ID: PMRREP3372| 190 Pages | 14 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

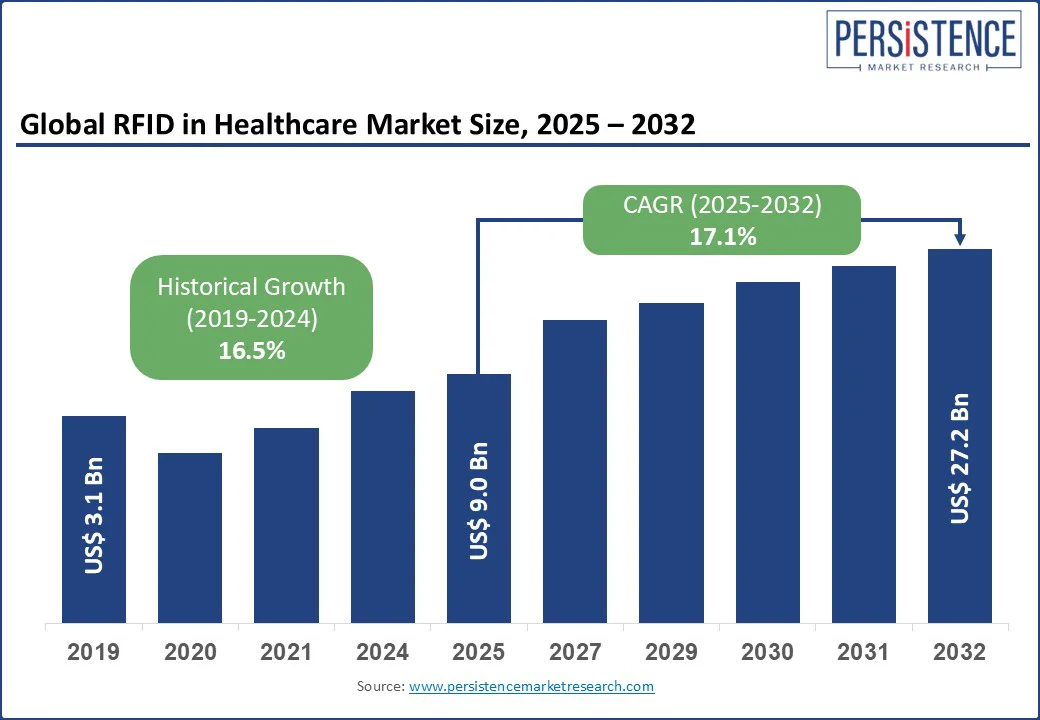

The global RFID in Healthcare Market size is likely to be valued at US$9.0 Bn in 2025 and is expected to reach US$27.2 Bn by 2032, growing at a CAGR of 17.1% during the forecast period from 2025 to 2032.

This growth is fueled by the need for enhanced patient safety with RFID, efficient RFID asset tracking in healthcare, and streamlined hospital supply chain RFID in medical environments.

Key RFID in Healthcare Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

RFID in Healthcare Market Size (2025E) |

US$9.0 Bn |

|

Market Value Forecast (2032F) |

US$27.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

16.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

17.1% |

The rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is placing unprecedented strain on healthcare systems. These long-term conditions require frequent hospital visits, continuous monitoring, and precise medication administration, creating a heightened need for technologies that ensure accuracy and efficiency. RFID systems meet this demand by enabling reliable patient identification, real-time location tracking, and automated data capture, which help reduce delays and medical errors.

Alongside disease management, global healthcare policies are placing greater emphasis on patient safety as a core performance measure. For instance, the U.S. Centers for Disease Control and Prevention (CDC) notes that 6 in 10 American adults have at least one chronic disease, and 4 in 10 live with two or more highlighting the urgent need for robust tracking and safety systems.

High implementation costs of RFID in healthcare remain a major barrier to adoption. Hospitals face significant expenses for RFID tags, RFID readers, antennas, middleware, and software integration. Additional outlays include healthcare staff training, system configuration, and ongoing maintenance. Smaller healthcare facilities often struggle with these capital requirements, creating ROI timelines longer and investment decisions more difficult.

Integration challenges in RFID healthcare systems also slow market growth. RFID solutions must integrate with Electronic Health Records (EHR), hospital asset management platforms, and IT security protocols often requiring costly customization. Industry data suggests integration and process redesign can represent 20–30% of the total RFID project budget. This complexity increases costs and extends implementation timelines, limiting short-term benefits and reducing overall adoption rates.

The emergence of fortified RFID solutions is creating new opportunities in healthcare, particularly for nutrient tracking and disease management. These advanced systems integrate RFID technology with biosensors and data analytics, enabling precise monitoring of patient nutrition intake, medication adherence, and biometric health indicators. Such capabilities are critical for managing chronic diseases, post-operative recovery, and specialized dietary requirements in hospitals and long-term care facilities.

In RFID healthcare applications, fortified solutions can store and transmit enriched datasets, linking patient profiles with nutritional plans, allergy alerts, and disease-specific treatment protocols. This enhances patient safety, reduces adverse events, and supports personalized care strategies. As healthcare providers shift toward data-driven treatment and preventive care models, these next-generation RFID systems represent a high-growth segment with strong adoption potential.

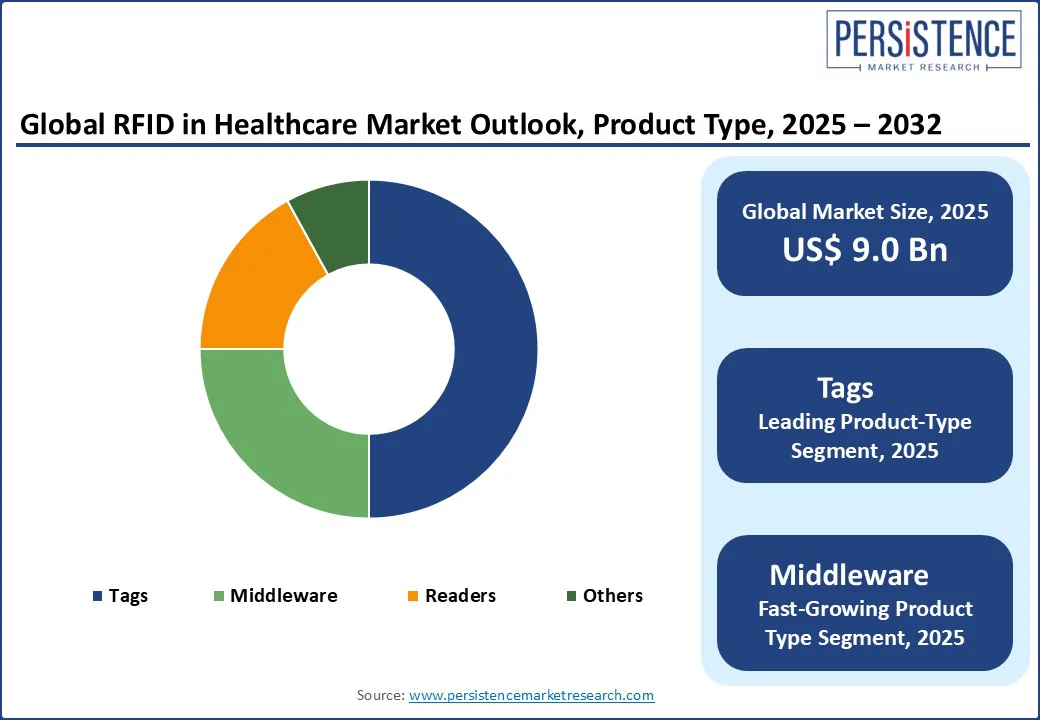

In 2025, RFID tags represent the dominant segment of the healthcare RFID market, holding around 50% share. Their versatility in patient identification, asset tracking, and inventory management makes them indispensable across hospitals, clinics, and laboratories. Within this category, passive RFID tags lead adoption due to their cost-effectiveness and suitability for high-volume applications. The latter’s extended battery life and capability for real-time tracking make them particularly valuable in large healthcare facilities with high asset mobility.

The middleware segment is the fastest-growing product. Middleware serves as the critical link between RFID hardware and hospital information systems, particularly Electronic Health Records (EHR). By enabling seamless integration, it supports advanced analytics that can reduce operational errors by up to 40%. As healthcare providers prioritize data-driven decision-making, middleware adoption is accelerating, solidifying its role as the technological backbone of RFID deployments.

In 2025, RFID asset tracking leads the healthcare application segment with roughly 40% market share. This dominance is fueled by the urgent need to quickly locate critical equipment during resource shortages, reducing delays in patient care. T

he technology enables hospitals to minimize asset loss and optimize utilization, generating estimated global savings of $3–5 Bn annually. Its ability to track high-value devices such as infusion pumps, ventilators, and portable monitors positions asset tracking as a core RFID use case in healthcare facilities worldwide.

Pharmaceutical tracking is the fastest-growing application. The RFID in healthcare market is expanding rapidly due to global counterfeit drug challenges, estimated to represent 10% of all pharmaceuticals. RFID-enabled serialization and authentication enhance drug supply chain integrity, ensuring product safety from manufacturer to patient. Other applications, including blood tracking (20% share) and RFID-enabled patient monitoring, also gain traction, supporting safety, compliance, and personalized care initiatives.

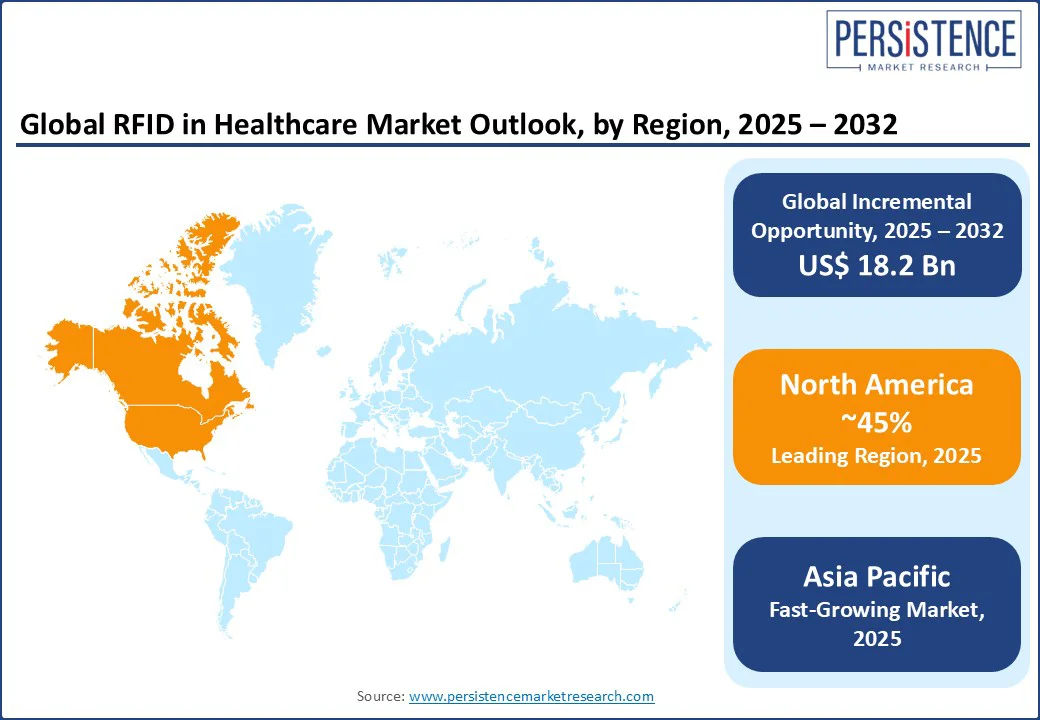

North America dominates the RFID in healthcare market with a 45% share, led by the U.S., which contributes 80% of regional revenue. In the U.S., adoption is driven by FDA Unique Device Identification (UDI) compliance, asset safety, and ethical sourcing initiatives. Innovative uses include ultrafiltered tracking for high-protein medical nutrition and lactose-free patient monitoring.

With obesity affecting 42% of U.S. adults, RFID supports nutrition and treatment compliance. Canada emphasizes regenerative farming-integrated RFID for healthcare-grade supplies, while Mexico experiences export-led growth in RFID medical technologies, boosting regional competitiveness and expanding applications in pharmaceuticals, blood tracking, and patient safety systems.

Europe holds a substantial share of the RFID in healthcare market, with Germany, the UK, and France at the forefront. In Germany, growth is supported by the EU AI Act and the €200 Bn InvestEU program, promoting ethical RFID adoption and strict data privacy in pharmaceutical tracking.

The UK, responding to post-Brexit supply chain challenges, has the NHS deploying RFID for blood tracking and patient safety. France accelerates adoption through national strategies targeting chronic disease management, integrating RFID into hospital supply chains. These initiatives position Europe as a leader in secure, compliant, and innovation-driven RFID healthcare solutions.

Asia Pacific RFID in healthcare market is the fastest-growing globally, led by India, China, and Japan. In India, adoption is driven by government initiatives such as the Mid-Day Meal Scheme, integrating fortified RFID for nutrition monitoring, alongside a projected 79 Mn diabetes cases by 2030, fueling demand for patient tracking.

China is advancing through digital transformation in urban hospitals, deploying RFID for medical equipment and asset management. Japan leads in elderly care tracking, leveraging RFID for hospital inventory control and patient safety, addressing its rapidly aging population and growing long-term healthcare needs.

The Global RFID in Healthcare Market is competitive, blending global giants and regional specialists. Key players focus on innovation, mergers, and distribution efficiency. Alien Technology, LLC, and Zebra Technologies Corp. lead with economies of scale, while Avery Dennison Corporation dominates tags. Impinj, Inc. and GAO RFID Inc. excel in middleware. Others include LogiTag Systems, Mobile Aspects, CenTrak, Inc., Terso Solutions, Inc., Tagsys RFID, metraTec GmbH, SpaceCode, Biolog-id, Cardinal Health, and Pepperl+Fuchs.

The RFID in healthcare market is projected to reach US$9.0 Bn in 2025.

Increasing chronic diseases, patient safety with RFID regulations, and an efficient hospital supply chain are key drivers.

The RFID in healthcare market is poised for a CAGR of 17.1% from 2025 to 2032.

Fortified solutions and IoT integration for preventive health with innovations in RFID healthcare technology.

Alien Technology, LLC, Zebra Technologies Corp., Avery Dennison Corporation, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author