ID: PMRREP35338| 190 Pages | 21 May 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

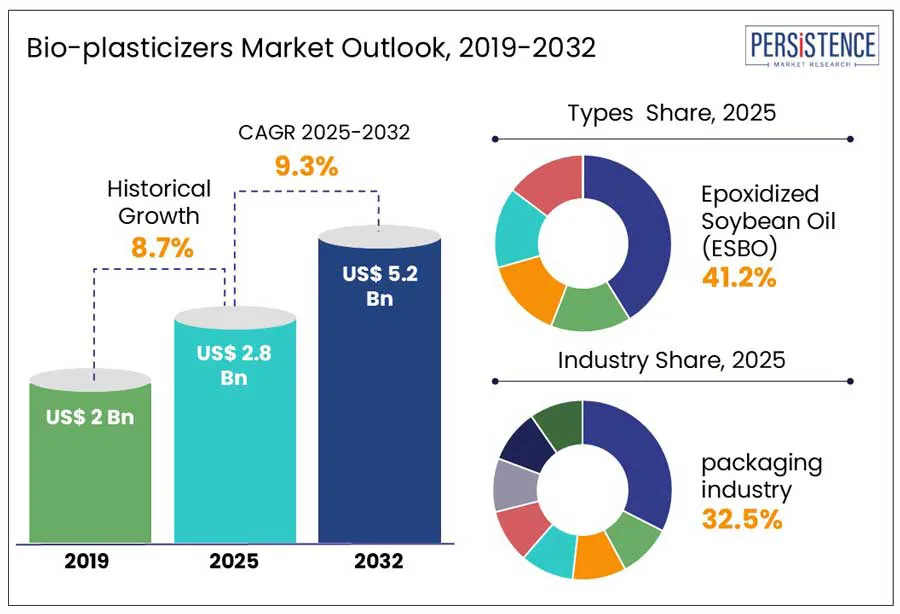

The global bio plasticizers market size is projected to reach US$ 2.8 Bn by 2025 and is anticipated to reach US$ 5.2 Bn at a CAGR of 9.3% by 2032. According to the Persistence Market Research report increasing demand for eco-friendly alternatives to traditional plasticizers fuels the need. Bio plasticizers are derived from renewable sources such as vegetable oils and starch, improve the flexibility of polymers while minimizing environmental impact. The market is expanding due to growing regulatory support, sustainability trends, and a rising number of applications in packaging, automotive, and consumer goods.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Bio plasticizers Market Size (2025E) |

US$ 2.8 Bn |

|

Market Value Forecast (2032F) |

US$ 5.2 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

9.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.7% |

Bio plasticizers, sourced from renewable materials such as vegetable oils and citrates, offers low toxicity, excellent biocompatibility, and decreased migration risks, making them suitable for IV bags, tubing, catheters, and blood storage containers. As hospitals and medical device producers focus on patient safety, there is a growing demand for environmentally friendly, non-toxic plasticizers, fueling market expansion. For example, B. Braun Medical has developed DEHP-free intravenous bags and tubing using bio-based plasticizers like TOTM and ATBC. These materials provide enhanced flexibility, strength, and compatibility with biological systems, eliminating health risks associated with phthalates.

The higher manufacturing costs compared to conventional phthalate-based plasticizers. Phthalates are derived from petroleum, benefit from established, large-scale production methods that result in lower prices, typically around US$1.00–US$1.50 per kg. In contrast, bio plasticizers come from sources such as vegetable oils, starches, and citrates, require intricate extraction and processing techniques, leading to costs between US$2.50 and US$4.00 per kg.

Moreover, bio plasticizers generally exhibit lower thermal stability and often necessitate modifications for them to be compatible with existing polymer systems. These challenges in terms of cost and performance hinder bio plasticizers' ability to compete, especially in industries like packaging and consumer goods that are sensitive to price.

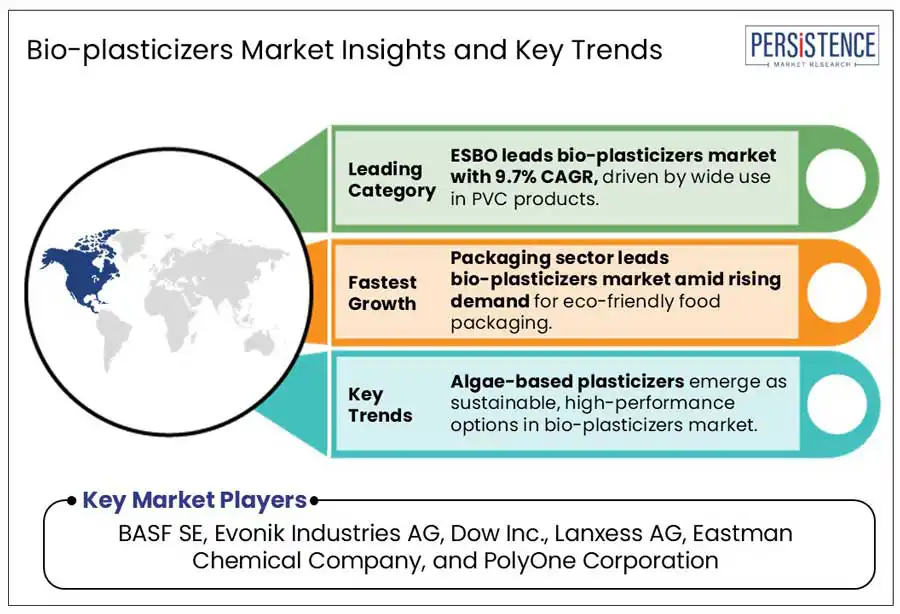

Algae-based plasticizers are becoming a sustainable and high-performance alternative in the bio plasticizers market. Algae grows quickly in a minimal land, and does not compete with food crops, making them an eco-friendly raw material. Rich in natural oils, they provide excellent flexibility, biodegradability, and thermal stability, which makes them ideal for use in packaging, medical devices, and consumer goods. Additionally, their low carbon footprint positions them as a significant innovation in sustainable materials. For instance, Eranova has launched AlgX, a bio-based resin made from green algae, suitable for various industrial processes such as extrusion, injection, and thermoforming. This resin is used in products like meal trays, garbage bags, and reusable packaging.

Among the types of bio plasticizers, the Epoxidized Soybean Oil (ESBO) segment leads the market, primarily due to its strong presence in PVC applications. It is expected to experience a robust CAGR of 9.7% by 2032. ESBO is commonly used as a plasticizer and stabilizer in food packaging, medical devices, and plastic films, with a high demand for phthalate-free alternatives. Its excellent thermal and oxidative stability enhances the durability of PVC-based materials, making it an ideal choice for long-term applications. For example, Nestlé and Heinz use ESBO in the PVC gaskets of their glass jar packaging to ensure airtight sealing while avoiding toxic phthalates. The FDA and European Food Safety Authority (EFSA) have approved ESBO for such applications, further solidifying its position as the leading bio-based plasticizer in the market.

The packaging industry is expected to reach at 9.5% CAGR by 2032. The packaging industry dominates the bio plasticizers market due to the rising demand for sustainable food packaging. With increasing consumer awareness and stringent regulations against phthalate-based plasticizers, manufacturers are shifting towards bio-based alternatives such as Epoxidized Soybean Oil (ESBO) and Citrates, which offer flexibility, durability, and food safety compliance. The food & beverage sector, in particular, relies heavily on bio-plasticized films, wraps, and containers to meet eco-friendly and non-toxic packaging standards.

For instance, in Europe and North America, McDonald follows 100% sustainable packaging, and has introduced biodegradable containers, straws, and wraps. These bio-based materials ensure food safety and compliance, and reflect on the growing demand for sustainable food packaging and its impact on the bio plasticizers market.

North America will lead the market in the coming years. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) have imposed restrictions on phthalates due to their potential health risks, including endocrine disruption and toxicity concerns. This has led to increased demand for bio-based alternatives derived from renewable sources such as vegetable oils, starch, and citrates.

Industries such as packaging, automotive, and healthcare are actively adopting bio plasticizers to comply with environmental and safety standards, fostering market expansion and innovation in sustainable plasticizer solutions. For example, the U.S. Consumer Product Safety Improvement Act (CPSIA) restricts the use of certain phthalates in children's toys and childcare products due to their potential health risks. Similarly, California’s Proposition 65 mandates labeling for products containing harmful phthalates, pushing manufacturers toward safer alternatives such as bio plasticizers.

Europe bio plasticizers packaging market is projected to grow from approximately €150–155 billion in 2024 to €185–190 billion, reaching a CAGR of around 4% by 2029. This growth reflects the rising demand for sustainable and innovative packaging solutions, particularly eco-friendly materials like bioplastics. However, the lack of clear EU regulations on bioplastics presents challenges for businesses in this sector.

While the EU is working on policies to support the circular economy, such as the Circular Economy Action Plan and the European Green Deal, the specific regulatory framework for bioplastics is still evolving. Clear regulations could enhance market adoption and investment in sustainable packaging. For a foreseeable future, the industry will be pivotal in shaping how bioplastics can fulfill sustainability goals within the expanding European packaging market.

The bio plasticizers industry position benefits from abundant natural resources, such as soybean, castor, palm, and sunflower oils, which are essential raw materials for bio-plasticizer production. Countries such as Indonesia and Malaysia rank among the world's largest producers of palm oil, while India and China lead in the production of castor and soybean oils. This easy access to raw materials greatly reduces procurement costs. Moreover, the region enjoys low labor costs and large-scale production capabilities, making manufacturing more cost-effective compared to Western countries.

The global bio plasticizers market is intensely competitive, with leading companies prioritizing product development, sustainability initiatives, and expansion into new regions to enhance their market position. The companies are focusing on strategic partnerships, mergers and acquisitions, as well as investment in R&D to create bio-based plasticizers that offer improved performance and environmental advantages.

The market competition is fueled by rising regulatory demands on phthalate-based plasticizers and an increasing need for eco-friendly alternatives in sectors such as packaging, consumer products, automotive, and construction. Firms are also concentrating on growing their production capacity and ensuring stable raw material supply chains to achieve cost-effectiveness.

Furthermore, local players in developing markets are gaining ground by providing economical and region-specific solutions. The market is anticipated to undergo additional consolidation as leading companies invest in biodegradable and non-toxic plasticizer options to secure a competitive advantage.

The market is estimated to be valued at US$ 2.8 Bn in 2025.

Rising demand for bio-based and non-toxic plasticizers in the medical sector is the key demand driver.

In 2025, North America dominates the global market with a 30.1% share

Among types, the preference for Epoxidized Soybean Oil (ESBO) segment is expected to grow rapidly at 9.7% CAGR from 2025-2032.

BASF SE, Evonik Industries AG, Dow Inc., Lanxess AG, Eastman Chemical Company, and PolyOne Corporation are the leading players in the market.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: kilotons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author