ID: PMRREP29185| 190 Pages | 29 Apr 2025 | Format: PDF, Excel, PPT* | Food and Beverages

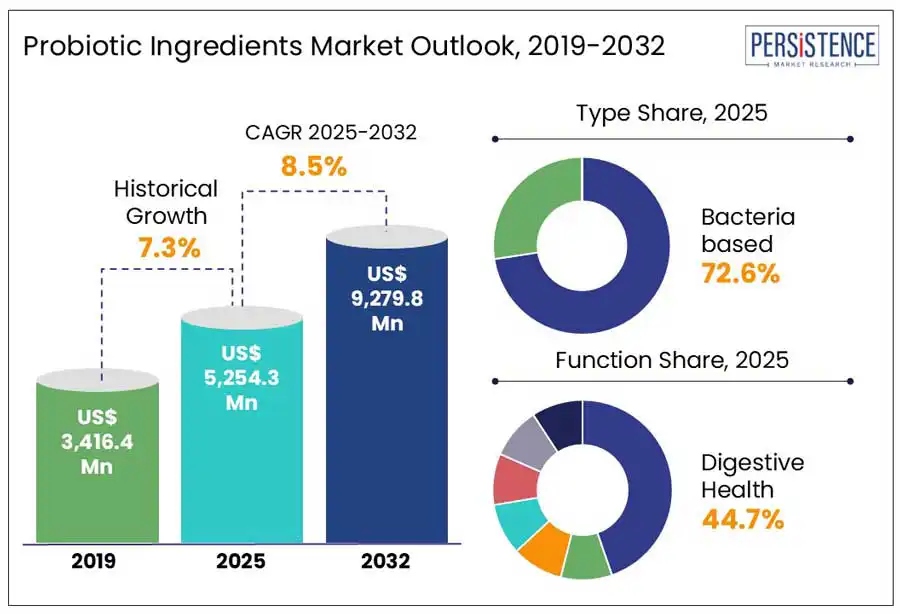

The global probiotic ingredients market size is estimated to grow from US$ 5,254.3 million in 2025 to US$ 9,279.8 million by 2032. The market is projected to record a CAGR of 8.5% by 2032. According to the Persistence Market Research report, rising consumer awareness of gut health and immune supports the need for probiotic products. The industry has significant opportunities to create innovative probiotic formulations targeting specific health benefits such as digestive, immune, and mental wellness.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Probiotic ingredients Market Size (2025E) |

US$ 5,254.3 Mn |

|

Market Value Forecast (2032F) |

US$ 9,279.8 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

8.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.3% |

The growing recognition of the "fourth meal" trend, which refers to an additional, health-focused intake outside the regular diet, has generated robust consumer demand. This consumption pattern is closely linked to the growing health awareness, as consumers include dietary supplements into their daily routines to improve overall well-being. Probiotics, renowned for their ability to promote digestive and immune health, have become an essential component of these supplementary routines.

Persistence Market Research conducted a recent survey in early 2025 on dietary supplements and their impact. The survey concluded that approximately 67% of consumers cited digestive health as a primary motivation for starting probiotic supplementation, underlining its critical role in their wellness journeys. This shift in dietary behavior has reshaped the probiotics landscape, offering sustained growth opportunities for ingredient manufacturers catering to the evolving health and lifestyle demands.

One of the key constraints in the probiotic ingredients market is the complexity and variability of international regulations. Regulatory policies vary drastically across regions making it challenging for companies to create standardized formulas and ease global market access. Probiotics are regulated as dietary supplements in some countries, while they are categorized as food or pharmaceuticals in others with their own set of safety, effectiveness, and labeling guidelines. For example, in the U.S., the Food and Drug Administration (FDA) has not approved any probiotic product for use as drug or biological product in infants of any age.

The FDA mandates a Biologics License Application (BLA), which ensures a thorough assessment of the product's safety, efficacy, and manufacturing methods. This regulatory disparity affects innovation and commercialization efforts, resulting in slower product launches and global distribution of probiotic-based products.

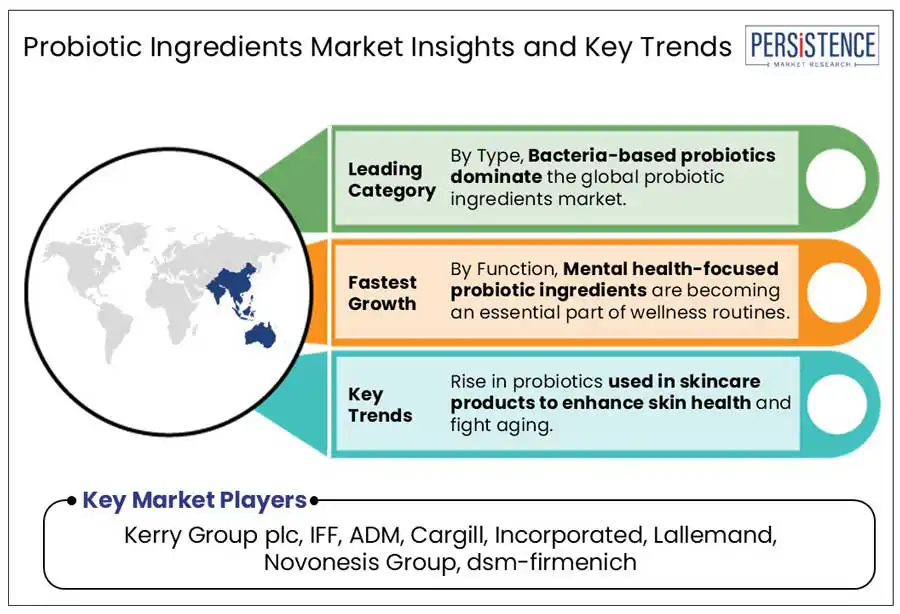

The probiotic ingredients market is experiencing growing interest in developing psychobiotic probiotic strains that influence the gut-brain axis and enhance mental well-being. As stress, anxiety, and depression become more common globally, people are looking for natural, science-backed treatments to enhance emotional wellness. Psychobiotics offer innovation as they target neurotransmitter regulation, cortisol levels, and inflammation through gut microbiome modulation.

A good example is Institut AllergoSan's OMNi-BiOTiC® STRESS Repair, a product designed explicitly to combat mental stress and improve psychological resilience. It is a unique blend of nine scientifically proven bacterial strains to strengthen the gut barrier and reduce stress-related gut-brain interactions. The product is also free of animal protein, gluten, yeast, and lactose, making it suitable for a variety of dietary needs. With the growing consumer awareness of the gut-brain connection, demand for tailored psychobiotic solutions is projected to grow.

Bacteria-based probiotics lead the probiotics ingredients market due to their proven effectiveness, diverse strains, and wide applications in human and animal health. Notable strains such as Lactobacillus and Bifidobacterium are essential for promoting digestive health, enhancing immunity, and improving nutrient absorption. Supported by strong clinical research and adaptable delivery methods, these probiotics have solidified their position as market leaders. However, yeast-based probiotics, particularly Saccharomyces boulardii, are gaining momentum and are expected to register a high CAGR during the forecast period.

Yeast probiotics offer unique benefits such as stability under harsh gastrointestinal conditions and antibiotic resistance, making them valuable in both therapeutic and preventive applications. Their growing adoption in addressing gut inflammation, antibiotic-associated diarrhea, and other digestive disorders fuels their demand. As innovation in probiotic formulations continues, yeast-based alternatives are carving out a strong niche alongside their bacterial counterparts.

A healthy gut is crucial for nutrient absorption, immune function, and mental clarity. The health awareness is growing for gut microbiota, probiotics is targeting digestive issues such as IBS, bloating, and constipation is becoming mainstream. With consumers prioritizing holistic wellness, the demand for effective probiotics with support for digestive health is on the rise.

Significant growth opportunities are unfolding in women's health, particularly with the rising demand for probiotics that enhance hormonal balance, support pregnancy wellness, and alleviate menopause symptoms. Moreover, the market focuses more on oral and skin health, fueled by a heightened interest in effective solutions for acne, oral hygiene, and anti-aging. These dynamic sectors are poised for explosive growth, presenting exciting and innovative avenues for industry leaders.

The food supplement industry in Europe is rapidly expanding, driven by increasing consumer awareness of gut health and immunity. Digestive health products dominate, especially in Italy and Spain, where they are favored by health-conscious consumers. Additionally, demand for energy-boosting probiotic supplements is rising, with brands launching innovative blends. Celebrity endorsements and social media marketing are significantly boosting consumer interest. A notable example is actress Maggie Q’s wellness brand ActivatedYou, which has launched Morning Complete, a nutrient-rich supplement combining prebiotics, probiotics, and green superfoods. The rise in influencer-driven marketing and growing emphasis on personalized wellness further amplify product adoption, making Europe a hotbed for probiotic innovation and brand expansion across multiple health platforms.

North America probiotic ingredients market is thriving, driven by innovation, strong R&D infrastructure, and growing health awareness. With advanced research labs and biotech hubs in the U.S. and Canada, companies invest in next-generation probiotics targeting specific health outcomes. Immune health has emerged as a key focus in this region. The rising demand for functional beverages and sports nutrition products offers major opportunities for key players. Brands are incorporating probiotics into protein shakes, kombucha, and wellness drinks, aligning with consumer preferences for convenient, gut-boosting formats. This innovation-driven, health-conscious landscape has set the stage for sustained market expansion across the region.

Asia Pacific has emerged as the global powerhouse of probiotic ingredient innovation and consumption, driven by strong cultural acceptance, rapid urbanization, and rising health consciousness. In Japan, the probiotic market remains highly developed, with Yakult, the iconic probiotic drink born in Japan, continuing to thrive as a global symbol of gut health. Meanwhile, the Indian ecosystem has been growing more research-driven as scientists have recently developed a next-generation probiotic strain called Lactobacillus plantarum JBC5, demonstrating possibilities for longevity and healthy aging. These developments, followed by the growing middle-income population and the rising demand for functional foods, unveil potential growth opportunities for the food industry to flourish in Asia Pacific.

The global probiotic ingredients market is characterized by a fragmented yet highly competitive landscape, driven by increasing demand in the health and wellness sectors. Many players, ranging from multinational corporations to regional specialists, are actively innovating to gain a competitive edge. Leading companies are investing significantly in R&D to create strain-specific probiotics that target various functions, including immunity, digestive health, mental wellness, and women's health.

Advanced delivery formats, scientific backing, and partnerships with academic institutions are becoming key differentiators in this market. Additionally, there's a growing focus on clean-label formulations while expanding into functional foods, beverages, and sports nutrition. As consumer needs diversify across demographics and regions, companies increasingly prioritize product personalization, regional adaptation, and sustainable production strategies.

The industry is projected to be valued at US$ 5,254.3 Mn in 2025.

The rise of “fourth meal” habits, referring to the daily intake of dietary supplements drives the market expansion.

The global industry is expected to witness a CAGR of 8.5% between 2025 and 2032.

The development of psychobiotics that target mental wellness is a key market opportunity.

Key players include Kerry Group plc, IFF, ADM, Cargill Incorporated, Lallemand, Novonesis Group, DSM-Firmenich, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Form

By Function

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author