ID: PMRREP32715| 289 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

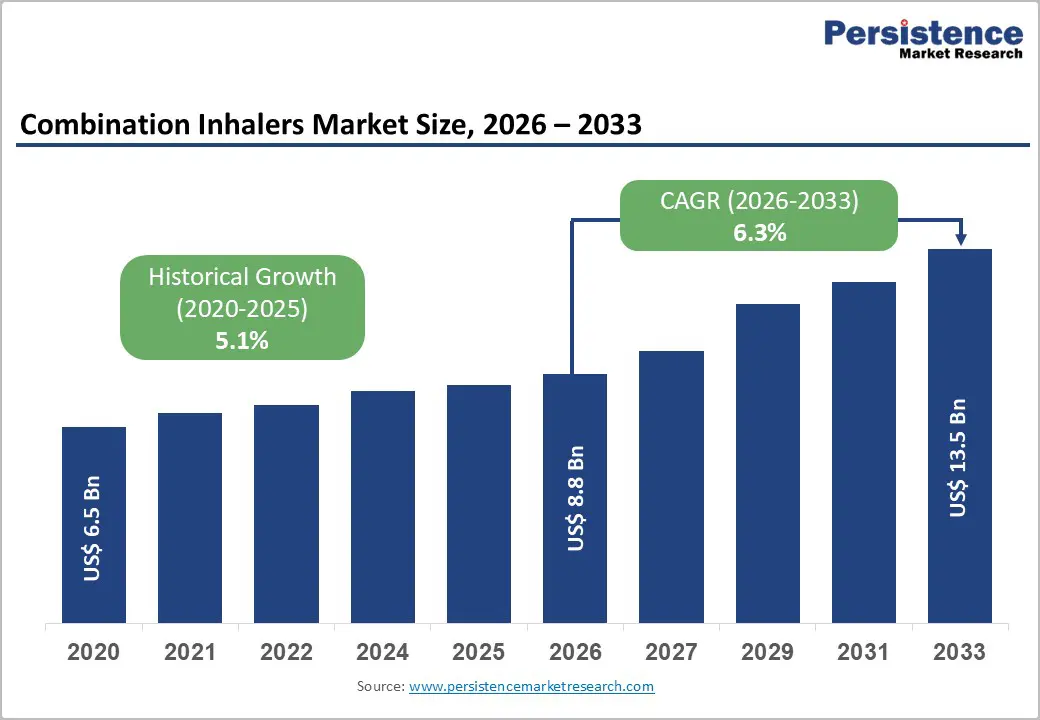

The global Combination Inhalers market size is expected to be valued at US$ 8.8 billion in 2026 and projected to reach US$ 13.5 billion by 2033, growing at a CAGR of 6.3% between 2026 and 2033.

Market expansion is fundamentally driven by escalating prevalence of chronic respiratory diseases including asthma and chronic obstructive pulmonary disease affecting over 400 million patients globally, combined with increasing adoption of fixed-dose combination inhalers offering superior clinical efficacy, improved patient convenience, and enhanced medication adherence. The global COPD and asthma therapeutics market demonstrates robust growth with combination therapies commanding approximately 40% of the respiratory medications market, reflecting widespread recognition of combination therapy superiority in managing moderate to severe disease. Technological advancements in inhaler device design, including enhanced dry powder inhaler formulations and next-generation metered-dose inhalers, continue to support market expansion across diverse geographic regions and patient populations.

| Key Insights | Details |

|---|---|

|

Combination Inhalers Market Size (2026E) |

US$ 8.8 billion |

|

Market Value Forecast (2033F) |

US$ 13.5 billion |

|

Projected Growth CAGR (2026-2033) |

6.3% |

|

Historical Market Growth (2020-2025) |

5.1% |

The exponential growth in respiratory disease incidence represents the most significant market growth driver for combination inhalers globally. According to the World Health Organization, asthma affects approximately 262 million individuals worldwide with approximately 3.9 million deaths annually, while COPD impacts over 400 million patients representing the third leading cause of death globally. The Global Burden of Disease Study indicates respiratory disease prevalence is accelerating in emerging markets due to urbanization, air pollution, smoking patterns, and increasing disease awareness. Clinical evidence demonstrates that combination inhalers provide superior disease management compared to monotherapy, with fixed-dose ICS/LABA combinations reducing asthma exacerbations by approximately 50-60% compared to monotherapy alternatives. Government health initiatives promoting COPD and asthma detection, management guidelines recommending combination therapy, and expanding healthcare accessibility in developing nations are substantially elevating global demand for convenient, effective combination inhaler solutions.

The substantial clinical and economic benefits associated with improved medication adherence represent a transformational growth driver for combination inhalers. Patient adherence to respiratory medications remains suboptimal, with approximately 50-60% of asthma and COPD patients exhibiting non-compliance with prescribed therapies, leading to increased exacerbations, hospitalizations, and healthcare costs. Fixed-dose combination inhalers simplify treatment regimens by consolidating multiple medications into single devices, reducing daily medication burden and substantially improving patient compliance. According to healthcare literature, combination inhalers demonstrate 20-35% improvement in adherence rates compared to multi-inhaler regimens requiring separate administration. The 2024 GINA (Global Initiative for Asthma) guidelines recommend ICS/formoterol combinations as maintenance-and-reliever therapy across disease severities, supporting expanded combination inhaler adoption. Healthcare systems increasingly recognize that simplified treatment regimens translate to improved clinical outcomes, reduced healthcare expenditures, and enhanced quality of life for respiratory disease patients.

Combination inhaler development requires substantial research and development investment encompassing drug formulation optimization, device engineering, regulatory compliance, and comprehensive clinical validation. The complexity of combining multiple active pharmaceutical ingredients within fixed-dose formulations necessitates advanced pharmaceutical expertise and specialized manufacturing infrastructure. Regulatory approval pathways for combination inhalers are stringent, requiring separate safety and efficacy assessments for novel combinations, clinical endpoint demonstration, and comprehensive bioavailability and bioequivalence studies across diverse patient populations.

Multiple major combination inhalers have recently experienced patent expirations or face imminent expiration, including established ICS/LABA combinations that historically generated substantial pharmaceutical revenue. Generic and biosimilar competitor entry following patent expiration significantly compresses pricing and reduces pharmaceutical margins, particularly impacting emerging market profitability. Manufacturing complexity and specialized regulatory requirements for generic combination inhalers create entry barriers, but lower-cost competitor alternatives still constrain pricing power for established branded products.

Significant growth opportunities exist for pharmaceutical manufacturers developing next-generation triple combination inhalers optimized for treatment of moderate to severe COPD. According to clinical literature, triple combination therapies combining ICS/LABA/LAMA demonstrate superior efficacy in reducing exacerbations by approximately 27% compared to LABA/LAMA combinations while improving lung function and quality of life metrics. The ETHOS, IMPACT, and TRILOGY clinical trials established triple therapy efficacy in symptomatic COPD patients with exacerbation history, supporting expanded adoption. Current market analysis indicates triple combination products represent one of the fastest-growing segments at approximately 8.4% CAGR, driven by disease severity awareness and guideline recommendations supporting triple therapy in moderate-severe disease management. Manufacturers developing innovative delivery mechanisms, improved pulmonary bioavailability, and enhanced safety profiles through advanced triple combinations can establish competitive advantages in premium-priced therapeutic segments.

Substantial growth opportunities exist for combination inhaler manufacturers developing cost-effective solutions optimized for emerging market requirements across India, China, Southeast Asia, and Latin America. According to regional market analysis, Asia-Pacific demonstrates 7.8% CAGR growth, driven by expanding middle-class populations, increasing healthcare investment, and disease awareness in rapidly developing economies. Generic fixed-dose combination manufacturers focusing on cost optimization while maintaining quality standards can capture market share among price-sensitive patient segments in emerging regions. Strategic partnerships with regional pharmaceutical companies, government health programs, and community health initiatives facilitate market penetration. Development of simplified multi-dose devices and patient education programs supporting proper inhaler technique adoption can accelerate adoption in resource-constrained healthcare settings.

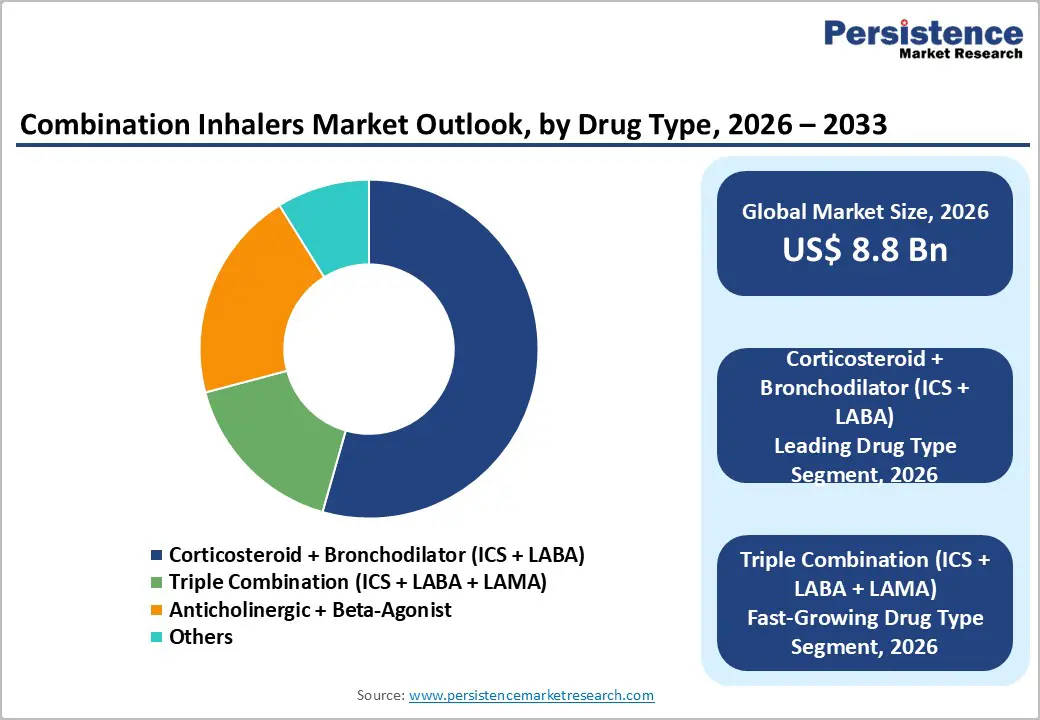

Within drug type category, Corticosteroid + Bronchodilator (ICS + LABA) dominates the market with 43% market share in 2025, reflecting the established efficacy, proven safety profile, and widespread clinical acceptance of this combination across asthma and COPD treatment guidelines. ICS/LABA combinations have demonstrated superior clinical efficacy for over two decades, with extensive evidence supporting reduction in exacerbations, improvement in lung function, and quality of life enhancement. Major pharmaceutical manufacturers including GlaxoSmithKline, AstraZeneca, and Boehringer Ingelheim maintain established market positions through branded products while generic competition has expanded market accessibility. The fastest-growing drug type segment is Triple Combination (ICS + LABA + LAMA), projected to expand at approximately 8.4% CAGR (2025-2032), driven by clinical efficacy demonstration in moderate to severe COPD and emerging adoption as asthma therapy for patients with persistent airflow limitation.

By device type, Metered Dose Inhalers (MDIs) represent the leading segment, capturing approximately 47% market share in 2025, reflecting the widespread deployment, patient familiarity, cost-effectiveness, and technological maturity of pressurized MDI platforms. MDIs remain the dominant delivery mechanism for combination therapies, with extensive formulation optimization and device innovation supporting clinical efficacy across diverse patient populations. The fastest-growing device type segment is Dry Powder Inhalers (DPIs), projected to expand at approximately 7.2% CAGR (2025-2032), driven by patient preference for breath-actuated systems reducing coordination requirements, technological advancement in multi-dose dry powder formulations, and improved deposition efficiency for combination drugs.

By distribution channel, Retail Pharmacies command the leading position with approximately 52% market share in 2025, reflecting traditional healthcare infrastructure reliance on community pharmacies for prescription dispensing, patient counseling, and treatment support. Retail pharmacies maintain established relationships with patients and prescribing physicians supporting continued dominance despite emerging digital health trends. The fastest-growing distribution segment is Online Pharmacies, projected to expand at approximately 9.3% CAGR (2025-2032), driven by accelerated e-commerce adoption, convenient home delivery, privacy preferences, and emerging regulatory frameworks enabling digital pharmaceutical distribution in developed and emerging markets.

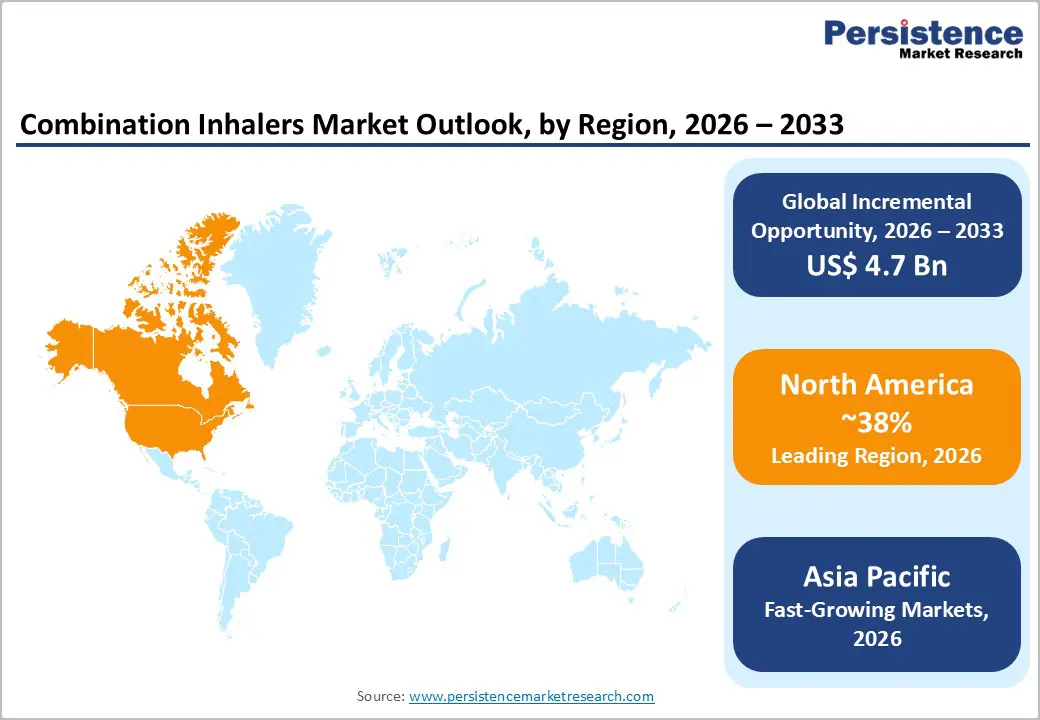

North America commands approximately 38% global market share in 2025, supported by substantial patient population with asthma and COPD prevalence, established healthcare infrastructure, robust pharmaceutical innovation ecosystem, and comprehensive insurance coverage supporting medication accessibility. The United States represents the region’s dominant market with approximately 25 million asthma patients and 15 million COPD patients requiring ongoing pharmaceutical management. Major pharmaceutical manufacturers including AstraZeneca, GlaxoSmithKline, and Novartis maintain significant North American operations supporting product development, regulatory approval, and market expansion.

North American regulatory frameworks emphasizing evidence-based medicine and guideline adherence drive adoption of combination inhalers as preferred treatment approaches. Clinical practice increasingly incorporates ICS/formoterol as maintenance-and-reliever therapy across asthma severities, with expanded adoption of triple combinations in COPD patient populations. Insurance coverage policies prioritizing cost-effective combination therapy deployment and favorable reimbursement environments support sustained market growth in North America.

Asia Pacific emerges as the fastest-growing regional market, projected to expand at approximately 7.8% CAGR (2025-2032), driven by rapidly expanding patient populations with asthma and COPD, accelerating disease awareness, healthcare infrastructure development, and government initiatives promoting respiratory disease management. China and India represent the largest regional markets with expanding disease prevalence driven by urbanization, air pollution, and smoking patterns. According to regional analysis, India and China combined represent over 40% of global asthma and COPD burden, creating substantial market demand for affordable combination inhaler solutions.

Manufacturing capabilities in Asia-Pacific support cost-effective combination inhaler production, with companies including Cipla, Dr. Reddy’s Laboratories, and Lupin Limited establishing strong regional market positions. Government healthcare initiatives including Universal Health Coverage expansion in India and medical insurance programs in China increase medication accessibility. Strategic localization efforts and development of simplified combination inhaler formulations optimized for emerging market requirements facilitate accelerated regional market penetration.

The global combination inhalers market exhibits consolidation among multinational pharmaceutical manufacturers and growing participation from emerging market-focused generic manufacturers. Competitive strategies emphasize innovation in combination formulations, device technology advancement, and emerging market penetration. Key differentiators include clinical efficacy data, device usability, regulatory approvals, and pricing strategies aligned with regional healthcare systems.

The global Combination Inhalers Market is projected to reach US$ 8.8 billion in 2026, up from US$ 6.5 billion in 2020, with expansion driven by escalating asthma and COPD prevalence affecting over 400 million patients globally, improved patient adherence through simplified treatment regimens, and technological advancement in inhaler device design.

Key demand drivers include escalating prevalence of chronic respiratory diseases particularly asthma and COPD affecting millions globally, increasing adoption of fixed-dose combination inhalers offering superior clinical efficacy and improved patient convenience.

North America currently leads with approximately 38% market share in 2025, supported by substantial patient populations with asthma and COPD, established healthcare infrastructure, robust pharmaceutical innovation ecosystem, and comprehensive insurance coverage facilitating medication accessibility.

Development of advanced triple combination therapies optimized for moderate-to-severe COPD and asthma-COPD overlap management represents the most attractive opportunity, with triple combinations demonstrating superior efficacy in reducing exacerbations and improving patient outcomes.

Key players include AstraZeneca, GlaxoSmithKline, Novartis, Boehringer Ingelheim, Chiesi Farmaceutici, Cipla, Dr. Reddy’s Laboratories, Lupin, and Teva Pharmaceutical, among others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Mn/Bn, Volume: As Applicable |

|

Geographical Coverage |

North America, Europe, East Asia, South Asia and Oceania, Latin America, Middle East and Africa |

|

Segmental Coverage |

Drug Type; Device Type; Distribution Channel |

|

Competitive Analysis |

Novartis AG, AstraZeneca plc, GlaxoSmithKline plc, Viatris Inc., Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim, Chiesi Farmaceutici S.p.A., Dr. Reddy’s Laboratories, Cipla Ltd. |

|

Report Highlights |

Market Forecast and Trends, Competitive Intelligence & Share Analysis, Growth Factors and Challenges, Strategic Growth Initiatives, Pricing Analysis, Future Opportunities and Revenue Pockets, Market Analysis Tools |

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author