ID: PMRREP4764| 183 Pages | 18 Sep 2025 | Format: PDF, Excel, PPT* | Semiconductor Electronics

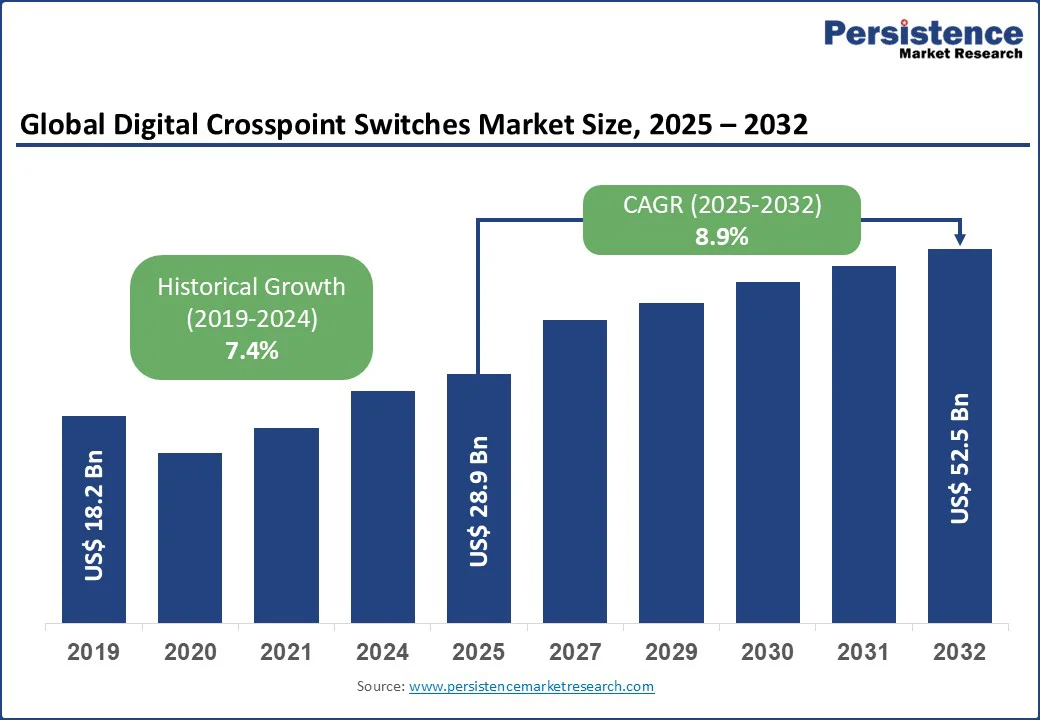

The global digital crosspoint switches market size is likely to be valued at US$28.9 Bn in 2025 and poised to reach US$52.5 Bn by 2032, growing at a CAGR of 8.9% during the forecast period from 2025 to 2032, driven by the increasing demand for high-speed data transmission, advanced telecommunications infrastructure, and the proliferation of data centers globally.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Digital Crosspoint Switches Market Size (2025E) | US$28.9 Bn |

| Market Value Forecast (2032F) | US$52.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 7.4% |

The global digital crosspoint switches market is experiencing significant growth due to the worldwide surge in data center investments and the rapid expansion of 5G networks. Digital crosspoint switches are essential for managing high-speed signal routing in data centers, ensuring low-latency and high-bandwidth connectivity critical for cloud computing and big data analytics.

According to the International Data Corporation (IDC), forecasts worldwide spending on edge computing will reach US$317 Bn by 2026, with a significant portion allocated to hyperscale data centers in the U.S., China, and Europe.

The rollout of 5G networks further drives demand, as these switches enable efficient signal routing in telecommunications infrastructure. For instance, China’s 5G base station installations reached 4.25 million by January 2025, per the Ministry of Industry and Information Technology, necessitating advanced crosspoint switches.

Companies such as texas instruments and Analog Devices reported increased sales of high-performance switches in 2024, driven by these trends. Government initiatives, such as the EU’s Digital Decade plan, further fuel demand, positioning telecommunications and data centers as key growth drivers through 2032.

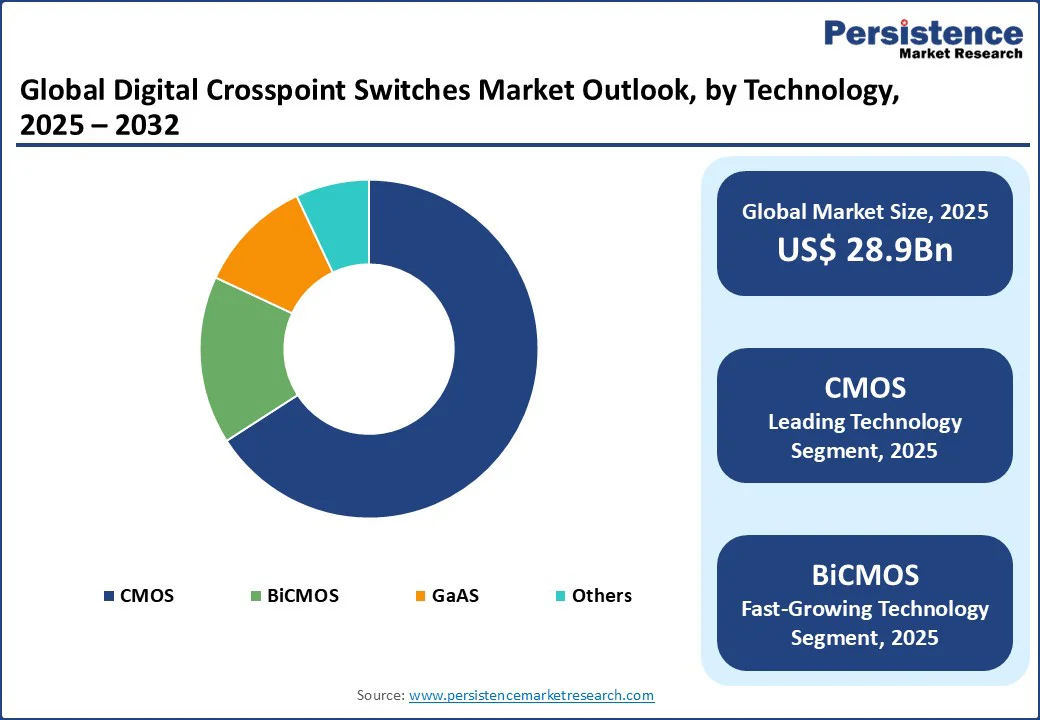

The digital crosspoint switches market faces challenges due to high development costs and competition from alternative technologies, such as optical switches and software-defined networking (SDN). Developing advanced crosspoint switches requires significant investment in research and development (R&D), particularly for cutting-edge CMOS and BiCMOS technologies.

Additionally, optical switches, which offer higher bandwidth and lower power consumption, are gaining traction in data centers and telecommunications. The adoption of SDN, which enables flexible network management, further challenges the digital crosspoint switches market, particularly in cost-sensitive regions. Limited standardization in emerging markets and concerns over power efficiency in high-density applications also hinder adoption, restraining overall market growth.

The increasing adoption of artificial intelligence (AI) and Internet of Things (IoT) technologies presents significant opportunities for the digital crosspoint switches market. These switches are critical in AI-driven systems and IoT networks, where high-speed data routing and low-latency connectivity are essential.

Companies such as NXP Semiconductors and Broadcom are innovating with low-power, high-speed switches tailored for AI and IoT ecosystems. Government initiatives, such as the U.S. CHIPS Act of 2022, promote semiconductor advancements, creating opportunities for manufacturers to develop next-generation crosspoint switches to meet the evolving needs of AI and IoT applications through 2032.

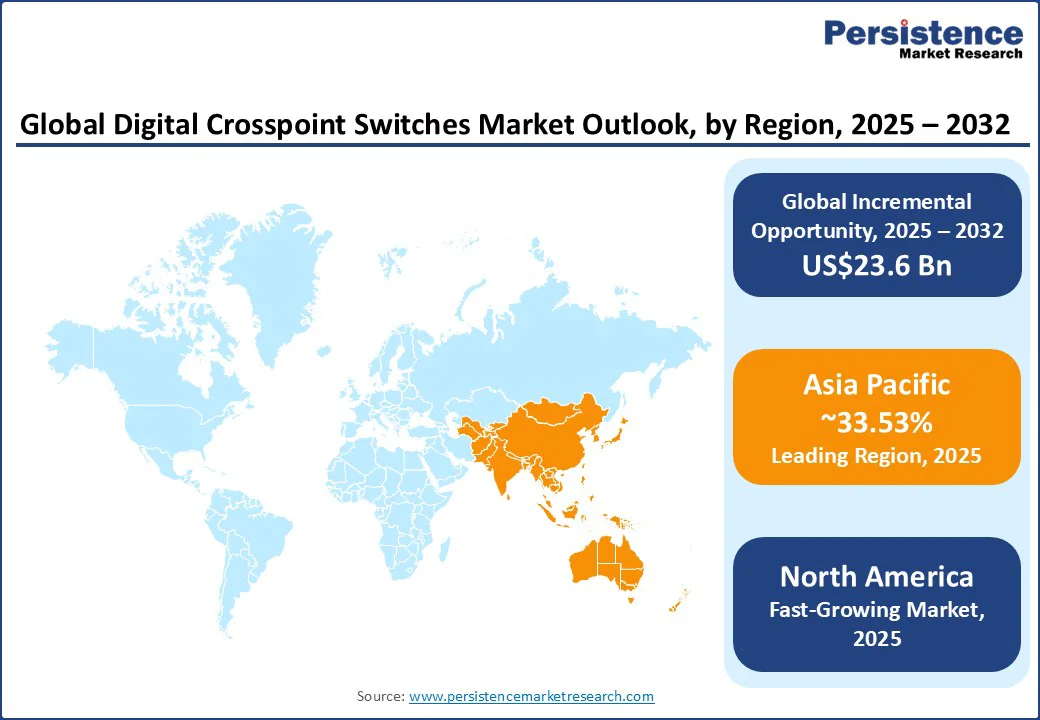

Asia Pacific is set to dominate the digital crosspoint switches market, capturing an estimated 33.5% of the digital crosspoint switches market share by 2025. This leadership is driven by rapid advancements in digital infrastructure, particularly in key economies such as China and South Korea.

China’s aggressive 5G rollout, with over 4.25 million 5G base stations installed by January 2025 (according to the Ministry of Industry and Information Technology), fuels robust demand for high-performance switching technologies. South Korea, home to semiconductor giants such as Samsung, further strengthens the digital crosspoint switches market through the production of cutting-edge crosspoint switches critical for telecommunications and data centers.

Additionally, India’s ambitious Digital India initiative accelerates the adoption of digital services, creating a growing need for efficient data routing solutions. Government-backed projects, including China’s 14th Five-Year Plan, emphasize smart infrastructure and digital transformation, ensuring sustained investment in semiconductor manufacturing and network expansion.

Together, these factors position Asia Pacific as a powerhouse, securing its market dominance through 2032 and beyond.

North America stands out as the fastest-growing region in the digital crosspoint switches market, propelled by significant investments in data centers and 5G infrastructure across the U.S. and Canada. The U.S. data center industry, a major consumer of high-speed digital crosspoint switches, depends on these components for efficient and reliable signal routing essential to cloud computing, artificial intelligence, and edge computing applications.

Canada’s expanding telecommunications sector, guided by regulatory frameworks from the Canadian Radio-television and Telecommunications Commission, drives demand for advanced 5G-compatible switches to support nationwide network upgrades.

Leading semiconductor companies such as Texas Instruments and Broadcom dominate the regional market, leveraging their extensive distribution networks to supply critical infrastructure projects, including smart city developments and large-scale digital ecosystems. Furthermore, growing consumer preference for high-performance, low-latency switches in networking equipment reinforces North America’s stronghold, ensuring sustained market growth and technological leadership in the coming years.

Europe ranks as the second fastest-growing region in the digital crosspoint switches market, propelled by strict regulatory frameworks, booming telecommunications demand, and rapid data center expansion in key countries such as Germany and the UK.

The region’s data centers increasingly rely on advanced crosspoint switches to support the surging needs of cloud computing, artificial intelligence, and edge computing applications. Germany’s telecommunications industry is a significant consumer of BiCMOS switches, with major semiconductor players such as Infineon Technologies and STMicroelectronics driving innovation and supply.

The EU’s Digital Decade initiative further accelerates growth by promoting 5G deployment and Internet of Things (IoT) projects across member states, thereby increasing demand for high-performance, low-latency switching solutions.

Additionally, Europe’s strong emphasis on sustainability and compliance with advanced connectivity standards encourages companies to develop energy-efficient and environmentally friendly switch technologies. These combined factors position Europe for sustained market growth and technological leadership in the digital crosspoint switch sector.

The global digital crosspoint switches market is highly competitive, characterized by a fragmented landscape with numerous global and regional players. Leading companies, such as Texas Instruments, Analog Devices, and Broadcom, dominate through extensive product portfolios and global distribution networks.

Regional players such as Cypress Semiconductor focus on localized offerings in the Asia Pacific. Companies are investing in advanced CMOS and BiCMOS technologies and low-power designs to enhance market share, driven by demand for high-speed connectivity in data centers and telecommunications.

The digital crosspoint switches market is projected to reach US$28.9 Bn in 2025.

Surge in data center investments and 5G network expansion are the key market drivers.

The digital crosspoint switches market is poised to witness a CAGR of 8.9% from 2025 to 2032.

The rising demand in AI and IoT applications is the key market opportunity for the digital crosspoint switches market.

Texas Instruments, Analog Devices, Broadcom, and NXP Semiconductors are key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Technology

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author