ID: PMRREP35706| 189 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

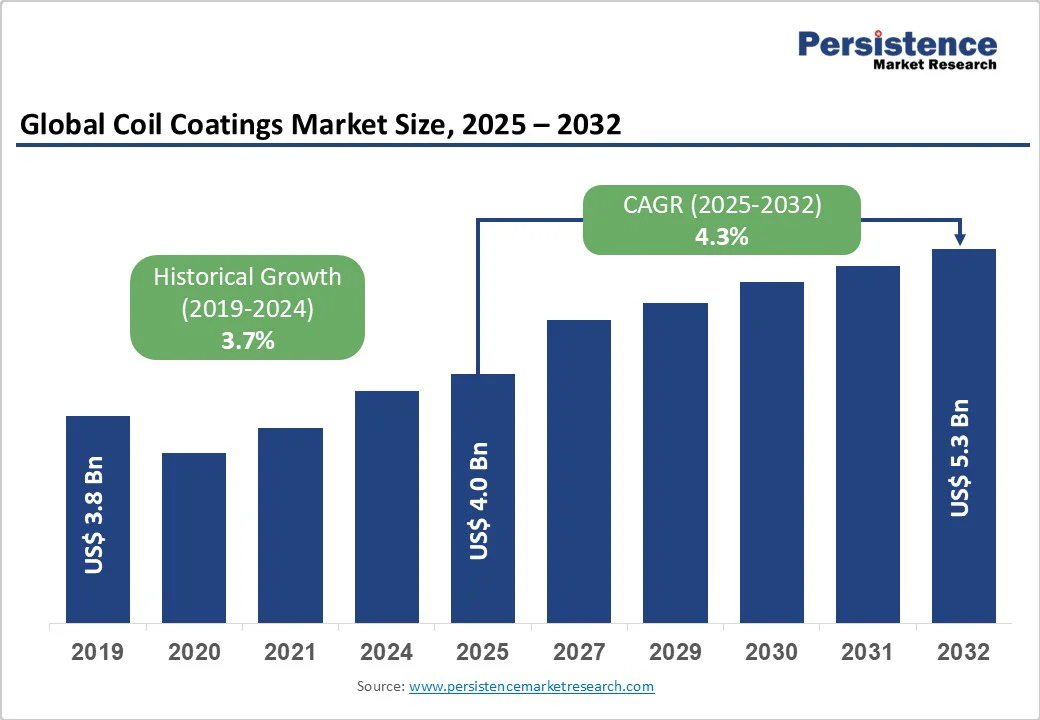

The global coil coating market size is likely to be valued at US$4.0 billion in 2025 and is projected to reach US$5.3 billion by 2032, growing at a CAGR of 4.3% between 2025 and 2032. Several factors underpin this market trajectory. Demand is strongly supported by investments in the building and construction sector, particularly in large infrastructure projects across India, East Asia, and the Middle East.

| Key Insights | Details |

|---|---|

|

Coil Coatings Market Size (2025E) |

US$4.0 Bn |

|

Market Value Forecast (2032F) |

US$5.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.7% |

Technological advancement in coil coating is characterized by the emergence of energy-efficient, UV/EB curing systems and low-VOC products that align with tightening global environmental regulations. For example, PPG’s DuraNEXT™ portfolio, launched in 2024, provides fast-curing coil coatings that significantly reduce CO2 emissions and energy consumption.

Beckers’ FutureLab innovation center, launched in 2024, focuses on next-generation sustainable solutions. Regulatory pressure is also shaping innovation. In the EU, frameworks such as the European Green Deal aim to reduce greenhouse gas emissions by 55% by 2030, underscoring the need for carbon-reducing technologies in surface finishing.

For coil coating producers, the adoption of energy-saving curable coatings translates into lower operational costs and improved sustainability credentials, offering a market-aligned pathway for growth.

The construction industry remains the largest consumer of coil-coated materials, particularly for roofing, siding, and wall panels. India, for instance, allocated US$133 billion to capital expenditure in FY2024–25, accounting for 3.4% of GDP, directed at housing, logistics, and infrastructure projects.

The U.S. market demonstrated total construction spending of US$2.2 trillion in 2024, equivalent to 4.5% of GDP, supporting strong end-use material requirements. At a global level, the steel industry allocated 52% of its apparent usage in 2023 to buildings and infrastructure, highlighting a structural connection between steel demand and coating consumption. The market implication is a stable consumption base, reinforced by urbanization, government housing programs, and durable infrastructure pipelines.

The automotive and transportation sectors represent a critical downstream driver of coil-coated sheet demand. In 2024, global car sales reached 74.6 million units, a 2.5% increase from 2023. China alone sold 23 million cars, accounting for approximately 31% of international sales.

Vehicle production reached 75.5 million units, with China leading at 35.4% of global production share. Coil-coated steel sheets are essential for structural durability, anti-corrosion performance, and aesthetics in transportation applications.

With India emerging as the third-largest heavy truck manufacturer globally and growing investments in electric mobility, such as EV opportunities worth US$206 billion by 2030, long-term demand appears structurally aligned between mobility trends and coil coating applications.

Environmental compliance is a significant barrier across advanced economies. Regulations in the EU and the U.S. mandate strict low-VOC and sustainable manufacturing practices, compelling manufacturers to invest in costly research and development (R&D). Initiatives such as the EU Emissions Trading System (ETS) further elevate compliance costs.

At the same time, U.S. EPA standards demand tighter emissions monitoring. Transitioning to water-based or bio-based resin systems requires capital investment in formulation technology, facility upgrades, and certification processes. Smaller regional competitors often face entry restrictions due to these high compliance costs, consolidating competitive advantages for multinational incumbents but limiting broader scalability within the overall supply chain.

Opportunities stem directly from government-led green policies emphasizing energy-efficient buildings, sustainable infrastructure, and low-emission materials. In Germany, federal legislation, such as the Fast-Charging Act and the Electric Mobility Act, enables the expansion of electric vehicle infrastructure, thereby increasing downstream demand for coil coating of advanced building panels and durable transport equipment.

Middle Eastern giga-projects, including Saudi Vision 2030’s NEOM and Diriyah Gate, create immediate demand for large-scale housing and industrial projects, alongside mandates for eco-sustainable finishes. For coil coating providers, this represents an opportunity to establish product positioning around energy-efficient, low-carbon-certified coatings, which governments actively endorse in tender frameworks.

The transition toward next-generation UV/EB curing technology signals a structural opportunity to replace traditional solvent-borne coatings. Companies such as allnex, Arkema, and PPG are investing in such systems, offering up to 60% energy savings and reductions in production time. For end-users, this delivers both compliance and operational savings.

With industrial segments such as metal packaging, appliances, and automotive demanding tighter cost efficiency and sustainability, the shift away from conventional solvent systems toward advanced curable systems provides suppliers with differentiated value creation. Mid-sized producers adopting these systems can capture niches that are not effectively served by incumbent petroleum-based coatings.

Global construction output is shifting increasingly toward emerging markets. India projects real estate to reach US$5.8 trillion by 2047, contributing 15.5% of GDP, underpinned by urbanization and housing programs like PMAY-U (with over 86.6 lakh units completed). In South America, low construction costs and a strong labor supply bolster the competitive positioning of global participants. Brazil alone recorded a 14.1% growth in new vehicle sales in 2024, alongside infrastructure expansions, which supported localized demand for coated sheets. For coil coating firms, coupling distribution with local production in these regions enables reduced delivery cycles, regulatory arbitrage, and enhanced market penetration.

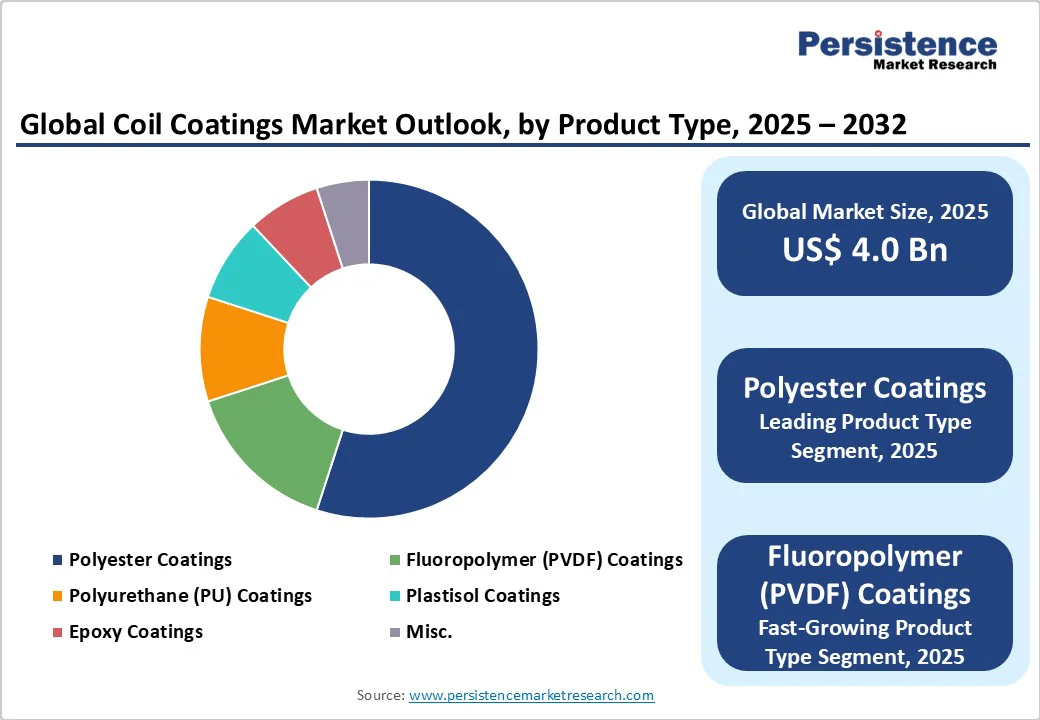

Polyester coatings are expected to hold approximately 55% of the market share in 2025, primarily due to their cost-effectiveness, corrosion resistance, and widespread applicability in building and consumer goods. These coatings dominate roofing and siding due to durable finish and strong weather resistance, forming the primary backbone of market penetration.

Fluoropolymer (PVDF) coatings are projected to account for 15% of the market in 2025 and represent the fastest-growing category. With demand sustained in architectural, automotive, and high-performance applications, PVDF coatings benefit from superior thermal endurance and resistance to UV degradation, enabling their adoption in advanced infrastructure and automobile projects across Europe, East Asia, and North America.

Steel remains the dominant substrate, holding approximately 70% market share in 2025. The material’s affordability, strength, and structural relevance make it the preferred option in construction and heavy industrial segments. Steel’s role in global infrastructure: 52% of its usage in 2023 was in building and construction, anchoring its importance in coil coating formulations.

Aluminum, accounting for 30% of the same year's production, is the fastest-growing substrate. Its lightweight properties and flexibility render it pivotal for automotive and consumer appliances that require both performance and efficiency. With the global push toward electric vehicles and lightweighting initiatives, aluminum usage is expected to grow as a complement to coil-coated steel in supply chains.

Building and Construction leads with 45% share in 2025. This dominance stems from demand for aluminum and steel panels in roofing, wall systems, and window components. India, the United States, and the Middle East flagship giga-projects affirm continued material consumption.

The automotive and transportation sector is the fastest-growing segment, with a 15% market share. As vehicle production reached 75.5 million units in 2024, the adoption of precision-finished coil-coated substrates for both functional and aesthetic purposes remains strong. The expansion of electric vehicles further accelerates this segment, aligning coil coating demand with transportation electrification programs.

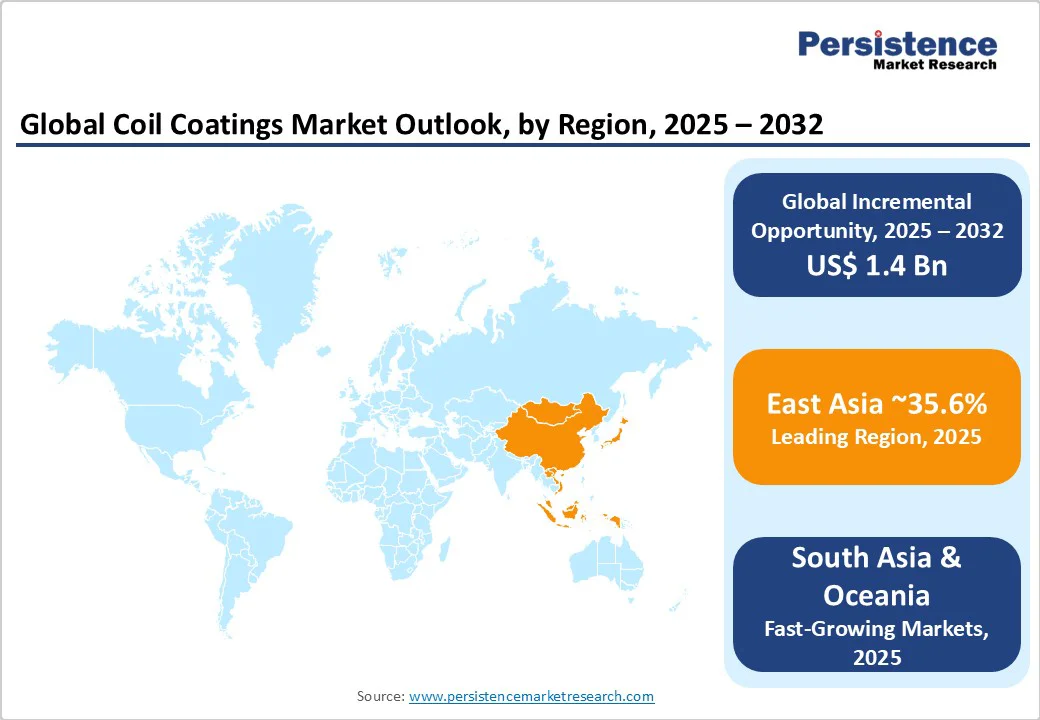

Asia Pacific, anchored by East Asia (35.6%) and South Asia & Oceania (11.4%), is the world’s largest coil coating region, accounting for nearly half of global market share. China leads due to large-scale steel production that is 1,012 million tonnes in 2023, which is 54% of world output, coupled with automotive production dominance, 23 million cars sold in 2024.

India contributes significantly via massive infrastructure spending, US$ 133 billion annual capital expenditure in FY2024–25, 3.4% of GDP, and a surge in automotive and EV adoption.

Japan remains a global research hub, investing 3.9 trillion yen in R&D expenditures in 2022. ASEAN nations benefit from competitive manufacturing, integrated exports, and construction appetite. This regional demand is expected to remain structurally stable, supported by urbanization and industrialization trends.

North America is projected to hold 17.9% of the global Coil Coating Market in 2025, driven primarily by U.S. market dynamics. The U.S. maintains strong construction demand, with annual spending of US$2.2 trillion in 2024 (4.5% of GDP), and automotive sales reaching 1.46 million units in August 2025.

EPA environmental regulations underpin the market’s transition toward sustainable, low-VOC products, compelling product line innovation. Competitive positioning is consolidated, with AkzoNobel, PPG, and Ternium expanding coil coating facilities across Mexico and the U.S.

Investments include AkzoNobel’s US$3.6 million facility expansion in Garcia, Mexico, in 2024. Future regional demand will be reinforced by automotive sector lightweighting and infrastructure refurbishment programs.

Europe is expected to hold a 22.6% share of the global market in 2025, reflecting its strong heritage as a manufacturing hub for the automotive and construction sectors. Germany anchors this performance, producing 4.1 million passenger cars in 2024 and investing approximately EUR 30 billion annually in research and development.

The construction sector’s trajectory was mixed, with EU output down 0.8% year-on-year in 2024, but individual countries, such as Spain, posted 11.2% growth. Environmental compliance remains critical, steered by the European Green Deal and emissions-cutting frameworks. Major suppliers, such as Beckers, have located their R&D FutureLab in Liverpool, UK (2024), to advance sustainable coil coatings, consolidating regional design leadership and innovation.

The global Coil Coating Market is moderately consolidated, with leading multinational companies holding significant market influence while facing competition from regional players.

Top companies, such as AkzoNobel, PPG Industries, Beckers Group, Axalta Coating Systems, Nippon Paint Holdings, Kansai Paint, Ternium USA, and Sherwin-Williams, focus on expanding production capacity, advancing sustainable and energy-efficient coating technologies, and strengthening their geographic presence.

These firms are investing in R&D centers, launching UV/EB-curable product lines, and pursuing strategic acquisitions to maintain competitive advantage in a market driven by regulatory demands and end-use diversification.

The global Coil Coatings market is projected to be valued at US$ 4.0 Bn in 2025.

The Polyester Coatings segment is expected to hold a 55% market share due to its cost-effectiveness, versatile performance, and widespread use in building and construction applications.

The market is poised to witness a CAGR of 4.3% from 2025 to 2032.

The Coil Coatings market growth is driven by technological advancements in energy-efficient and sustainable coatings, structural demand from the building and construction sector, and automotive production recovery.

Key market opportunities include policy-backed green transitions in coatings, substitution of traditional coatings with UV/EB-curable systems, and infrastructure investment in emerging markets.

The top key market players in the global Coil Coatings market include Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Beckers Group, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems Ltd., Kansai Paint Co., Ltd.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Region Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

By Product Type

By Substrate

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author