ID: PMRREP32442| 174 Pages | 19 Aug 2025 | Format: PDF, Excel, PPT* | Industrial Automation

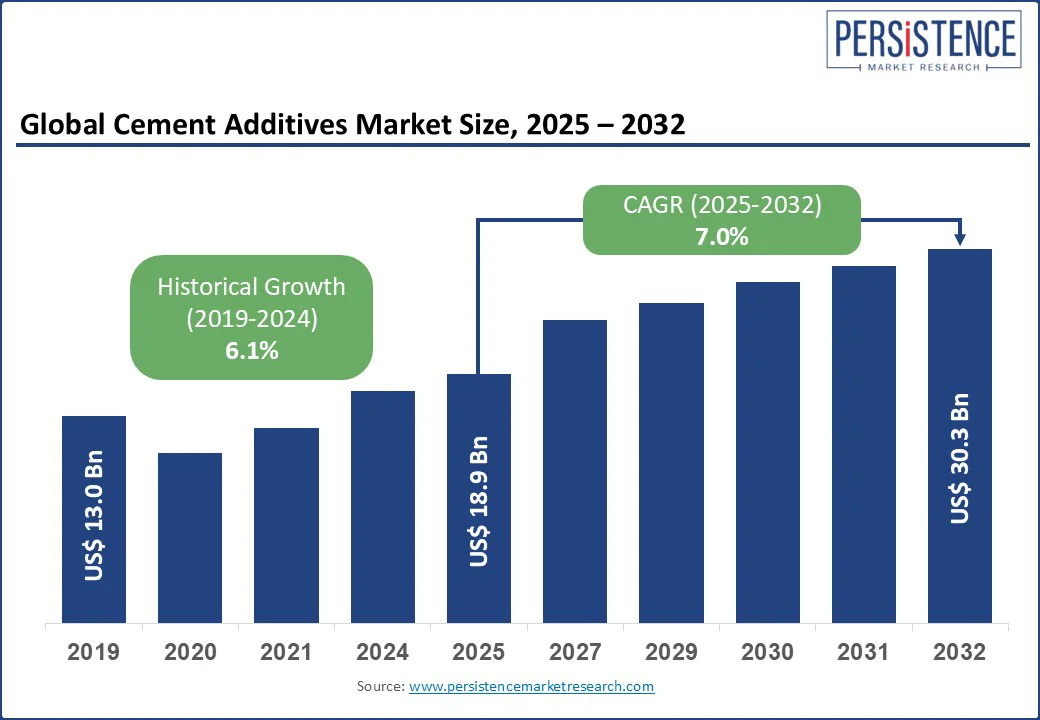

The global cement additives market size is likely to reach US$18.9 Bn in 2025 and is expected to reach US$30.3 Bn by 2032, registering a CAGR of 7.0% during the forecast period from 2025 to 2032.

The cement additives market has experienced significant growth, driven by the global surge in construction activities, increasing demand for high-performance concrete, and the push for sustainable building materials. The sector is propelled by the need for cost-effective, durable, and environmentally friendly additives that enhance cement properties while meeting stringent environmental regulations and construction standards.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Cement Additives Market Size (2025E) |

US$18.9 Bn |

|

Market Value Forecast (2032F) |

US$30.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.0% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.1% |

The surge in construction and infrastructure development is a primary catalyst driving the growth of the cement additives market. Rapid urbanization, population growth, and economic expansion in emerging economies have led to a significant increase in demand for residential, commercial, and industrial buildings.

Governments worldwide are investing heavily in infrastructure projects, including highways, bridges, airports, and public transportation, to support sustainable development and enhance connectivity.

For instance, India’s National Infrastructure Pipeline (NIP) aims to invest over $ 1.5 trillion in infrastructure development by 2025, fueling demand for advanced construction materials. These large-scale projects require materials with enhanced durability, workability, and strength qualities provided by cement additives. Additionally, the shift towards smart cities and green buildings has intensified the need for high-performance concrete with superior properties.

Cement additives improve concrete performance by optimizing setting times, reducing water content, and enhancing resistance to environmental factors, making them indispensable in modern construction and infrastructure initiatives. This trend continues to fuel market expansion globally.

Fluctuating raw material costs pose a significant challenge to the cement additives market. The prices of key raw materials such as chemicals, minerals, and polymers used in manufacturing cement additives are subject to volatility due to factors such as supply chain disruptions, geopolitical tensions, and changes in demand-supply dynamics.

For instance, the sharp increase in crude oil prices in 2022 led to a substantial rise in the cost of petroleum-based chemicals, which are critical inputs for many chemical additives. This unpredictability makes it difficult for manufacturers to maintain stable pricing, affecting profit margins and potentially leading to increased costs for end-users. Additionally, raw material scarcity or sudden price hikes may cause delays in production and supply chain inefficiencies. Such uncertainties can hinder investment in research and development and slow down market growth, posing a considerable restraint for the cement additives industry globally.

Advancements in sustainable additive technologies present a significant opportunity for the cement additives market. As the construction industry faces increasing pressure to reduce its environmental footprint, there is a growing demand for eco-friendly additives that enhance concrete performance while minimizing carbon emissions. Innovations such as bio-based additives, recycled material incorporation, and low-carbon chemical formulations are gaining traction.

For instance, companies such as BASF have developed eco-friendly concrete additives that incorporate recycled materials and reduce the carbon footprint of construction projects. These technologies improve concrete durability, reduce water and energy consumption, and promote the use of industrial by-products such as fly ash and slag as sustainable additives.

Additionally, regulatory frameworks and green building certifications are encouraging the adoption of sustainable materials. By investing in research and development of greener additives, manufacturers can meet evolving market needs, differentiate their products, and contribute to global sustainability goals. This shift not only opens new market segments but also supports long-term growth in the cement additives industry.

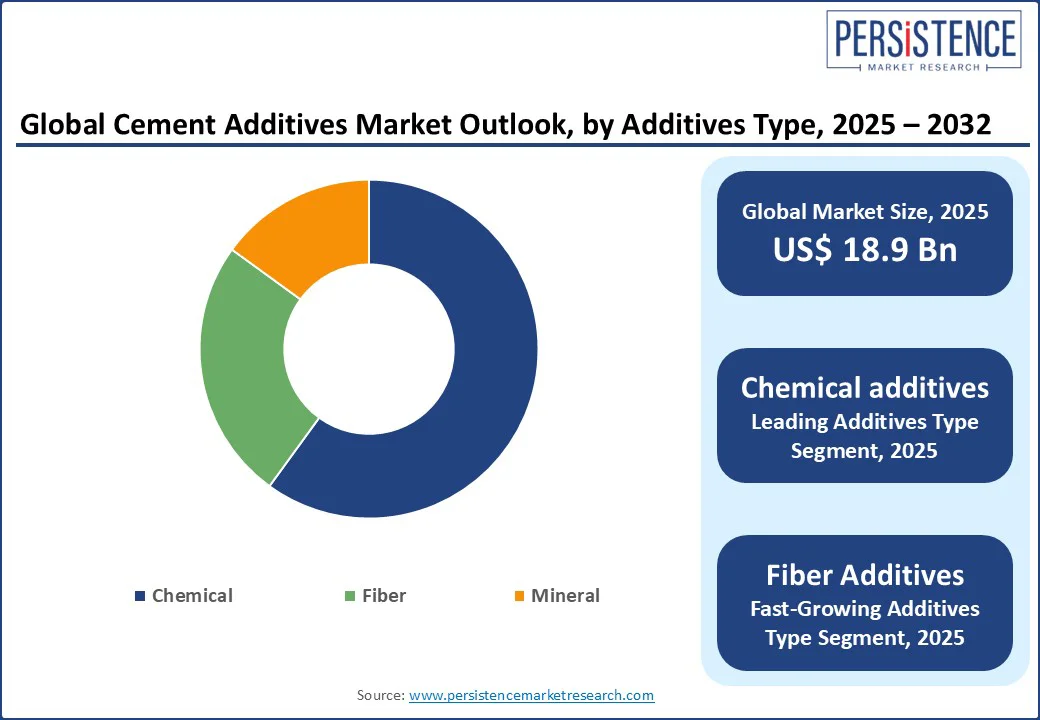

Chemical Additives dominate the cement additives market, expected to account for approximately 60% of the sector share in 2025. Their dominance stems from their versatility, cost-effectiveness, and ability to enhance critical concrete properties such as strength, workability, and setting time. Chemical additives, including water reducers, plasticizers, and retarding agents, are widely used in high-performance concrete for infrastructure and commercial projects. Their compatibility with various cement types and construction applications enhances their applicability across industries.

The Fiber Additives segment is the fastest-growing from 2025 to 2032, driven by increasing demand for high-durability concrete in infrastructure and industrial applications. Fiber additives, such as polypropylene and steel fibers, improve concrete’s tensile strength and crack resistance, making them ideal for heavy-duty applications such as bridges, tunnels, and pavements. The rise of sustainable construction practices and advancements in fiber technology, which reduce production costs, are accelerating the adoption of fiber additives, particularly in emerging markets.

Water Reducers hold the largest market share, accounting for approximately 28% of revenue in 2025. Their popularity is driven by their ability to reduce water content in concrete mixtures while maintaining workability, resulting in stronger and more durable concrete. Water reducers are critical for high-performance concrete used in large-scale infrastructure projects, such as dams and high-rise buildings, and their eco-friendly variants support sustainability goals in construction.

Chemical Resistance Additives are the fastest-growing segment, driven by the growing demand for concrete that can withstand harsh environmental conditions, such as exposure to chemicals, saltwater, and extreme temperatures. These additives are particularly sought after in industrial applications, such as chemical plants and coastal infrastructure, where durability is paramount. The growing focus on infrastructure resilience in regions prone to environmental challenges is driving the rapid adoption of chemical resistance additives.

The North American cement additives market is experiencing steady growth, driven by increasing infrastructure development and renovation activities across the region. The United States and Canada are focusing on upgrading aging infrastructure, including roads, bridges, airports, and public transportation systems, which is boosting demand for high-performance cement additives that enhance concrete durability and workability.

According to the American Society of Civil Engineers (ASCE), the U.S. infrastructure received a grade of C- in 2023, prompting a multibillion-dollar investment plan to improve and modernize infrastructure, fueling additive demand. Additionally, the growing emphasis on sustainable construction practices and stringent environmental regulations, such as the U.S. EPA’s focus on reducing carbon emissions in the construction sector, is encouraging the adoption of eco-friendly additives that reduce carbon footprints. Innovations in additive technologies, such as water reducers, superplasticizers, and retarders, are gaining traction to meet these demands.

The rising investment in commercial and residential construction, coupled with government initiatives promoting green building standards such as LEED and WELL certifications, further propels market expansion. Overall, the North American cement additives market is poised for consistent growth, supported by technological advancements, increasing infrastructure funding, and heightened awareness of sustainable building practices.

The European cement additives market is witnessing steady growth, fueled by robust infrastructure modernization and stringent environmental regulations across the region. Countries such as Germany, France, and the UK are investing heavily in upgrading transportation networks, including highways, railways, and airports, driving demand for high-performance cement additives that improve concrete strength and durability. The European Union’s commitment to sustainability through policies such as the European Green Deal promotes the use of eco-friendly additives to reduce carbon emissions in construction.

Innovations in admixtures, such as low-carbon and bio-based additives, are gaining traction to meet these environmental goals. Furthermore, renovation of aging infrastructure and growth in the residential and commercial construction sectors support market expansion. Increasing awareness of green building certifications such as BREEAM further encourages the adoption of sustainable cement additives. Overall, Europe’s cement additives market is poised for progressive growth, driven by environmental focus and infrastructural investments.

The Asia Pacific global cement additives market dominates the global landscape, accounting for over 46% of total revenue in 2025. Rapid urbanization, industrial growth, and large-scale infrastructure development in countries such as China, India, Japan, and Southeast Asian nations are key growth drivers.

The rising demand for residential, commercial, and industrial construction projects fuels the need for advanced cement additives that enhance concrete strength, durability, and workability. Governments in the region are investing heavily in smart city initiatives, transportation networks, and sustainable infrastructure, further propelling market demand. Environmental regulations and the push for greener construction practices have accelerated the adoption of eco-friendly additives, such as bio-based and low-carbon formulations.

Additionally, the increasing adoption of precast concrete and ready-mix concrete in construction projects is boosting the demand for specialized additives that improve setting times and durability. Combined with growing R&D investments, expanding manufacturing capacities, and rising awareness about sustainable construction, the Asia Pacific market continues to lead globally, reflecting robust growth prospects and significant revenue contribution.

The Global cement additives market is characterized by strong competition, regional strengths, and a mix of global and local manufacturers. In developed regions such as North America and Europe, large firms such as BASF SE, Sika AG, and Dow dominate through scale, advanced technology, and established partnerships with construction and infrastructure giants.

In the Asia Pacific, rapid urbanization and infrastructure growth are attracting significant investments from both local and international players. Companies are focusing on sustainability, cost-efficiency, and innovation to gain a competitive edge. R&D in eco-friendly and high-performance additives has emerged as a key differentiator, enabling firms to meet evolving regulatory and market demands. Strategic alliances and acquisitions are further intensifying the competitive landscape.

The Global Cement Additives market is projected to reach US$ 18.9 Bn in 2025.

The surge in construction and infrastructure development is a key driver.

The Cement Additives market is poised to witness a CAGR of 7.0% from 2025 to 2032.

Advancements in sustainable additive technologies are a key opportunity.

Dow, BASF SE, AkzoNobel NV, HeidelbergCement, and Sika AG are key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

|

By Additives Type

By Function

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author