- Executive Summary

- Global Electronic Logging Device (ELD) Market Snapshot, 2025 and 2032

- Market Opportunity Assessment, 2025 - 2032, US$ Bn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Challenges

- Key Trends

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Value Chain Analysis

- Key Market Players

- Regulatory Landscape

- PESTLE Analysis

- Porter’s Five Force Analysis

- Consumer Behavior Analysis

- Price Trend Analysis, 2019 - 2032

- Key Factors Impacting Product Prices

- Pricing Analysis, By Vehicle Type

- Regional Prices and Product Preferences

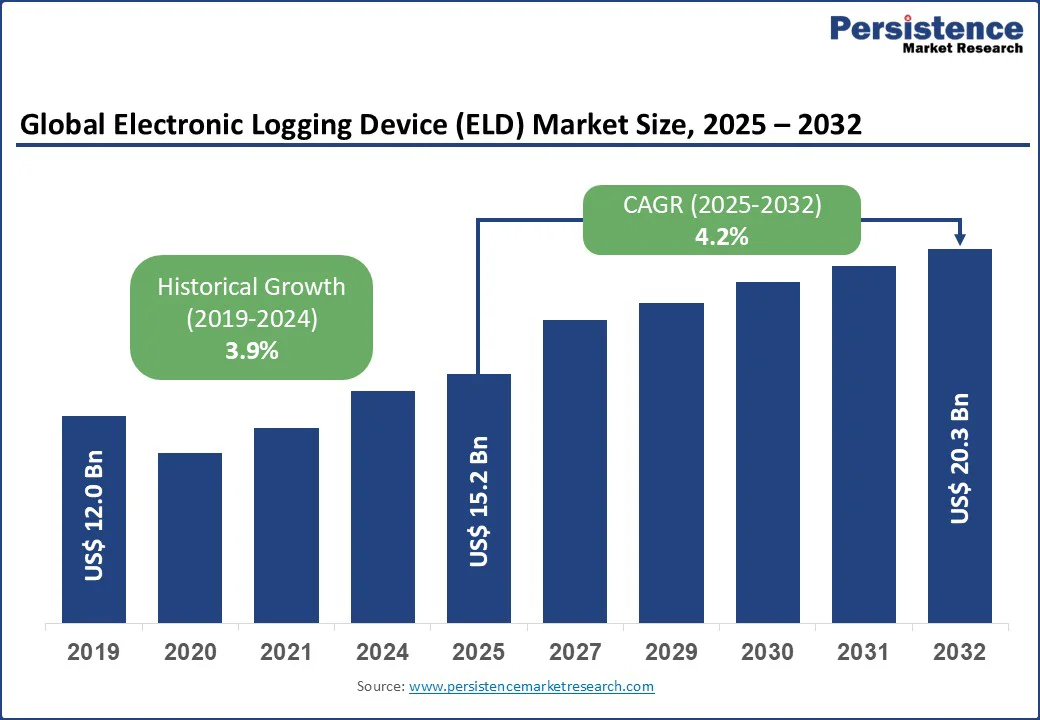

- Global Electronic Logging Device (ELD) Market Outlook

- Market Size (US$ Bn) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, 2025-2032

- Global Electronic Logging Device (ELD) Market Outlook: Vehicle Type

- Historical Market Size (US$ Bn) Analysis, By Vehicle Type, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Vehicle Type, 2025-2032

- Heavy Commercial Vehicles (HCVs)

- Light Commercial Vehicles (LCVs)

- Buses and Coaches

- Market Attractiveness Analysis: Vehicle Type

- Global Electronic Logging Device (ELD) Market Outlook: Fleet Size

- Historical Market Size (US$ Bn) Analysis, By Fleet Size, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Fleet Size, 2025-2032

- Medium Fleets (50-249 vehicles)

- Large Fleets (250+ vehicles)

- Small Fleets (1-49 vehicles)

- Market Attractiveness Analysis: Fleet Size

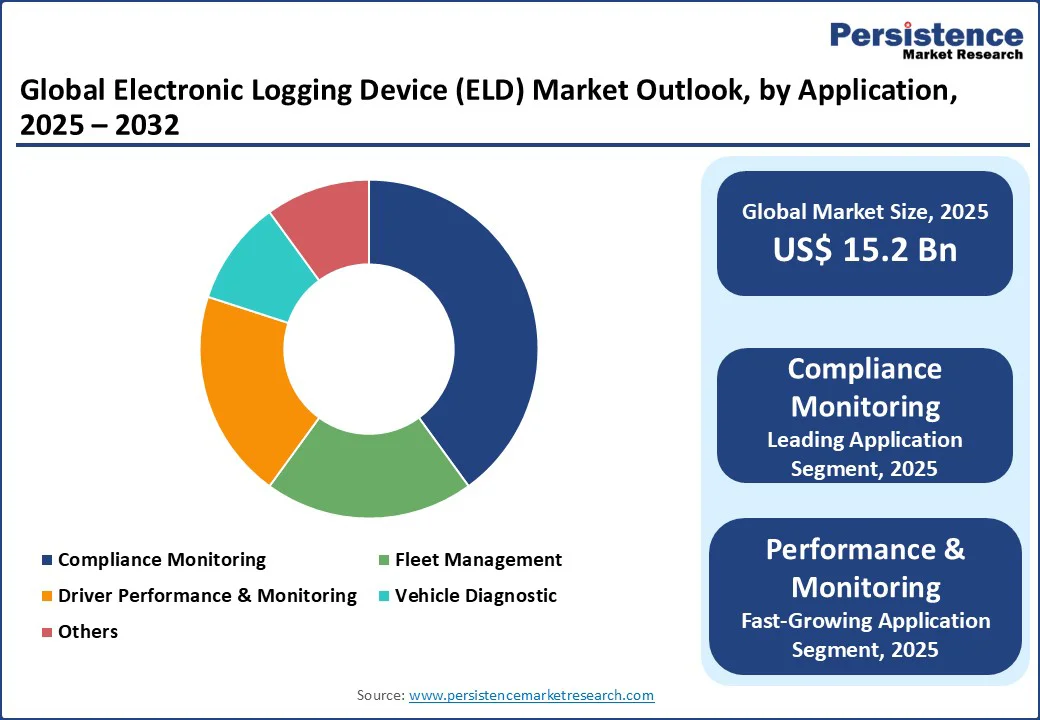

- Global Electronic Logging Device (ELD) Market Outlook: Application

- Historical Market Size (US$ Bn) Analysis, By Application, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Fleet Management

- Compliance Monitoring

- Driver Performance & Monitoring

- Vehicle Diagnostic

- Others

- Market Attractiveness Analysis: Application

- Market Size (US$ Bn) Analysis and Forecast

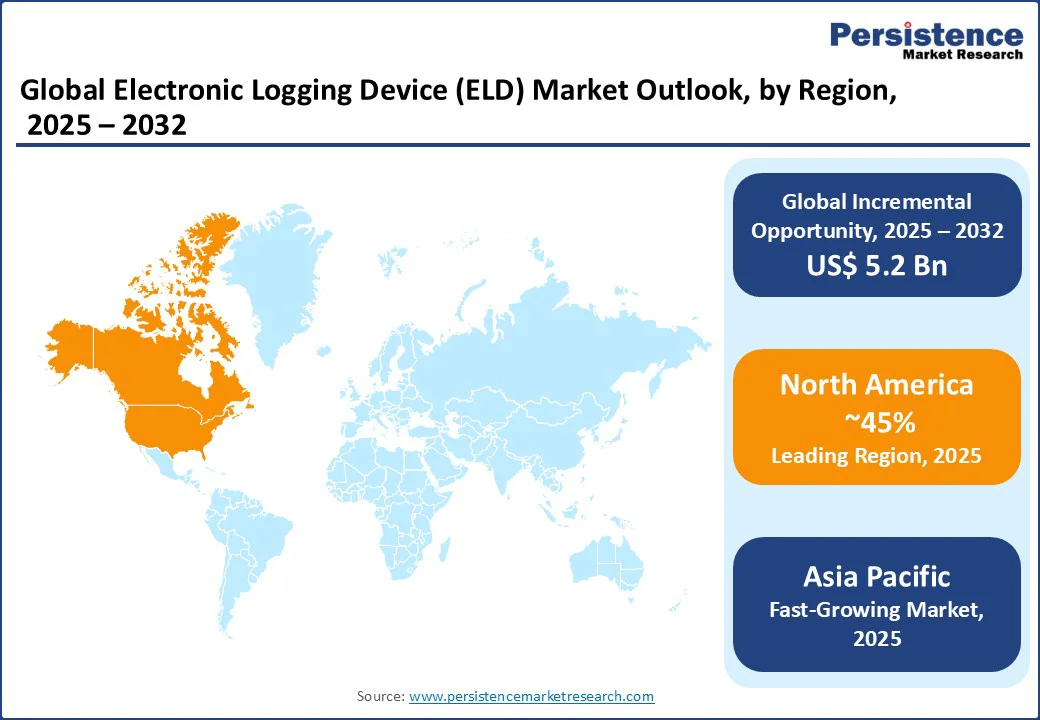

- Global Electronic Logging Device (ELD) Market Outlook: Region

- Historical Market Size (US$ Bn) Analysis, By Region, 2019-2024

- Market Size (US$ Bn) Analysis and Forecast, By Region, 2025-2032

- North America

- Latin America

- Europe

- East Asia

- South Asia and Oceania

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Electronic Logging Device (ELD) Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Vehicle Type

- By Fleet Size

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- U.S.

- Canada

- Market Size (US$ Bn) Analysis and Forecast, By Vehicle Type, 2025-2032

- Heavy Commercial Vehicles (HCVs)

- Light Commercial Vehicles (LCVs)

- Buses and Coaches

- Market Size (US$ Bn) Analysis and Forecast, By Fleet Size, 2025-2032

- Medium Fleets (50-249 vehicles)

- Large Fleets (250+ vehicles)

- Small Fleets (1-49 vehicles)

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Fleet Management

- Compliance Monitoring

- Driver Performance & Monitoring

- Vehicle Diagnostic

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Europe Electronic Logging Device (ELD) Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Vehicle Type

- By Fleet Size

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Rest of Europe

- Market Size (US$ Bn) Analysis and Forecast, By Vehicle Type, 2025-2032

- Heavy Commercial Vehicles (HCVs)

- Light Commercial Vehicles (LCVs)

- Buses and Coaches

- Market Size (US$ Bn) Analysis and Forecast, By Fleet Size, 2025-2032

- Medium Fleets (50-249 vehicles)

- Large Fleets (250+ vehicles)

- Small Fleets (1-49 vehicles)

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Fleet Management

- Compliance Monitoring

- Driver Performance & Monitoring

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- East Asia Electronic Logging Device (ELD) Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Vehicle Type

- By Fleet Size

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- China

- Japan

- South Korea

- Market Size (US$ Bn) Analysis and Forecast, By Vehicle Type, 2025-2032

- Heavy Commercial Vehicles (HCVs)

- Light Commercial Vehicles (LCVs)

- Buses and Coaches

- Market Size (US$ Bn) Analysis and Forecast, By Fleet Size, 2025-2032

- Medium Fleets (50-249 vehicles)

- Large Fleets (250+ vehicles)

- Small Fleets (1-49 vehicles)

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Fleet Management

- Compliance Monitoring

- Driver Performance & Monitoring

- Vehicle Diagnostic

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- South Asia & Oceania Electronic Logging Device (ELD) Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Vehicle Type

- By Fleet Size

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- India

- Indonesia

- Thailand

- Singapore

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Bn) Analysis and Forecast, By Vehicle Type, 2025-2032

- Heavy Commercial Vehicles (HCVs)

- Light Commercial Vehicles (LCVs)

- Buses and Coaches

- Market Size (US$ Bn) Analysis and Forecast, By Fleet Size, 2025-2032

- Medium Fleets (50-249 vehicles)

- Large Fleets (250+ vehicles)

- Small Fleets (1-49 vehicles)

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Fleet Management

- Compliance Monitoring

- Driver Performance & Monitoring

- Vehicle Diagnostic

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Latin America Electronic Logging Device (ELD) Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Vehicle Type

- By Fleet Size

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Bn) Analysis and Forecast, By Vehicle Type, 2025-2032

- Heavy Commercial Vehicles (HCVs)

- Light Commercial Vehicles (LCVs)

- Buses and Coaches

- Market Size (US$ Bn) Analysis and Forecast, By Fleet Size, 2025-2032

- Medium Fleets (50-249 vehicles)

- Large Fleets (250+ vehicles)

- Small Fleets (1-49 vehicles)

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Fleet Management

- Compliance Monitoring

- Driver Performance & Monitoring

- Vehicle Diagnostic

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Middle East & Africa Electronic Logging Device (ELD) Market Outlook

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- By Country

- By Vehicle Type

- By Fleet Size

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2025-2032

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Bn) Analysis and Forecast, By Vehicle Type, 2025-2032

- Heavy Commercial Vehicles (HCVs)

- Light Commercial Vehicles (LCVs)

- Buses and Coaches

- Market Size (US$ Bn) Analysis and Forecast, By Fleet Size, 2025-2032

- Medium Fleets (50-249 vehicles)

- Large Fleets (250+ vehicles)

- Small Fleets (1-49 vehicles)

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2025-2032

- Fleet Management

- Compliance Monitoring

- Driver Performance & Monitoring

- Vehicle Diagnostic

- Others

- Market Attractiveness Analysis

- Historical Market Size (US$ Bn) Analysis, By Market, 2019-2024

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- Garmin ELD

- Overview

- Segments and Vehicle Type

- Key Financials

- Market Developments

- Market Strategy

- KeepTruckin

- Omnitracs

- Trimble

- Geotab

- Samsara

- Verizon Connect

- AT&T Fleet Complete

- Donlen

- Stoneridge

- TomTom Telematics

- Blue Ink Technology

- CarrierWeb

- ORBCOMM

- Pedigree Technologies

- Teletrac Navaman

- Wheels Inc.

- Transflo

- Others

- Garmin ELD

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment