ID: PMRREP35880| 185 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

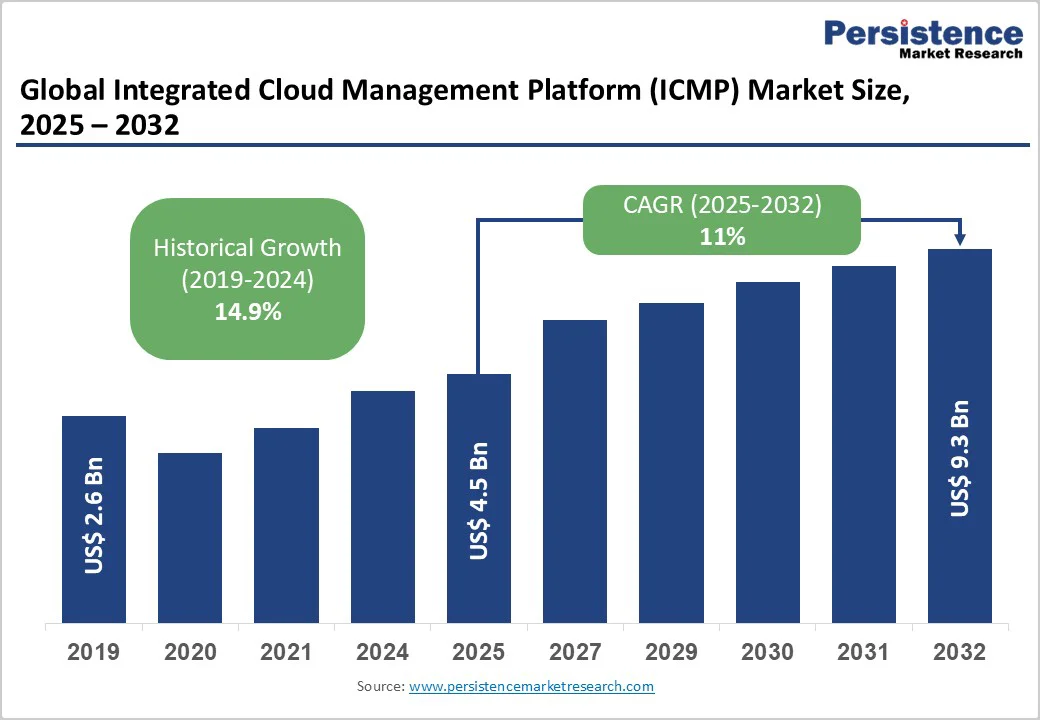

The global integrated cloud management platform (ICMP) market size is likely to be valued at US$4.5 Billion in 2025. It is estimated to reach US$9.3 Billion by 2032, growing at a CAGR of 11% during the forecast period from 2025 to 2032, driven by the increasing adoption of multi-cloud and hybrid cloud environments by enterprises seeking enhanced governance, automation, and cost optimization across complex IT landscapes.

The growing demand for integrated cloud management platforms (ICMPs) stems from the need for unified consoles to manage public, private, and multi-cloud environments while ensuring security, compliance, and operational efficiency.

Advances in AI-driven AIOps, container orchestration, and policy automation enhance ICMP capabilities, supporting digital transformation and data governance while addressing the increasing cloud complexity worldwide, thereby accelerating ICMP market adoption and growth.

| Key Insights | Details |

|---|---|

| Integrated Cloud Management Platform (ICMP) Market Size (2025E) | US$4.5 Bn |

| Market Value Forecast (2032F) | US$9.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 11% |

| Historical Market Growth (CAGR 2019 to 2024) | 14.9% |

As cyber threats continue evolving in sophistication and scale, enterprises are compelled to adopt integrated cloud security management features embedded within ICMP solutions to mitigate risks effectively. The surge in ransomware attacks, supply chain threats, and data breaches targeting cloud infrastructures has heightened security vigilance globally.

For example, according to the 2025 ENISA Threat Landscape Report, cyberattacks targeted public administration, transport, digital infrastructure and services, finance, and manufacturing sectors in the European Union (EU).

Regulations such as the Cybersecurity Maturity Model Certification (CMMC) in the U.S. defense sector and the European NIS2 Directive demand stringent cloud security compliance and continuous risk monitoring. This environment stimulates extensive enterprise investment in ICMP platforms that unify security posture management, automated compliance reporting, and threat detection within cloud operations.

The integration of security modules, such as Cloud Security Posture Management (CSPM) and Cloud Workload Protection Platforms (CWPP), in ICMPs is enabling proactive defense mechanisms, reducing incident response time and operational overheads.

An often-overlooked structural challenge hampering the efficiency of integrated cloud management platforms lies in the variability and limitations of cloud service provider (CSP) APIs.

Major hyperscalers such as AWS, Microsoft Azure, and Google Cloud expose different API models, rate limits, and feature sets, creating fragmentation that complicates seamless multi-cloud orchestration. This fragmentation forces ICMP developers to continually invest in adaptor layers and custom integrations, raising development costs and time-to-market.

For enterprises, this may translate into partial platform capabilities, diminished automation fidelity, and occasionally, increased failure rates in multi-cloud governance functions. Sudden CSP API changes or deprecations can also disrupt established ICMP workflows, increasing operational risk. This restraint is especially critical for organizations with complex hybrid deployments, where consolidated visibility and control are paramount.

The accelerated adoption of cloud-native architectures, microservices, and containerization opens a significant growth avenue for integrated cloud management platforms optimized for container and Kubernetes orchestration.

By 2025, more than 70% of enterprises are projected to run containerized workloads in production, as per several industry reports. This evolution is pushing organizations to seek ICMP functionality that efficiently manages Kubernetes cluster lifecycle, enforces security policies, monitors container performance, and automates scaling and upgrades.

The fragmented container ecosystem, combined with growing complexity in securing and orchestrating multi-cluster environments, is driving the demand for tools integrated with cloud management platforms to reduce the operational burden. The expanding use of service meshes and serverless functions is necessitating enhanced governance layers within ICMPs.

Multi-cloud and hybrid cloud governance consoles are the leading segment for 2025, commanding the largest ICMP market revenue share estimated at around 34%. This prominence is driven by the urgent need among enterprises for centralized management interfaces that unify policy enforcement, resource provisioning, compliance monitoring, and operational visibility across diverse public, private, and hybrid cloud environments.

Governance consoles serve as the foundational control plane, integrating critical functions such as security posture management, cost allocation, and automated workflow execution. The growing complexity of cloud estates and increasing regulatory mandates are intensifying demand for these platforms, as organizations strive to reduce operational risks and ensure consistent cloud compliance at scale.

The fastest-growing component segment from 2025 to 2032 is container and Kubernetes management. This growth is fueled by proliferating container adoption, hybrid cluster orchestration demands, and the need for integrated security postures across containerized environments.

Vendors providing comprehensive lifecycle management and seamless integration with service meshes and DevOps pipelines are capturing this expanding market slice, reflecting strategic shifts towards container-native cloud operations automation.

Public cloud solutions are set to command roughly 55% of the integrated cloud management platform market share in 2025, driven by scalability, flexible subscription models, and deep integrations with hyperscaler ecosystems. They enable rapid innovation cycles and cost-effective cloud governance for enterprises of varying sizes, supporting broad adoption, especially among small and medium enterprises (SMEs) and digitally native firms.

The fastest-growing deployment model segment from 2025 to 2032 is multi-cloud ICMP. This surge is attributable to enterprises desiring vendor diversification to mitigate risks, optimize costs, and dynamically allocate workloads across multiple cloud providers.

Multi-cloud ICMP platforms deliver unified policy controls, security enforcement, and cost management across heterogeneous platforms with enhanced visibility. Technology partnerships between ICMP vendors and major cloud providers further catalyze this growth by integrating advanced API capabilities and security frameworks.

The BFSI vertical leads in 2025, comprising an estimated 30% of the ICMP market, propelled by intensive regulatory compliance needs and digital banking transformations necessitating robust cloud governance and audit capabilities. This segment emphasizes security-integrated cloud management frameworks that meet rigorous standards such as PCI-DSS and SOX.

The IT and telecom sector is the fastest-growing vertical from 2025 to 2032, driven by the deployment of network functions virtualization (NFV), 5G core networks, and cloud-native architectures, which is creating demand for advanced cloud orchestration tools. The sector benefits from emerging telco cloud ecosystems that integrate ICMPs with OSS/BSS platforms to improve operational agility and service delivery.

North America is forecast to maintain leadership with an estimated 40% of the integrated cloud management platform market in 2025, owing to the mature cloud infrastructure, early multi-cloud adoption, and concentrated vendor ecosystem in the U.S. Regulatory frameworks such as FedRAMP and NIST cybersecurity standards provide strong compliance incentives, fostering ICMP deployment across federal and commercial sectors.

The innovation-driven concentration in Silicon Valley and Boston-area tech hubs supports rapid R&D cycles and competitive product development.

The growth trajectory of the regional market through 2032 is driven by ongoing modernization initiatives and the adoption of emerging cloud-native technologies. Investment trends spotlight vigorous venture capital support for AI-powered cloud governance startups and expanding hyperscaler-ICMP partnerships, enhancing platform interoperability and security compliance.

Key U.S. enterprises are leading the way in pioneering integrated cloud security and automation initiatives, positioning North America as a strategic hub of innovation.

In Europe, the market is likely to make substantial gains from a robust regulatory environment that harmonizes cloud governance practices while also emphasizing data sovereignty under GDPR and emerging NIS2 directives. These regulations have created a strong demand for ICMP solutions capable of enforcing compliance and audit readiness at scale.

The evolving digital sovereignty and cloud strategy frameworks are pushing European enterprises toward hybrid and private cloud-focused ICMP deployments. The European ICMP market is further propelled by governmental cloud adoption initiatives and increasing digital infrastructure investments.

The regional competitive scene includes a blend of global vendors and specialized European players prominent in compliance-driven solution innovation. Rising investments aim to enhance cloud security, sovereignty, and framework interoperability amid mounting geopolitical data concerns.

The Asia Pacific market is anticipated to exhibit the highest forecast CAGR from 2025 to 2032, reflecting vigorous investment flows, growing SME cloud engagement, and demand for hybrid and multi-cloud governance. Led by rapid cloud adoption in China, India, Japan, and ASEAN, the market here is driven by government smart infrastructure projects, manufacturing digital transformation, and expanding regional data centers.

The region’s regulatory landscape features evolving data localization laws and cybersecurity statutes shaping ICMP deployment models. Strategic partnerships between global ICMP solution providers and emerging local cloud platforms are facilitating tailored solutions meeting regional operational and compliance requirements.

Investment in cloud-native security and performance analytics tools is intensifying, supporting rapid digital economy growth and competitive technology ecosystems across key countries.

The global integrated cloud management platform (ICMP) market structure is moderately consolidated. Industry leaders include IBM, Microsoft, VMware, Google, and ServiceNow, commanding substantial enterprise engagements owing to their integrated cloud portfolios, extensive R&D investments, and large partner ecosystems.

This concentration creates high entry barriers but also intensifies competition among these incumbents to innovate in AI-driven automation and seamless multi-cloud governance.

A small bracket of nimble midsize firms and startups is shaping the competitive landscape by specializing in container management, edge-cloud integration, and vertical compliance solutions, thus advancing technological differentiation. The market reflects a balanced mix of consolidation, sustaining scale economies, and specialized innovation, driving feature differentiation and customer customization.

The global integrated cloud management platform (ICMP) market is projected to reach US$4.5 Billion in 2025.

The sustained increase in digital transformation initiatives, regulatory pressures for data governance, and rising cloud operational complexity are driving the market.

The integrated cloud management platform (ICMP) market is poised to witness a CAGR of 11% from 2025 to 2032.

Widening adoption of multi-cloud and hybrid environments, growing demand for unified management consoles across public and private clouds, and advances in AI-driven AIOps, container orchestration, and policy automation together create strong market opportunities.

IBM Corporation, Microsoft Corporation, VMware, Inc., and Google LLC are some of the top players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Deployment Model

By End-Use Vertical

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author