ID: PMRREP35648| 184 Pages | 24 Sep 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

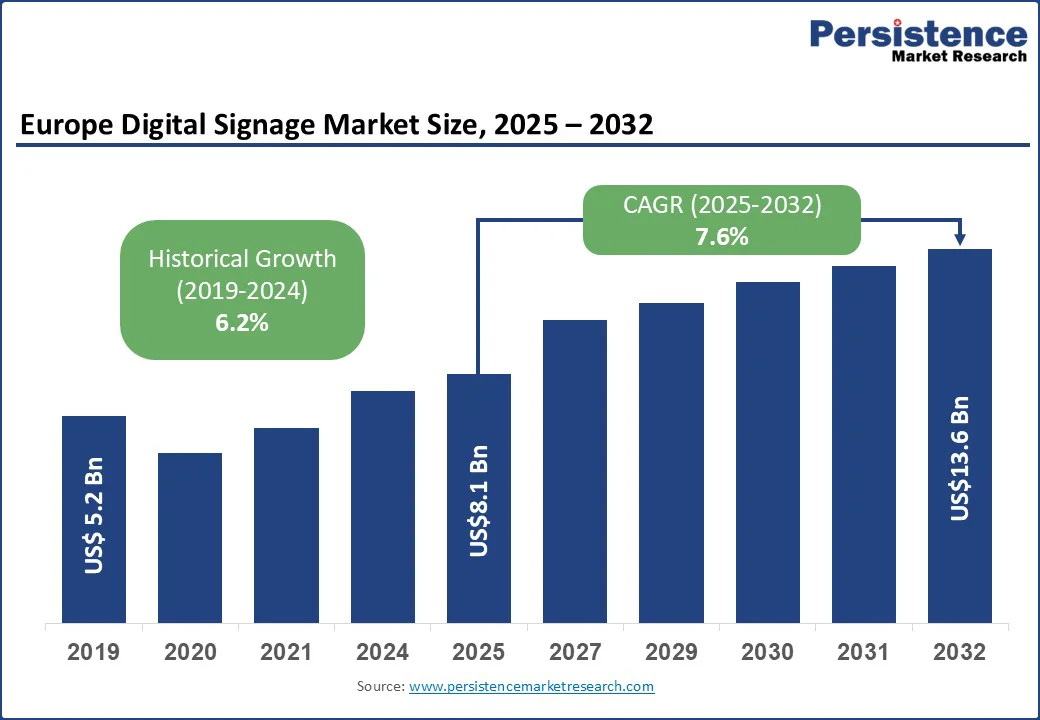

The Europe digital signage market size is likely to be valued at US$8.1 Bn in 2025 and is expected to reach US$13.6 Bn by 2032, growing at a CAGR of 7.6% during the forecast period from 2025 to 2032, fueled by advanced display technologies, cloud-based content management, and increasing adoption across retail, transportation, healthcare, and entertainment sectors.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Digital Signage Market Size (2025E) | US$8.1 Bn |

| Market Value Forecast (2032F) | US$13.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.2% |

Europe digital signage market demonstrates a strong growth momentum, fueled by the widespread deployment of interactive digital signage solutions across retail, hospitality, and public infrastructure sectors. Advanced kiosks, multi-touch displays, and NFC-enabled interfaces allow organizations to deliver personalized customer experiences, real-time promotions, and dynamic content updates, increasing engagement by over 75% according to EU studies.

Government initiatives such as the EU Horizon Mission “Climate-Neutral and Smart Cities by 2030” (€98 Mn) (US$115.1 Mn) and broader Horizon Europe funding {€100 Bn (US$117.4 Bn) from 2021 - 2027} support smart city infrastructure, further accelerating adoption.

Corporate investment is also high; European retailers invested €15.8 Bn (US$17.95 Bn) in digital transformation in 2023, with digital signage representing 18%. Consumer acceptance remains robust, with 79% favoring kiosks for simplified ordering and 44% for self-paced browsing, validating interactive displays as a key driver for enhancing customer experience, operational efficiency, and brand engagement across sectors.

Despite strong growth, the European digital signage market faces a significant restraint from intensifying competition with online and broadcast advertising channels. Rising internet penetration has shifted consumer attention toward personalized digital ads, social media, and streaming services, which often deliver more cost-effective, targeted engagement than physical signage. Organizations may prioritize online and broadcast spending over digital display installations, constraining retail and public sector investments.

Moreover, implementation of digital signage entails considerable upfront costs for hardware, professional installation, and maintenance, which can deter smaller enterprises or those with limited resources. The region’s fragmented market further compounds this challenge, as smaller vendors often lack standardized integration platforms and technical expertise. Consequently, while digital signage provides real-time engagement and operational benefits, competing digital marketing channels and perceived financial barriers can limit adoption across certain industry segments, especially among SMEs.

Integration with smart city and IoT-enabled infrastructure offers significant growth opportunities for the Europe digital signage market. Government investments in urban mobility, the modernization of public transportation, and citizen engagement platforms are establishing digital displays as vital communication tools in metropolitan areas, transit hubs, and public facilities. Initiatives such as the European Data Space for Smart and Sustainable Cities and Communities, the EU Local Digital Twins Toolbox, and the Living-in program support this development.

The EU initiative promotes interoperable, AI-powered smart city solutions, with digital signage acting as the main interface for citizens. Advanced programmatic digital out-of-home (DOOH) networks optimize content based on pedestrian traffic, demographics, and environmental conditions, enhancing ad effectiveness.

Sectors such as healthcare, education, and transportation are adopting connected display systems for patient updates, campus information, and route guidance. Innovations, including SIM-enabled signage, allow deployment in previously inaccessible areas. This convergence of IoT, AR/VR, and real-time analytics represents a transformative growth opportunity for European digital signage.

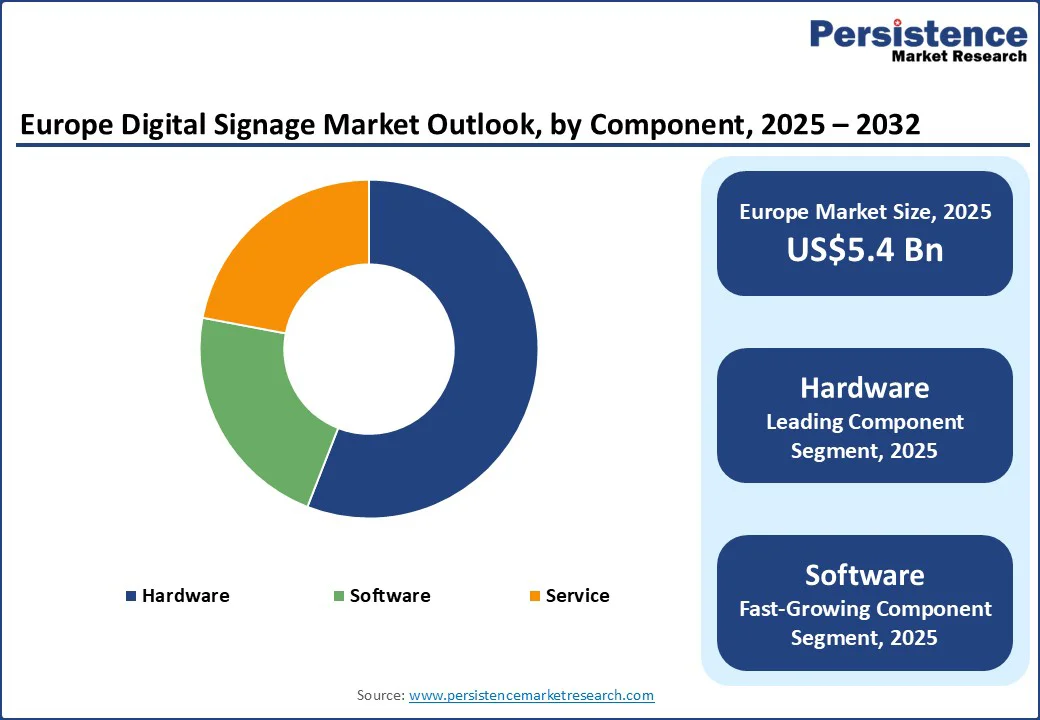

Based on component type, the market is fragmented into hardware, software, and services. In 2025, the hardware segment accounted for over 65% of the market share, underscoring the essential role of resilient display components in outdoor and high-traffic settings. Advertisers and municipalities rely on weather-proof, durable hardware to sustain continuous campaigns in major urban centers such as London, Paris, and Berlin.

To address varying climatic challenges from heavy rains in Northern Europe to intense sunlight in Southern Europe, manufacturers have introduced anti-glare screens, adaptive brightness control, vandal-resistant enclosures, and advanced cooling systems. These innovations enhance operational reliability and prolong unit lifespan, delivering high-value solutions that protect advertisers’ return on investment.

Even if software currently represents a smaller revenue share of the market, it is poised for rapid growth as companies demand data-driven marketing tools. Enterprise performance management and content management platforms enable real-time tracking of campaign metrics, dynamic messaging adjustments, and integration of loyalty program data.

European retailers and venue operators in smart stadiums, airports, and transport hubs are already leveraging these systems to optimize in-store promotions, personalize customer experiences, and demonstrate measurable ROI. The fusion of robust hardware with sophisticated software underscores a shift toward a fully integrated, intelligent digital signage ecosystem that delivers both operational efficiency and impactful marketing performance.

In 2025, the retail segment is anticipated to dominate Europe’s digital signage market with a 23.8% revenue share, driven by its integration with omnichannel strategies. Digital signage guides customers through click-and-collect services, highlights online deals, and displays real-time inventory, enhancing convenience and blending online and offline shopping experiences.

According to the European Commission, retail is one of the largest industrial ecosystems in the EU, contributing 11.5% of value added and employing nearly 30 million people across 5.5 million companies, 99% of which are SMEs.

The ecosystem generates over €1.4 billion (US$1.59 Bn) in gross value added and spans grocery and non-grocery retail, wholesale, and online platforms, while closely connecting with manufacturers, logistics providers, financial services, and retail real estate. Serving 450 million consumers daily, households spend roughly one-third of their budget in retail shops, making digital signage a critical tool for customer engagement, shaping perceptions, and driving profitability.

The transportation segment is the fastest-growing area in Europe’s digital signage market, projected to expand at an 8.3% CAGR from 2025 to 2033. Airports, train stations, and bus terminals use interactive, high-brightness screens for flight, gate, and baggage updates, wayfinding, advertising, and entertainment. These 24/7 displays improve navigation, deliver tailored content, and transform waiting periods into engaging, seamless journeys for passengers.

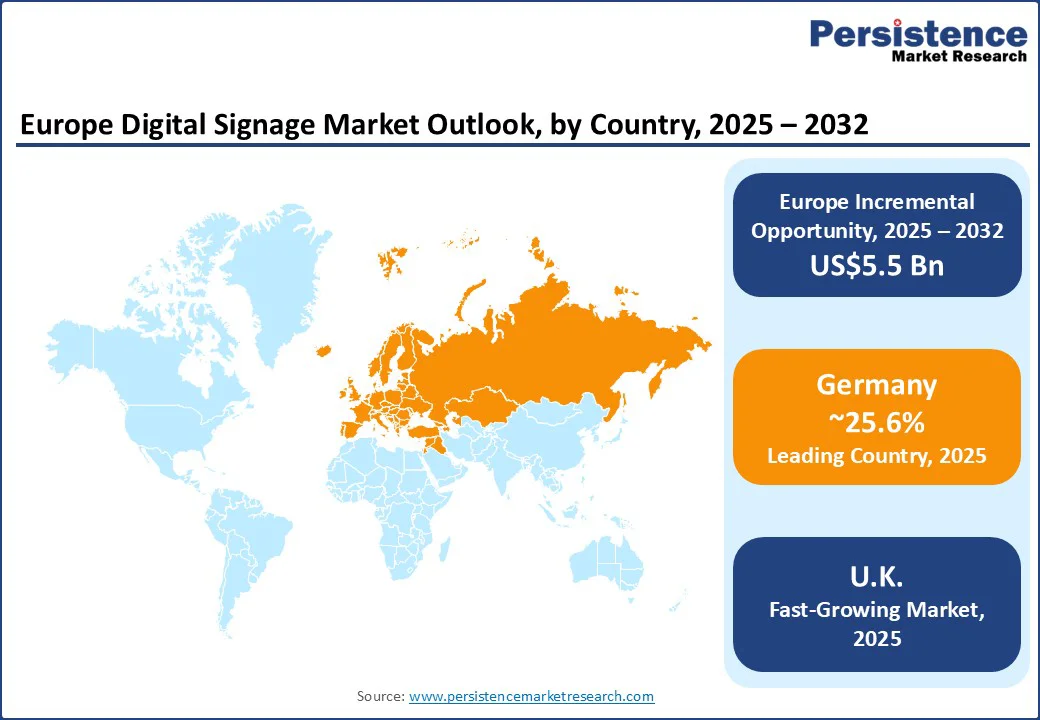

Germany is expected to dominate Europe’s digital signage market with a 25.6% revenue share in 2025, driven by the country’s focus on digitalizing transportation infrastructure and enhancing passenger experiences. Deutsche Bahn and regional transit networks deploy digital displays for real-time travel updates, platform information, and safety messaging, reducing delays and improving commuter satisfaction.

Major airports, including Frankfurt and Munich, leverage signage for multilingual navigation, dynamic advertising, and personalized passenger communication, aligning with Germany’s broader strategy of modernizing infrastructure and integrating smart technologies.

Germany is also leading in retail and in-store digital transformation. Musikhaus Thomann, a music retailer founded in 1954, partnered with digital signage provider Giada to implement a comprehensive digital transformation project.

Visual Art Germany showcases how digital in-store communication can scale from local pilots to global standards, emphasizing strategy, creativity, and integration. For global brands focused on enhancing in-store experiences, Germany is setting the benchmark for the future of digital signage.

Top digital signage software companies in Germany include VIDERO GmbH, SmilControl - Digital Signage, and m.i.b GmbH, offering innovative solutions for both transportation and retail sectors. These players support dynamic content management, interactive displays, and large-scale deployments, fueling sustained market growth.

The U.K. digital signage market is projected to grow significantly over the forecast period, led by the sports and entertainment sector. Premier League stadiums, music venues, and theaters are adopting advanced displays for live updates, interactive content, and targeted advertising, enhancing fan and visitor experiences.

These installations also create new revenue opportunities for sponsors. Ongoing investments in modernizing facilities and embracing immersive digital signage solutions are driving steady market growth and innovation across the U.K.

Europe digital signage market is becoming intensely competitive as manufacturers and solution providers emphasize innovation, partnerships, and large-scale deployments. Rising demand across retail, corporate, transportation, and sports is accelerating the shift toward interactive, scalable, and energy-efficient solutions to gain market leadership.

Europe digital signage market is estimated to be valued at US$8.1 Bn in 2025.

The widespread deployment of interactive digital signage solutions across retail, hospitality, and public infrastructure sectors is the key demand driver for the Digital Signage market.

In 2025, Germany is anticipated to dominate the Europe digital signage market with an exceeding 25.6% revenue share in the market.

Among end-use industries, the retail industry holds the highest preference, capturing beyond 23.8% of the market revenue share in 2025.

The key players in the Europe digital signage market are Samsung Electronics, NEC Display Solutions, BrightSign, LG Electronics, BenQ, Sharp Corporation, and MMD.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Hghlights |

|

By Component

By Screen Type

By Technology

By End-use Industry

Screen Size

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author