ID: PMRREP35662| 189 Pages | 26 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

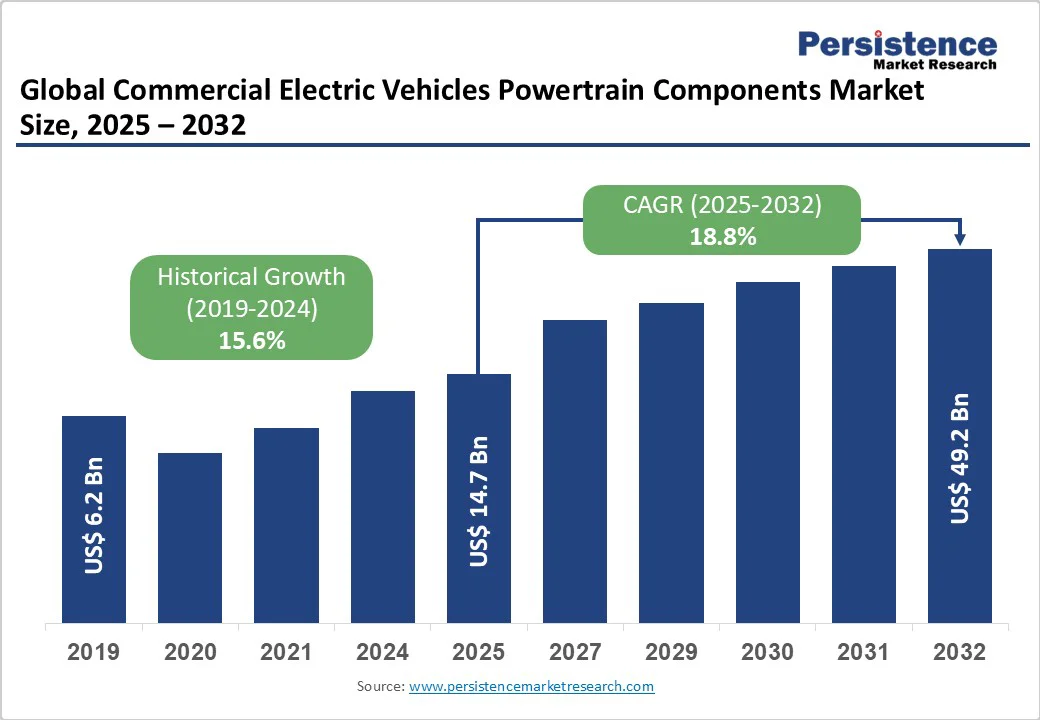

The global commercial electric vehicles powertrain components market size is likely to value at US$ 14.7 Bn in 2025, and is expected to reach US$ 49.2 Bn by 2032, growing at a CAGR of 18.8% during the forecast period from 2025 to 2032. Improvements in battery technology, such as higher energy density, fast-charging capabilities, and modular e-axle systems encourage the market growth.

| Key Insights | Details |

|---|---|

|

Commercial Electric Vehicles Powertrain Components Market Size (2024A) |

US$ 12.7 Bn |

|

Estimated Market Size (2025E) |

US$ 14.7 Bn |

|

Projected Market Value (2032F) |

US$ 49.2 Bn |

|

Value CAGR (2025 to 2032) |

18.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

15.6% |

The increasing shift of leading original equipment manufacturers (OEMs) toward electrifying their commercial vehicle portfolios is a key factor driving the global electric commercial vehicle (ECV) powertrain components market. Companies such as Daimler Truck, Volvo Group, Ford, Tata Motors, Mahindra, and BYD are making substantial investments in vehicle electrification and have announced plans to transition their fleets to fully electric or hybrid commercial vehicles to support the development of zero-emission commercial vehicles.

For instance, Volvo Trucks recently launched the FM 4×2 Electric Highway Tractor at the Bharat Mobility Global Expo 2024, specifically aiming at regional haulage and logistics operations in India. The company has also announced a 600 km-range electric truck and, in partnership with Renault, initiated Flexis SAS, a joint venture focused on next-generation electric vans, further expanding its electric offerings.

Daimler Trucks is also enhancing its electrification efforts through strategic collaborations with companies like DHL and Hylane for fully electric logistics fleets. They plan to launch the eCanter electric truck in India within the next 6 to 12 months. Tata Motors unveiled six new electric commercial vehicles (CVs) at the Auto Expo 2025, including the Ace Pro, which is branded as India’s most affordable four-wheel mini electric truck. This trend toward electrification will drive the commercial electric vehicle powertrain components market across the globe.

The complexity of high-voltage cabling and system integration represents a significant challenge for the electrification of commercial vehicle powertrains, particularly in heavy-duty applications. Heavy-duty electric vehicles (EVs) require thick, rigid cables that can handle high current loads and must be routed through constrained and non-linear chassis spaces. This complexity makes the installation process labor-intensive, time-consuming, and prone to design inefficiencies.

Unlike passenger EVs, heavy-duty commercial vehicles encounter greater spatial and thermal management challenges, making cable routing and component placement more demanding. Traditional methods of integrating these cables not only prolong production times but also increase manufacturing and maintenance costs, ultimately reducing the cost-efficiency of electrified solutions.

The rising shift toward electric commercial fleets in e-commerce, quick delivery, and last-mile logistics presents a significant growth opportunity for the global electric vehicle (EV) powertrain components market. The rapid expansion of e-commerce, especially following global events that accelerated online shopping, has accelerated the need for sustainable delivery solutions. Major e-commerce companies are partnering with original equipment manufacturers (OEMs) and logistics firms to deploy electric commercial vehicles as a way to decarbonize their fleet operations.

For example, in January 2025, Amazon placed its largest-ever order for electric trucks, requesting over 140 Mercedes-Benz eActros 600 electric heavy goods vehicles (HGVs) and eight Volvo FM Electrics in the U.K.

This initiative is part of Amazon’s £300 million investment in green transportation aimed at reducing its carbon footprint. VECV's Eicher Trucks and Amazon have announced a collaboration to deploy up to 1,000 electric trucks across various payload categories over the next five years. In May 2025, Volvo Trucks received an order of 30 e-trucks from Linfox, an Australian-based logistics company. These strategic collaborations are establishing a strong and growth outlook for the global commercial electric vehicle (EV) powertrain components market.

The integration of wide-bandgap semiconductors, particularly gallium nitride (GaN) and silicon carbide (SiC), is a significant trend that transforms the commercial electric vehicle (EV) powertrain components industry. These advanced materials are changing EV power systems by providing faster switching speeds, reduced energy losses, and improved thermal conductivity compared to traditional silicon-based components. This transition allows for the development of more compact and efficient inverters, onboard chargers, and DC-DC converters, which are essential components in commercial EV powertrains.

These semiconductors are crucial for advancing vehicle electrification, especially for commercial EVs, where high performance, durability, and energy efficiency are vital. As the demand for high-power, long-range commercial EVs continues to rise, the adoption of GaN and SiC-based powertrain components is expected to accelerate, fostering innovation and competitiveness in the global market.

Battery packs are expected to dominate the global commercial EV powertrain components market, contributing around 23% of the global market share in 2025. These packs are essential for powering the electric drivetrain and determining key metrics such as range, energy efficiency, and vehicle performance. Lithium-ion battery chemistries, especially LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt), are leading the market due to their optimal balance of cost, safety, and energy density.

The increasing demand for electrifying heavy-duty trucks, city buses, and delivery vans is driving the development of modular, high-voltage battery systems. Manufacturers are also more frequently adopting battery pack standardization and vertical integration strategies to enhance cost efficiency and supply chain security. Battery packs remain the most expensive component of commercial EVs, making them key to OEMs’ cost-cutting plans and innovation roadmaps.

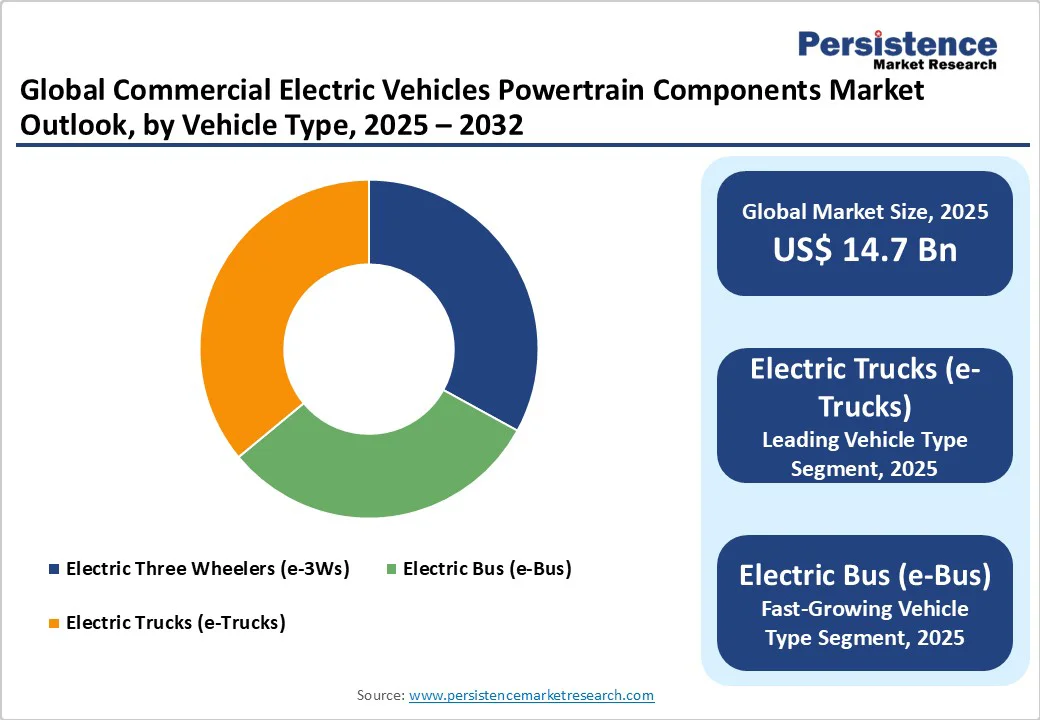

Electric trucks (e-Trucks) are expected to lead the commercial EV powertrain components market by capturing around 36% of global market share in 2025. The rise of zero-emission freight transport, supported by government incentives and emission regulations, is driving rapid electrification in medium- and heavy-duty trucking segments. Logistics and e-commerce companies are investing in electric trucks for regional and urban delivery, while fleet operators are piloting long-haul electric trucks with extended range capabilities.

Key OEMs such as Volvo, Daimler, Tesla, and BYD are scaling production of light to heavy-duty electric trucks, with partnerships across component suppliers such as Dana, BorgWarner, and ZF. Advancements in battery-swapping, fast charging, and integrated drive units are further accelerating e-truck adoption, especially in regulated markets like North America and Europe.

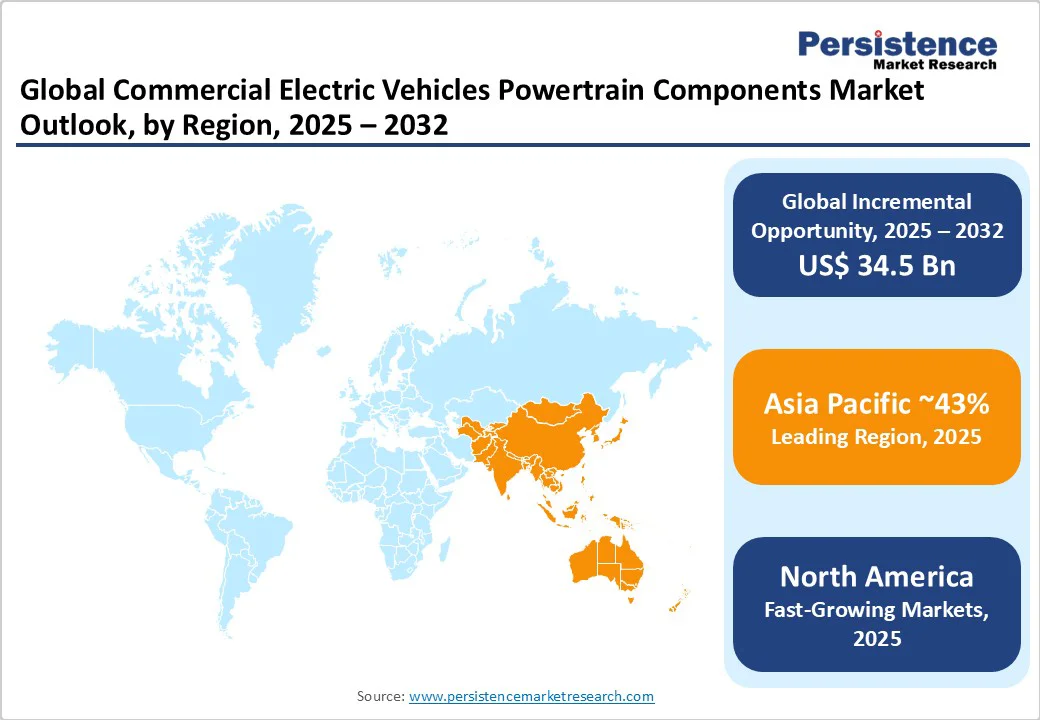

The commercial EV powertrain components market in North America is projected to be the fastest-growing market, with a CAGR of 20.3% from 2025 to 2032. This growth is driven by strong policy support under the U.S. Inflation Reduction Act (IRA), California’s Advanced Clean Trucks (ACT) regulation, and Canada’s Zero-Emission Vehicle (ZEV) mandates. North American OEMs and Tier-1 suppliers are heavily investing in electrified platforms for trucks, buses, and delivery vans.

Companies such as Cummins, Dana Inc., BorgWarner, and Allison Transmission are expanding their powertrain portfolios to include e-axles, inverters, and integrated drive units tailored for regional demands. Additionally, the rapid growth of e-commerce and last-mile delivery fleets is boosting demand for light- and medium-duty electric vehicles, creating a robust ecosystem for commercial EVs and their core components.

Asia Pacific is expected to lead the global commercial EV powertrain components market, capturing nearly 43% of the market share in 2025. This dominance is driven by robust policy support, advanced manufacturing ecosystems, and early adoption of electric mobility in both public and private transportation sectors. Countries such as China, India, and Japan are high-potential markets for commercial EVs, particularly in the three-wheeler, electric bus, and light-duty segments.

Government incentives, domestic battery production, and an increasing demand for ECVs from public transport and last-mile delivery companies further reinforce their position. Asia Pacific’s vertically integrated supply chains, skilled workforce, and lower production costs make it one of the key regions in the global commercial EV powertrain component supply, both in terms of volume and innovation.

The global commercial electric vehicles powertrain components market is witnessing intense competition as key automakers, specialized EV component manufacturers, and emerging regional players increasingly vie for market share. This evolving landscape is characterized by rapid technological innovation, strategic collaborations, and capacity expansions focused on electrifying medium- and heavy-duty vehicles across logistics, public transportation, and industrial applications.

Prominent players such as BorgWarner Inc., Dana Incorporated, ZF Friedrichshafen AG, Bosch Mobility Solutions, and Valeo continue to lead the market through integrated product portfolios. These companies leverage their global manufacturing footprint, R&D capabilities, and long-term OEM partnerships to develop scalable and modular electric powertrain platforms tailored for commercial applications.

The global market is projected to be valued at US$ 14.7 Bn in 2025.

Electric trucks (e-Trucks) are expected to lead the commercial EV powertrain components market by capturing around 36% of global market share in 2025.

The commercial EV powertrain components market is poised to witness a CAGR of 18.8% from 2025 to 2032.

Robust electrification of commercial vehicles by leading OEMs, fuelling demand for powertrain components

Growing adoption of electric fleets in E-commerce, quick delivery, and last-mile logistics creates growth opportunities for commercial electric vehicles' powertrain components.

Key market players include Bosch Mobility, Dana Incorporated, ZF Friedrichshafen AG, BorgWarner Inc., and Eaton Corporation, etc.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Billion for Value Units for Volume |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

By Component Type

By Propulsion Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author