ID: PMRREP35622| 200 Pages | 17 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

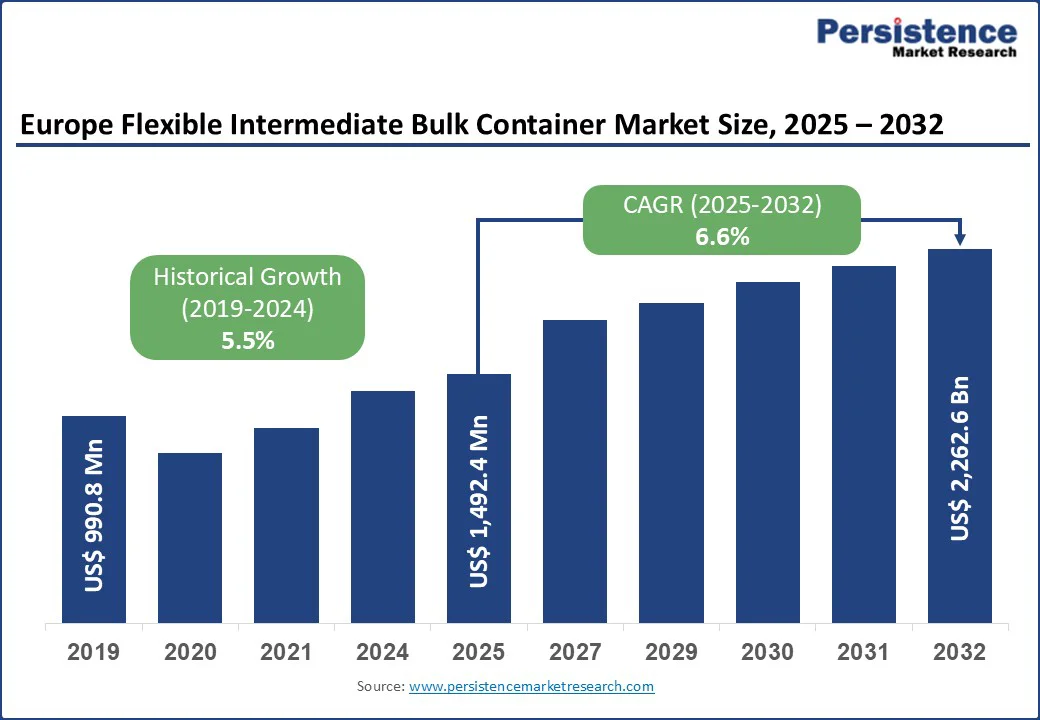

Europe flexible intermediate bulk container market size is likely to value at US$ 1,492.4 Mn in 2025 to US$ 2,262.6 Mn by 2032 growing at a CAGR of 6.6% during the forecast period from 2025 to 2032 based on the growing demand from the food, chemical, and pharmaceutical industries for cost-effective, bulk packaging solutions.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Europe Flexible Intermediate Bulk Container Market Size (2025E) | US$ 1,492.4 Mn |

| Market Value Forecast (2032F) | US$ 2,262.6 Mn |

| Projected Growth (CAGR 2025 to 2032) | 6.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.5% |

The growing global trade in bulk materials including chemicals, pharmaceuticals, and food products drives rising demand for FIBCs. As businesses expand their global reach, the demand for efficient and dependable packaging solutions increases. FIBCs are a versatile option because they are designed for easy cross-border transportation, allowing for the movement of large quantities of goods.

With lightweight form and high storage capacity, the cost of transportation is saved, thus the firms, interested in improving their logistics, find these appealing. Additionally, FIBCs' ability to serve all sorts of commodities-from powders to granules-enables their wide use in various industries, such as agriculture, chemicals, and food processing, which stimulates further demand for FIBCs across different regions.

The absence of uniformity in FIBCs creates considerable issues across businesses. Businesses frequently encounter compatibility challenges when using several types of equipment or systems, such as filling, lifting, and storage mechanisms, due to the wide range of designs, sizes, and material specifications. This unpredictability might result in operational inefficiencies, as businesses may have to invest in customized solutions or struggle to integrate FIBCs with existing infrastructure.

Furthermore, sourcing FIBCs becomes more complex and time-consuming as firms traverse several providers, each with its own set of standards. Without a universal standard, the risk of mishandling, delays, or equipment incompatibility increases, which may hamper efficiency and overall performance.

As sustainability becomes a standout priority across industries, there's a growing opportunity for FIBC manufacturers to offer eco-friendly, recyclable, and even bio-based solutions. This aligns with rising regulatory pressure and corporate commitments to circular economy principles.

Firms such as FlexSack have introduced FIBCs made with 30% recycled polypropylene, while Packem Umasree launched a plant for 100% rPET-based bags. In Europe, demand is surging, and Germany and the Netherlands are enacting regulations that require at least 30% recycled content in industrial packaging by 2025. Moreover, nearly 5,000 tonnes of bio-FIBCs were shipped in Europe in 2024, offering 20% lower CO2 emissions and matching the tensile strength of virgin polypropylene.

These initiatives point to a clear market shift, innovators investing in bio-based and recycled material technologies stand to capture eco-conscious buyers in agriculture, food, and industrial packaging.

In 2025, the Type A segment accounted for the largest market revenue share of over 56.0%. Type A FIBCs are manufactured using plain woven polypropylene or other non-conductive materials and lack mechanisms to dissipate static electricity. They are primarily used for transporting non-flammable products where the risk of static discharge is negligible.

As the most basic and economical option, Type A FIBCs are valued for their durability, reusability, and cost-effectiveness, making them highly suitable for general-purpose applications. Industries such as agriculture, food (for non-flammable goods), and construction remain key adopters due to the bags’ affordability and wide availability.

The Type D segment is projected to record the fastest CAGR of 7.6% during the forecast period. Constructed from antistatic and static-dissipative fabrics, these FIBCs do not require grounding and safely neutralize static charges through corona discharge. Type D bags are particularly useful in hazardous environments with high concentrations of flammable vapors or where grounding access is limited, driving their growing adoption in sensitive industrial applications.

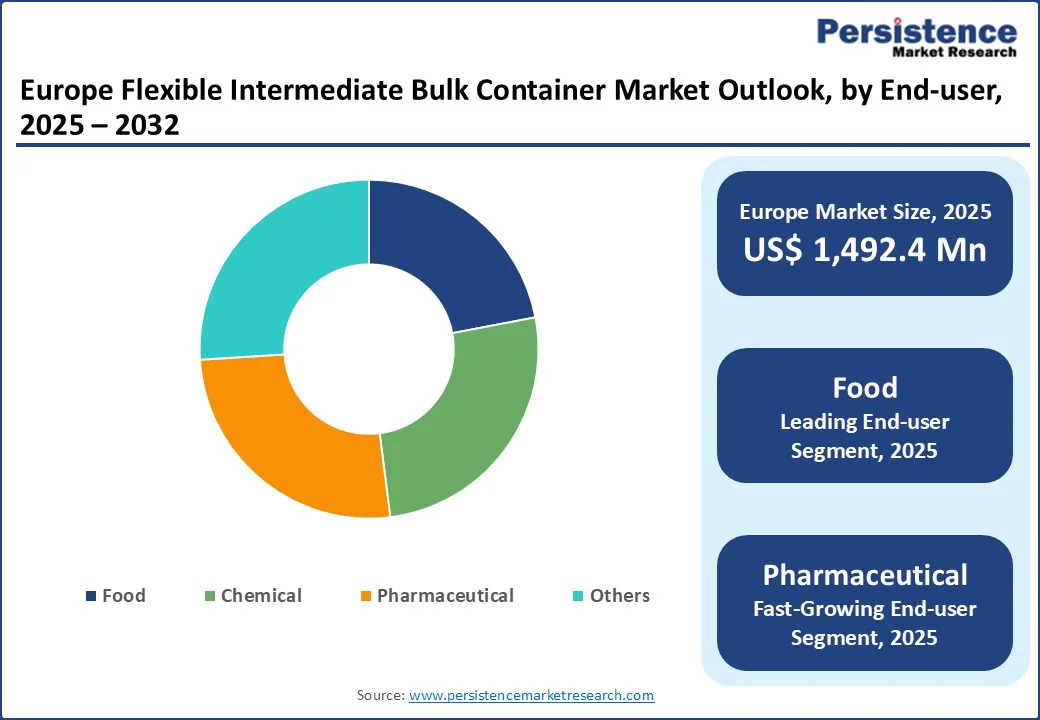

In 2025, the food segment accounted for the largest revenue share of over 32.0% in the FIBC market. The food industry relies heavily on FIBCs to package and transport bulk products such as sugar, flour, grains, starch, salt, and dairy powders.

These containers are favored due to their compliance with food safety regulations, availability in food-grade variants, and efficiency in handling large volumes. The rising global demand for processed and packaged foods, particularly across developing markets, continues to be a key growth driver for this segment.

The pharmaceutical segment is projected to grow at the fastest CAGR during the forecast period. FIBCs are increasingly used for transporting active pharmaceutical ingredients (APIs), excipients, and fine powders. To meet stringent requirements, these containers are manufactured in cleanroom environments and comply with GMP and hygiene standards, ensuring safe and contamination-free handling in pharmaceutical logistics.

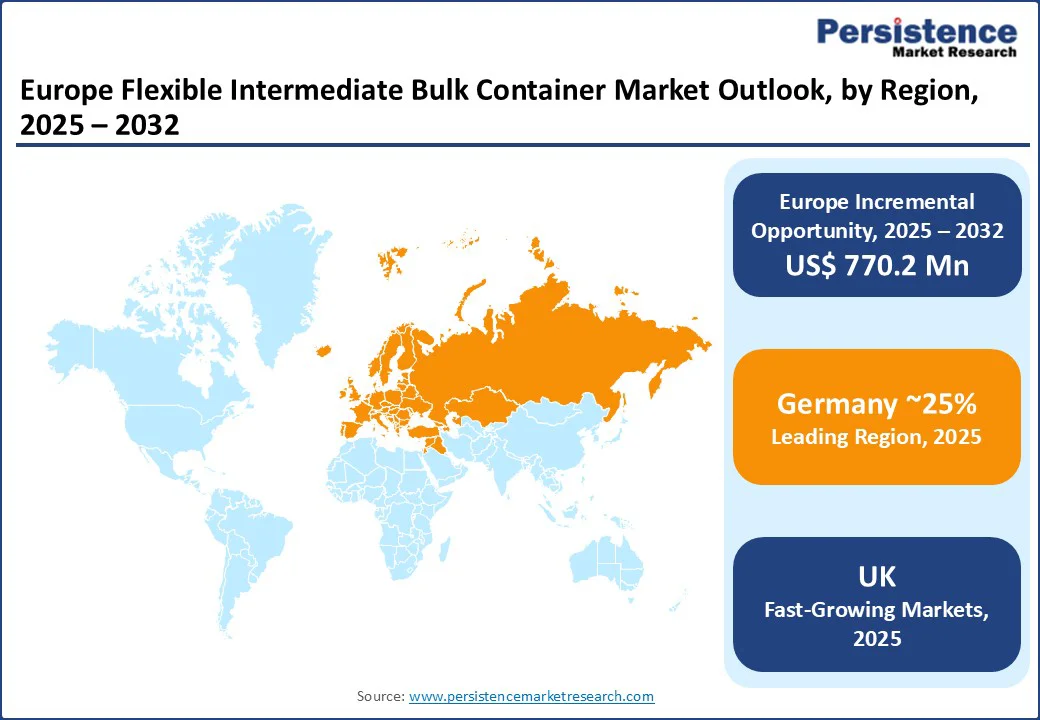

Germany is the powerhouse of Europe flexible intermediate bulk container market, driven by its advanced industrial ecosystem, cutting-edge engineering, and export-oriented economy. The country’s strong focus on innovation, supported by substantial R&D funding and academic collaboration, has enabled the rapid adoption of next-generation Flexible Intermediate Bulk Container technologies.

Key sectors such as automotive, manufacturing, and energy are major consumers, continuously integrating intelligent and sustainable solutions. Government initiatives promoting digitalization and Industry 4.0 further stimulate market expansion.

With a robust infrastructure and globally competitive companies, Germany plays a pivotal role in shaping the technological and regulatory direction of the European Flexible Intermediate Bulk Container market. Major sectors like automotive, energy, and heavy machinery are key adopters, leveraging Flexible Intermediate Bulk Container systems to improve productivity, reduce emissions, and maintain Germany's competitive industrial edge.

U.K. has established itself as a dynamic and influential player in the European Flexible Intermediate Bulk Container (FIBC) market, driven by its robust innovation ecosystem and forward-looking policy environment.

Strategic investments in digital infrastructure and the integration of emerging technologies such as AI, automation, and smart logistics solutions are propelling market growth. Post-Brexit regulatory reforms and the government’s strong commitment to sustainability have further enhanced the UK’s appeal for FIBC adoption and deployment.

High demand from sectors including healthcare, logistics, and advanced industries continues to support steady expansion. In addition, the country’s strong academic-industry collaborations and support for startups foster innovation in packaging technologies and supply chain efficiency.

The UK’s thriving startup ecosystem, combined with a focus on sustainable and next-generation solutions, positions it as a strong contender in shaping the future of the European FIBC market.

Europe flexible intermediate bulk container market is highly competitive and fragmented, with the presence of established local & global players, and startups. The top 5 companies in the global flexible intermediate bulk container industry are Berry Global Group, Inc., LC Packaging International BV, Rishi FIBC Solutions, Intertape Polymer Group, and Halsted, collectively accounting for more than 30% market share.

Leading companies in the market are investing in sustainable material, biodegradable coating, and high-performance bulk packaging solutions to meet the government regulations and growing consumer preference towards sustainable packaging options.

The next-generation bulk bags are focusing on lightweight, recyclable, and anti-static materials to enhance safety, durability, and efficiency for handling bulk materials across several industries such as chemical, pharmaceutical, and construction. The adoption of smart manufacturing and automation is fuelling the production of the advanced FIBCs, ensuring maximum efficiency, wastage reduction and improved cost management.

Europe Flexible Intermediate Bulk Container market is estimated to be valued US$ 1,492.4 Mn in 2025.

The key demand driver for the Flexible Intermediate Bulk Container (FIBC) market is the growing need for efficient, cost-effective, and durable bulk packaging solutions across agriculture, chemicals, pharmaceuticals, and construction industries.

In 2025, the Germany is likely to dominate with an exceeding 25% revenue share in the Europe Flexible Intermediate Bulk Container market.

Among the Product Type, Type A hold the highest preference, capturing beyond 40% market revenue share in 2025, surpassing other Vehicles.

The key players in the Europe Flexible Intermediate Bulk Container market are Greif, LC, Packaging, Mondi Group, The FIBC Company and Sackmaker.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material Type

By End-user

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author