ID: PMRREP35411| 187 Pages | 5 Jun 2025 | Format: PDF, Excel, PPT* | Food and Beverages

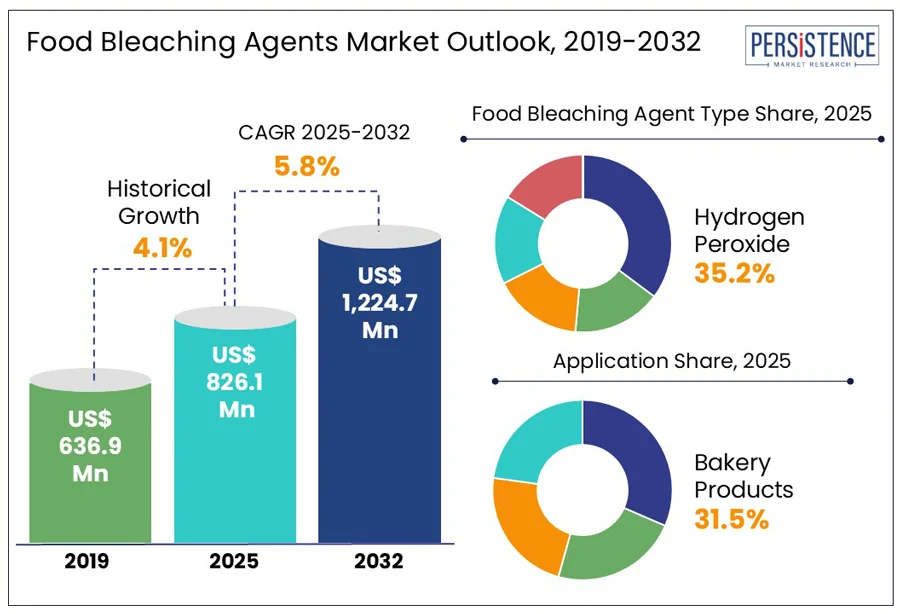

The global food bleaching agents market size is predicted to reach US$ 1,224.7 Mn in 2032 from US$ 826.1 Mn in 2025. It will likely witness a CAGR of around 5.8% in the forecast period between 2025 and 2032.

Food bleaching agents are extensively used to alter the color, improve the texture, and extend the shelf life of various food products. Yet, their use sits at the crossroads of convenience, controversy, and innovation. While benzoyl peroxide and hydrogen peroxide have become standard in mass-scale baking and dairy processing, rising scrutiny around their health impact and regulatory acceptance is reshaping the market. With countries such as the U.K. and the U.S. revisiting safety thresholds, the market is predicted to enter a phase of rapid transition.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Food Bleaching Agents Market Size (2025E) |

US$ 826.1 Mn |

|

Market Value Forecast (2032F) |

US$ 1,224.7 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.1% |

Increasing demand for processed food is predicted to directly influence the food bleaching agents market growth in the foreseeable future, finds Persistence Market Research. This is because manufacturers are looking to maintain product consistency, visual appeal, and quick production cycles to meet scale. Processed foods also place a premium on whitened and decolorized ingredients owing to visual branding requirements. For example, in convenience bakery items such as cake mixes or white sandwich bread, manufacturers use azodicarbonamide and benzoyl peroxide to lighten flour color and improve texture.

The surge in health-positioned processed foods, including protein bars and shakes, has propelled demand for visually appealing whey isolates. These are often bleached during processing to remove the natural yellow hue of whey, ensuring a clean look in the final product. Fonterra and Arla Foods, two of the most prominent whey producers worldwide, reported in their 2023 Environmental, Social, and Governance (ESG) disclosures that bleaching and enzymatic treatment processes are now standard in their WPI facilities to meet client aesthetic specifications, mainly in Asia Pacific.

Concerns over nutrient degradation and health risks associated with food bleaching agents are increasingly influencing regulatory decisions and consumer preferences. Scientific studies have shown that commonly used bleaching agents can reduce the levels of essential nutrients, especially fat-soluble vitamins such as A and E, in treated flour and dairy products. A recent study published in the Journal of Food Processing and Preservation found that benzoyl peroxide treatment reduced vitamin A content in flour by up to 18%, raising alarms in markets where micronutrient deficiencies remain a concern.

Health-related controversies surrounding specific bleaching agents have also led to outright bans or heavy scrutiny, mainly in regions with proactive food safety norms. Azodicarbonamide has been flagged for forming semicarbazide and urethane during baking. Following consumer backlash and a petition signed by more than 100,000 people, U.S. restaurant chain Subway removed azodicarbonamide from its bread a few years ago. The compound also remains banned in the European Union and Australia due to these health risks.

In flour treatment, researchers are exploring the use of ozone gas as a safe, residue-free bleaching and antimicrobial agent. Ozone’s short half-life and decomposition into oxygen make it a viable alternative to benzoyl peroxide. A 2023 study by the University of Guelph demonstrated that ozone treatment could reduce flour pigmentation by over 70% without affecting gluten quality, while preserving up to 92% of vitamin E. Several flour mills in Canada and the U.S., including Miller Milling, have begun small-scale trials of ozone-based systems to meet clean-label requirements.

Nanotechnology is another area gaining traction. Of late, researchers in South Korea developed a silica-based nanocarrier system for controlled delivery of bleaching agents in dairy processing. It lowered direct chemical exposure while achieving uniform decolorization. Published in Food Chemistry, the study highlighted that the system reduced bleaching agent concentration by 40% while maintaining comparable whitening results, opening possibilities for safe and targeted applications. Similar innovations in the market are anticipated to create lucrative opportunities for food bleaching agent companies.

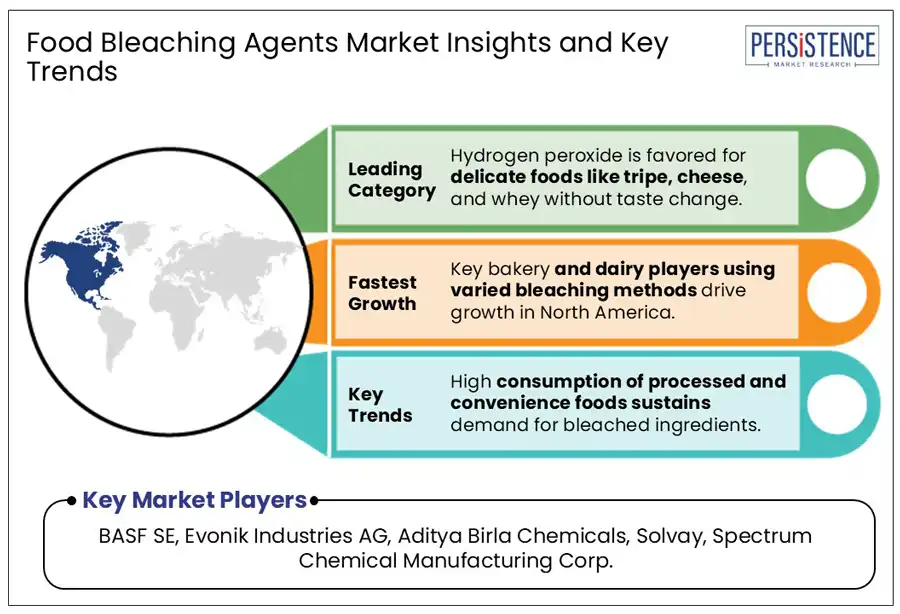

In terms of type, the market is divided into azodicarbonamide, hydrogen peroxide, ascorbic acid, and chlorine dioxide. Out of these, hydrogen peroxide is predicted to account for a share of approximately 35.2% in 2025, owing to its high oxidative efficiency and its safe decomposition profile. It breaks down into water and oxygen, making it ideal for food applications where residual contamination is a concern. This is mainly important in dairy and starch processing where bleaching must not interfere with taste, safety, or color.

Azodicarbonamide, on the other hand, is envisioned to witness an average growth rate through 2032 because of its dual role as both a flour bleaching agent and dough conditioner. It is particularly valuable in high-speed commercial baking environments due to its ability to improve flour whiteness while also enhancing dough elasticity and gas retention. This makes it suitable for producing uniformly textured and visually appealing bread, buns, and other baked goods. It is also economically attractive as it is cost-effective, stable, and requires minimal equipment adjustments for incorporation into flour milling processes.

Based on application, the market is segregated into bakery products, flour, and cheese. Among these, bakery products are anticipated to hold nearly 31.5% of the food bleaching agents market share in 2025, as these require both color and functional modification to meet industrial and consumer expectations. Bleaching agents help improve the appearance, baking performance, and shelf stability of flour-based products. These also shorten the natural aging process of flour, making it ready for immediate use, thereby accelerating production cycles.

Cheese is expected to showcase a decent CAGR from 2025 to 2032 due to the requirement for consistent visual appearance, particularly in processed and mass-market cheese products. Natural cheese, especially varieties such as cheddar and mozzarella, contains residual pigments such as annatto or carotenoids from animal feed, which can cause significant variation in hue. To counter this inconsistency, bleaching agents are used to decolorize whey and milk during the early stages of cheese production. Hydrogen peroxide acts as a decolorizer and a microbial control agent in cheese production.

In 2025, North America will likely account for a considerable share of around 28.1% as it is experiencing a gradual shift due to regulatory pressures and clean-label trends. In the U.S. food bleaching agents market, the Food and Drug Administration (FDA) permits the use of certain agents such as hydrogen peroxide and benzoyl peroxide in specific applications, including oil refining and flour treatment, but their use is strictly controlled. Benzoyl peroxide, for example, is allowed up to a concentration of 50 parts per million (ppm) in flour, as per the FDA’s CFR Title 21. Increasing consumer awareness about chemical additives, however, has led to a drop in the utilization of conventional bleaching agents in retail food products.

Renowned flour milling companies in the U.S., including General Mills and Ardent Mills, have responded by increasing their focus on unbleached and organically processed flour variants. As per a recent study, sales of unbleached flour surged by 6.4% year-over-year in 2023 in the U.S., outperforming bleached flour, which witnessed declining or stagnant sales. It has had a direct impact on the demand for benzoyl peroxide and similar agents used in flour bleaching. The dairy industry is still relying on hydrogen peroxide for applications such as microbial control in aseptic packaging and bleaching whey.

In Europe, the use of food bleaching agents is tightly regulated and significantly restricted compared to other regions. This is primarily due to the European Food Safety Authority’s (EFSA) strict stance on food additives. Benzoyl peroxide, once used widely in flour bleaching, is now banned under EU Regulation No. 1333/2008 on food additives. This has effectively eliminated its use in bakery and flour milling across EU member states.

Local manufacturers are hence shifting toward natural alternatives, including microfiltration and enzymatic treatment, specifically in flour and vegetable oil processing. A strong push toward clean-label and organic food production in the region has also impacted the market. As per data from the Research Institute of Organic Agriculture (FiBL) and IFOAM Organics Europe, retail sales of organic products in the European Union reached €45.1 Bn in 2022. This reflected rising consumer preference for additive-free products, thereby hampering sales of bleaching agents.

In Asia Pacific, China has rolled out stringent regulations affecting the use of certain bleaching agents. Local authorities banned the production of benzoyl peroxide and calcium peroxide in recent years, which are commonly used in flour bleaching. It was due to increasing consumer demand for natural foods and reduced reliance on chemical modifiers.

India is speculated to emerge as a significant market owing to its booming food processing industry. The demand for on-the-go food products and functional flour has resulted in increasing use of bleaching agents in the bakery sector. There is, however, a noticeable shift toward natural and enzyme-based bleaching solutions to keep up with the trend for clean-label products.

The food bleaching agents market houses a relatively small pool of specialized chemical manufacturers that operate under tight regulatory oversight. Key companies are leveraging their expertise in food-grade processing agents and inorganic chemicals. They are striving to maintain a competitive edge by delivering high-purity bleaching agents, including benzoyl peroxide and hydrogen peroxide, that comply with global food safety norms. Their manufacturing processes are designed to meet clean-label expectations and minimize residue.

The market is projected to reach US$ 826.1 Mn in 2025.

Rising consumption of processed food and increasing adoption of AI-based precision dosing systems are the key market drivers.

The market is poised to witness a CAGR of 5.8% from 2025 to 2032.

Increasing investments in safe bleaching agent alternatives and surging demand for natural food ingredients are the key market opportunities.

BASF SE, Evonik Industries AG, and Aditya Birla Chemicals are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Food Bleaching Agent Type

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author