ID: PMRREP30629| 202 Pages | 10 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

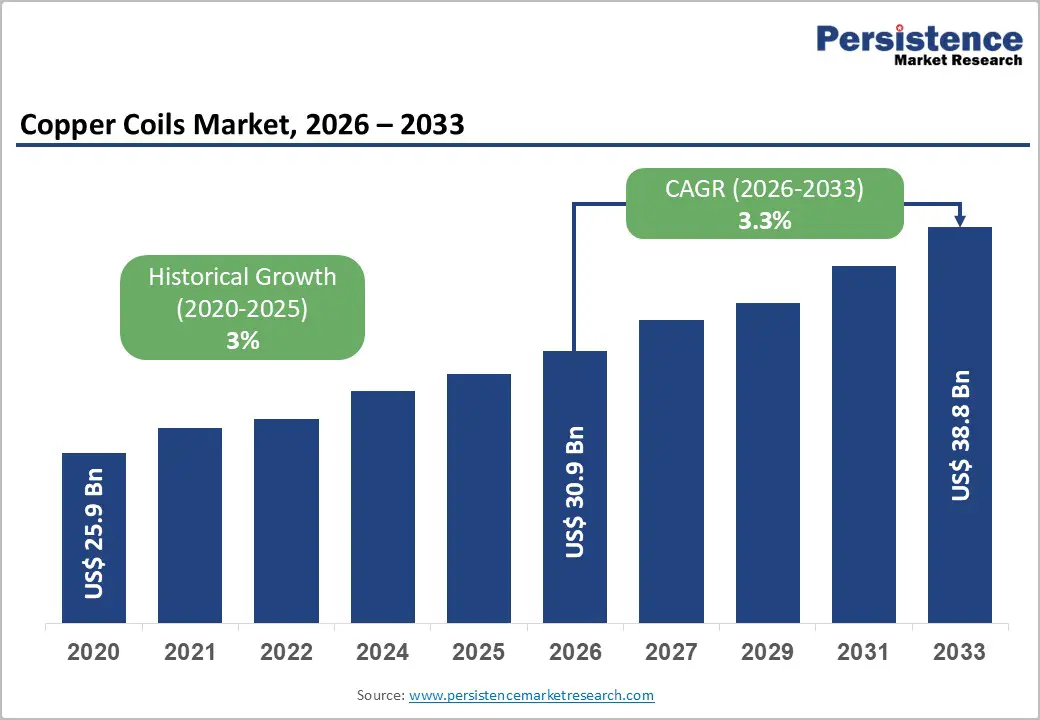

The global copper coils market size is likely to be valued at US$ 30.9 billion in 2026, and is projected to reach US$ 38.8 billion by 2033, growing at a CAGR of 3.3% during the forecast period 2026−2033. Sustained demand from energy-efficient thermal systems, electrification across industrial value chains, and infrastructure modernization programs are the primary growth determinants for this market.

Rapid urban population growth and rising middle-income households have increased the installation density of air conditioning, refrigeration, and heating systems, directly elevating copper coil consumption. Increased regulatory emphasis on energy efficiency and thermal conductivity standards has reinforced material preference for copper over alternative metals, strengthening structural demand stability. Technological integration in heating, ventilation, & air conditioning (HVAC) and electrical equipment manufacturing has further elevated the use of precision-engineered copper coils, particularly in compact, high-performance systems.

| Key Insights | Details |

|---|---|

| Copper Coils Market Size (2026E) | US$ 30.9 Bn |

| Market Value Forecast (2033F) | US$ 38.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 3.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 3% |

Expansion of Energy-Efficient HVAC and Thermal Systems

Growing global emphasis on energy conservation and reduced carbon intensity has accelerated the deployment of high-efficiency HVAC and refrigeration systems across residential, commercial, and industrial infrastructure. Regulatory frameworks issued by energy ministries and environmental agencies increasingly mandate minimum energy performance standards for cooling and heating equipment. Copper coils, characterized by high thermal conductivity, corrosion resistance, and durability, align with these compliance requirements, reinforcing consistency in material selection across original equipment manufacturers.

Urban infrastructure modernization programs increased penetration of centralized cooling systems, smart buildings, and district heating networks. These systems require precision-engineered heat-exchange components, directly stimulating demand for copper coils. Manufacturing technology improvements have enabled thinner, more compact coil designs without compromising thermal performance, supporting integration into space-constrained installations. The combined effect of regulatory alignment, technological compatibility, and long operational life positions copper coils as a foundational component within energy-efficient thermal systems.

Volatility in Copper Raw Material Pricing

Copper coil manufacturing remains highly sensitive to fluctuations in refined copper pricing, driven by variability in mining output, geopolitical supply risks, movements in energy costs, and global commodity trading dynamics. Disruptions in major producing regions or sudden shifts in trade policies often trigger sharp price increases, which compress manufacturer margins and complicate long-term pricing commitments with original equipment manufacturers. Such volatility creates challenges in raw material procurement, inventory valuation, and capital planning, as manufacturers must manage cost exposure while maintaining supply continuity.

Sustained pricing uncertainty often results in delayed capacity expansion, cautious investment decisions, and selective order fulfillment, limiting scalability during demand upcycles. Downstream equipment manufacturers may respond by redesigning components to lower copper intensity or by exploring alternative materials to manage cost exposure. Although large-scale substitution remains technically constrained due to performance and compliance requirements, persistent copper price volatility continues to act as a structural restraint.

Acceleration of Electrification Infrastructure in Emerging Economies

Rapid industrialization and urban expansion across emerging economies have significantly accelerated investments in electrification infrastructure, spanning power distribution networks, transportation electrification, and industrial manufacturing capacity. Governments across the Asia Pacific, Latin America, the Middle East, and Africa are implementing large-scale programs focused on grid modernization, renewable energy integration, and expansion of electric mobility ecosystems. These initiatives require extensive deployment of electrical equipment, transformers, motors, charging systems, and power management solutions, all of which rely on copper coils for efficient electrical conductivity and thermal performance. Global copper demand is projected to rise by up to 70% by 2050 compared with 2021 levels, driven largely by these electrification and clean energy infrastructure build-outs. Public funding support, multilateral development financing, and policy-driven infrastructure roadmaps collectively create a scalable and expanding addressable base for copper coil applications.

Electrification initiatives in emerging markets typically emphasize long service life, high energy efficiency, and low maintenance requirements to reduce the total lifecycle costs of infrastructure assets. For example, Indian Railways has achieved 99.2% electrification of its broad gauge network under Mission 100% Electrification, electrifying nearly all routes. This rapid progress integrates solar power at stations and modern technologies such as mechanized foundations and automatic wiring trains to enhance efficiency and sustainability. Copper coils align with these priorities due to proven durability, thermal stability, and consistent electrical performance under demanding operating conditions. As electrification deployment scales, the demand for copper coils will extend beyond initial equipment installation to include ongoing maintenance, system retrofitting, efficiency upgrades, and network capacity expansion.

Purity Type Insights

The bare segment is likely to lead, with a projected 58% share of the copper coils market in 2026, due to its extensive use in electrical equipment, transformers, generators, and industrial motors that require high conductivity and stable current flow. Manufacturers prioritize bare copper coils for applications involving direct electrical contact, high current density, and customized winding configurations. Established manufacturing standards, predictable performance characteristics, and wide supplier availability support large-scale adoption across industrial value chains. Cost efficiency compared to insulated alternatives further strengthens preference in heavy-duty applications.

Insulated copper coil is expected to be the fastest-growing segment from 2026 to 2033 due to the increasing emphasis on electrical safety, equipment miniaturization, and higher operational densities in modern electrical and electronic systems. Insulation reduces short-circuit risk, enhances thermal stability, and supports reliable performance in compact assemblies. Rising adoption of electric mobility platforms, smart appliances, advanced electronics, and automated systems continues to elevate demand. Regulatory enforcement of safety standards and ongoing improvements in polymer insulation materials further accelerate uptake, positioning insulated copper coils for rapid expansion across technology-driven end-use industries.

Application Insights

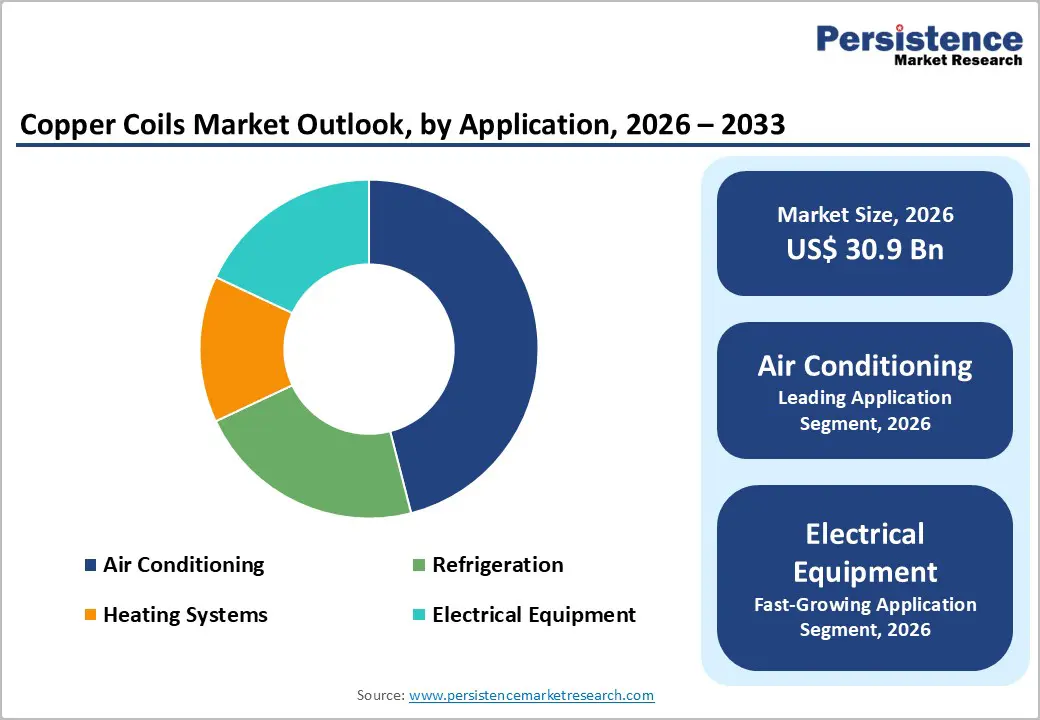

Air conditioning is projected to account for approximately 46% of the copper coils market's revenue in 2026, supported by high installation density across residential, commercial, and industrial buildings and sustained replacement demand. Cooling systems rely heavily on copper coils for efficient heat transfer, corrosion resistance, and durability under continuous operating conditions. Urbanization, rising living standards, and the expansion of commercial infrastructure continue to drive air conditioning penetration globally. Regulatory mandates focused on energy efficiency and thermal performance further reinforce copper preference in condenser and evaporator designs.

Electrical equipment is projected to be the fastest-growing segment from 2026 to 2033, underpinned by accelerating electrification initiatives, grid modernization programs, and rising investments in industrial automation. Expansion of power transmission and distribution infrastructure, electric mobility systems, and renewable energy integration increases demand for motors, transformers, generators, and control equipment that depend on copper coils. Governments and utilities prioritize efficiency, reliability, and long service life, reinforcing copper adoption. Growth also extends beyond initial installations to maintenance and capacity upgrades, creating recurring demand.

End-User Insights

The HVAC segment is slated to hold a dominant position, with an anticipated 41% share of the market in 2026, driven by sustained construction activity across residential, commercial, and industrial buildings, as well as rising retrofit demand for energy-efficient heating and cooling systems. HVAC equipment relies extensively on copper coils for heat exchange, refrigerant circulation, and thermal stability, making copper a core material across condensers and evaporators. Regulatory emphasis on energy efficiency and system performance further reinforces copper adoption within new installations and upgrades. Contractor familiarity, standardized installation practices, and established distribution networks support consistent procurement.

The automotive segment is forecast to be the fastest-growing between 2026 and 2033, driven by the rapid expansion of electric vehicle production, the deployment of charging infrastructure, and vehicle electrification mandates. Copper coils are essential components in traction motors, onboard chargers, inverters, and thermal management systems, where efficiency, reliability, and compact design are critical. Automotive manufacturers prioritize copper for its high electrical conductivity and thermal performance under heavy loads. Government incentives for electric mobility, tightening emission regulations, and increasing model availability accelerate electrified vehicle adoption.

North America Copper Coils Market Trends

North America is expected to maintain a strong position in the copper coils market, driven by mature industrial infrastructure and well-established HVAC, refrigeration, and electrical equipment manufacturing sectors. Stable regulatory frameworks emphasizing energy efficiency, thermal performance, and environmental compliance reinforce the preference for copper in heat exchange and electrical conductivity applications. Advanced manufacturing practices, combined with long-standing supplier networks and high-quality production standards, ensure consistent availability of precision-engineered copper coils for industrial, commercial, and residential use. Ongoing retrofitting and upgrading of aging infrastructure, including power grids and centralized cooling systems, supports continuous demand for high-performance copper coil solutions.

Regional market dynamics are also being shaped by technological innovation and transition toward electrification across industries. Widening adoption of smart buildings, automated manufacturing, and electric mobility systems increases the need for high-efficiency copper coils in motors, transformers, and thermal management components. Manufacturers are integrating compact, insulated, and advanced polymer-coated coils to meet evolving system requirements. Collaborative initiatives between enterprises and government bodies promote energy-efficient designs and sustainable supply chain practices, strengthening copper as a preferred material.

Europe Copper Coils Market Trends

Europe command notable influence in the market for copper coils on the back of advanced industrial ecosystems and a focus on precision engineering in electrical and thermal systems. High adoption of smart manufacturing technologies and automation enables the production of sophisticated coil designs that deliver consistent performance under demanding operational conditions. Regional demand is getting boosted even more by the integration of next-generation building management systems, district heating and cooling networks, and compact industrial equipment that require durable and efficient copper coils. Sustainability initiatives, circular economy practices, and emphasis on material recyclability encourage manufacturers to prioritize copper, given its long lifecycle and efficiency advantages.

The market here also benefits from innovation in energy-efficient technologies and specialized applications. Growth is fueled by deployment of combined heating and cooling systems, advanced electric motor assemblies, and high-density electronic equipment that require custom-engineered coils with improved thermal and electrical properties. Investment in research and development enhances polymer insulation, compact coil geometries, and multi-functional coil solutions, meeting evolving performance and safety standards. Strategic partnerships between equipment manufacturers and component suppliers drive faster adoption of advanced copper coil solutions.

Asia Pacific Copper Coils Market Trends

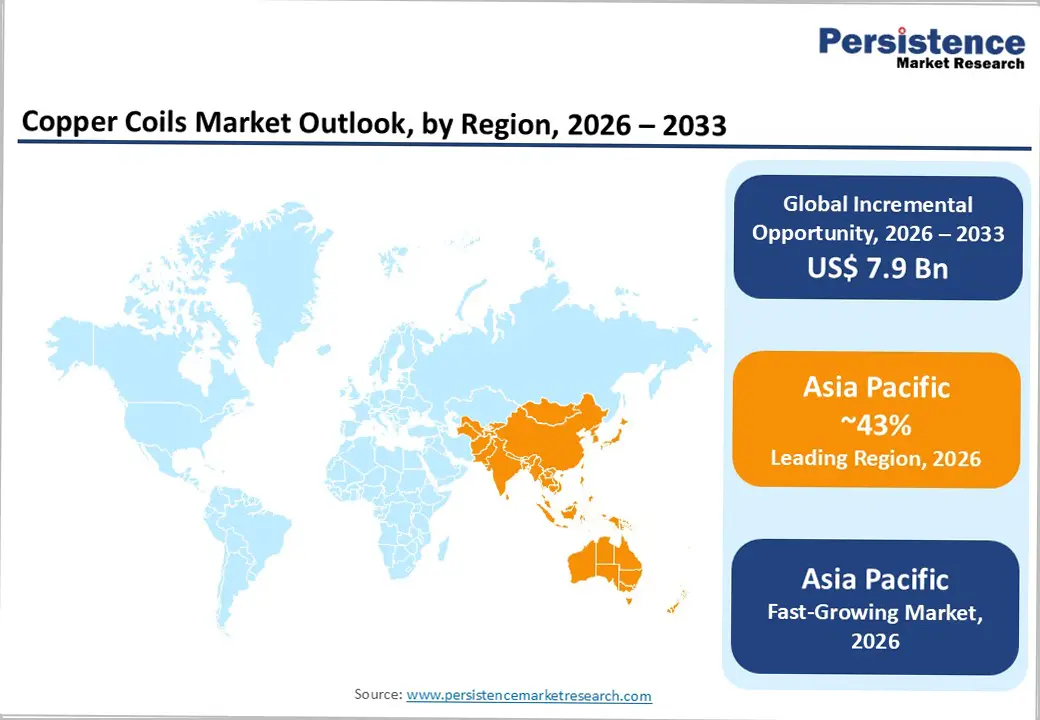

Asia Pacific is positioned to dominate in 2026, capturing an estimated 42% of the copper coils market share, reflecting the regional market's extensive industrial base, high-volume manufacturing capabilities, and concentrated adoption of energy-intensive electrical and HVAC systems. Major economies such as China and India account for a substantial proportion of global appliance, automotive, and electrical equipment production, creating consistent upstream demand for copper coils. Urbanization and infrastructure modernization programs, including smart buildings, district cooling, and industrial automation, further reinforce structural consumption. Local policy incentives, such as import substitution measures and subsidies for domestic coil manufacturing, enhance supply chain efficiency while reducing dependency on imports. Asia Pacific benefits from established supplier networks, competitive labor costs, and proximity to raw material sources, enabling manufacturers to achieve economies of scale.

Asia Pacific is also forecast to be the fastest-growing market for copper coils through 2033, driven by rapid electrification, rising electric vehicle production, and the integration of renewable energy infrastructure. Expanding power grids and industrial automation initiatives require precision-engineered copper coils for transformers, motors, inverters, and thermal management systems, driving incremental demand. The region’s increasing focus on energy efficiency and regulatory compliance encourages replacement and retrofitting of existing systems with high-performance copper coil solutions. Technological advancements in compact, insulated, and high-conductivity coils further enable adoption in space-constrained and high-density applications. Growing middle-class populations and deepening consumer electronics penetration are also pushing up the demand for residential and commercial cooling and heating.

The global copper coils market structure can be characterized as being moderately fragmented, comprising a mix of global and regional manufacturers. Market dynamics are influenced by the presence of both large-scale international corporations and smaller specialized producers. Leading companies leverage extensive production capacities and diversified exposure across end-use sectors, such as power generation, construction, and automotive applications. Strategic long-term supply agreements with industrial clients enable these players to secure consistent demand and enhance operational stability. Quality consistency, process efficiency, and the ability to meet customized specifications remain critical differentiators in this competitive landscape, especially as end-users increasingly prioritize reliability and performance for critical infrastructure and manufacturing processes.

Key players in the market, including Prysmian Group, Nexans, Southwire Company, LLC., and Sumitomo Electric Industries, Ltd., focus on strengthening their market positions through technical collaboration with equipment manufacturers and continuous product innovation. Investments in research and development support advancements in copper coil manufacturing, such as improving conductivity, corrosion resistance, and dimensional precision. These companies also emphasize global distribution networks and customer service capabilities to maintain strong relationships across multiple regions. Regional manufacturers, while smaller in scale, compete by offering specialized products and responsive service, creating a balanced market structure.

Key Industry Developments

The global copper coils market is projected to reach US$ 30.9 billion in 2026.

Rising demand for electrification, power infrastructure expansion, and industrial applications drives the market.

The market is poised to witness a CAGR of 3.3% from 2026 to 2033.

Growing adoption of electric vehicles and renewable energy infrastructure presents key opportunities in the market.

Few of the key players in this market include Prysmian Group, Nexans, Southwire Company, and Sumitomo Electric Industries, Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author