies, Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Deployment Mode

By Component

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author