ID: PMRREP3305| 212 Pages | 8 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

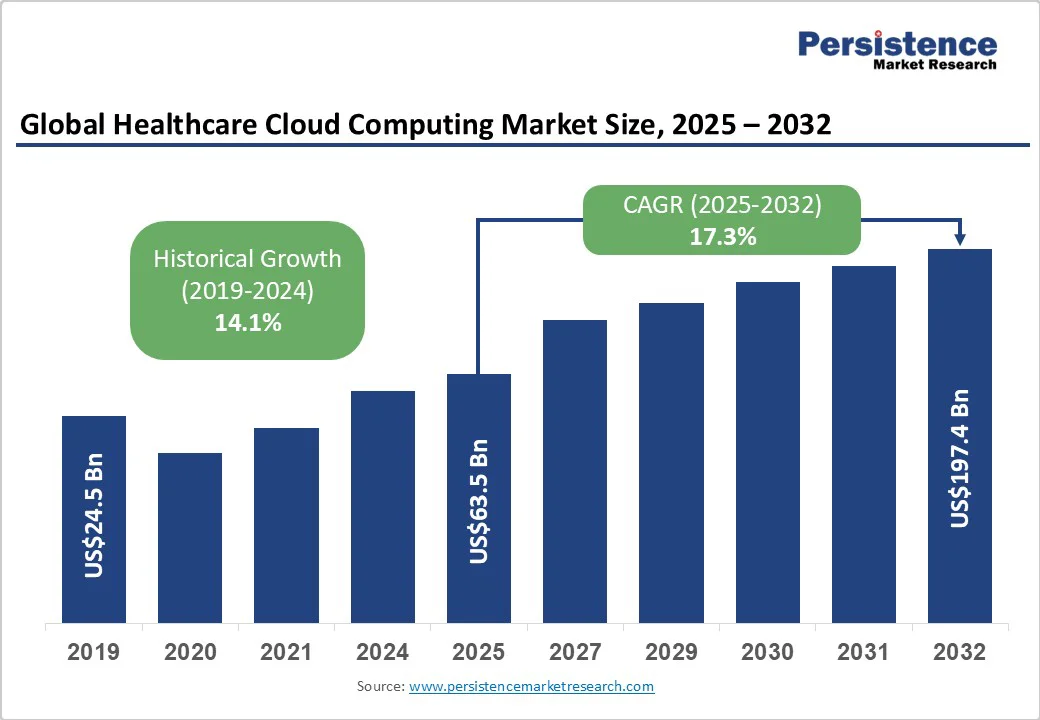

The global healthcare cloud computing market size is likely to be valued at US$63.5 Bn in 2025, and is estimated to reach US$197.4 Bn by 2032, growing at a CAGR of 17.3% during the forecast period 2025 - 2032, driven by the increasing adoption of cloud infrastructure for data accessibility, telehealth expansion, and AI integration in healthcare analytics.

Accelerated digitization due to increasing healthcare data volumes and government initiatives for health IT modernization intensifies cloud demand.

| Key Insights | Details |

|---|---|

| Healthcare Cloud Computing Market Size (2025E) | US$63.5 Bn |

| Market Value Forecast (2032F) | US$197.4 Bn |

| Projected Growth (CAGR 2025 to 2032) | 17.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 14.1% |

Healthcare providers globally are accelerating cloud adoption to enable real-time access to patient data, improving clinical decision-making and care coordination. Over 80% of U.S. hospitals now use cloud-based EHRs, according to HHS. With global healthcare data expected to exceed 2,000 exabytes by 2025 (IDC), the cloud offers scalable infrastructure for data interoperability.

Integration with AI and machine learning supports personalized medicine, predictive analytics, and chronic disease management, driving annual market spending growth of ~20% through 2032. These advances support a shift toward value-based care, enhancing outcomes and lowering costs.

Telehealth usage has surged by 38% globally post-pandemic, according to the WHO, driven by the need for accessible, remote care. Cloud technologies support this growth by enabling secure, scalable platforms for video consultations, remote monitoring, and integration with health records. Regulatory support from the U.S. FDA and EMA is further boosting adoption in North America and Europe.

The WHO notes telehealth now reaches over 3 billion people, underscoring the role of cloud computing as critical healthcare infrastructure. Investment in cloud-based telehealth is expected to rise, enhancing system resilience and scalability.

Continual advancements in service models within cloud computing empower healthcare providers to adopt modular and scalable IT solutions. Public sector initiatives, such as the Digital Health and Care Innovation of the European Union (EU), allocate multi-billion-dollar budgets to support cloud adoption while ensuring stringent compliance with data protection laws such as the GDPR.

Flexible pricing models and increased public cloud acceptance reduce initial adoption barriers. Cutting-edge technologies, including blockchain for secure data exchange and AI-enabled diagnostic tools, are expanding the healthcare cloud market’s value, projected to increase by over US$120 Bn through 2032, according to the International Telecommunication Union (ITU).

The upfront expenditures for migrating legacy systems, training personnel on cloud platforms, and implementing comprehensive cybersecurity measures remain significant, especially for smaller providers and in developing regions. Capital expenses range from US$1 Mn to over US$10 Mn, depending on the scale of infrastructure, which restricts the adoption speed.

The Healthcare Financial Management Association reports that 27.0% of mid-sized providers postponed cloud deployment, citing financial constraints. Additionally, complexities in integrating bespoke healthcare applications and existing EHRs affect operational continuity, potentially delaying cloud transition timelines and increasing implementation risks.

Despite advancements in cybersecurity, healthcare data remains a prime target for cyberattacks, with the global average cost of a healthcare data breach reaching US$10.1 Mn in 2024 (IBM Security). Breach incidents expose organizations to legal penalties and erode patient trust, impacting reputational standing.

Regulatory requirements such as HIPAA in the U.S. and GDPR in Europe impose rigorous controls on data management, complicating cross-border cloud deployments. These compliance complexities encourage healthcare providers to prefer private or hybrid cloud models, which may limit broader public cloud adoption and its associated economies of scale.

Asia Pacific, Latin America, and parts of Africa represent high-growth markets due to increasing healthcare IT investments and digital infrastructure improvements. India’s National Digital Health Mission aims to provide cloud-backed EHRs and telemedicine access to its 1.3 billion population by 2030, fueling regional cloud demand.

China and ASEAN countries showcase CAGR projections exceeding 22.0% over the next decade, propelled by government policies and rising healthcare expenditures. This segment is expected to contribute an incremental US$50 Bn in market valuation by 2032, presenting considerable opportunities for cloud service providers to deploy scalable, interoperable solutions tailored to diverse healthcare ecosystems.

The integration of cloud computing with AI, IoT, blockchain, and big data analytics is enabling innovative healthcare applications such as remote monitoring, predictive diagnostics, and secure patient data exchanges. This technological synergy is expanding service portfolios and delivering value-added services, anticipated to capture a significant market share over the next decade.

The global market is expected to benefit significantly from these converging trends, providing healthcare organizations with actionable insights, operational efficiencies, and enhanced patient outcomes, thereby elevating cloud adoption at unprecedented rates.

In 2025, public cloud remains the dominant deployment model in healthcare cloud computing, holding approximately 42.0% market revenue share. The public cloud's appeal lies in cost efficiency, ease of scalability, and flexible subscription pricing that significantly reduce capital expenditures for healthcare organizations. Its widespread adoption is further accelerated by SaaS applications and global healthcare providers managing cross-border data operations.

Hybrid cloud is the fastest-growing deployment model segment, projected to grow at a robust CAGR of 18.2% through 2032. This growth is driven by ever-increasing concerns about data security, privacy, and regulatory compliance in healthcare. The hybrid model offers a balanced approach by combining the security and control of private clouds for sensitive data with the scalability and cost benefits of public clouds for less sensitive workloads.

Private cloud solutions are also gaining traction, particularly in regions with stringent data sovereignty regulations, contributing to a multi-cloud strategic approach among healthcare providers to optimize performance, security, and compliance simultaneously.

Software-as-a-Service (SaaS) is slated to lead the model segment in 2025, representing nearly 48.0% of the healthcare cloud computing market revenue share. The rapid adoption of SaaS models is attributed to their streamlined deployment, lower capital investment, and subscription-based flexible pricing that appeal to healthcare providers seeking efficient tools for clinical workflows, electronic medical records, telehealth platforms, and revenue management. SaaS enables seamless updates, interoperability, and multi-location accessibility, enhancing patient care and administrative efficiency.

Infrastructure-as-a-Service (IaaS) is the fastest-growing service model segment, with an impressive CAGR of 19.4% through 2032. This surge is fueled by healthcare providers’ growing demand for scalable and secure infrastructure to support AI-driven analytics, big data processing, and extensive storage needs arising from increasing volumes of healthcare data, including imaging and genomic data. Platform-as-a-Service (PaaS) also shows steady growth, facilitating rapid application development and deployment of specialized healthcare solutions.

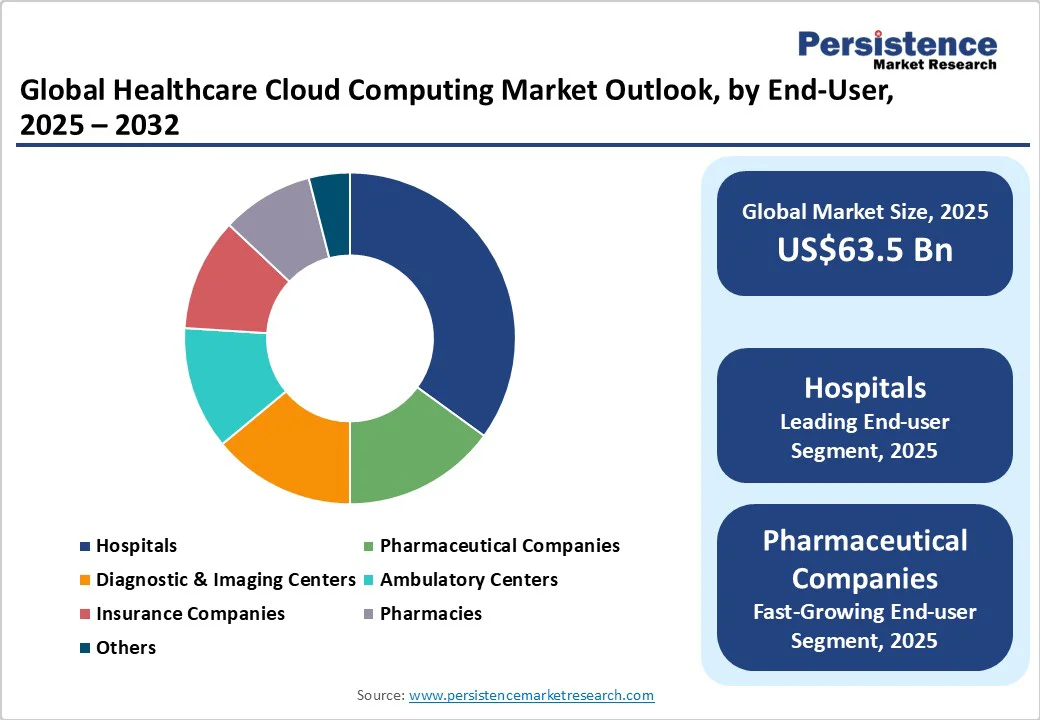

Hospitals are the largest end-user segment of healthcare cloud computing in 2025, holding about 35.0% market share. Hospitals lead due to their expansive use of cloud-enabled electronic health records, telehealth services, data analytics, and patient management systems aimed at improving care coordination, operational efficiency, and regulatory compliance. The adoption is driven by the need for integrated care models, optimized resource management, and enhanced patient outcomes.

The pharmaceutical segment is recognized as the fastest-growing, with a CAGR of roughly 19.2% from 2025 to 2032. Pharmaceutical companies increasingly leverage cloud computing for drug discovery, clinical trials management, regulatory compliance, and supply chain management. The scalability, security, and advanced analytics capabilities of cloud platforms empower pharmaceutical firms to accelerate research, enhance collaboration, and ensure compliance with complex global regulations.

Electronic medical records (EMR) are anticipated to lead, accounting for an estimated 55.0% revenue share in 2025. EMR adoption supports critical patient data management functions, including data interoperability and care coordination across multiple healthcare settings, enhancing clinical decision-making and operational workflows. The cloud-based nature of EMRs facilitates real-time data access and exchange, supporting integrated healthcare ecosystems.

Telehealth applications, by contrast, are the fastest-growing segment, with a forecasted CAGR of over 18.0% through 2032. This rapid growth is driven by rising patient demand for virtual consultations, remote monitoring, and the integration of telehealth with cloud-based analytics platforms, which has accelerated notably post-COVID-19. Telehealth expansion improves healthcare accessibility, especially in geographically underserved regions, while providing cost-effective care delivery models.

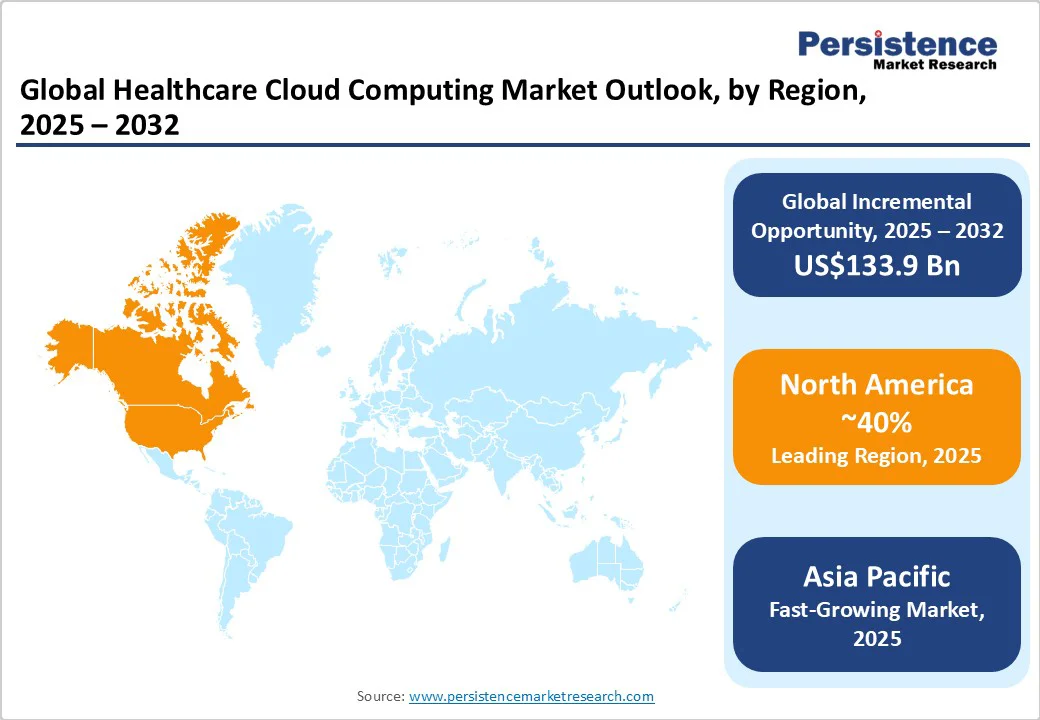

North America holds the largest portion of the healthcare cloud computing market share at approximately 40.0% in 2025, led by the U.S. The regional market benefits from a mature healthcare IT infrastructure, robust R&D investments, and supportive policies such as HIPAA and the HITECH Act that incentivize secure digital health innovation.

Rapid adoption of telehealth and AI-powered diagnostics contributes to strong growth at a CAGR of around 16.5%. Market competition is marked by collaborations between top technology firms and healthcare providers focusing on cloud-native innovation, interoperability standards development, and expanded telehealth capabilities.

Europe is expected to account for about 25.0% of the healthcare cloud computing market in 2025. Key contributors include Germany, the U.K., France, and Spain, powered by their well-established healthcare infrastructures and regulatory frameworks, such as GDPR, promoting data privacy and security. The market is expected to grow at a CAGR of 16.2%.

European healthcare providers show high demand for private and hybrid cloud deployments due to stringent data sovereignty laws. Funding for digital health initiatives and cross-border data exchange frameworks further drives adoption, with investments focusing on cloud platform customizations to meet multi-jurisdictional compliance and language diversity.

Asia Pacific is projected to be the fastest-growing regional market with an estimated CAGR of 22.1% from 2025 to 2032. The region holds roughly 20.0% market share as of 2025. Major market growth engines are China, Japan, India, and ASEAN nations that are experiencing rapid healthcare infrastructure upgrades and increasing IT spending.

Government initiatives such as India’s National Digital Health Mission are accelerating cloud adoption in EHR and telemedicine. Competitive advantages in the region include cost-effective manufacturing, a large patient base driving telehealth demand, and local cloud providers developing region-specific solutions addressing regulatory and connectivity challenges. This makes Asia Pacific a critical growth engine for the global healthcare cloud market.

The global healthcare cloud computing market is moderately consolidated, with top players such as Amazon Web Services, Microsoft, Google Cloud, and IBM accounting for around 55% of the market share. These leaders leverage robust infrastructure and healthcare-specific offerings, while numerous mid-sized vendors provide niche solutions, adding to market fragmentation.

The landscape is evolving through strategic mergers, partnerships, and platform integrations. Innovation is focused on AI and machine learning to boost diagnostics and efficiency. Subscription pricing models and scalable infrastructure support cost efficiency. Growth strategies include geographic expansion, regulatory compliance customization, and cloud-based support for value-based care and clinical trial data management.

The healthcare cloud computing market is projected to reach US$63.5 Bn in 2025.

Increasing adoption of cloud infrastructure for data accessibility, telehealth expansion, and AI integration in healthcare analytics is driving the market.

The healthcare cloud computing market is poised to witness a CAGR of 17.3% from 2025 to 2032.

Accelerated digitization due to increasing healthcare data volumes and government initiatives for health IT modernization are key market opportunities.

Amazon Web Services (AWS), Microsoft Corporation, and Google Cloud are some of the key players in the healthcare cloud computing market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Deployment Model

By Service Model

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author