ID: PMRREP34880| 185 Pages | 28 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

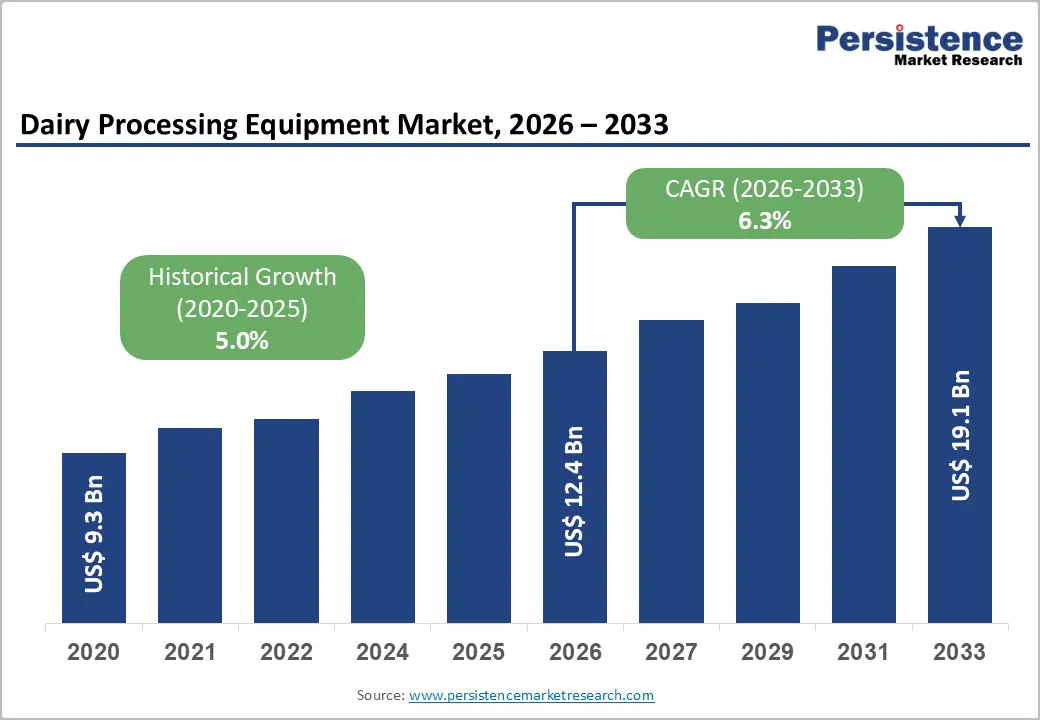

The global dairy processing equipment market size is expected to be US$ 12.4 billion in 2026 and is projected to reach US$ 19.1 billion by 2033, growing at a CAGR of 6.3% from 2026 to 2033.

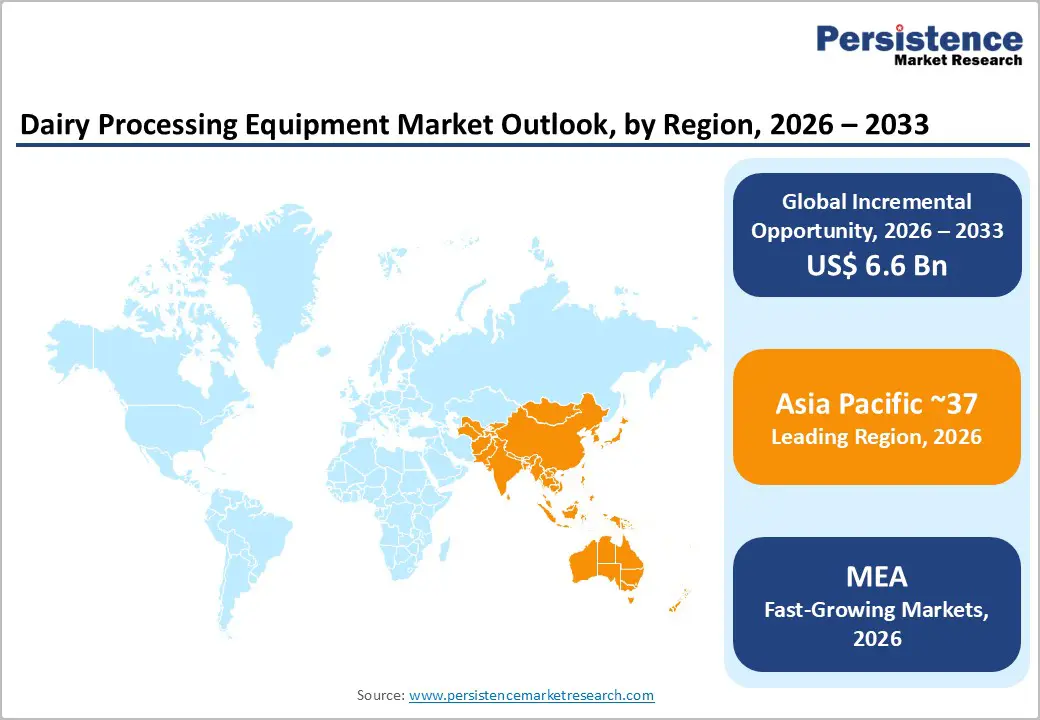

Market expansion is driven by rising dairy consumption from population growth and urbanization, stringent FDA and PMO food safety regulations requiring advanced pasteurization, and accelerating automation investments, modernizing processing facilities. North America grows at 5.5% CAGR through innovation leadership, Europe holds 24% share via manufacturing heritage and sustainability focus, while Asia Pacific leads with 37% share driven by infrastructure development.

| Key Insights | Details |

|---|---|

| Dairy Processing Equipment Market Size (2026E) | US$ 12.4 billion |

| Market Value Forecast (2033F) | US$ 19.1 billion |

| Projected Growth CAGR (2026 - 2033) | 6.3% |

| Historical Market Growth (2020 - 2025) | 5.0% |

Rising global dairy product consumption and stringent regulatory compliance requirements are systematically driving industrial dairy processing equipment investment, with global milk production supporting diverse product categories including liquid milk, cheese, yogurt, butter, and milk powder, requiring specialized processing equipment meeting FDA pasteurization mandates stipulating precise temperature and time controls as documented in 21 CFR 1240.61 supporting sustained modernization investment across facilities. Population growth and urbanization trends supporting rising dairy consumption across developing economies. Liquid milk & processed milk applications commanding 34-36% of equipment market share. Cheese, yogurt, and fermented dairy demand supporting specialized processing requirements. Extended shelf-life products requiring UHT and aseptic processing technologies. Protein enrichment and functional dairy trends driving demand for advanced separation and concentration equipment. Government dairy development programs supporting infrastructure investment particularly in emerging markets.

Membrane filtration technology advancement and widespread adoption are systematically driving equipment market expansion, with membrane filtration systems representing fastest-growing equipment segment at 8.1% CAGR and enabling 99.99% bacteria and spore removal while supporting protein concentration, water recovery, and energy efficiency improvements supporting emerging applications and equipment replacement cycles. Ultrafiltration and microfiltration enabling protein standardization and quality improvement. Nanofiltration and reverse osmosis supporting concentration and demineralization processes. Water recovery and sustainability benefits reducing operational costs and environmental impact. Flexibility in product formulation enabling dairy processors to develop value-added products. Cost-effectiveness compared to traditional evaporation supporting adoption across facility sizes. AI-driven automation integration enabling predictive maintenance and operational optimization. Energy efficiency advantages supporting sustainability goals and cost reduction.

Dairy processing equipment market expansion is constrained by substantial upfront capital requirements for advanced machinery and processing lines, with Minnesota Department of Agriculture emphasizing significant investments required by small dairy processing plants to procure pasteurizers, homogenizers, and fermentation equipment creating adoption barriers particularly for small and medium-scale dairy producers limiting market penetration in price-sensitive segments. Regulatory compliance infrastructure costs exceeding small operator budgets. Skilled workforce requirements for complex equipment operation. Extended ROI timelines of 5-10 years limiting investment justification. Maintenance and spare parts expenses creating ongoing operational costs. Technology integration complexity requiring specialized expertise. Supply chain dependencies for critical components. Currency fluctuations affecting international equipment pricing.

Dairy processing equipment market expansion is constrained by supply chain vulnerabilities affecting specialized component availability, with semiconductor and pneumatic component shortages impacting automation system deployment and advanced control system delivery limiting equipment manufacturer capacity and extending project timelines affecting customer adoption and market growth. Stainless steel material sourcing affecting equipment fabrication. Specialized gasket and seal component availability impacting hygienic equipment standards. Motor and drive system shortages affecting automation deployment. Ceramic membrane filtration component constraints limiting advanced filtration expansion. Global logistics disruptions affecting equipment delivery. Supplier consolidation reducing alternative sourcing options. Quality control challenges in component procurement.

Specialized dairy product development, including protein ingredients, functional dairy, and premium formulations, represents an emerging opportunity, with protein ingredients and functional dairy products expanding at an 8.8% CAGR, driving demand for advanced separation, concentration, and fortification equipment that enables premium, higher margin dairy processing. Whey protein and lactose production support ingredient market expansion, while functional dairy enriched with probiotics and bioactives requires precise, specialized processing control. Plant-based dairy blending demands flexible processing platforms, infant formula customization reinforces premium positioning, and sports nutrition growth accelerates functional dairy adoption. Clean label and natural ingredient preferences support traditional processing approaches, while customized fortification requirements create sustained demand for specialized equipment solutions across evolving global dairy value chains and advanced manufacturing ecosystems.

Energy efficiency and sustainability focus represent an emerging opportunity, as dairy processors invest in heat recovery systems, energy efficient evaporators, and water recycling technologies to reduce operating costs, meet environmental compliance, and enable premium pricing through differentiation. GEA low thermophile systems lower energy use in milk powder production, while heat pump integration supports sustainable processing. Water recovery reduces consumption, waste optimization advances circular economy goals, and carbon footprint reduction aligns with corporate sustainability targets. Renewable energy integration supports cleaner operations, while lifecycle assessment and environmental impact reduction strengthen brand positioning, regulatory alignment, and customer preference, creating long-term competitive advantage across global dairy processing equipment markets driven by sustainability-led investment decisions and long-horizon capital planning for future growth globally.

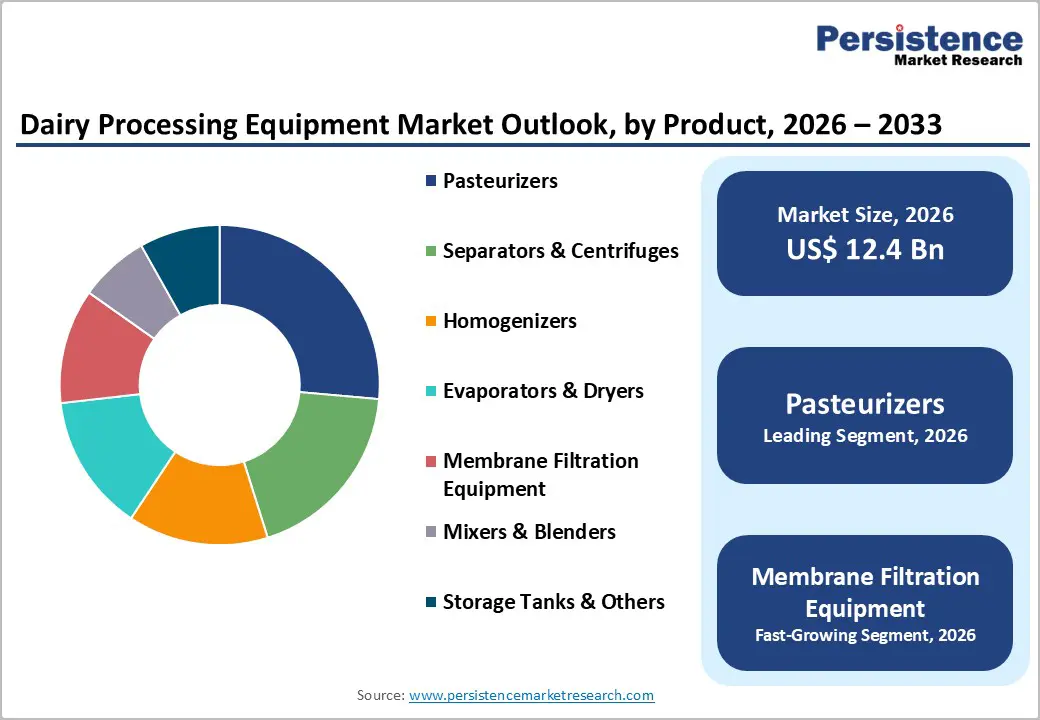

Pasteurizers command around 26% of dairy processing equipment market share, representing the dominant equipment type, reflecting fundamental regulatory requirement mandating pasteurization across all milk product processing operations, supporting consistent demand across facility sizes and product categories. Thermal pasteurization systems ensure pathogen elimination. High-temperature short-time (HTST) processing maximizing product quality. Ultra-high temperature (UHT) systems supporting shelf-stable products. Regulatory compliance assurance through FDA and PMO standards. Plate and frame heat exchangers support efficient thermal processing. Continuous monitoring and recording systems ensure regulatory documentation. Flexibility across product categories supporting diverse dairy applications.

Membrane filtration equipment is the fastest growing category at about 8.1%, driven by protein separation, water recovery, and energy efficiency, enabling specialty dairy and sustainable processing. Ultrafiltration concentrates proteins, microfiltration removes bacteria, nanofiltration supports demineralization, reverse osmosis recovers water, ceramic membranes enhance durability, modular designs add flexibility, and AI optimization maximizes efficiency across modern plants worldwide with scalable deployment capabilities.

Automatic processing systems command ~64% of market share, representing dominant operation type reflecting industry preference for continuous automated processing supporting higher throughput, consistency, and reduced labor requirements across large-scale dairy facilities supporting sustained investment in advanced automation. Continuous processing systems maximizing production efficiency. Automated control systems ensuring process consistency. Real-time monitoring and adjustment supporting product quality. Reduced operator intervention addressing labor constraints. Higher throughput capacity supporting scale economics. Consistent product quality supporting brand standards. Extended runtime capability maximizing facility utilization.

Semi-automatic systems expand at 5% CAGR, driven by small and mid-scale dairy processors seeking flexible, affordable solutions across cost-conscious and emerging markets. Lower capital investment, batch processing flexibility, simplified operation and maintenance, customizable automation levels, scalable capacity expansion, and reduced technical complexity enable balanced efficiency and cost performance, supporting broad adoption while accommodating diverse formulations, preferences, and modernization paths.

Liquid milk and processed milk applications command approximately 34% of market share, representing a dominant application reflecting the established global beverage market and fundamental pasteurization requirement across milk processing operations, supporting the largest addressable market category. Whole milk and skim milk processing support the commodity market. Standardized milk products enable consistent quality. Extended shelf-life milk supports distribution efficiency. Flavored and specialty milk beverages supporting value-added positioning. RTD (ready-to-drink) milk applications supporting convenience segments. Clean-in-place (CIP) system integration supporting operational efficiency. Regulatory compliance assurance through rigorous pasteurization standards.

Protein ingredients and functional dairy products are the fastest-growing application segment at 8.8% CAGR, driven by health and wellness demand and membrane filtration enabling protein separation and premium positioning. Growth is supported by whey proteins for sports nutrition, milk protein concentrates for beverages, probiotics, lactose-free formulations, infant formula customization, plant-based alternatives, and clean-label processing aligned with evolving consumer dietary preferences.

North America expands at a prominent 5.5% CAGR, driven by technology innovation leadership, stringent regulatory framework, sophisticated consumer preferences, and established dairy infrastructure supporting market growth and premium technology adoption across processing segments. U.S. dairy processing strength supports equipment demand across scales. FDA regulatory excellence is driving advanced processing investment. Automated facility modernization supporting labor efficiency. Specialty dairy product development supporting premium equipment adoption. Sustainable processing emphasis supporting green technology investment. Advanced automation ecosystem enabling competitive advantage. Innovation infrastructure supporting technology advancement.

The North American market is characterized by technology leadership and automation emphasis, with large-scale dairy processors investing in advanced systems. Regulatory compliance infrastructure supporting modernization. Strong R&D and innovation focus supporting specialty product development. Established supply chains and service networks supporting equipment deployment.

Europe maintains a significant share with a considerable growth pace, driven by stringent regulatory frameworks, sustainability consciousness, advanced manufacturing heritage, and strong dairy production supporting premium technology positioning and regulatory compliance emphasis. Germany manufacturing strength supports dairy equipment leadership. UK regulatory framework driving compliance-focused investment. France's sustainability focus supporting green processing technology. Spain dairy production supports regional equipment demand. EU food safety regulations driving modernization. Environmental directives supporting sustainable processing. Advanced manufacturing excellence supporting quality standards.

European market is characterized by strict regulatory compliance and sustainability emphasis with manufacturers focusing on energy efficiency and environmental impact reduction. Strong emphasis on quality and reliability supporting premium positioning. Advanced technical standards supporting specialized equipment development. Circular economy integration supports resource optimization.

Asia Pacific commands 37% share, driven by rapid dairy consumption growth, emerging market infrastructure development, manufacturing excellence, and accelerating technology adoption supporting market growth exceeding global averages. China dairy market expansion at 6.9% CAGR supporting equipment demand. India's dairy revolution at 6.4% CAGR with cooperative and private sector investment. Japan's technology leadership in dairy processing innovation. ASEAN region expansion supporting regional distribution hub development. Government dairy development programs support infrastructure investment. Manufacturing cost advantages enables competitive equipment pricing. Emerging market dairy consumption is supporting sustained growth.

The market growth in the Asia Pacific is characterized based on emerging market opportunities and growing demand. Cost-conscious procurement supporting mid-range equipment adoption. Manufacturing presence attracting equipment supplier investment. Government initiatives supporting dairy infrastructure modernization and technology adoption.

The global dairy processing equipment market exhibits a consolidated structure, led by multinational players such as GEA Group, Tetra Pak International, and Alfa Laval through integrated processing, automation, and packaging solutions, supported by specialized manufacturers including SPX FLOW, Krones AG, Paul Mueller, and Feldmeier Equipment delivering technology-focused differentiation, alongside emerging regional players such as Scherjon Dairy Equipment and IDMC Limited capturing niche opportunities through innovation and market specialization.

The global Dairy Processing Equipment Market was valued at US$ 12.4 Billion in 2026 and is projected to reach US$ 19.1 Billion.

The rise in dairy consumption and regulatory compliance, rapid adoption of membrane filtration technologies enabling high-efficiency separation, and automation and Industry 4.0 integration are improving operational efficiency and labor productivity.

The diary processing equipment market is projected to expand at a 6.3% CAGR between 2026 and 2033.

Key opportunities lie in emerging market dairy infrastructure development, rising demand for value-added and functional dairy products, and increasing investment in energy-efficient and sustainable processing technologies.

The market is led by GEA Group, Tetra Pak, and Alfa Laval, supported by SPX FLOW, Krones, Paul Mueller Company, and Feldmeier Equipment, with ongoing innovations in membrane filtration, automation, and sustainable processing solutions driving competitive differentiation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Equipment Type

By Operation Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author