ID: PMRREP18658| 200 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

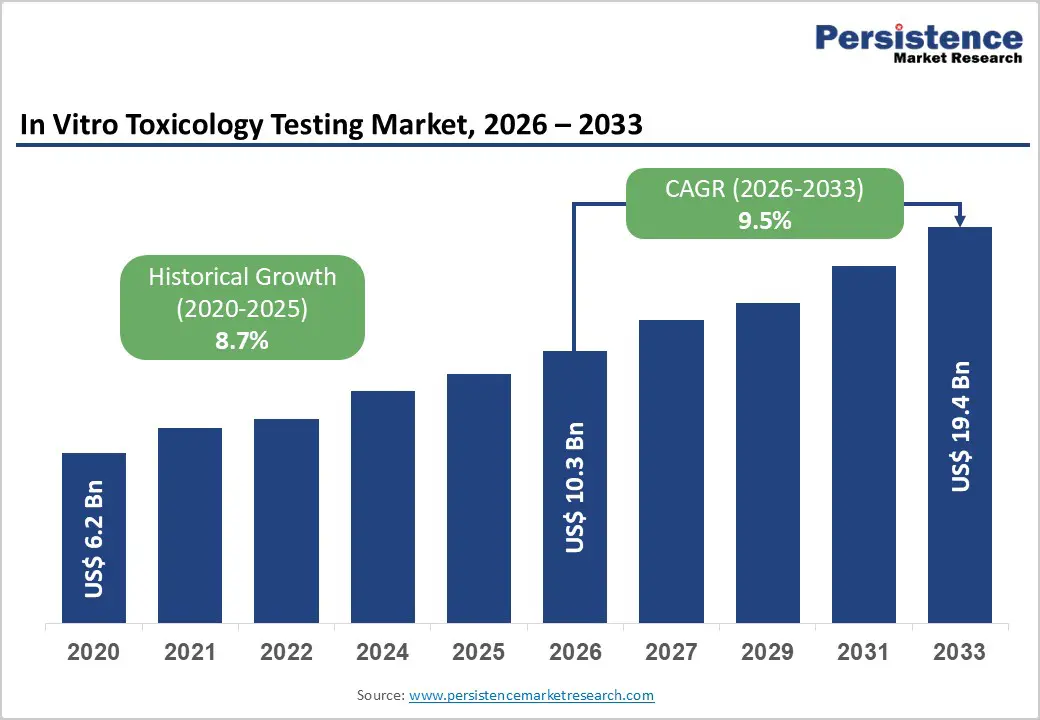

The global in vitro toxicology testing market is estimated to grow from US$ 10.3 billion in 2026 to US$ 19.4 billion by 2033. The market is projected to record a CAGR of 9.5% during the forecast period from 2026 to 2033.

In vitro toxicology testing examines the presence or absence of harmful chemicals or toxins in cells of an organism. This testing process is used to recognise dangerous chemical substances and helps in detecting toxicity at the early stages of development of new products like agricultural chemicals, cosmetics, drugs and food additives. The in vitro toxicology testing is done for evaluating safety in drug development and also to rank the chemicals in terms of their potency.

The global in vitro toxicology testing market is witnessing significant growth due to an increase in the number of R&D procedures where in vitro testing is required. Also, ban on animal testing is also significantly contributing to the growth of this market. Another factor boosting the market of in vitro toxicology testing is the growing environmental concerns and to ensure that no toxins via the agricultural chemicals, etc. enter the environment. In addition, advancements in the 3D cell culture is also boosting this market.

| Global Market Attributes | Key Insights |

|---|---|

| In Vitro Toxicology Testing Market Size (2026E) | US$ 10.3 Bn |

| Market Value Forecast (2033F) | US$ 19.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 9.5% |

| Historical Market Growth (CAGR 2020 to 2024) | 8.7% |

Advances in cell culture technologies are significantly strengthening the scientific value of in vitro toxicology testing. Modern systems such as three-dimensional organotypic cultures, spheroids, and microphysiological models recreate more lifelike tissue behavior compared to traditional monolayer cultures. These platforms use human-derived primary cells or induced pluripotent stem cell-based lineages, improving the ability to predict organ-level responses, chronic exposure patterns, and subtle mechanistic changes. As toxicology shifts toward more human-relevant evidence, these culture systems help companies evaluate potentially harmful compounds earlier and with greater biological accuracy.

In parallel, high-content imaging and multiplex assay platforms now allow researchers to measure multiple toxicity endpoints in a single experiment. Biomarkers related to oxidative stress, mitochondrial injury, membrane damage, DNA impairment, and organ-specific toxicity can be captured simultaneously, enabling faster screening cycles and cost-effective data generation. This scalable approach supports pharmaceutical and chemical companies that handle large compound libraries and require early risk identification. Together, these advancements are reducing reliance on animal testing, shortening preclinical timelines, and increasing confidence in safety decisions driving sustained demand for sophisticated in vitro toxicology technologies.

Despite strong progress, current in vitro toxicology models do not yet capture the full complexity of systemic and long-term toxicities. Certain endpoints such as reproductive toxicity, developmental toxicity, immunotoxicity, and multistage carcinogenicity require integrated biological responses that arise from whole-organism interactions. Single-organ or isolated-tissue models often struggle to reflect hormonal regulation, metabolic interplay, or cumulative exposure effects, limiting their ability to fully replace traditional in vivo studies.

Regulatory bodies also require extensive validation before adopting new testing methods into formal guidelines. Demonstrating consistent reproducibility across laboratories, achieving broad scientific consensus, and proving relevance to human outcomes can take several years. These lengthy timelines and high validation costs can deter smaller laboratories or service providers from investing in advanced platforms. As a result, market expansion sometimes slows due to regulatory hesitancy and the incomplete ability of current systems to address all required endpoints for comprehensive safety assessment.

The increasing availability of omics-based datasets and high-resolution cellular information is opening new possibilities for toxicogenomics and computational toxicology. Gene expression profiling, pathway mapping, and proteomic signatures allow researchers to identify early molecular disturbances that occur long before visible cellular damage. This helps detect potential liabilities at the discovery stage, reducing costly late-stage failures. Toxicogenomics also provides mechanistic insight, enabling companies to understand how chemicals or drug candidates interact with biological pathways and trigger adverse responses, supporting more informed decision-making.

At the same time, advances in computational modeling are enabling predictive toxicology approaches that combine historical data, mechanistic knowledge, and quantitative structure-activity relationships. These models allow rapid screening of large chemical libraries, prioritizing candidates for deeper experimental evaluation. Global organizations and regulatory bodies are working toward structured frameworks for interpreting complex biological datasets, which is expected to gradually strengthen confidence in these newer methodologies. Companies that build robust databases, analytical tools, and integrated platforms capable of linking experimental findings with predictive modeling can offer differentiated services. This creates opportunities for subscription-based data solutions, mechanism-focused testing packages, and collaborative research programs that enhance long-term revenue potential in the in vitro toxicology market.

The products and services category are led by the services segment, which is projected to command around 43% of the in vitro toxicology testing market in 2025. Pharmaceutical, cosmetic, and chemical companies increasingly turn to contract research organizations and specialized laboratories for assay development, method validation, and detailed data interpretation. Outsourcing gives these organizations access to advanced platforms such as 3D tissue models, high-content imaging systems, and organ-on-chip technologies without the burden of major capital investments or the need for specialized in-house expertise.

Regulatory requirements for GLP-compliant studies, adherence to OECD test guidelines, and rigorous documentation further enhance the importance of experienced service providers with established quality systems and international accreditations. As non-animal alternatives continue to gain validation and global regulators widen the acceptance of in vitro methods, the need for comprehensive service portfolios is steadily increasing. Providers offering end-to-end toxicology screening, mechanistic studies, and support for multi-regional submissions are positioned to benefit most from the ongoing market expansion.

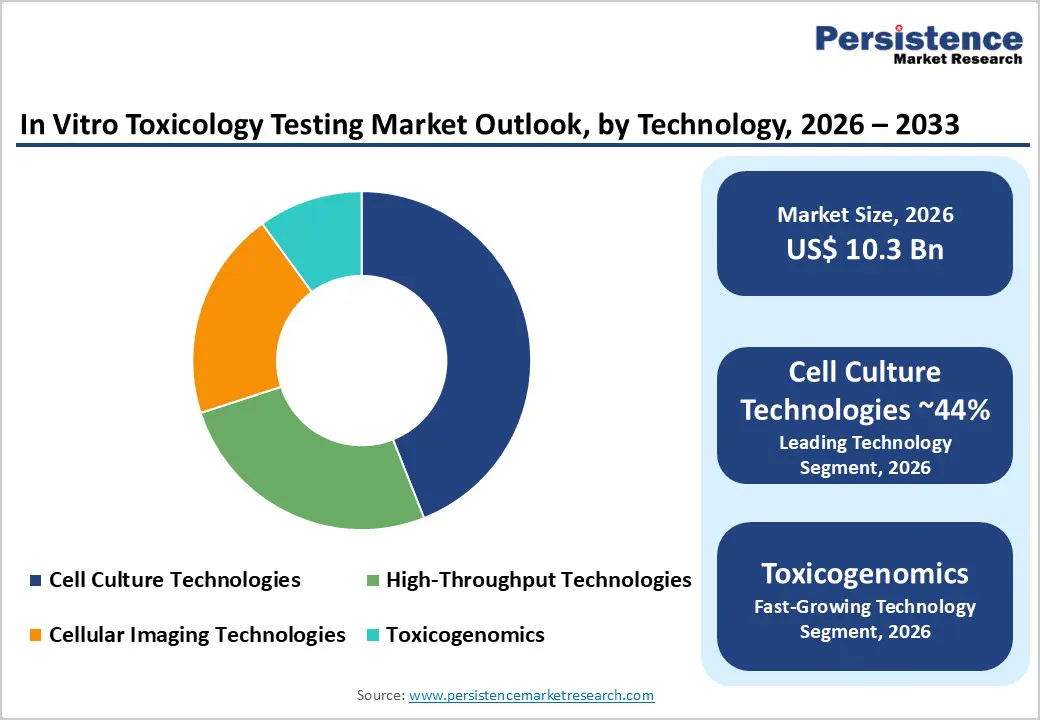

Cell culture technologies remain the dominant foundation of the in vitro toxicology testing market due to their strong biological relevance, reliability, and reproducibility. These systems allow researchers to study cellular responses to chemicals or drug candidates in controlled environments, supporting early-stage detection of toxicity during development. The segment continues to advance with wider use of human-derived cell lines, 3D cultures, and microtissue models that more closely mimic real physiological conditions. Investments from industry players, such as funding directed toward enhancing 3D cell culture platforms, are further strengthening technological capabilities and expanding application areas.

High-throughput technology is expected to record the fastest growth in the coming years. Its ability to test large volumes of compounds simultaneously, incorporate multiple cell types, and reduce experimental timelines makes it a preferred choice for rapid safety screening. This approach decreases overall testing costs while improving scalability and consistency. Companies offering high-throughput solutions, such as platforms designed for parallel toxicity assays, continue to support more efficient and comprehensive in vitro toxicology evaluations.

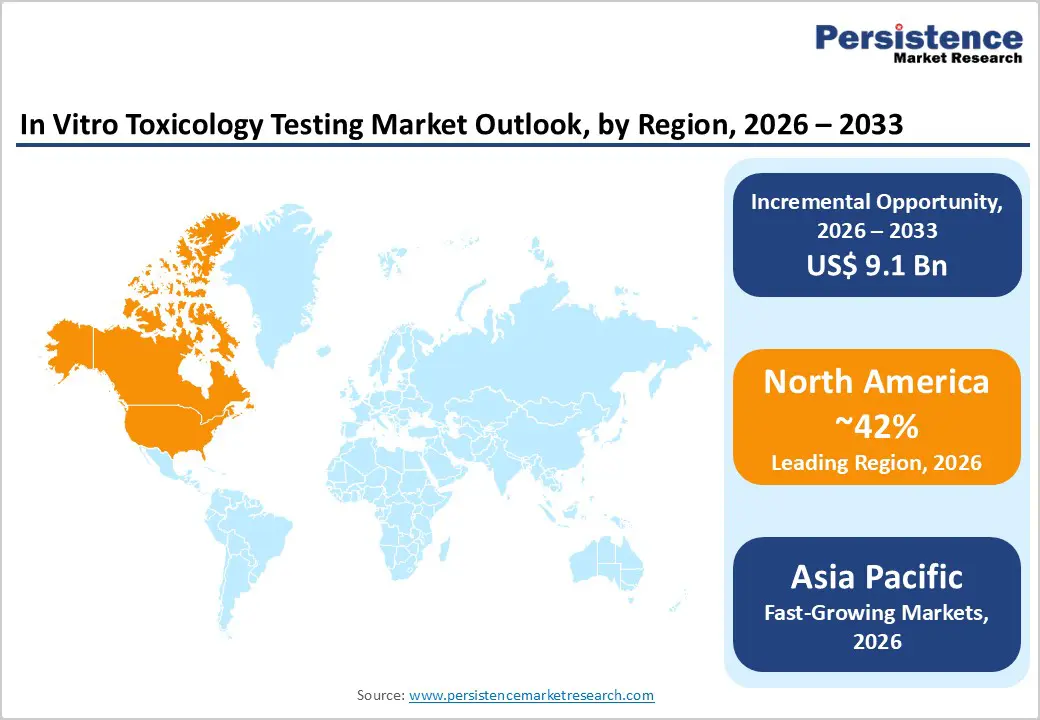

North America continues to lead the in vitro toxicology testing market, driven by mature research infrastructure, strong pharmaceutical and biotechnology pipelines, and early adoption of non-animal testing technologies. The region benefits from a high concentration of contract research organizations, academic laboratories, and technology innovators offering advanced 3D cell cultures, microphysiological systems, and high-content imaging platforms. Regulatory agencies, including the U.S. FDA and EPA, are increasingly encouraging alternative test methods, creating a favourable environment for validated in vitro models. This regulatory push, combined with ongoing initiatives to replace or reduce animal testing, accelerates investments in mechanism-focused assays and next-generation toxicology tools.

The region is also witnessing steady growth in toxicogenomics and mechanistic safety studies, aligning with the broader shift toward data-driven risk assessment. Rising pressure to shorten drug development timelines and reduce late-stage failures is prompting pharmaceutical companies to integrate in vitro testing earlier in discovery workflows. Additionally, collaborations between government agencies, industry players, and academic centers are supporting method standardization and cross-laboratory validation. These efforts strengthen confidence in alternative testing strategies, positioning North America as a global leader in advancing predictive toxicology technologies.

The Asia Pacific region is emerging as the fastest-growing market for in vitro toxicology testing due to expanding pharmaceutical manufacturing, increasing clinical research activity, and rising adoption of non-animal testing methods. Countries such as China, India, South Korea, and Japan are investing heavily in modern laboratory infrastructure and public health research, encouraging wider use of cell-based and mechanistic toxicology platforms. The growth of regional contract research organizations and technology parks is making advanced testing capabilities more accessible to local and international companies. This expansion is reinforced by the growing need for high-throughput screening solutions to support large-scale chemical, cosmetic, and pharmaceutical evaluations.

Regulatory modernization is also contributing to market growth. Several Asia Pacific governments are updating chemical safety regulations, incorporating alternative test methods, and supporting initiatives that reduce reliance on animal studies. Increased collaboration with global research organizations and industry partnerships is improving training, assay validation, and quality benchmarking across regional laboratories. As consumer safety concerns rise and domestic industries expand their global footprint, adoption of standardized, human-relevant in vitro toxicology approaches is expected to accelerate steadily throughout the region.

The competitive landscape of the in vitro toxicology testing market is characterized by a mix of established laboratory service providers, technology developers, and specialized assay manufacturers. Leading companies focus on expanding their portfolios with advanced 3D cultures, high-content imaging systems, and mechanistic toxicity assays to strengthen their scientific capabilities. Many players invest in partnerships, acquisitions, and facility expansions to increase geographic reach and support regulatory-compliant studies across multiple regions. Competition is also shaped by the growing demand for non-animal testing solutions, prompting firms to refine assay validation, improve reproducibility, and align with global guidelines. Smaller niche companies differentiate themselves through specialized models, organ-specific platforms, and customized testing services, creating a dynamic market environment driven by innovation and expanding regulatory acceptance.

The global market is projected to be valued at US$ 10.3 Bn in 2026.

Growing focus on animal-free testing, regulatory pressure for safer products, technological advances, and rising demand for rapid, cost-efficient toxicity assessment.

The global market is poised to witness a CAGR of 9.5% between 2026 and 2033.

Expansion of high-throughput and AI-powered platforms, rising toxicogenomics adoption, and increasing use of predictive models for early-stage drug screening.

North America is the Leading Region in the global in vitro toxicology testing market.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product & Services

By Technology

By Method

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author