ID: PMRREP35856| 199 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

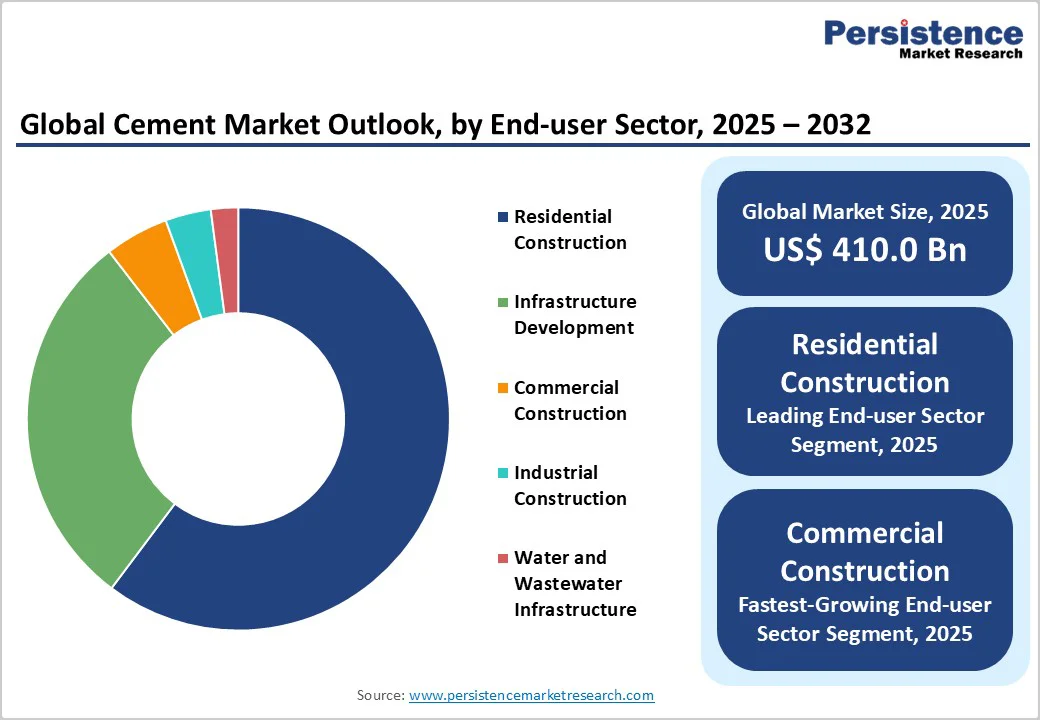

The global cement market size is likely to be valued at US$410.0 billion in 2025. It is estimated to reach US$569.3 billion by 2032, growing at a CAGR of 4.8% during the forecast period from 2025 to 2032, driven by the unprecedented pace of urbanization and record infrastructure investments, notably in the Asia Pacific.

A growing shift toward the development of sustainable, low-carbon cement products alongside expanding commercial construction sectors, including fast-growing data center developments, is catalyzing demand across emerging and developed economies.

| Key Insights | Details |

|---|---|

| Cement Market Size (2025E) | US$410.0 Bn |

| Market Value Forecast (2032F) | US$569.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.8% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.2% |

Asia Pacific remains the fulcrum of the cement market growth, with India, China, and Southeast Asian economies embarking on ambitious infrastructure modernization and urban expansion initiatives. The Asian Development Bank (ADB) estimates US$1.7 trillion in planned infrastructure investment across Asia from 2023 to 2030, which will directly augment cement consumption through large-scale roadways, railways, and residential projects.

India is projected to reach 441.9 million tons of cement consumption by 2025, accounting for over 60% of residential construction demand in the region. This surge in urbanization drives significant demand for ready-mixed and blended cements that align with sustainable construction goals. Regulatory impetus from governments mandating low-carbon building practices can further accelerate the adoption of blended Portland Pozzolana and slag cement varieties in the coming years.

The energy-intensive production process of the cement industry faces mounting pressure from rising fossil fuel costs and stringent carbon-emission regulations, particularly in North America and Europe. Carbon pricing mechanisms, such as the European Union (EU) Emissions Trading System, have imposed compliance costs averaging €30-50 (US$34.60-57.70) per ton of CO2 emitted, thereby inflating overall production costs by a substantial margin. These factors are constraining margins and slowing capacity expansion or modernization in regions with less economic flexibility.

Supply chain disruptions in raw materials, notably gypsum and clinker, and procurement complexities exacerbated by geopolitical tensions have further amplified operational risks. As a result, such cost pressures have the potential to reduce regional cement gross margins, compelling manufacturers to seek efficiency and alternative fuels amid competitive challenges. Managing escalating input costs alongside decarbonization mandates represents a critical structural challenge for sustained growth.

Europe's regulatory landscape is rapidly steering cement producers toward green product innovation, positioning the region as a lucrative opportunity hub for low-carbon cement adoption. The European Commission (EC)’s Fit for 55 regulatory package targets a 55% reduction in greenhouse gas emissions by 2030, compelling the sector to innovate with blended and geopolymer cement variants that may achieve up to 40% lower embodied carbon.

Several manufacturers are leveraging technology partnerships to develop integrated carbon capture, utilization, and storage (CCUS) production lines. This opportunity leverages unmet customer demand for sustainable construction materials, backed by EU funding schemes estimated at €20 billion (US$23.1 billion) for green tech acceleration. Activating this segment requires navigating complex certification frameworks and achieving competitive price parity with traditional cement products, promising significant growth for agile and technology-forward industry participants.

Ordinary Portland Cement (OPC) is likely to sustain its leading position with a commanding market share of about 48.8% in 2025. The predominance of OPC can be attributed to its broad applicability across diverse construction activities, from residential housing to infrastructure projects. OPC’s production infrastructure is well-established globally, offering cost advantages and consistency in performance that support its continued dominance.

It is particularly favored for general-purpose concrete and mortar applications due to its reliable early strength development and adaptability across climatic conditions. While environmental regulations are increasing, OPC remains central to most construction value chains due to existing supply networks and industry familiarity.

Blended cement, specifically Portland Pozzolana Cement (PPC), is rapidly gaining traction through 2032. The increasing regulatory emphasis on sustainability and carbon footprint reduction in cement production primarily drives this growth.

PPC’s significant substitution of clinker with supplementary cementitious materials such as fly ash and volcanic pozzolans reduces CO2 emissions by nearly 20-30% compared to OPC. PPC provides enhanced durability, particularly sulfate resistance, making it highly desirable in infrastructure and marine construction projects. Government policies that incentivize greener construction practices further reinforce the growing adoption of PPC.

Bagged cement is expected to account for approximately 47.5% of revenue in 2025. This segment dominates due to its alignment with retail and small-to-medium project demands, particularly in emerging markets where decentralized construction activities are extensive.

The convenience and flexibility afforded by this packaging type appeal to individual consumers, small contractors, and local builders. Its widespread availability through hardware stores and expanding organized retail channels facilitates accessibility in Tier-2 and Tier-3 cities, optimizing market penetration and consumer reach.

Bulk cement packaging is anticipated to be the fastest-growing segment during 2025 - 2032. This growth trajectory correlates strongly with urban infrastructure projects and large-scale commercial developments that increasingly favor ready-mix concrete for quality, efficiency, and sustainability benefits.

Bulk packaging facilitates seamless logistics and direct supply to ready-mix plants and industrial consumers, reducing overall handling costs and enabling greater automation. Advances in bulk storage and transport technology, coupled with government-led infrastructure investments, particularly in the Asia Pacific and North America, are accelerating adoption in this segment.

Residential construction is the predominant end-use sector, with an estimated 60% share in 2025. Its leadership is underpinned by the robust pace of urbanization in the Asia Pacific and supportive policy frameworks promoting affordable housing and rural electrification.

Rapid population migration toward urban centers creates sustained demand for both new housing and retrofit projects. Builders, developers, and other businesses in the residential sector are focusing on cost efficiency and local supply chain support, driving a steady increase in cement consumption.

The commercial construction sector is projected to register the highest growth rate over the 2025 - 2032 period. This surge is driven by increasing economic diversification, digitization, and the expansion of e-commerce infrastructure, resulting in heightened demand for data centers, office buildings, and retail complexes.

The shift toward commercial real estate catering to technology and logistics has stimulated the demand for specialty cements, including high-performance and low-carbon variants. Flexible building solutions and smart urban development plans are also contributing to the rapid sectoral expansion.

North America is projected to hold a market share of approximately 12% in 2025, principally influenced by the U.S., which accounts for nearly 85% of regional consumption.

Cement demand is underpinned by substantial federal and state-led infrastructure renewal programs targeting highways, bridges, and utility modernization. Regulatory frameworks promoting net-zero emissions by 2050 are driving innovation, with significant incentives for carbon capture adoption and low-carbon cement products.

The U.S. Environmental Protection Agency (EPA) enforces stringent emissions standards, encouraging technological enhancements in manufacturing and supply chain optimization.

The regional competitive landscape is characterized by vertically integrated manufacturers with strong sustainability commitments and established logistics infrastructure, ensuring efficient delivery to critical markets. Investment trends indicate increased capital allocation toward R&D for alternative binder technologies, energy-efficient kiln designs, and the digitalization of production processes.

Europe is poised to grow at the fastest rate in 2025 and is characterized by a highly regulated environment shaped by the European Green Deal and national carbon-neutrality agendas. Countries such as Germany, the U.K., France, and Spain are pioneering regulatory harmonization focused on clinker substitution, carbon emissions reporting, and incentivizing green construction materials.

Market growth is also supported by infrastructure refurbishment, urban regeneration, and expansion of sustainable housing, alongside robust private and public investments in transportation and energy sectors.

European cement producers face competitive pressures from stringent environmental compliance, but leverage EU funding and technology partnerships to gain leadership in eco-efficient cement varieties and CCUS integration. Strategic acquisitions for geographic consolidation and innovation funding characterize the competitive atmosphere, positioning Europe as a technology-forward, environmentally conscious market.

Asia Pacific unequivocally dominates with a market share of approximately 70% in 2025, led by China, India, Japan, and ASEAN countries. The region's competitive advantage stems from abundant access to raw materials, low-cost manufacturing, and rapid urbanization.

India’s cement consumption is projected to reach 441.9 million tons by 2025, driven by government housing and infrastructure schemes, including the Smart Cities Mission. China continues to consolidate its regional lead through the modernization of mega infrastructure projects and the adoption of advanced low-carbon clinker technologies.

Southeast Asia’s accelerated industrialization and urban migration are complementing infrastructure development, creating significant growth pockets in Vietnam, Indonesia, and Thailand.

Market growth in the Asia Pacific is supported by favorable demographics, industrial diversification, and increasing environmental regulations mandating the use of blended cements. Market competition is fragmented across countries. However, multinational companies are aggressively expanding capacity and digitizing supply chains to capitalize on the surging demand.

The global cement market is moderately concentrated, with the top five multinational companies accounting for roughly 45% of global revenues.

Industry leaders such as LafargeHolcim, HeidelbergCement, China National Building Material Company (CNBM), Ultratech Cement, and CEMEX benefit from extensive vertically integrated operations encompassing raw material extraction, manufacturing, logistics, and downstream distribution. This integration facilitates cost optimization, sustainability innovation, and responsiveness to regional market demands.

The market outside of these major players is relatively fragmented, with numerous local producers servicing regional needs, especially in the Asia Pacific. These local entities often compete on price and service agility but face challenges in scaling new technology adoption and achieving stringent environmental compliance.

Competitive positioning hinges on advancing green cement portfolios, streamlining supply chains, and leveraging technology to differentiate products. Market dynamics feature ongoing consolidation and strategic alliances aimed at capturing emerging market opportunities and technological leadership.

The global cement market is projected to reach US$410.0 Billion in 2025.

Massive urbanization and record infrastructure investments, notably in Asia Pacific, and an exponential increase in construction activities worldwide are driving the cement market.

The cement market is poised to witness a CAGR of 4.8% from 2025 to 2032.

Growing shift toward the development of sustainable, low-carbon cement products alongside expanding commercial construction sectors, including fast-growing data center developments, and stringent regulatory mandates for the building & construction sector, particularly in North America and Europe, are key market opportunities.

LafargeHolcim, HeidelbergCement AG, and China National Building Material Company (CNBM) are a few of the key players in the cement market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Packaging Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author