ID: PMRREP32856| 250 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

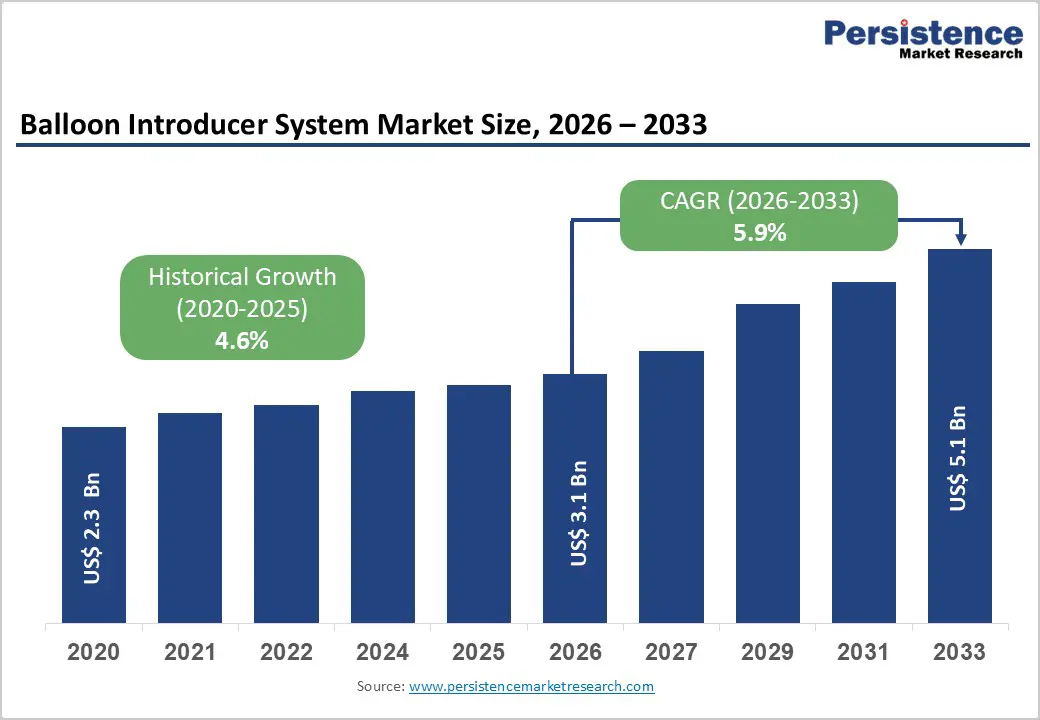

The global Balloon Introducer System Market size is estimated to grow from US$ 3.1 Bn in 2026 to US$ 5.1 Bn by 2033. The market is projected to record a CAGR of 5.9% during the forecast period from 2026 to 2033.

Global demand for balloon introducer systems is rising steadily, driven by the growing burden of cardiovascular and peripheral vascular diseases worldwide. Increasing prevalence of coronary artery disease, peripheral artery disease, and neurovascular disorders largely linked to aging populations, diabetes, obesity, and sedentary lifestyles is expanding the pool of patients requiring catheter-based interventions. Rising procedure volumes for angioplasty, stent deployment, and endovascular therapies are directly supporting demand for reliable and high-performance balloon introducer systems. Advancements in catheter design, including improved trackability, pushability, and coating technologies, are enhancing procedural success rates while reducing complications. The shift toward minimally invasive, image-guided, and outpatient interventions is further accelerating adoption. Additionally, expanding healthcare investments in catheterization laboratories, growing interventional cardiology expertise, and continuous clinical innovation in balloon technologies are reinforcing sustained market growth across both developed and emerging regions.

| Key Insights | Details |

|---|---|

| Balloon Introducer System Market Size (2026E) | US$ 3.1Bn |

| Market Value Forecast (2033F) | US$ 5.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.6% |

The increasing global prevalence of cardiovascular and peripheral vascular diseases is a primary driver of sustained growth in the balloon introducer system market. Rising incidence of coronary artery disease, peripheral artery disease, and neurovascular disorders driven by aging populations, diabetes, obesity, smoking, and sedentary lifestyles is significantly expanding the number of patients requiring catheter-based interventions. Higher survival rates following acute cardiac events and chronic vascular conditions are increasing demand for repeat and complex endovascular procedures, further supporting long-term utilization of balloon introducer systems.

Technological advancements are accelerating adoption across interventional settings. Continuous innovation in balloon design, including improved trackability, pushability, lesion-crossing capability, and pressure resistance, is enhancing procedural success rates and clinical outcomes. Developments in coating technologies, shaft materials, and balloon compliance profiles are reducing vessel trauma and procedural complications. In parallel, growing adoption of minimally invasive, image-guided interventions and expansion of catheterization laboratories worldwide are increasing procedural volumes. Integration of balloon introducer systems with advanced imaging platforms and next-generation guidewires is further improving precision and efficiency. Together, rising disease burden and sustained technological innovation are driving steady expansion of the global balloon introducer system market.

High procedural costs associated with endovascular interventions remain a key restraint for the balloon introducer system market, particularly in low- and middle-income regions. Although balloon introducer devices themselves are relatively standardized, overall treatment costs are elevated due to the need for advanced catheterization laboratories, imaging systems, contrast agents, and highly trained interventional specialists. Expenses related to consumables, repeat procedures, and post-intervention monitoring further increase the economic burden on healthcare systems and patients. In many regions, inconsistent or limited reimbursement coverage for interventional cardiology and peripheral procedures restricts patient access and delays treatment.

Additionally, uneven availability of skilled interventional cardiologists and vascular specialists limits broader market adoption. Balloon-based interventions require specialized training and experience, particularly for complex coronary, peripheral, and neurovascular procedures. In emerging markets, gaps in healthcare infrastructure, limited access to cath labs, and fragmented referral pathways contribute to underutilization. Rural and semi-urban areas often lack advanced diagnostic and interventional capabilities, leading to delayed diagnosis and reliance on medical management rather than procedural intervention. These economic, infrastructural, and workforce-related constraints continue to limit full market potential despite growing clinical demand.

Expansion of advanced cardiovascular care infrastructure presents a significant growth opportunity for the global balloon introducer system market. Governments and private healthcare providers are increasingly investing in catheterization laboratories, cardiac care centers, and vascular specialty hospitals to address the rising burden of cardiovascular disease. Development of tertiary and quaternary care facilities, particularly in Asia Pacific, Latin America, and the Middle East, is improving access to interventional procedures and supporting higher device utilization. These investments are enabling wider adoption of modern balloon introducer systems across both public and private healthcare settings.

The ongoing shift toward minimally invasive, catheter-based interventions is further creating strong growth avenues. Physicians are increasingly favoring angioplasty and endovascular therapies over open surgical procedures due to shorter recovery times, reduced complication risks, and lower overall healthcare costs. Growing adoption of outpatient and same-day discharge models is reinforcing demand for efficient, easy-to-handle balloon introducer systems. Advancements in drug-coated balloons, specialty balloons, and compatibility with complex lesion management are expanding clinical applications. In parallel, continued research into novel materials, coatings, and device integration is expected to unlock new opportunities and sustain long-term market growth.

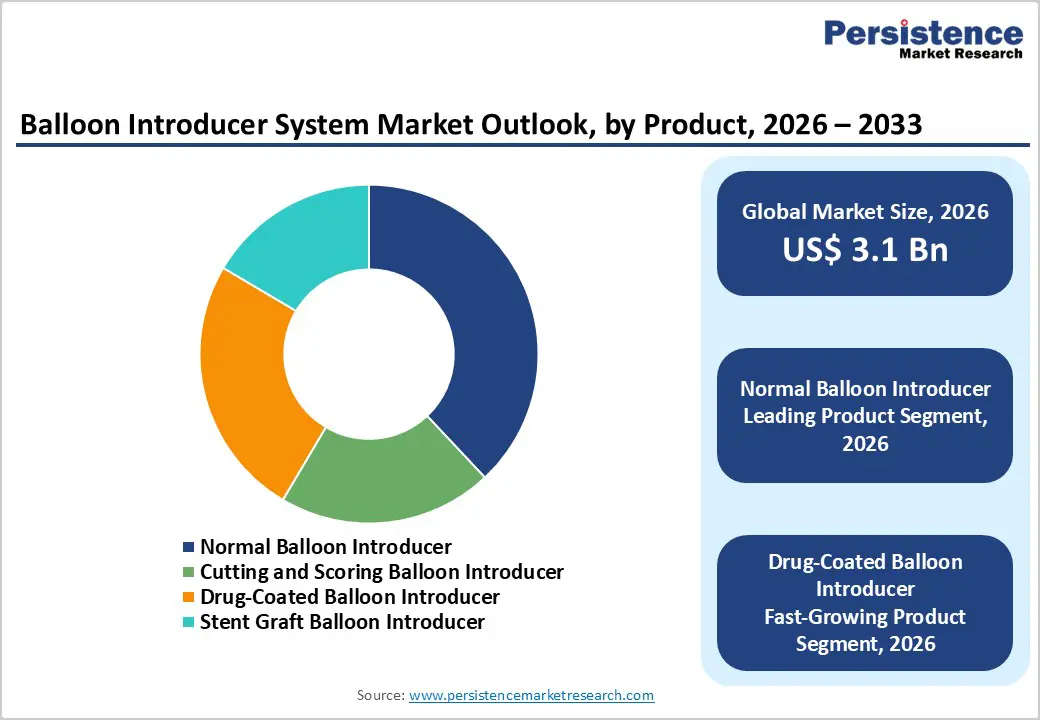

The normal balloon introducer segment is projected to dominate the global balloon introducer system market in 2026, accounting for a revenue share of 38.0%. Segment leadership is primarily driven by its broad applicability across coronary, peripheral, and neurovascular interventions, making it a first-line choice in routine angioplasty procedures. Normal balloon introducers offer reliable performance, predictable inflation characteristics, and compatibility with a wide range of guidewires and access systems. Their relatively lower cost compared to specialized or drug-coated variants supports widespread adoption, particularly in high-volume catheterization laboratories and cost-sensitive healthcare settings. Strong physician familiarity, standardized procedural workflows, and consistent clinical outcomes further reinforce their dominance. Additionally, continuous refinements in balloon materials, shaft flexibility, and trackability have enhanced procedural reliability, supporting sustained use across both elective and emergency interventions.

The rapid exchange (Rx) segment is projected to dominate the global balloon introducer system market in 2026, accounting for a revenue share of 52.0%. This dominance is attributed to the growing preference for streamlined interventional workflows that reduce procedure time and improve catheter handling. Rapid exchange systems enable single-operator control, faster device exchanges, and improved procedural efficiency, which are critical in high-throughput cardiac catheterization environments. Increasing volumes of coronary and peripheral interventions, particularly among aging populations with complex vascular disease, continue to support strong adoption. Rx systems are especially favored in minimally invasive procedures due to their ease of navigation and reduced learning curve. Technological advancements improving pushability, torque response, and lesion-crossing performance further strengthen their clinical appeal, reinforcing rapid exchange platforms as the preferred technology across most interventional settings.

The hospitals segment is projected to dominate the global balloon introducer system market in 2026, accounting for a revenue share of 64.5%. Hospitals remain the primary centers for complex cardiovascular and endovascular interventions due to their access to advanced imaging infrastructure, hybrid operating rooms, and multidisciplinary interventional teams. High patient inflow for coronary artery disease, peripheral artery disease, and neurovascular conditions sustains consistent demand for balloon introducer systems. Hospitals are also early adopters of next-generation catheter technologies, supported by structured procurement processes and clinical evaluation committees. The availability of intensive care support, emergency services, and specialized interventional cardiology units further reinforces hospital dominance. While ambulatory surgical centers are gradually expanding their role in selected procedures, hospitals continue to lead due to their capacity to manage high-risk and complex cases.

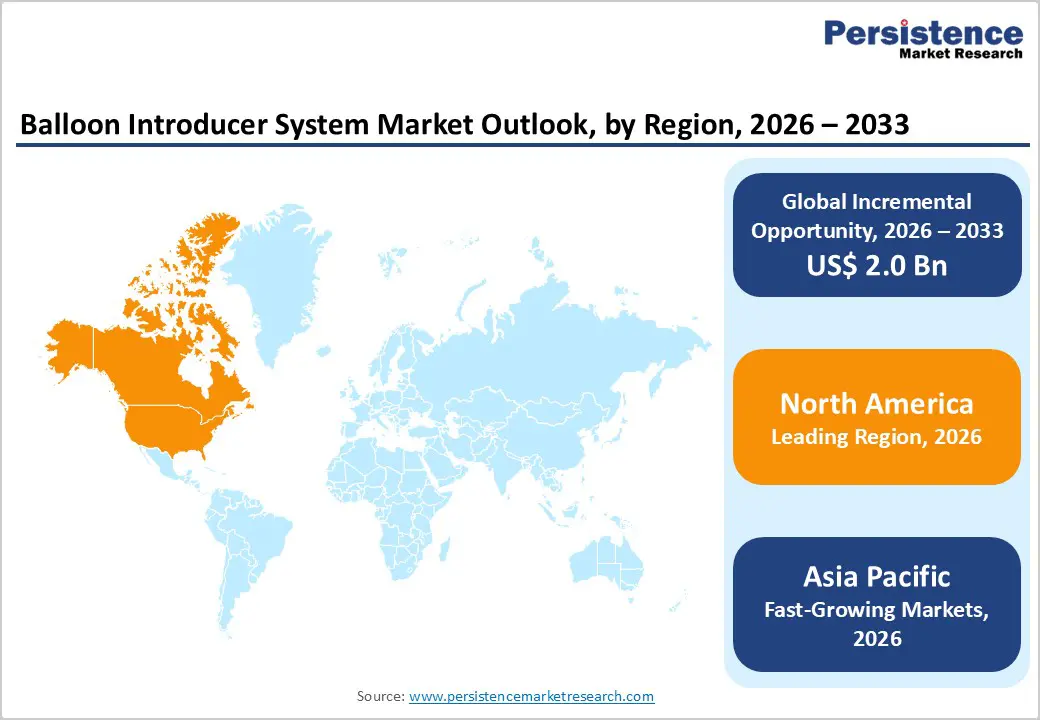

The North America balloon introducer system market is expected to dominate globally with a value share of 48.5% in 2026, led primarily by the U.S. The region benefits from a highly developed healthcare infrastructure, widespread access to catheterization laboratories, and high procedural volumes for coronary and peripheral interventions. A strong prevalence of cardiovascular diseases, driven by aging demographics, obesity, diabetes, and sedentary lifestyles, sustains long-term demand. Favorable reimbursement frameworks for interventional cardiology procedures support early diagnosis and timely treatment, enabling rapid adoption of advanced balloon introducer technologies.

The presence of leading medical device manufacturers, robust physician training programs, and continuous clinical research activity further accelerates innovation uptake. Additionally, strong emphasis on minimally invasive procedures, outpatient catheter-based treatments, and quality outcome metrics reinforces consistent utilization across both academic and community hospital settings.

The Europe balloon introducer system market is expected to grow steadily, supported by an aging population and rising incidence of cardiovascular and peripheral vascular diseases. Key countries including Germany, the U.K., France, Italy, and the Nordic region contribute significantly due to well-established public healthcare systems and strong access to interventional cardiology services. Increasing adoption of standardized clinical guidelines and evidence-based treatment pathways ensures stable procedure volumes across the region.

Healthcare systems are increasingly emphasizing minimally invasive approaches to reduce hospital stays and overall treatment costs, supporting demand for balloon-based interventions. Cost-containment pressures are encouraging hospitals to adopt reliable, durable balloon introducer systems with proven clinical performance. Cross-border clinical collaborations, pan-European training initiatives, and gradual regulatory harmonization are improving technology diffusion. Together, these factors are supporting consistent, incremental growth across the European market.

The Asia Pacific balloon introducer system market is expected to register a relatively higher CAGR of around 7.9% between 2026 and 2033, driven by rapid healthcare infrastructure expansion and rising interventional procedure volumes. Countries such as China, India, Japan, South Korea, and Southeast Asian nations are experiencing increased diagnosis and treatment of coronary and peripheral artery diseases due to urbanization, lifestyle changes, and aging populations. Expanding access to tertiary care hospitals, growing numbers of trained interventional cardiologists, and rising healthcare expenditure are improving procedural penetration.

Government initiatives aimed at strengthening cardiac care networks and improving emergency vascular services are accelerating adoption. Additionally, medical tourism, private hospital expansion, and partnerships with global device manufacturers are enhancing technology availability. Increasing awareness of early intervention benefits and improving procedural outcomes are expected to sustain strong regional momentum.

The global balloon introducer system market is highly competitive, with strong participation from companies such as Koninklijke Philips N.V., Medtronic, MicroPort Scientific Corporation, OrbusNeich Medical, and Terumo Corporation. These players benefit from broad cardiovascular and endovascular device portfolios, long-standing relationships with interventional cardiologists and vascular surgeons, advanced catheter and balloon design capabilities, and well-established global distribution networks. Competitive strategies focus on expanding balloon introducer offerings, improving trackability, pushability, and lesion-crossing performance, supporting minimally invasive interventions, and enhancing overall procedural efficiency.

Companies are also investing in clinical studies, product portfolio expansions, physician training initiatives, and geographic penetration across emerging markets. Ongoing innovation in balloon materials, coating technologies, shaft design, and compatibility with complex interventional procedures is intensifying competition and supporting continuous market evolution.

The global balloon introducer system market is projected to be valued at US$ 3.1 Bn in 2026.

Rising prevalence of cardiovascular diseases, increasing preference for minimally invasive procedures, and expanding healthcare infrastructure globally drive the balloon introducer system market growth.

The global balloon introducer system market is poised to witness a CAGR of 5.9% between 2026 and 2033.

Technological advancements in device design, expanding applications beyond cardiology, and growing adoption in emerging markets present key opportunities for market expansion.

Koninklijke Philips N.V., Medtronic, MicroPort Scientific Corporation, OrbusNeich Medical, Terumo Corporation are some of the key players in the balloon introducer system market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn Volume (Units) If Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Technology

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author