ID: PMRREP11791| 190 Pages | 29 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

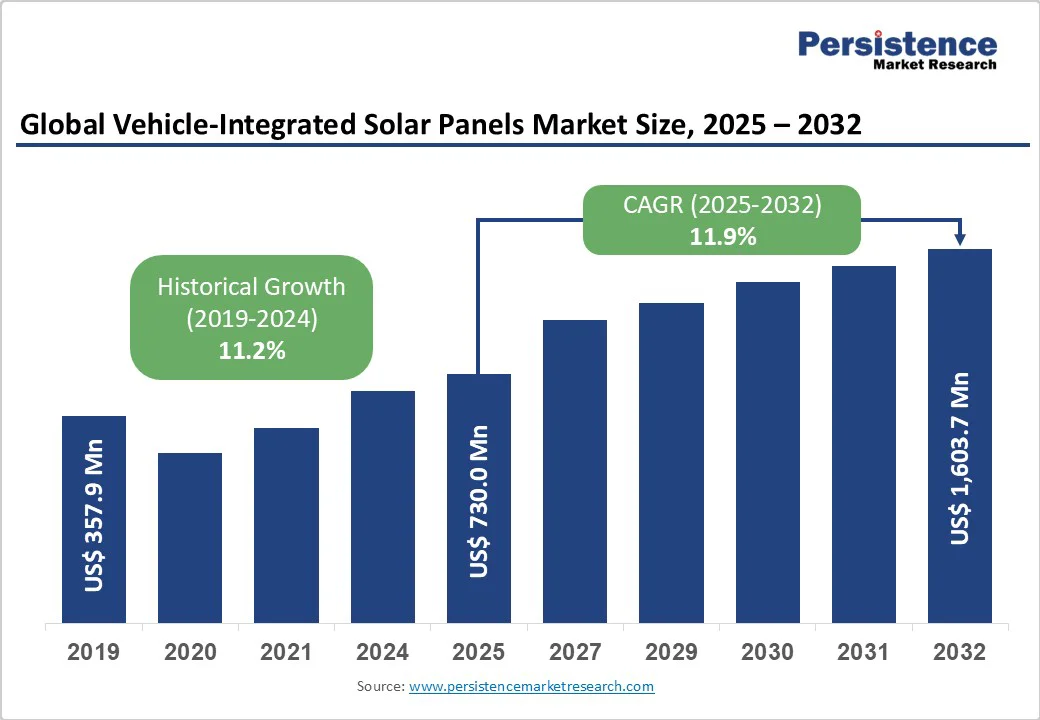

The global vehicle-integrated solar panels market size is likely to be valued at US$730.0 Mn in 2025 and is expected to reach US$1,603.7 Mn by 2032, growing at a CAGR of 11.9% during the forecast period from 2025 to 2032.

The increasing adoption of electric and hybrid vehicles worldwide is coupled with government incentives and environmental regulations.

| Key Insights | Details |

|---|---|

| Vehicle-Integrated Solar Panels Market Size (2025E) | US$730.0 Mn |

| Market Value Forecast (2032F) | US$1,603.7 Mn |

| Projected Growth (CAGR 2025 to 2032) | 11.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 11.2% |

The global transition to electric vehicles (EVs) is a key driver for the vehicle-integrated solar panels market. Governments worldwide are implementing policies to accelerate EV adoption, aiming to reduce greenhouse gas emissions and dependency on fossil fuels. This shift encourages the integration of innovative technologies, such as solar panels on vehicles, to improve energy efficiency and support sustainable mobility.

For instance, in India, initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme and the National Electric Mobility Mission Plan (NEMMP) 2020 promote EV adoption and infrastructure development. By integrating solar panels into EVs, these efforts also contribute to renewable energy goals, lowering the transportation sector’s carbon footprint and enhancing energy independence.

In India, the government's commitment to sustainable mobility is evident through initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme and the National Electric Mobility Mission Plan (NEMMP) 2020. These programs encourage the adoption of EVs and the development of related infrastructure. Additionally, integrating solar panels into EVs aligns with India's renewable energy goals, reducing the carbon footprint of transportation and promoting energy independence.

One of the major restraints for the vehicle-integrated solar panels market is the high manufacturing cost. Producing efficient, lightweight, and flexible solar panels suitable for vehicle integration requires advanced materials and sophisticated fabrication techniques.

These costs increase the overall price of vehicles equipped with solar technology, limiting adoption, especially in price-sensitive markets. Additionally, the need for specialized installation and maintenance adds to the financial burden, slowing large-scale implementation.

Durability challenges further restrict market growth. Solar panels integrated into vehicles must withstand extreme weather conditions, vibrations, and mechanical stress over long periods. Ensuring consistent energy generation under such conditions is technically complex, as panels may degrade or become less efficient over time. These durability concerns raise reliability issues, impacting consumer confidence and wider market penetration.

Advancements in flexible and lightweight solar technologies present significant opportunities for the vehicle-integrated solar panels market. Flexible solar panels can be seamlessly integrated onto curved vehicle surfaces, enhancing energy generation without compromising design or aerodynamics. Innovations in materials such as thin-film photovoltaics and perovskite-based cells are improving efficiency, durability, and cost-effectiveness, making solar-equipped vehicles more viable for mainstream adoption.

Emerging markets also offer substantial growth potential. Countries in the Asia Pacific, Latin America, and Africa are increasingly adopting electric vehicles and investing in renewable energy infrastructure. Rising environmental awareness, government incentives, and improving EV affordability in these regions create favorable conditions for integrating solar technology. Together, technological advancements and expanding markets provide a strong pathway for market expansion and increased adoption of vehicle-integrated solar solutions.

Monocrystalline solar panels are projected to hold a dominant position in 2025, capturing around 45% share. Their high efficiency, extended lifespan, and reliable performance under low-light conditions make them a preferred choice for automotive manufacturers. These panels ensure steady energy output, which is crucial for electric and hybrid vehicles that demand consistent and durable power sources.

Flexible solar panels are the fastest-growing segment, driven by their lightweight and adaptable design. Their ability to conform to curved vehicle surfaces without affecting aerodynamics makes them suitable for innovative vehicle models. Improvements in thin-film and perovskite technologies are boosting their efficiency and durability, supporting wider adoption in both passenger and commercial vehicles.

Roof-mounted solar panels are expected to dominate in 2025, holding approximately 50% share. Their ease of installation, optimal exposure to sunlight, and compatibility with most vehicle designs make them the preferred choice among manufacturers. Roof-mounted panels provide consistent energy generation, making them particularly suitable for electric and hybrid vehicles that require reliable auxiliary power.

Integrated body panels are emerging as the fastest-growing segment due to their ability to seamlessly blend solar technology into the vehicle’s exterior. These panels can be embedded into doors, hoods, and other surfaces without compromising design or aerodynamics. Advances in flexible and lightweight solar technologies are enhancing their efficiency and durability, driving increased adoption across innovative and high-end vehicle models.

Electric vehicles (EVs) are projected to dominate, accounting for approximately 55% share in 2025. Their growing adoption, driven by government incentives, environmental regulations, and increasing consumer preference for sustainable mobility, positions EVs as the primary segment for solar integration. Solar panels in EVs enhance energy efficiency, extend driving range, and reduce reliance on external charging infrastructure, making them highly attractive to manufacturers and consumers alike.

Passenger cars are emerging as the fastest-growing segment. Advances in flexible and lightweight solar technologies allow seamless integration into car roofs and body panels without affecting design or aerodynamics. Rising demand for eco-friendly personal vehicles, coupled with improved affordability, is accelerating the adoption of solar-equipped passenger cars globally.

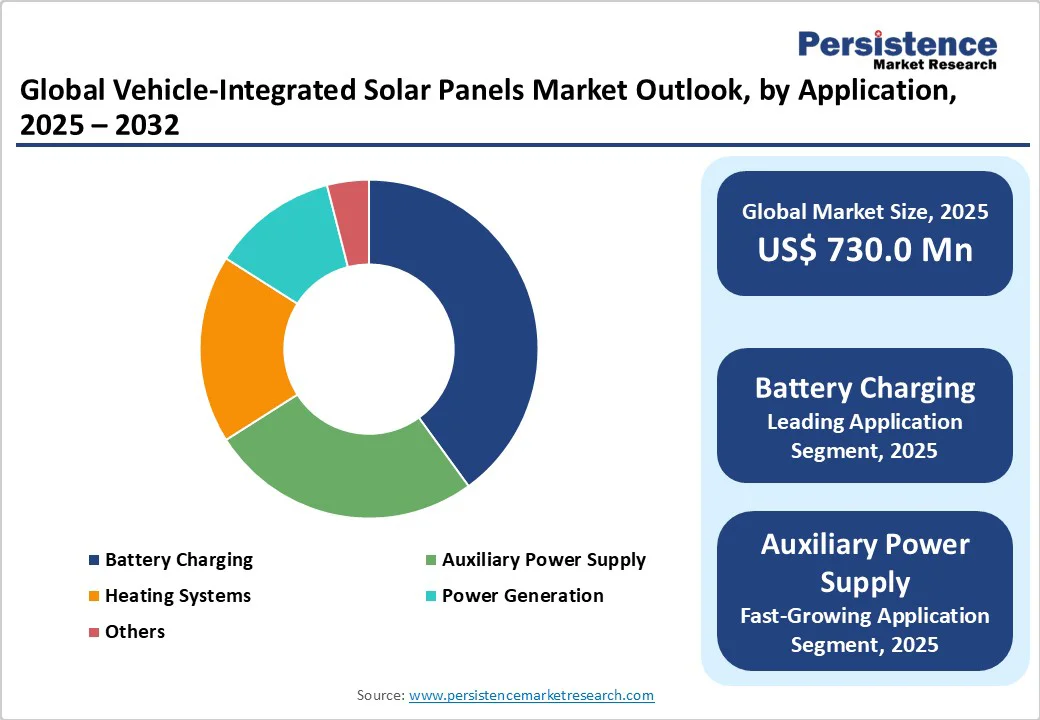

Battery charging applications are expected to dominate, capturing around 40% share in 2025. Solar panels dedicated to battery charging help extend the driving range of electric and hybrid vehicles while reducing dependence on conventional charging infrastructure. This makes them a preferred choice for manufacturers and consumers seeking enhanced energy efficiency and sustainability.

Auxiliary power supply (APS) applications are the fastest-growing segment. Solar panels are used for APS support vehicle systems such as air conditioning, infotainment, lighting, and other electronics without drawing power from the main battery. Advances in flexible and lightweight solar technologies are enabling more efficient APS integration, boosting adoption in passenger vehicles and commercial fleets aiming for improved energy management and reduced operational costs.

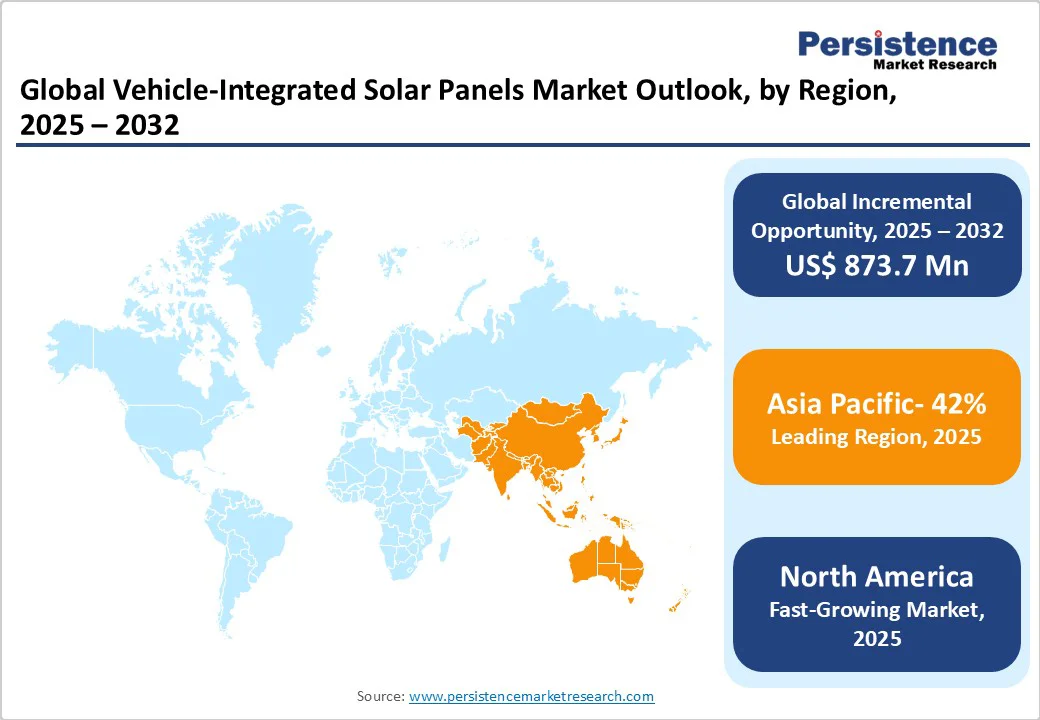

North America is witnessing the fastest growth, fueled by rising electric and hybrid vehicle adoption, favorable government policies, and heightened environmental consciousness. Incentives such as federal and state tax credits for EV purchases, along with investments in renewable energy infrastructure, are driving both consumer and manufacturer interest in solar-equipped vehicles.

Innovations in lightweight and flexible solar technologies are enabling easier integration into vehicle designs. Coupled with the region’s commitment to reducing carbon emissions and promoting sustainable transportation, the demand for solar-powered battery charging and auxiliary power systems is expanding rapidly, supporting robust market growth.

Europe holds a significant share in 2025, driven by stringent environmental regulations, strong government support for electric vehicles, and increasing consumer demand for sustainable transportation solutions. Countries across the region are investing heavily in renewable energy and EV infrastructure, encouraging automakers to integrate solar technologies into vehicles.

Advanced automotive manufacturing capabilities and the presence of key industry players further strengthen Europe’s position. Additionally, rising awareness of carbon footprint reduction and energy-efficient mobility solutions is fueling the adoption of solar panels in both passenger and commercial vehicles, consolidating the region’s dominance in the global market.

Asia Pacific is projected to account for 42% of the global share, fueled by growing adoption of electric and hybrid vehicles, supportive government policies, and significant investments in renewable energy infrastructure. Nations such as China, Japan, and South Korea are encouraging the integration of solar technologies in vehicles through incentives and regulatory initiatives.

In addition, the presence of major automotive manufacturers and increasing consumer interest in sustainable, energy-efficient transportation are driving demand. These factors position the Asia Pacific as a dominant region in the global landscape of vehicle-integrated solar panels.

The global vehicle-integrated solar panels market is highly competitive, characterized by continuous innovation and technological advancements. Companies are focusing on developing high-efficiency, lightweight, and flexible solar solutions to enhance vehicle performance and energy efficiency.

Strategic partnerships, mergers, and collaborations with automotive manufacturers are common to expand market presence and accelerate adoption. Additionally, investments in research and development are driving improvements in durability and integration techniques. Market players are also emphasizing sustainability and cost optimization to cater to growing demand across electric and hybrid vehicles globally.

The vehicle-integrated solar panels market is projected to reach US$730.0 Mn in 2025, driven by EV adoption and renewable energy policies.

Surge in EV production, government incentives, and consumer demand for sustainable vehicles fuel market growth.

The vehicle-integrated solar panels market will grow from US$730.0 Mn in 2025 to US$1,603.7 Mn by 2032, with a CAGR of 11.9%.

Lightweight solar technology advancements and emerging market expansion drive opportunities in EVs and passenger cars.

Leading players include Lightyear, Sono Motors, Aptera Motors, Toyota, Tesla, Hyundai, Ford, Volkswagen, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Panel Type

By Installation Method

By Vehicle

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author