ID: PMRREP20491| 190 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

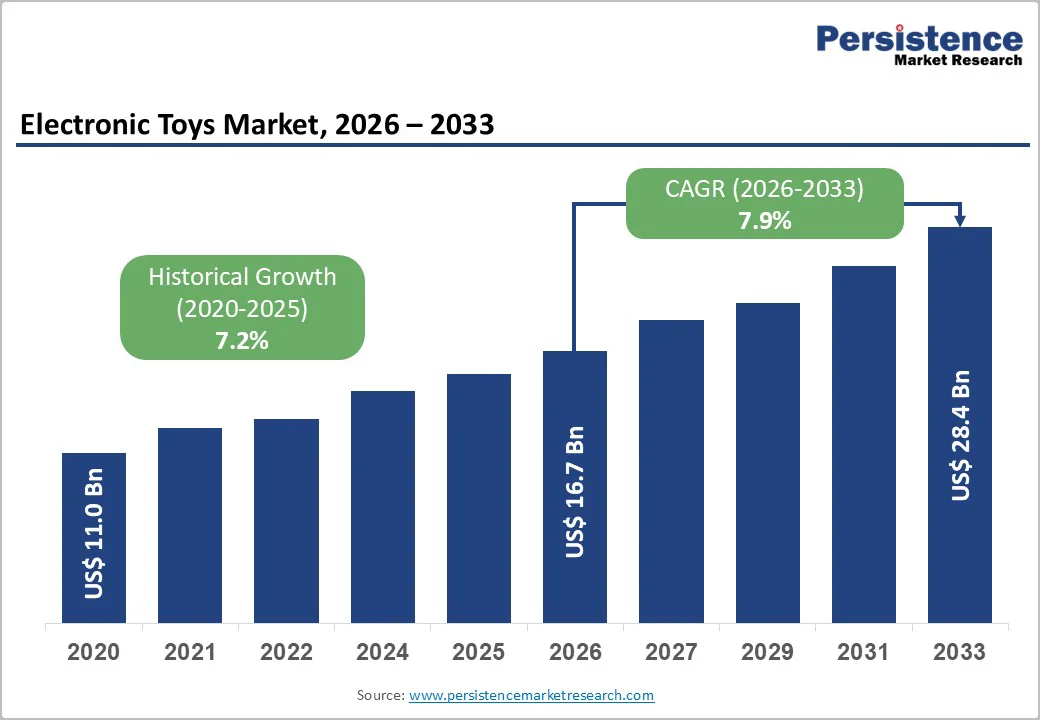

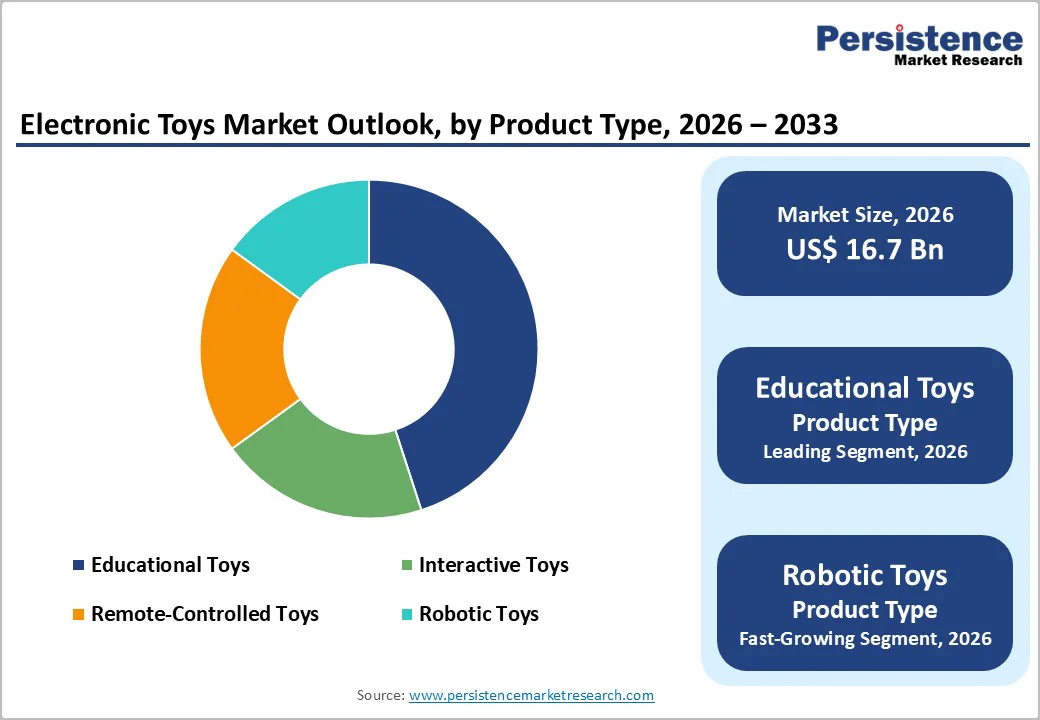

The global electronic toys market size is likely to be valued at US$16.7 billion in 2026, and is expected to reach US$28.4 billion by 2033, growing at a CAGR of 7.9% during the forecast period from 2026 to 2033, driven by the increasing prevalence of STEM-focused play, rising demand for interactive learning in early childhood, and advancements in AI-enabled and robotic toy technologies. Growing demand for safe, engaging electronic toys, especially for educational and interactive categories, is accelerating adoption across age groups. Advances in rechargeable battery systems and app-integrated designs are further boosting uptake by offering more sustainable, customizable options. Increasing recognition of electronic toys as critical for cognitive development in digital-native generations remains a major driver of market growth.

| Report Attribute | Details |

|---|---|

|

Electronic Toys Market Size (2026E) |

US$16.7 Bn |

|

Market Value Forecast (2033F) |

US$28.4 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

7.9% |

|

Historical Market Growth (CAGR 2020 to 2025) |

7.2% |

The rising demand for STEM-focused play is quickly becoming a major opportunity for electronic toy manufacturers, fueled by growing parental demand for educational, skill-building toys and reduced screen-time guilt. Traditional passive toys often create limited engagement, especially among preschoolers, leading to shorter attention spans and lower learning outcomes. Interactive technologies, including robotic kits, app-connected toys, rechargeable educational games, voice-interactive devices, and sensor-based playsets, address these concerns by offering a dynamic, hands-on alternative. These formats simplify learning, reduce the need for multiple toys, and are particularly effective during early development stages where cognitive stimulation is critical.

Electronic toys significantly lower the risk of developmental delays, boredom, and excessive screen exposure, which remain major concerns in child-rearing settings. They also support improved engagement and easier parental monitoring, especially for rechargeable battery and educational grades, making them ideal for high-volume or premium markets. As global education organizations push for wider STEM coverage and user-friendly play, demand continues to expand across remote-controlled, interactive, and robotic categories.

High development and safety testing costs present a significant barrier for companies advancing next-generation electronic toys and novel play systems. Developing innovative products such as AI-powered robots, app-integrated educational kits, or sensor-rich playsets requires extensive research, specialized microchips, and advanced safety testing that are far more expensive than basic toys. Safety is an even greater challenge: many smart toys, battery-powered lots, and interactive models are sensitive to choking hazards, overheating, and data privacy, requiring rigorous optimization to ensure that they remain safe throughout playtime. Achieving long-term compliance often involves costly ASTM trials, sophisticated drop testing, and the use of high-grade plastics, which significantly increase R&D expenditures.

Meeting stringent regulatory expectations for CPSIA compliance, battery safety, and batch consistency requires multiple certification studies under various conditions and across several production batches. This adds both time and financial burden to development timelines. Scaling up manufacturing requires controlled assembly, specialized testing labs, and quality-assurance systems, further driving up overall costs. For smaller toy makers, these challenges can limit innovation or delay market entry.

Innovations in AI-enabled and rechargeable electronic toy platforms are reshaping the global play landscape by tackling two key challenges, engagement drop-off and battery dependency. AI-powered toys adapt to each child, providing personalized learning experiences in educational kits and reducing reliance on static play. Features such as voice recognition, adaptive difficulty, cloud updates, and sensor fusion enhance user engagement, improve learning retention, and minimize frustration, lowering return rates for brands and easing parental concerns.

Advances in rechargeable technologies, including long-life lithium-ion batteries, wireless charging docks, eco-friendly packs, and modular power systems, promote sustainable play by reducing the need for disposable batteries. These solutions extend playtime, support uninterrupted sessions, and are ideal for large-scale educational programs. Emerging technologies such as solar-assisted charging, bio-based casings, and VLP-based power further improve convenience and environmental sustainability.

Educational toys are anticipated to dominate the market, accounting for approximately 40% of the revenue share in 2026. Their dominance is driven by learning value, parental preference, and STEM focus, making them preferred for skill-building. Educational toys provide interactive learning, ensure development, and contribute to engagement, making them suitable for large-scale parenting campaigns. LEGO Education SPIKE Prime is a STEM-focused educational toy popular in schools and homes. It combines hands-on building with coding and robotics, allowing children to construct and program models using real sensors and motors. The platform helps children learn engineering, coding, and robotics through structured, guided activities.

Robotic toys represent the fastest-growing segment, due to their advanced interaction and expanding use in coding and play. Their programmable profile makes them ideal for targeted creativity, reducing passive play. Continuous innovations in AI robotics are further strengthening their appeal, driving rapid adoption across North America and Europe, where demand for smart, engaging toys is accelerating. Sphero BOLT is a popular programmable robotic toy that blends play with coding education. Aimed at children aged 8 and above, it features advanced sensors and an 8×8 LED matrix that can be programmed through drag-and-drop or text-based coding (JavaScript/Python) to move, light up, respond to its surroundings, and complete creative tasks.

Preschoolers lead the market, holding approximately 35% of the share in 2026, driven by high demand for skill-building, large parental programs, and a strong global focus on early learning. Their dominance continues as families expand educational play. Rising adoption of toddler interactive and expanded school-age campaigns highlights the growing focus on developmental stages. LeapFrog and Fisher Price are leading toy brands whose products are specifically designed for preschoolers (roughly ages 3–5) and are widely recognized for promoting early learning and developmental skills such as language, motor skills, and cognitive reasoning. These products are commonly used both at home and in early childhood programs, reflecting strong parental and educator preference.

School age is the fastest-growing segment, due to strong momentum in STEM toys and expanding inclusion of coding kits in older kids. The growing shift toward advanced educational platforms, along with better challenges, accelerates the adoption. Advancements in robotic and app-integrated toys and the continued progress of interactive learning entering family trials drive market growth. LEGO Education SPIKE Prime combines physical building elements with a programmable hub and app-based coding interface. It is used extensively in elementary and middle school classrooms to introduce children to engineering, robotics, and block-based coding.

Rechargeable battery leads the market, holding approximately 60% of the share in 2026, driven by sustainability, cost savings, and large eco-conscious programs. Their dominance continues as parents expand green choices. Rising adoption of non-rechargeable hybrids and expanded portable campaigns highlight the growing focus on convenience. Energizer Household Products, a division of Energizer Holdings, Inc. (NYSE: ENR), was once again recognized as a leader in the battery industry with its latest innovation, Energizer® EcoAdvanced™, the world’s first AA battery made with four percent recycled batteries. Energizer EcoAdvanced was considered Energizer’s highest performing alkaline battery and was used to power consumers’ most critical devices while creating less impact on the planet.

The non-rechargeable battery segment is the fastest-growing, driven by its affordability and widespread use in budget-friendly toys. The increasing preference for low-cost, disposable power solutions, combined with easy availability, is accelerating adoption. Advances in alkaline batteries and the introduction of compact packs through market trials are further supporting growth. Products such as Duracell’s CopperTop alkaline batteries are commonly chosen for inexpensive electronic toys, such as battery-powered cars, basic handheld games, flashing lights, and noise-making toys, where low initial cost and instant power are crucial. Disposable batteries continue to be the preferred option in price-sensitive areas of the toy market.

Online retail is expected to dominate the market, contributing nearly 45% of revenue in 2026, due to remaining the primary hub for convenience, a large variety, and management of diverse toy aisles requiring easy comparison. Their strong digital reach, review systems, and ability to handle high-volume or bundled sales drive higher turnover. Online retail is leading robotic rollouts as well as administering emerging educational trials. Amazon.com generated approximately?US$4,870?million in online toy sales, making it the top e-commerce store worldwide for toys by revenue. This illustrates how digital platforms with vast product assortments and strong logistics lead the sector.

Specialty stores are likely to be the fastest-growing segment, driven by their strong expertise and expanding role in premium toy purchases. They offer convenient, quick, and accessible expert advice, attracting buyers who prefer in-store, tactile settings. Increased outreach programs, experience focus, and wider availability of routine and high-end toys further accelerate uptake, boosting rapid adoption across both urban and semi-urban areas. FAO Schwarz is a premium specialty toy retailer known for its curated assortment of high-end, interactive, and exclusive toys, immersive in-store experiences, and expert staff who help guide buyers through complex or premium purchases, including educational and collectible toys that benefit from tactile exploration and expert advice.

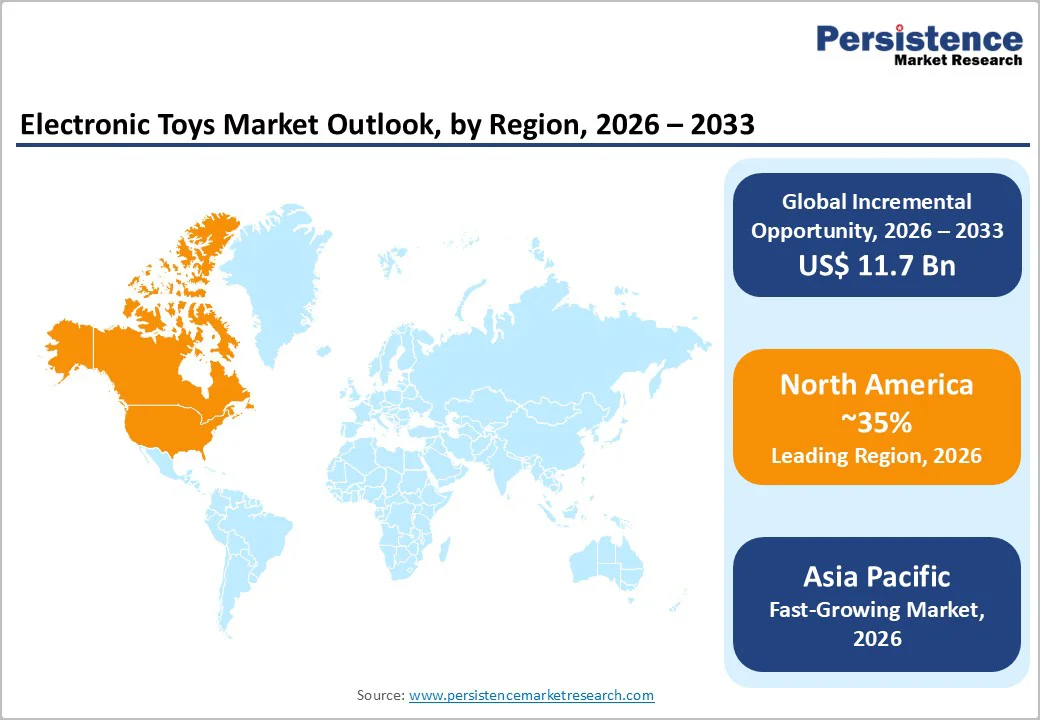

North America is projected to lead, accounting for nearly 35% of the market share in 2026, supported by the region’s advanced retail infrastructure, strong research and development capabilities, and high public awareness of educational play benefits. Distribution systems in the U.S. and Canada provide extensive support for toy programs, ensuring wide accessibility of electronic toys across educational, interactive, and robotic populations. Increasing demand for rechargeable, convenient, and easy-to-use forms is further accelerating adoption, as these formats improve engagement and reduce barriers associated with battery waste.

Innovation in electronic toys technology, including stable AI interaction, improved sensor delivery, and targeted educational enhancement, is attracting significant investments from both public and private sectors. Government initiatives and STEM campaigns continue to promote use against passive play, screen time concerns, and emerging learning gaps, creating sustained market demand. The growing focus on robotic kits and specialty uses, particularly for school age and others, is expanding the target applications for electronic toys.

Europe is fueled by increasing awareness of developmental benefits, strong retail systems, and government-led education programs. Countries such as Germany, France, and the U.K. have well-established parenting frameworks that support routine play and encourage adoption of innovative toy delivery methods, including electronic toys. These engaging formulations are particularly appealing for educational populations, eco-conscious parents, and interactive users, improving compliance and coverage rates.

Technological advancements in electronic toys development, such as enhanced AI engagement, application-targeted delivery, and improved rechargeable grades, are further boosting market potential. European authorities are increasingly supporting research and trials for toys against both routine and specialized needs, strengthening market confidence. The growing emphasis on convenient, eco-friendly options is aligned with the region’s focus on preventive learning and reducing battery waste. Public awareness campaigns and promotion drives are expanding reach in both urban and rural areas, while suppliers are investing in sensors and novel variants to increase efficacy.

Asia Pacific is expected to be the fastest-growing market for electronic toys from 2026 to 2033, driven by increasing parental awareness, supportive government initiatives, and the expansion of educational and play programs throughout the region. Countries such as India, China, Japan, and Southeast Asian nations are actively promoting toy campaigns to address educational growth and emerging interactive needs. Electronic toys are particularly attractive in these regions due to their affordable administration, ease of scaling, and suitability for large-scale family drives in both urban and rural populations.

Technological advancements are supporting the development of stable, effective, and easy-to-use electronic toys, which can withstand challenging climatic conditions and minimize battery dependence. These innovations are critical for reaching remote households and improving overall play coverage. Growing demand for educational, robotic, and interactive applications is contributing to market expansion. Public-private partnerships, increased toy expenditure, and rising investments in sensor research and manufacturing capacity are further accelerating growth. The convenience of toy delivery, combined with improved engagement and reduced risk of boredom, positions electronic toys as a preferred choice.

The global electronic toys market features competition between established toy giants and emerging tech-integrated brands. In North America and Europe, Mattel and Hasbro lead through strong R&D, distribution networks, and retail ties, bolstered by innovative grades and educational programs. In Asia Pacific, VTech Holdings Limited advances with localized solutions, enhancing accessibility. Interactive delivery boosts engagement, cuts passive play risks, and enables mass routines across regions. Strategic partnerships, collaborations, and acquisitions merge expertise, expand portfolios, and speed commercialization. Rechargeable formulations solve sustainability issues, aiding penetration in eco-focused areas.

The global electronic toys market is projected to reach US$16.7 billion in 2026.

The rising prevalence of STEM-focused play and demand for interactive learning are the key drivers.

The electronic toys market is poised to witness a CAGR of 7.9% from 2026 to 2033.

Advancements in AI-enabled and rechargeable delivery platforms are the key opportunities.

Mattel, Hasbro, LEGO, VTech Holdings Limited, and Funko are the key players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020–2025 |

|

Forecast Period |

2026–2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Age Group

By Power Source

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author