ID: PMRREP33464| 198 Pages | 24 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

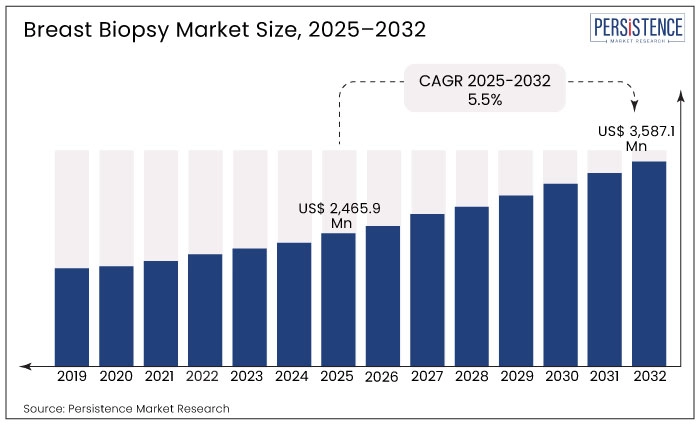

The global breast biopsy market is forecasted to evolve at a CAGR of 5.5% to reach a valuation of US$ 3,587.1 Million by the end of 2032.

Changes in an individual's lifestyle, including behavioral patterns, dietary preferences, and physical activity levels, have the potential to worsen breast cancer. Obesity is linked to higher blood insulin levels, which have been correlated with various types of cancer, particularly breast cancer.

Breast cancer can be caused by several lifestyle factors, including drinking alcohol, being overweight, using birth control measures, receiving menopausal hormone therapy, and getting breast implants. The rising incidence of breast cancer globally means more individuals being diagnosed with the disease. A breast biopsy is a crucial diagnostic procedure to confirm whether a suspicious breast lesion is cancerous or benign. The increasing number of breast cancer cases contributes to the demand for breast biopsy tests.

Emphasis on early detection and screening programs for breast cancer has led to a greater number of cases being identified at an early stage. Regular mammography screenings and increased awareness have helped in detecting breast abnormalities at earlier, more treatable stages. Early detection often requires further evaluation through breast biopsy, leading to an increased demand for these procedures.

The trend toward minimally invasive biopsy techniques, such as core needle biopsy and vacuum-assisted biopsy, has gained momentum. These procedures offer greater accuracy, reduced patient discomfort, and faster recovery times compared to traditional open surgical biopsies. Increasing prevalence of breast cancer has contributed to the adoption of these less invasive techniques.

Increasing prevalence of breast cancer has a direct impact on the breast biopsy market. As breast cancer rates rise, demand for breast biopsy procedures also increases. This has spurred research and development efforts to improve breast biopsy techniques and technologies. Ongoing advancements in biopsy devices, imaging integration, robotics, and liquid biopsy technologies aim to enhance diagnostic accuracy, streamline procedures, and improve patient outcomes. All these factors propel the growth of the market.

| Report Attributes | Details |

|---|---|

|

Global Breast Biopsy Market Size (2025) |

US$ 2,465.9 Million |

|

Projected Market Value (2032) |

US$ 3,587.1 Million |

|

Market Growth Rate (2025 to 2032) |

5.5% CAGR |

| Historical Market Growth Rate (CAGR 2019 to 2024) |

3.8% |

“Increasing Prevalence of Breast Cancer and Growing Demand for Minimally-Invasive Techniques”

Devices for breast biopsies are being used more often to locate and map breast cancer. Only a limited number of companies, however, are now actively involved in the production of breast biopsy equipment, suggesting that there are opportunities for manufacturers to enter the market as the demand for these devices rises quickly.

Breast cancer is the most prevalent type of cancer in developing countries, and its prevalence among women in urban areas is rising quickly. Early discovery is a significant factor in the efficient management and treatment of this illness. To raise awareness and remove the stigma attached to breast cancer symptoms and treatment, breast cancer awareness events are organized.

Companies in developing regions have enormous potential because of the rising incidence of the disease. A large pool of cancer patients and rising per capita income are anticipated to create profitable opportunities for market penetration and expansion across the globe.

There is a continuous need for technological advancements in breast biopsy procedures and devices. Opportunities exist for the development of more precise and efficient biopsy devices, such as improved needle designs, advanced imaging integration, and robotic-assisted biopsy systems. Innovations that enhance accuracy, reduce procedure time, and improve patient comfort will be in high demand.

The trend toward personalized medicine in breast cancer management presents opportunities for the development of companion diagnostic tools and biomarker analysis techniques. Integration of molecular profiling and genetic testing in biopsy procedures allows for targeted therapies and individualized treatment approaches. Companies are now focusing on developing advanced biopsy devices that enable accurate biomarker analysis and genetic testing.

The market offers opportunities for technological advancements, the development of liquid biopsy and point-of-care devices, expansion into emerging markets, personalized medicine approaches, leveraging data analytics and AI, collaborations and partnerships, patient education, and integration of multimodal imaging. Exploring these opportunities can drive growth and improve patient care in the field of breast biopsy.

“High Cost of Breast Biopsy Equipment and Lack of Infrastructure for Efficient Installation”

Breast biopsy procedures can be expensive, particularly in some healthcare systems where financial constraints limit access to advanced diagnostic technologies. The cost of biopsy devices, imaging equipment, and pathology analysis can pose challenges for patients and healthcare providers, hindering the widespread adoption of these procedures.

In certain regions or remote areas, access to specialized healthcare facilities and trained medical professionals who can perform breast biopsies is also limited. Accuracy and success of breast biopsy procedures depend on the skills and experience of the operator performing the procedure. Inexperienced operators may have a higher risk of inadequate tissue sampling or technical errors, affecting the reliability of the biopsy results.

The regulatory landscape and reimbursement policies for breast biopsy procedures can vary across different regions. Obtaining regulatory approvals and securing adequate reimbursement can pose challenges for companies developing new biopsy technologies. Complex reimbursement processes may affect the adoption of advanced biopsy techniques, particularly in resource-constrained settings.

Lack of infrastructure, equipment, and skilled personnel restricts the availability of biopsy services, leading to delayed diagnoses and inadequate patient care.

What Makes the United States a Lucrative Market for Manufacturers of Breast Biopsy Equipment?

“Availability of Advanced Diagnostic Methods and Favorable Reimbursement Practices”

The U.S. dominated the North American region generating revenue worth US$ 594.7 million in 2024.

The market in the U.S. is one of the largest and most developed globally. It has experienced consistent growth due to factors such as an aging population, increasing breast cancer incidence, and advancements in biopsy technologies. The market is projected to continue growing as the demand for early detection and improved diagnostic accuracy remains high.

What is the Demand Projection for Breast Biopsy Equipment in China?

“Increasing Government Investments in Healthcare Infrastructure Development for Improved Patient Outcomes”

China held 38% share of the East Asia market for breast biopsies in 2024.

The market in China presents significant opportunities for growth and development due to the country's large population, increasing breast cancer incidence, improving healthcare infrastructure, technological advancements, and awareness initiatives. Continued investments in healthcare, increased access to advanced diagnostic technologies, and addressing regional disparities will further drive the growth of the breast biopsy market in China.

China has been investing significantly in healthcare infrastructure development, including the expansion of medical facilities and the introduction of advanced medical technologies. The improved access to healthcare services, specialized clinics, and advanced imaging equipment enhances the availability and quality of breast biopsy procedures across different regions of the country.

How is Demand for Breast Biopsy Equipment and Procedures Shaping Up in the United Kingdom?

“Increasing Awareness of Early Detection and Treatment”

The United Kingdom held 21.8% share of the European market in 2024.

The U.K. is known for its strong research and innovation in the field of healthcare. Ongoing research and collaborations contribute to the development of new biopsy technologies, improvement of diagnostic accuracy, and exploration of novel approaches, such as liquid biopsy, to enhance breast cancer diagnosis and management.

The country has stringent quality standards and regulations for medical devices, including those used in breast biopsy procedures. Compliance with these standards, as well as adherence to guidelines set by organizations like the National Institute for Health and Care Excellence (NICE), is important for companies operating in the U.K. breast biopsy market.

Which Breast Biopsy Product Accounts for High Sales?

“Cost-effectiveness and Ease of Use of Biopsy Needles Leading to High Product Sales”

The breast biopsy needles segment held 23.3% share of the global market in 2024.

Biopsy needles play a crucial role in breast biopsy procedures. These needles are typically used to penetrate the breast tissue and extract the tissue sample for examination. They come in different sizes, designs, and configurations to accommodate various biopsy techniques and patient requirements.

Due to its cost-effectiveness and ease of use by surgeons and radiologists during operations, the segment held a dominant share in 2022. Fluids, cells, or tissues are removed from a suspicious mass or any aberrant part of the body using a hollow thin needle and syringe. To identify the origin of the anomaly, the material is then examined under a microscope or put through a series of tests in a lab.

Which Indication Occupies a Leading Share of the Market?

“Increasing Utilization of Breast Biopsy Equipment for Diagnosis of Complex Cysts”

The complex cysts indication segment held 37.4% share of the global market in 2024.

A complex cyst in the breast refers to a fluid-filled sac with internal structures, such as solid components or septations, which can be seen in imaging studies like mammograms, ultrasounds, or MRIs. When a complex cyst is detected, a breast biopsy is recommended to evaluate the nature of the cyst and rule out any potential underlying abnormalities such as cancer.

Key manufacturers of breast biopsy devices are developing and launching novel products to detect breast cancer. To strengthen their market position, established players within the industry are adopting mergers and acquisitions as a key strategy.

The market is expected to reach US$ 3,587.1 million by 2032.

The market is forecasted to grow at a CAGR of 5.5%.

The United States, with revenue of US$ 594.7 million in 2024.

Complex cysts, accounting for 37.4% of the global market in 2024.

Hologic, Inc., with global R&D and training facilities for advanced breast healthcare solutions.

| Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

Value: US$ Bn, Volume: As applicable |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Covered |

|

| Report Highlights |

|

|

Customization & Pricing |

Available upon Request |

Product:

Indication:

End User:

Region:

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author