ID: PMRREP35326| 190 Pages | 16 May 2025 | Format: PDF, Excel, PPT* | Food and Beverages

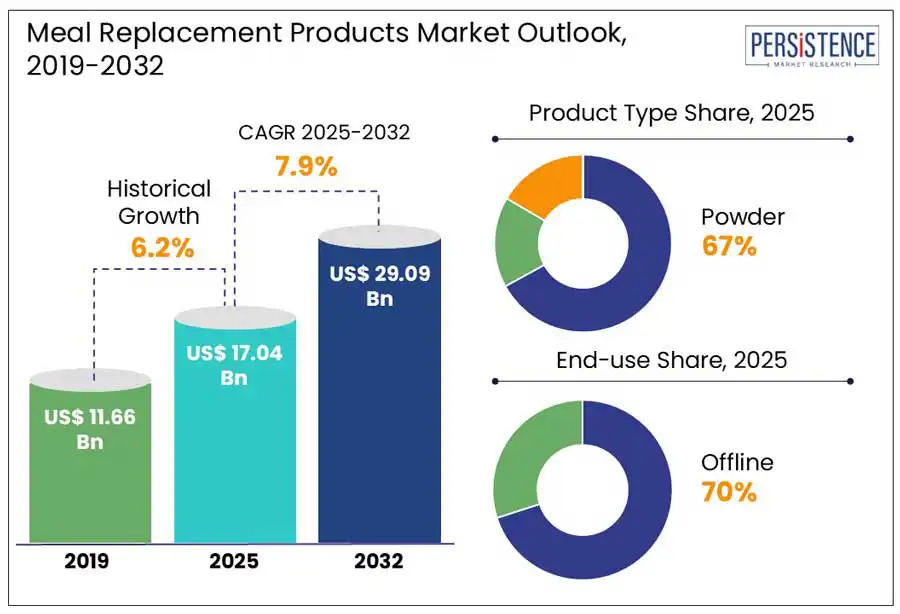

The global meal replacement products market size is projected to rise from US$ 17.04 Bn in 2025 to US$ 29.09 Bn by 2032. The market is further anticipated to register a CAGR of 7.90% during the forecast period from 2025 to 2032. According to the Persistence Market Research report, the rising incidence of lifestyle-related chronic diseases across all age groups has heightened general health awareness, encouraging individuals to adopt healthier lifestyle habits.

Consuming a balanced diet along with regular exercise is crucial for maintaining a healthy weight. Meal replacements offer an easy, nutritionally-balanced option for health-conscious individuals who have busy lifestyles or face difficulties making healthy meal choices due to lack of knowledge. These products offer precise calories, high protein, fiber, and essential vitamins and minerals, enabling weight management by promoting satiety and reducing hunger while ensuring adequate nutrient intake. By enabling portion control and offering a wholesome alternative to fast food, meal replacements help consumers maintain a balanced diet even when time or resources to plan balanced meals are limited. According to the National Institute of Diabetes and Digestive and Kidney Diseases, the 2020–2025 dietary guidelines for Americans recommend that adults wanting to lose weight must reduce their calorie intake.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Meal Replacement Products Market Size (2025E) |

US$ 17.04 Bn |

|

Market Value Forecast (2032F) |

US$ 29.09 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.90% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.2% |

The meal replacement products market is witnessing strong growth, driven by evolving lifestyles, rising health concerns, and increasing health consciousness. The rise in incidences of obesity, micronutrient deficiencies, and the incidence of chronic illnesses and cardiovascular illnesses linked to poor dietary choices is driving people to concentrate on their daily food choices. This shift is contributing to a surge in meal replacement products. According to the National Diabetes Statistics Report 2024, 38.4 million people of all ages, or 11.6% of the U.S. population, had diabetes. These factors have made people look for better meal alternatives, and consumers are actively seeking products with cleaner and nutritious ingredients.

Plant-based products and products fortified with prebiotics and probiotics are also in high demand. Consumers also look for third-party certifications for purity and ingredients before reaching out to buy. For example, Ample Complete Meal shake is said to be made from real-food ingredients. It is a 400-calorie meal and contains 25g of protein, 4g net carbs, healthy fats, prebiotic fibre, antioxidants, electrolytes, and probiotics. It has no gluten, soy, or GMOs.

Meal replacement products are generally more expensive than traditional meals, limiting their accessibility despite rising disposable incomes. The higher cost is due to the use of premium ingredients such as quality proteins, fibers, vitamins, and minerals, and the complexity of formulating a nutritionally balanced product with the right macronutrient distribution and taste. Additionally, significant R&D investments for new flavors, textures, and targeted dietary needs further increase production costs, restraining market growth.

Many consumers prefer the taste and perceived wholesomeness of traditional and organically produced foods over processed meal replacement products, even though the latter are nutrient-dense. Worldwide food influencers advocate for natural foods rather than protein powders and synthetic meal supplements. This trend has increased awareness and ethical responsibility for companies to provide clean-label products with transparent, natural cosmetic ingredient lists. However, sourcing and processing clean-label ingredients, especially plant-based proteins and natural flavors, are more complex and costly, raising manufacturing expenses and product prices.

Urbanization and the on-the-go lifestyle have significantly boosted the demand for convenient, portable meal options, especially among health- and fitness-conscious younger consumers who often go to work after gym sessions. This demographic’s higher disposable incomes enable them to invest in meal replacement products to avoid nutritionally deficient meals. Online purchasing options facilitate bulk buying, while modern preservation techniques extend shelf life, making ready-to-eat meals more accessible and appealing. For example, in September 2024, Arla Foods launched Protein Food to Go in Denmark, a new range of milk-based meal replacement drinks containing 30g of protein.

Additionally, meal replacement products come in powders, shakes, and protein bars, which are easy to carry and consume while traveling. There is a high demand for plant-based products owing to their lower calories and higher fiber. There is also an increased demand for personalized nutrition, depending on age, gender, dietary restrictions, and activity levels. AI is also being incorporated to support customized recommendation strategies, marking a significant trend in the meal replacement products.

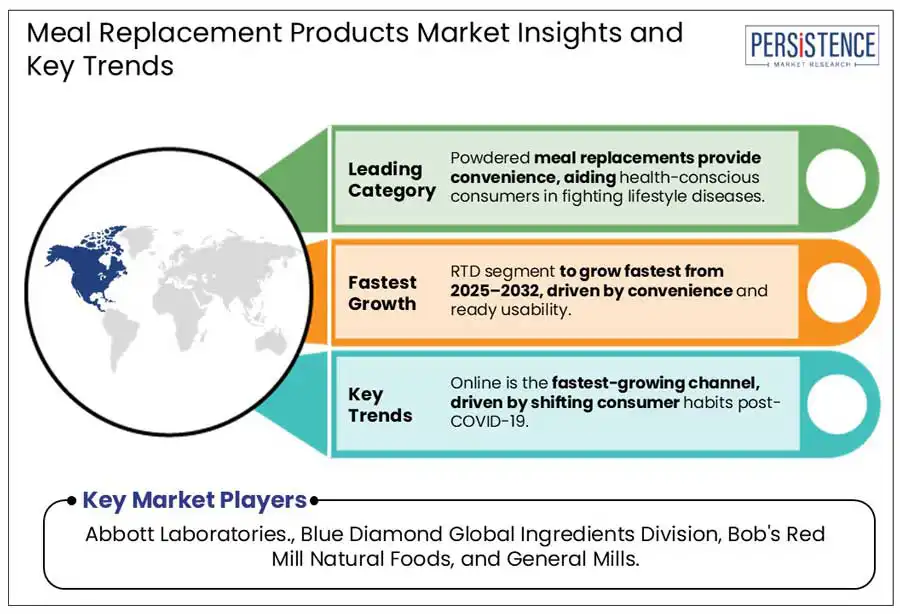

By product type, the meal replacement products market is segmented into powder, ready-to-drink, and protein bars. The powder segment held the largest revenue share of 67% in 2025 due to the convenience offered by the powdered meal replacements among health-conscious individuals. With intense job pressures leaving little time for meal planning and preparation, nutritional deficiencies have become rampant, thereby fueling the demand for on-the-go meal replacements. Meal replacement products in the powder form enable easy storage, have a longer shelf life. and enable simple preparation with water. Their minimal risk of contamination, along with the ability to customize portion sizes and ingredients, further enhances their appeal. The powdered form is also more cost-effective, especially when purchased in bulk, appealing to long-term users.

The ready-to-drink (RTD) segment is set to experience the fastest growth from 2025 to 2032 due to its convenience and immediate usability. RTD products require no preparation, making them ideal for on-the-go consumption, travel, pre-surgery nutrition, and weight loss. They offer better taste and satiety, effectively replacing calorie-dense meals with balanced nutrients. Innovations incorporating plant-based ingredients and specialized formulations, such as vegan, lactose-free, and keto-friendly options, are expanding their appeal. The RTD market is projected to nearly double by 2032, driven by rising health awareness, busy lifestyles, and product advancements.

Based on distribution channel, the offline channel (pharmacies/health stores, supermarket/hypermarkets, and convenience stores) is anticipated to dominate the meal replacement products market, holding the largest revenue share of approximately 70% in 2025. High foot traffic and a wide variety of over-the-counter meal replacement products encourage shoppers to resort to impulse buys. Customers have the advantage of comparing various brands and the nutritional labels before making the purchase. The proximity of the retail stores also helps in increased purchases of meal replacement products.

The online segment is the fastest-growing distribution channel, fueled by shifting consumer shopping behaviors since the COVID-19 pandemic. The increasing penetration of the internet and the widespread use of smartphones have made online shopping highly convenient. Online platforms help tech-savvy consumers to research various products and make informed purchases. Many e-commerce sites offer subscription services and regular, hassle-free deliveries, spurring market growth. Companies such as Herbalife, which resorted to selling its products through a network of independent salespeople for 35 years, shifted to online sales from its website in 2015.

North America is anticipated to lead with a revenue share of 55% in 2025. Many consumers in the region are well aware of the advantages of meal replacement products and have higher disposable incomes to afford these products, driving the meal replacement products. Busy lifestyles and the increasing incidence of obesity among individuals are also leading to a market boom. The strong presence of specialty retailers, well-established e-commerce platforms, and subscription-based services also contributes to market expansion. The region benefits from world-class advanced food technology, enabling the development of high-quality products that cater to a diverse range of people.

The U.S. market is expected to witness significant growth owing to the increasing health awareness among individuals about consuming the stipulated calories fortified with nutrients. The fitness and health influencers are also reshaping consumer behavior. The increasing prevalence of chronic lifestyle illnesses and the presence of a strong distribution network also play major roles in the meal replacement products market growth.

Asia Pacific market is likely to witness the fastest growth in the coming years. Increasing disposable incomes in India and China encourage consumers to explore various health supplements, including meal replacement products. Wide social media usage is also influencing lifestyle choices, with many people following celebrity fitness influencers. Growing awareness of macro and micro nutrition contributes to demand as several consumers are short of time to plan meals and cook, owing to business priorities and professional commitments.

The meal replacement products industry in China witnesses fast-growth in the forecast period, driven by urbanization, rising disposable incomes, increased health-consciousness, and the cultural shift toward Western diets and influencers. The increase in e-commerce penetration also drives market growth.

Europe is anticipated to dominate with substantial growth in the market by 2032. An increasing number of aging European consumers and high disposable incomes among the health-conscious younger population drive the demand. European consumers are aware of various health trends and balanced nutrition, and it also hosts a wide network of retail shops and pharmacies.

Germany's food industry is the fastest-growing market in Europe. The high presence of the geriatric population and increasing demand for clean, plant-based products drive market growth. There is a high demand for gluten-free and vegan products fortified with prebiotics and probiotics.

The global meal replacement products market is highly competitive, with the global and domestic players offering a wide range of products and vying for a higher market share. Companies invest in R&D activities and adopt growth strategies such as product innovations, strategic partnerships, and acquisitions. Moreover, companies are also strengthening their market position through e-commerce, direct-to-consumer models, and subscription-based offerings.

Key Industry Developments

The global market is projected to be valued at US$ 17.04 Bn in 2025.

Increasing health consciousness, aging population, rising disposable incomes among the younger demographic, and stronger preference for fortified and functional food owing to hectic lifestyles are propelling market growth.

The market is poised to witness a CAGR of 7.9% from 2025 to 2032.

The key market opportunities include a significant demand for plant-based and vegan options, appealing to a wider consumer base seeking alternatives.

Major players in the meal replacement products industry include Abbott Laboratories, Blue Diamond Global Ingredients Division, Bob's Red Mill Natural Foods, and General Mills.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author