ID: PMRREP28963| 190 Pages | 6 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

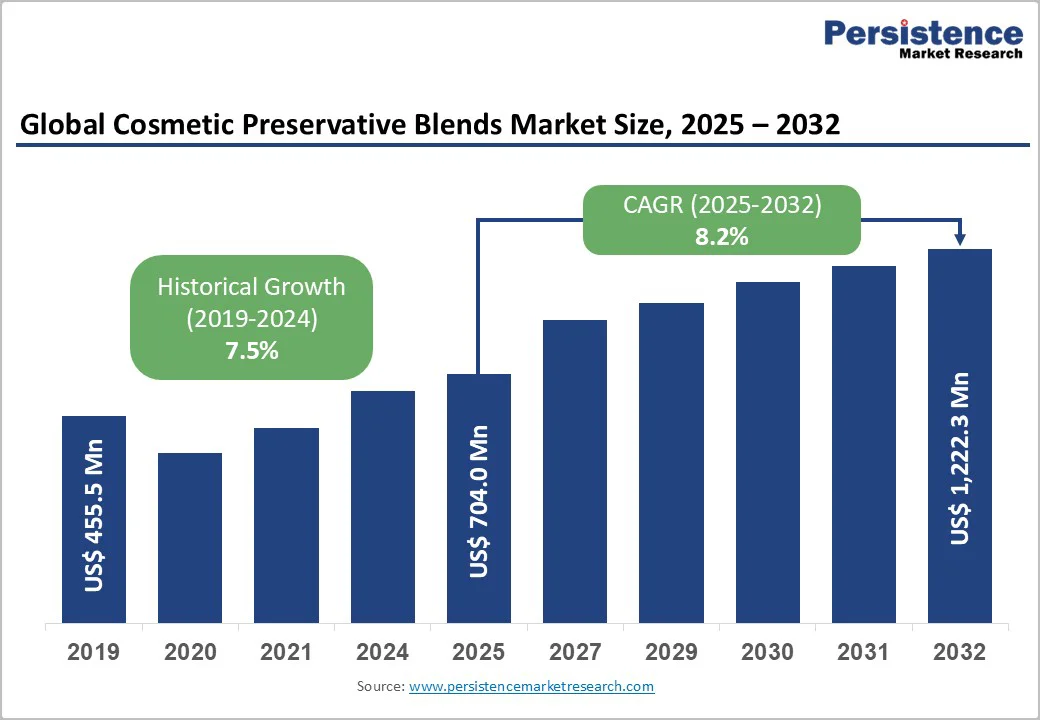

The global cosmetic preservative blends market size is likely to be valued at US$ 704.0 million in 2025, and is projected to reach US$ 1,222.3 million by 2032, growing at a CAGR of 8.2% during the forecast period 2025-2032. The growth trajectory is supported by expanding consumption of personal-care products, rising demand for clean-label formulations, and rigorous regulatory standards driving preservative complexity. The shift toward hybrid natural-synthetic preservative blends, coupled with geographic expansion in Asia Pacific and Latin America, further drives the market’s upward trend.

| Key Insights | Details |

|---|---|

| Cosmetic Preservative Blends Market Size (2025E) | US$ 704 Mn |

| Market Value Forecast (2032F) | US$ 1,222.3 Mn |

| Projected Growth (CAGR 2025 to 2032) | 8.2 % |

| Historical Market Growth (CAGR 2019 to 2024) | 7.5 % |

The accelerating demand for skincare, haircare, and toiletry products which is driven by urbanization, income growth, and evolving beauty standards, is directly boosting the need for effective preservative systems. With the market growing steadily, manufacturers are scaling production and diversifying portfolios to meet the formulation requirements of a growing and sophisticated consumer base. At the same time, product safety and shelf-life expectations are intensifying as global consumers demand longer-lasting, microbiologically stable formulations. This shift has positioned preservative blends, offering broad-spectrum antimicrobial protection, as a critical enabler of cosmetic product integrity.

The growing consumer preference for natural, “free-from,” and multifunctional cosmetics is reshaping the preservative landscape. Manufacturers are integrating botanical extracts, essential oils, organic acids, and mild synthetics to deliver broad-spectrum efficacy while maintaining clean-label claims, accelerating innovation and premiumization. Concurrently, stringent regulatory frameworks, from the European Union (EU)’s Cosmetics Regulation to the oversight of the U.S. Food and Drug Administration (FDA), are phasing out legacy preservatives such as parabens and formaldehyde donors. To comply, formulators increasingly depend on advanced, hybrid preservative blends that ensure efficacy, safety, and low irritation, thereby driving value creation and strategic supplier partnerships.

The high cost of natural and multifunctional preservative blends, coupled with raw material price volatility, poses a key challenge to market expansion. Inputs such as botanical extracts, organic acids, and specialty compounds often face supply-chain disruptions, increasing production costs and reducing margins. These pressures can deter smaller manufacturers and slow adoption in price-sensitive markets, particularly in mass and emerging segments.

Simultaneously, the growing popularity of preservative-free and minimalist formulations is reshaping consumer expectations, especially within premium skincare and niche cosmetic lines. While overall demand for preservatives remains positive, this trend has shrunk the addressable market for traditional blends, compelling manufacturers to innovate with low-dose, multifunctional, or hybrid systems to remain competitive.

The emerging economies of Asia Pacific and Latin America are witnessing rapid growth in cosmetics consumption, driven by rising disposable incomes, urbanization, and expanding middle-class populations. These markets present strong potential for preservative blend manufacturers to reach new consumers and establish long-term presence. Adapting formulations to local climatic conditions and regulatory frameworks can enhance adoption in these regions. Companies investing in regional production facilities and distribution partnerships are well-positioned to gain a competitive edge, offering cost-effective and reliable preservative solutions for diverse product categories.

Evolving consumer preferences are creating novel opportunities for next-generation preservative blends that offer multifunctional benefits such as antioxidant, soothing, or sensory enhancement properties. These advanced formulations go beyond microbial protection, supporting clean-label and high-performance cosmetic products that appeal to modern consumers. Simultaneously, the rise of specialized cosmetic sub-segments including baby care, men’s grooming, and vegan or natural beauty lines, drives the need for tailored preservative systems. Developers focusing on customized, low-irritant, and formulation-specific solutions can differentiate themselves in a crowded marketplace and capture greater value from these high-growth niches.

Synthetic preservatives continue to play a dominant role in cosmetic preservative blends due to their proven efficacy, formulation stability, and cost-effectiveness. They are widely used for their reliable antimicrobial protection and ease of incorporation into diverse cosmetic applications. Their established supply chains and regulatory approval further sustain their widespread adoption among manufacturers.

At the same time, natural preservatives are expected to generate promising prospects for market players, supported by rising consumer preference for clean-label, plant-based, and organic ingredients. These blends, often derived from botanical extracts and essential oils, align with the market’s shift toward sustainability and transparency. As regulatory and consumer trends evolve, natural preservative systems are expected to gain greater traction across premium and eco-conscious product lines.

Preservative blends designed for broad-spectrum preservation, such as microbial, fungal, bacterial control, remain the cornerstone of cosmetic formulations, ensuring safety, stability, and long shelf life across product categories. These blends are particularly valued for their effectiveness in preventing microbial, fungal, and bacterial contamination in standard cosmetic applications.

However, the market is increasingly embracing multifunctional preservative systems that combine antimicrobial action with added benefits such as antioxidant support, natural compatibility, and skin-conditioning properties. These blends align with the growing consumer demand for high-performance, low-irritant, and naturally inspired formulations, positioning multifunctional systems as the next stage of preservative innovation.

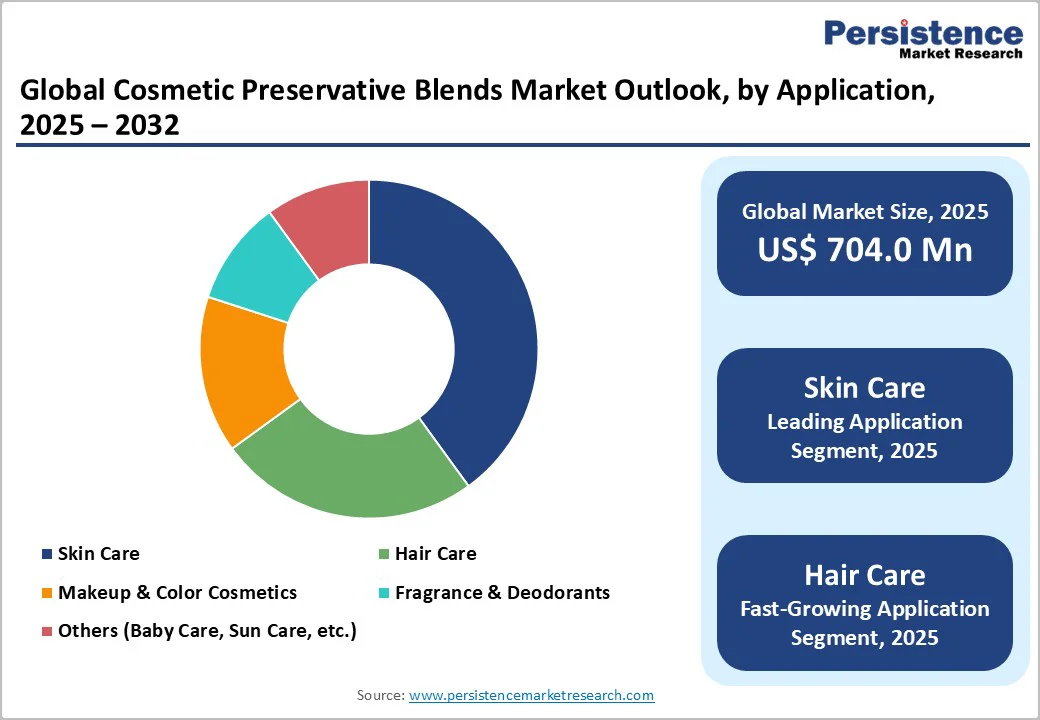

Skin and sun care products form the largest application segment for cosmetic preservative blends, as these formulations frequently involve water-based emulsions and active ingredients that require robust microbial protection. The high product diversity and continuous innovation in this segment make it a major driver of preservative-blend demand across both mass and premium product ranges.

Simultaneously, baby-care products are witnessing accelerating growth, driven by heightened health awareness among parents and the expansion of premium baby personal-care offerings. The need for gentle, hypoallergenic, and low-irritant preservative systems supports innovation in this niche, making it an attractive focus area for formulators targeting sensitive-skin applications.

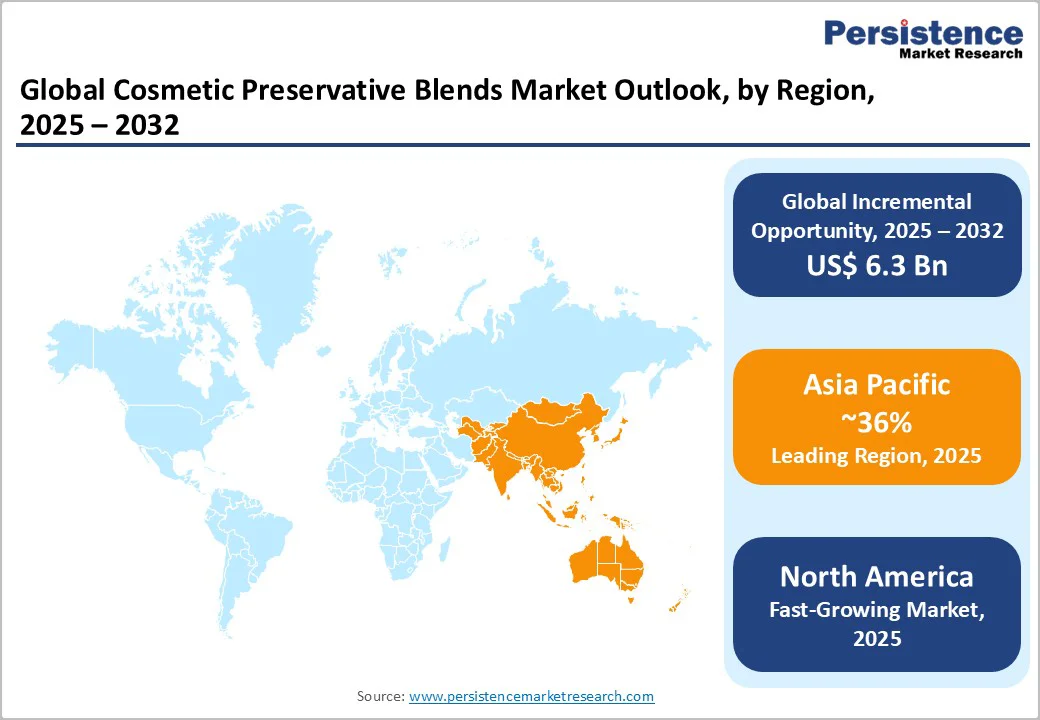

North America holds about 29% of the cosmetic preservative blends market share in 2025, powered by strong innovation, premium product positioning, and strict regulatory oversight of the FDA. Consumer demand for clean-label, safe, and high-performance cosmetics continues to heighten, bolstered by advanced research capabilities and established manufacturing infrastructure. The U.S. remains the central hub for innovation, hosting several global raw-material suppliers and formulation specialists.

Growth of this regional market is further fueled by trends such as the expansion of men’s grooming, anti-aging, and organic skincare products. Companies are actively engaging in mergers, acquisitions, and partnerships to strengthen their natural-preservative portfolios. However, market maturity and pricing pressure have created a competitive environment where differentiation relies heavily on product innovation and compliance with evolving safety regulations.

Europe remains one of the most established markets for cosmetic blends, holding about 27% of the global market share in 2025, aided by a robust cosmetics industry, stringent regulations of the EU, and consumer inclination toward eco-friendly products. Germany, the U.K., and France serve as key centers for manufacturing, innovation, and luxury product development. The regulatory framework encourages the shift from conventional preservatives to safer and naturally derived alternatives.

Regional cosmetic preservative blends market growth is underpinned by increasing e-commerce adoption, premium skincare trends, and collaborations between botanical extract producers and preservative formulators. Companies focusing on certified natural, vegan, and eco-labeled blends are well-positioned to benefit. While the expansion trajectory is steady, Europe continues to prioritize sustainability and regulatory compliance as the foundation for competitive success.

Asia Pacific is emerging as the most dynamic market for cosmetic preservative blends, accounting for about 36% of the market in 2025, driven by rising disposable incomes, rapid urbanization, and an expanding young population base. Countries such as China, Japan, India, and members of ASEAN are witnessing a surge in the demand for skincare, haircare, and clean-label cosmetic products. This momentum is reinforced by strong local manufacturing ecosystems and a flourishing e-commerce landscape.

As regulatory frameworks mature, local and global players are investing in regional R&D and production facilities to align with evolving safety standards. Partnerships with botanical extract suppliers and the introduction of region-specific preservative formulations are becoming key strategies. The region’s combination of scale, affordability, and innovation potential positions it as a central growth engine for the global preservative blends market.

The global cosmetic preservative blends market structure features moderate consolidation with strong competition among major multinational ingredient companies and emerging regional suppliers. Leading players such as BASF, Clariant, Lonza, and Ashland dominate through advanced formulation expertise, regulatory compliance, and innovation in natural and multifunctional preservative systems.

In Asia Pacific, smaller regional firms are gaining traction with cost-effective, plant-based blends catering to local cosmetic brands. Competition is intensifying as manufacturers focus on clean-label, sustainable, and hybrid preservative technologies. Strategic initiatives such as R&D investment, acquisitions, and brand partnerships are central to maintaining market leadership and responding to evolving consumer and regulatory demands.

• BASF SE

• Ashland Inc.

• Clariant AG

• Lonza Group

• Croda International Plc

• Ashland Specialties India Pvt Ltd

• Evonik Industries AG

• Ikeda Chemical Co., Ltd.

• Kao Corporation

• Symrise AG

• Clariant India Ltd

• Gattefossé

The global cosmetic preservative blends market is estimated to reach US$ 704 million in 2025.

Rising consumption of personal-care products, the shift toward clean-label and multifunctional formulations, and regulatory emphasis on product safety and microbial integrity are driving the market.

The market is poised to witness a CAGR of 8.2% from 2025 to 2032.

Expanding cosmetic production and local brand development in Asia Pacific and Latin America are accelerating adoption, and innovations in multifunctional and hybrid preservative systems are presenting strong potential for product differentiation and premium positioning.

Some of the leading market players include BASF SE, Clariant AG, Ashland Inc., Lonza Group, Symrise AG, and Thor Group Ltd.

|

Report Attribute |

Details |

|---|---|

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Material Type

By Application

By Functionality

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author