ID: PMRREP9167| 180 Pages | 11 Sep 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

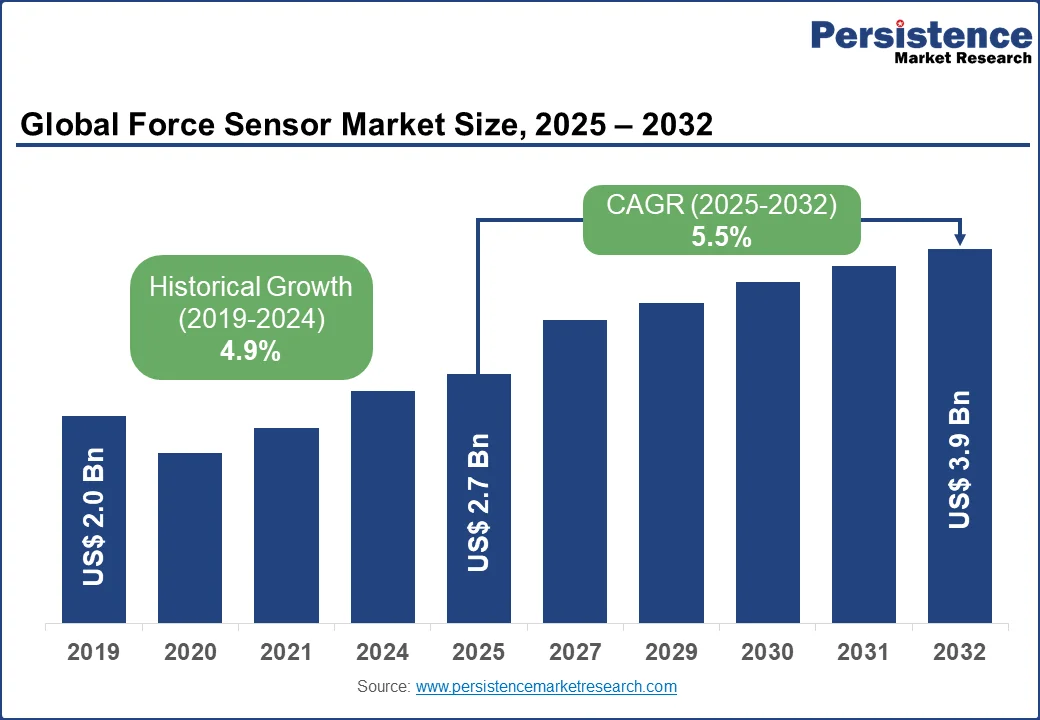

The global force sensor market size is likely to be valued at US$2.7 Bn in 2025, and anticipated to reach to US$3.9 Bn by 2032, growing at a CAGR of 5.5% during the forecast period 2025 - 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Force Sensor Market Size (2025E) | US$ 2.7 Bn |

| Market Value Forecast (2032F) | US$ 3.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.9% |

The market growth is driven by the increasing adoption of force sensors in industrial automation, automotive sensors, and healthcare applications, fueled by advancements in piezoelectric sensors, strain gauge technology, and capacitive force sensors.

Government initiatives promoting industrial automation and electric vehicles (EVs), coupled with rising demand for precision measurement, position the force sensor market as a vital component of technological and industrial progress.

The force sensor market is propelled by the rapid adoption of industrial automation, growing demand for automotive sensors, and advancements in healthcare applications. The global industrial automation market, with force sensors playing a critical role in robotics, material testing, and quality control, driving demand by 25% in manufacturing applications. The automotive sector, valued at US$2.5 Tn in 2025, relies on force sensors for brake pedal force, steering effort, and crash test measurements, with global EV sales reaching 10 Mn units in 2025.

For instance, Tesla’s Model Y, with 1.2 Mn units sold in 2025, uses force sensors for advanced driver assistance systems (ADAS), boosting demand. Government policies, such as the U.S. CHIPS Act allocating US$52 Bn for semiconductor manufacturing, support sensor production, while China’s Made in China 2025 initiative promotes automation, increasing force sensor adoption by 30% in Asia Pacific.

Advancements in piezoelectric sensors, offering 15% higher accuracy, and IoT integration in smart manufacturing further drive market growth, particularly in North America and Europe. The healthcare sector, with global medical device sales of US$500 Bn in 2025, uses force sensors in robotic surgery and prosthetics, contributing to a 20% demand increase.

The pressure sensor market faces challenges from high production costs and demand fluctuations in key industries. The manufacturing of advanced force sensors, such as piezoelectric sensors and capacitive force sensors, involves costly materials and precision engineering, with production costs accounting for 50% of total expenses. For instance, strain gauge sensors require high-purity materials, increasing costs by 10-15% in 2025, impacting affordability for smaller manufacturers in Asia Pacific.

Additionally, demand fluctuations in the automotive and manufacturing sectors, driven by economic uncertainties and supply chain disruptions, limit market expansion. For example, the global semiconductor shortage reduced automotive production by 7% in 2025, affecting force sensor demand.

Stringent safety and quality regulations, such as the EU’s Machinery Directive, impose compliance costs of 8-12% on companies such as Tekscan Inc. and Futek Advanced Sensor Technology, further restraining growth in price-sensitive markets such as Latin America.

The load sensor market accelerates the growth due to expanding applications in electric vehicles, healthcare, and consumer electronics, coupled with advancements in IoT-enabled sensors. The global electric vehicle market drives demand for force sensors in ADAS and battery management systems, with China and Europe leading adoption.

For instance, Volkswagen’s ID.4, with 500,000 units sold in 2025, integrates force sensors for safety systems, boosting demand by 15%. The healthcare sector offers significant opportunities, with robotic surgery systems such as Intuitive Surgical’s da Vinci using force sensors for precision, contributing to 20% market growth in medical applications.

The rise of wearable devices, with global sales reaching 500 Mn units in 2025, drives demand for capacitive force sensors in touch interfaces, particularly in North America. Innovations in piezoelectric sensors, offering 10% improved sensitivity, and IoT integration for real-time monitoring in smart manufacturing are creating opportunities for companies such as Alps Electric and Synaptics Inc. to expand market presence.

The compression & tension segment dominates with a 45% market share in 2025, driven by its versatility in applications such as automotive sensors, industrial automation, and material testing. These sensors measure both compressive and tensile forces, offering high accuracy for quality assurance in manufacturing, with global material testing demand growing by 15%.

The tension segment is the fastest-growing, driven by demand in aerospace and industrial automation. Tension force sensors, used in applications such as crane load monitoring and aerospace stress testing, offer high fatigue strength and stability, with aerospace demand growing by 20%. Companies such as Hottinger Baldwin Messtechnik (HBM) lead innovation in this segment, enhancing sensor durability by 12%.

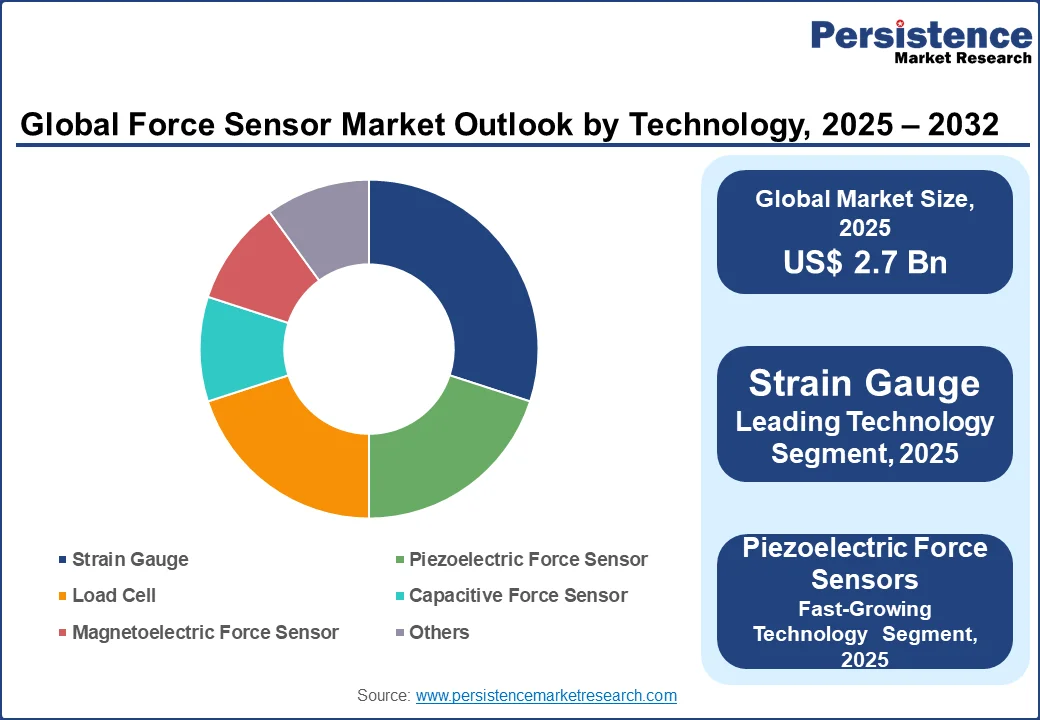

Strain gauge technology holds a 40% market share in 2025, valued for its precision and reliability in automotive, manufacturing, and healthcare applications. Strain gauge sensors, which measure changes in electrical resistance under force, are widely used in load cells for industrial automation, with global demand growing by 18%. Tekscan’s strain gauge sensors are used in automotive assembly lines, ensuring 10% higher accuracy. The segment dominates in North America, where 40% of manufacturing relies on strain gauge technology.

Piezoelectric force sensors are the fastest-growing, driven by their high sensitivity and use in healthcare and consumer electronics. These sensors, which convert mechanical force into electrical signals, are critical in robotic surgery and wearable devices, with global medical device demand rising by 20%. Alps Electric leads innovation, with piezoelectric sensors improving sensitivity by 15%, boosting adoption in Asia Pacific.

Manufacturing accounts for a 35% share in 2025, driven by the adoption of force sensors in industrial automation, robotics, and quality control. The global industrial automation market relies on force sensors for precise measurements in assembly lines, with China contributing 30% of global manufacturing output.

Automotive is the fastest-growing, fueled by demand for automotive sensors in electric vehicles and ADAS. Force sensors are critical for brake pedal force and crash test measurements. Sensata Technologies’ brake pedal force sensor, launched in 2022, improves braking efficiency by 10%, driving adoption in Europe and North America.

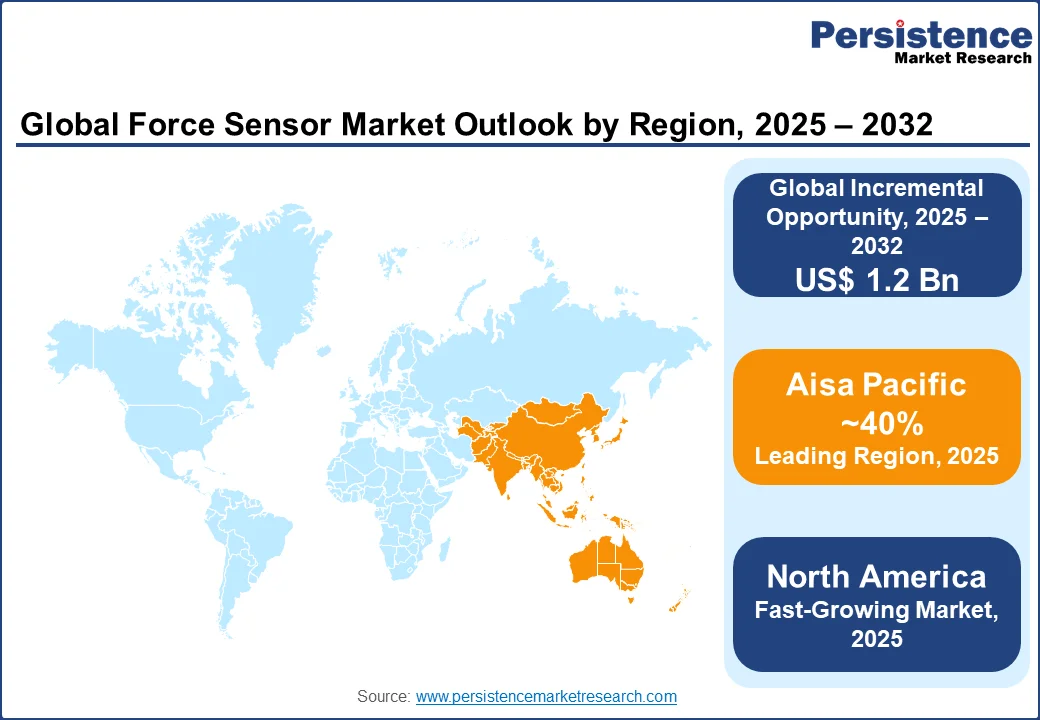

North America holds a 30% share in 2025, with the United States as the primary contributor, driven by advancements in industrial automation, automotive sensors, and healthcare applications. The U.S. market benefits from high demand for force sensors in electric vehicles, with 1.5 Mn EVs sold in 2025, a 25% increase from 2025.

For instance, Ford’s F-150 Lightning, with 200,000 units sold in 2025, uses force sensors for battery management, boosting demand by 15%. The manufacturing sector, contributing 11% to U.S. GDP, relies on force sensors for quality control, with 40% of manufacturers adopting strain gauge technology, per Research Nester.

Trends include IoT integration, with Honeywell’s IoT-enabled force sensors improving efficiency by 10% in smart manufacturing. The healthcare sector, with US$500 Bn in medical device sales, drives demand for piezoelectric sensors in robotic surgery.

Canada supports the sector with advanced manufacturing, contributing 10% to regional demand. The U.S.’s focus on precision measurement and e-commerce platforms such as Amazon enhances distribution, positioning North America as a key hub for the tactile sensor market.

Europe accounts for a 25% share in 2025, with Germany, France, and the U.K. as leading countries, driven by stringent safety regulations and automotive growth. Germany holds a 10% regional market share, fueled by its automotive industry, with 1 Mn EVs sold in 2025, supported by the EU’s Green Deal targeting 30% EV sales by 2030.

Force sensors are used in vehicles such as BMW’s iX, with 50,000 units sold in 2025, for ADAS and crash testing. France is driven by government subsidies covering 40% of EV costs, boosting demand for automotive sensors. The U.K. emphasizes industrial automation, with 20% of manufacturing adopting force sensors for robotics.

The EU’s Machinery Directive promotes safety, driving demand for strain gauge sensors in manufacturing, with 30% of processes using force sensors. Kistler Group’s acquisition of a U.K.-based R&D facility enhances innovation, while e-commerce platforms support distribution, positioning Europe as a key player in the torque sensor market.

Asia Pacific is the largest region, with a high market share in 2025, led by China, Japan, and India. China dominates with a leading global market share, driven by its industrial automation and automotive sectors, with 3.5 Mn EVs produced in 2025. Force sensors are used in BYD’s Atto 3, with 200,000 units sold in 2025, for battery management.

Japan contributes significantly, with Alps Electric investing US$100 Mn in a new sensor facility in 2025, supporting consumer electronics and automotive applications. Japan’s electronics industry, producing 25% of global smartphones, drives demand for capacitive force sensors, with Sony and Panasonic leading adoption.

India is the fastest-growing country, fueled by the Make in India initiative, which promotes manufacturing and automotive growth. Smartphone sales in India, boost demand for piezoelectric sensors. The region’s focus on smart manufacturing and China’s Made in China 2025 initiative supports market expansion, positioning Asia Pacific as the epicenter of the sector.

The force sensor market is highly competitive, characterized by rapid technological advancements, strategic partnerships, and a focus on sustainability to meet the growing demand for industrial automation, automotive sensors, healthcare applications, and consumer electronics.

Leading players, such as Alps Electric Co. Ltd., Synaptics Inc., Futek Advanced Sensor Technology Inc., Tekscan Inc., Hottinger Baldwin Messtechnik (HBM) GmbH, and Sensata Technologies, dominate the sector by leveraging innovations in piezoelectric sensors, strain gauge technology, load cells, and capacitive force sensors.

These companies are investing heavily in research and development (R&D) to enhance sensor accuracy, sensitivity, and durability, aligning with the needs of smart manufacturing, electric vehicles (EVs), and precision measurement applications.

The industry is further shaped by mergers, acquisitions, and collaborations with automotive manufacturers, healthcare providers, and technology firms, enabling companies to expand their geographic reach and product portfolios.

The force sensor market is projected to reach US$2.7 Bn in 2025, driven by demand for automotive sensors and industrial automation.

Rising industrial automation, electric vehicle adoption, and advancements in piezoelectric sensors fuel market growth.

The force sensor market is expected to grow at a CAGR of 5.5% from 2025 to 2032, driven by smart manufacturing and healthcare applications.

Expansion in electric vehicles, healthcare, and IoT-enabled sensors offers significant growth potential.

Leading players include Alps Electric, Synaptics, Futek, Tekscan, Kistler, and Sensata, focusing on innovation and partnerships.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019-2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Force Type

By Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author