ID: PMRREP33944| 213 Pages | 3 Feb 2026 | Format: PDF, Excel, PPT* | Healthcare

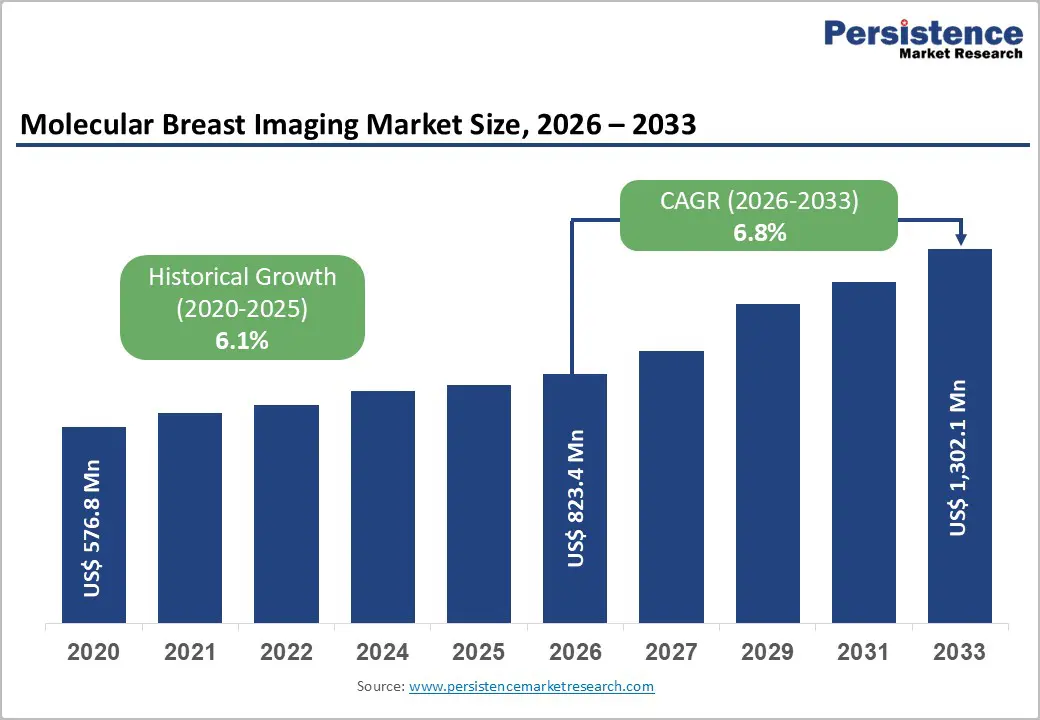

The global molecular breast imaging market size is expected to be valued at US$ 823.4 million in 2026 and projected to reach US$ 1,302.1 million by 2033, growing at a CAGR of 6.8% between 2026 and 2033.

The global rise in breast cancer incidences and the high prevalence of dense breast tissue affect approximately 10% of the screening population. Molecular Breast Imaging uses 99mTc sestamibi radiopharmaceuticals and specialized cadmium zinc telluride (CZT) gamma cameras and demonstrates superior diagnostic performance compared with conventional mammography, with a sensitivity of 91.7% and specificity of 80.7%, significantly surpassing traditional imaging modalities in women with dense breasts. FDA regulatory mandates requiring breast density notification in mammography reports (effective September 2024) have increased demand for advanced supplemental imaging solutions.

Additionally, the shift toward precision medicine and personalized risk stratification, combined with advances in dual-head gamma camera technology and reduced-dose radiation protocols, continues to drive clinical adoption across hospitals, diagnostic imaging centers, and specialized breast care facilities.

| Key Insights | Details |

|---|---|

| Molecular Breast Imaging Market Size (2026E) | US$ 823.4 million |

| Market Value Forecast (2033F) | US$ 1,302.1 million |

| Projected Growth CAGR (2026 - 2033) | 6.8% |

| Historical Market Growth (2020 - 2025) | 6.1% |

The rising prevalence of dense breast tissue among women is emerging as a significant driver for the molecular breast imaging (MBI) market. Dense breast tissue not only increases the risk of developing breast cancer but also complicates detection using conventional mammography, as dense tissue can mask tumors, leading to delayed or missed diagnoses. MBI offers a highly sensitive alternative, capable of detecting malignancies in dense breast tissue that traditional imaging may overlook. With growing awareness of breast density’s impact on cancer risk, clinicians are increasingly adopting MBI to ensure accurate and early detection. This trend is further fueled by regulatory recommendations and patient demand for more reliable diagnostic options. Consequently, the need for advanced imaging solutions like MBI is expanding rapidly, positioning it as a critical tool in personalized breast cancer care and early intervention strategies.

Cadmium zinc telluride (CZT) detector technology has revolutionized molecular breast imaging by enabling compact, high-resolution systems that acquire opposing breast views simultaneously via dual-head configurations. Contemporary systems achieve spatial resolution of approximately 2-3 millimeters, enabling detection of subcentimeter lesions with substantially improved sensitivity compared to historical scintimammography approaches. Dual-head molecular breast imaging systems demonstrate 90% sensitivity for lesion detection, compared to 80% for single-head systems, with a particular advantage for small lesions ≤10 millimeters, where sensitivity improves from 68% (single-head) to 82% (dual-head). Advances in image acquisition protocols have enabled radiation dose reduction to 240-300 MBq of Tc-99m sestamibi, substantially lower than historical standards and comparable to diagnostic positron emission tomography (PET) studies. Technological innovation in iterative reconstruction algorithms, metal artifact reduction, and quantification software has enhanced clinical utility, making molecular breast imaging increasingly viable as a routine supplemental diagnostic tool. The acquisition of GE Healthcare’s Discovery NM750b molecular breast imaging assets by SmartBreast (2021) with 217 global installations underscores confidence in the technology’s commercial viability and long-term clinical integration.

Regulatory uncertainty and limited large-scale clinical validation continue to restrain the growth of the Molecular Breast Imaging (MBI) market. While MBI demonstrates promising diagnostic accuracy, its adoption is hindered by inconsistent regulatory frameworks across regions, leading to delays in approvals and challenges in standardizing usage guidelines. Moreover, the scarcity of large multicenter clinical studies that validate long-term efficacy and cost-effectiveness creates hesitancy among healthcare providers and payers. Many clinicians still rely on traditional imaging modalities because of established protocols and reimbursement coverage, thereby limiting the integration of MBI into routine practice. This uncertainty not only slows market penetration but also impacts investor confidence and funding for research and development. Until more robust clinical evidence and regulatory clarity are established, widespread adoption of MBI will remain constrained despite its technical advantages.

The integration of Artificial Intelligence (AI) and computer-aided diagnosis (CAD) systems presents a significant growth opportunity for the Molecular Breast Imaging (MBI) market. AI algorithms can enhance image interpretation by identifying subtle patterns and anomalies that may be overlooked during manual analysis, thereby improving diagnostic accuracy and reducing false negatives, particularly in women with dense breast tissue. CAD systems streamline workflow, enabling faster processing of large imaging volumes and supporting radiologists in making more confident clinical decisions. Furthermore, the integration of MBI with AI-driven analytics enables personalized breast cancer screening and risk stratification, aligning with precision medicine initiatives. As healthcare providers increasingly adopt digital and AI-enabled diagnostic tools, MBI equipped with advanced AI and CAD capabilities is poised to see accelerated adoption, improved clinical outcomes, and expanded market penetration globally.

Dual-head gamma camera systems currently hold a dominant market position within the Modality category, serving as the technology platform of choice for contemporary molecular breast imaging applications. Dual-head configurations acquire simultaneous opposing breast views, enabling 90% sensitivity for breast lesion detection compared to 80% for single-head systems, providing a substantive diagnostic advantage, particularly for small lesions and evaluation of small-breasted women. The Discovery NM750b system (now rebranded as EVE CLEAR SCAN e750 following acquisition by SmartBreast) and Symbia Intevo SPECT/CT systems from Siemens Healthineers represent industry-leading dual-head platforms, commanding significant market share through established clinical track records and comprehensive feature sets.

Single-head gamma camera systems continue to represent approximately 30-35% of the installed base, primarily in resource-constrained settings or institutions with lower screening volumes. However, market dynamics increasingly favor dual-head systems due to superior diagnostic performance and enhanced patient experience, with conversion trends from single-head to dual-head configurations driving modality segment growth.

Planar imaging, representing two-dimensional image acquisition in positions identical to mammography, constitutes the dominant imaging technique within molecular breast imaging, accounting for approximately 65-70% of clinical applications. Planar imaging demonstrates exceptional clinical utility as a problem-solving modality for inconclusive mammographic findings, achieving rapid image acquisition with 10-minute protocols enabling integration into standard breast imaging workflows. SPECT imaging (single-photon emission computed tomography), acquiring three-dimensional volumetric information through limited-angle tomographic reconstruction, provides improved anatomical localization and contrast-to-noise characteristics compared to planar techniques.

Clinical evidence demonstrates that SPECT provides superior spatial resolution and reduced depth dependence compared with planar imaging, which is particularly advantageous for extra-axillary sentinel lymph node detection and assessment of complex anatomical distributions. However, SPECT imaging increases procedure time by 40-50%, delivers higher radiation dose, and requires specialized reconstruction algorithms, limiting routine adoption for screening applications.

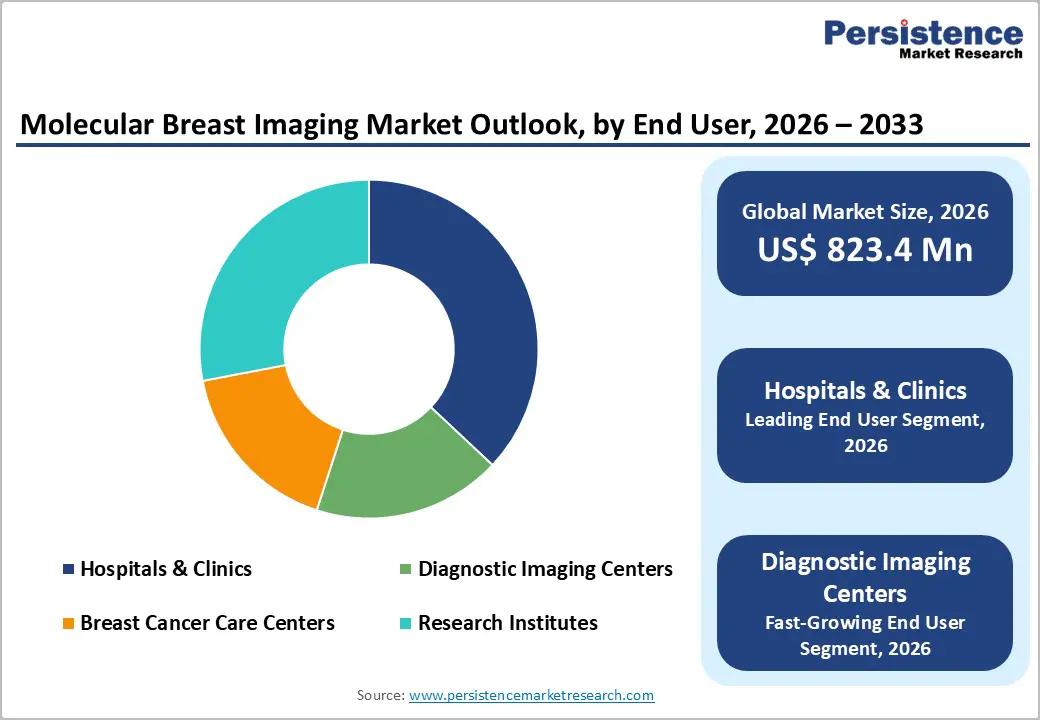

Hospitals and clinics represent the dominant end-user segment, accounting for approximately 37% market share in 2025, driven by established clinical infrastructure, existing nuclear medicine departments, and institutional capacity for comprehensive breast imaging programs. Major teaching hospitals and academic medical centers have integrated molecular breast imaging into multidisciplinary breast programs, positioning the technology as a complementary modality within comprehensive diagnostic algorithms. Diagnostic imaging centers constitute the fastest-growing end-user segment, experiencing growth rates exceeding 12-15% annually, driven by the trend toward specialized, high-volume imaging centers offering integrated breast imaging platforms combining mammography, ultrasound, tomosynthesis, and molecular breast imaging. These specialized centers optimize operational efficiency through dedicated workflows and radiologists' expertise, thereby creating attractive business models for the adoption of molecular breast imaging. Breast cancer care centers and research institutes, collectively accounting for 15-20% of market, drive molecular breast imaging adoption through clinical research initiatives evaluating molecular subtyping, treatment response monitoring, and novel radiopharmaceutical development.

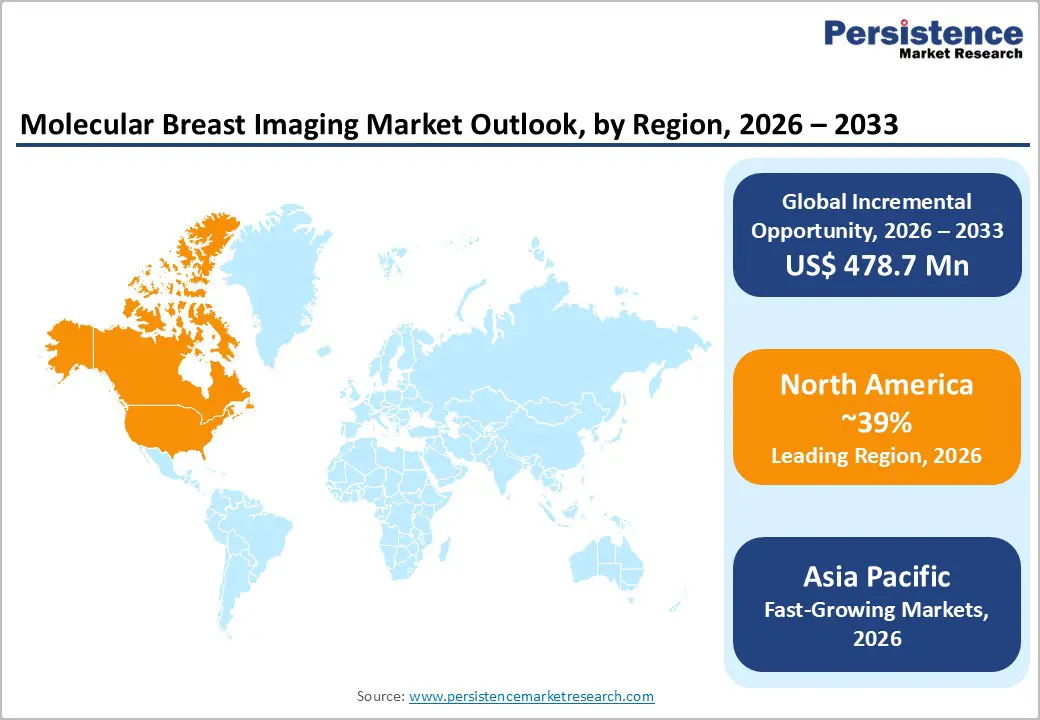

North America remains the leading region in the molecular breast imaging market, driven by a combination of advanced healthcare infrastructure, high breast cancer prevalence, and strong adoption of cutting-edge diagnostic technologies. The presence of well-established hospitals, specialty breast care centers, and diagnostic imaging facilities ensures early adoption of MBI systems. Favorable reimbursement policies and regulatory support further encourage healthcare providers to integrate MBI into routine screening and diagnostic workflows. Additionally, growing awareness of dense breast tissue and the limitations of traditional mammography has increased demand for more sensitive imaging solutions. Continuous investment in research, technological innovations, and collaborations between device manufacturers and medical institutions have also strengthened the region’s market leadership. North America’s focus on precision medicine, AI integration, and personalized patient care reinforces its dominant position, making it a critical hub for the global adoption and development of MBI.

The Asia Pacific molecular breast imaging market is emerging rapidly, driven by increasing breast cancer awareness, rising prevalence of dense breast tissue, and expanding healthcare infrastructure. Countries such as China, India, Japan, and South Korea are witnessing growing demand for advanced diagnostic technologies to address gaps in early detection. Limited access to traditional imaging and rising patient preference for accurate, non-invasive methods further fuel MBI adoption.

Government initiatives promoting cancer screening, coupled with investments in modern hospitals and diagnostic centers, support market growth. Additionally, increasing collaborations between regional healthcare providers and international MBI system manufacturers are accelerating technology transfer and local deployment. With rising disposable incomes, improved healthcare coverage, and growing emphasis on early diagnosis, the Asia Pacific is positioned as the fastest-growing regional market for MBI, offering significant opportunities for expansion and innovation.

The molecular breast imaging market is moderately competitive, with several key players focusing on product innovation, strategic partnerships, and geographic expansion to strengthen their market position. Companies are investing in advanced dual-head imaging systems, AI integration, and enhanced detector technologies to improve diagnostic accuracy and workflow efficiency. Collaborations with hospitals, diagnostic centers, and research institutes enable broader adoption and clinical validation. New entrants are exploring cost-effective solutions to target emerging markets, while established players leverage brand reputation and regulatory approvals to maintain leadership.

The global Molecular Breast Imaging market is projected to reach US$ 823.4 million in 2026.

Dense breast tissue prevalence, advanced dual-head gamma camera systems, FDA breast density mandates, higher cancer detection rates, and AI integration.

North America maintains the dominant regional market position with approximately 39% global market share in 2025.

Integration of AI and computer-aided diagnosis (CAD) systems to improve efficiency and diagnostic accuracy.

Koninklijke Philips N.V., Hitachi Ltd., Siemens Healthcare GmbH, CANON MEDICAL SYSTEMS CORPORATION, General Electric, etc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020-2025 |

| Forecast Period | 2026-2033 |

| Market Analysis Units | Value: US$ Mn/Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Modality

By Imaging Technique

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author