ID: PMRREP2842| 187 Pages | 1 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

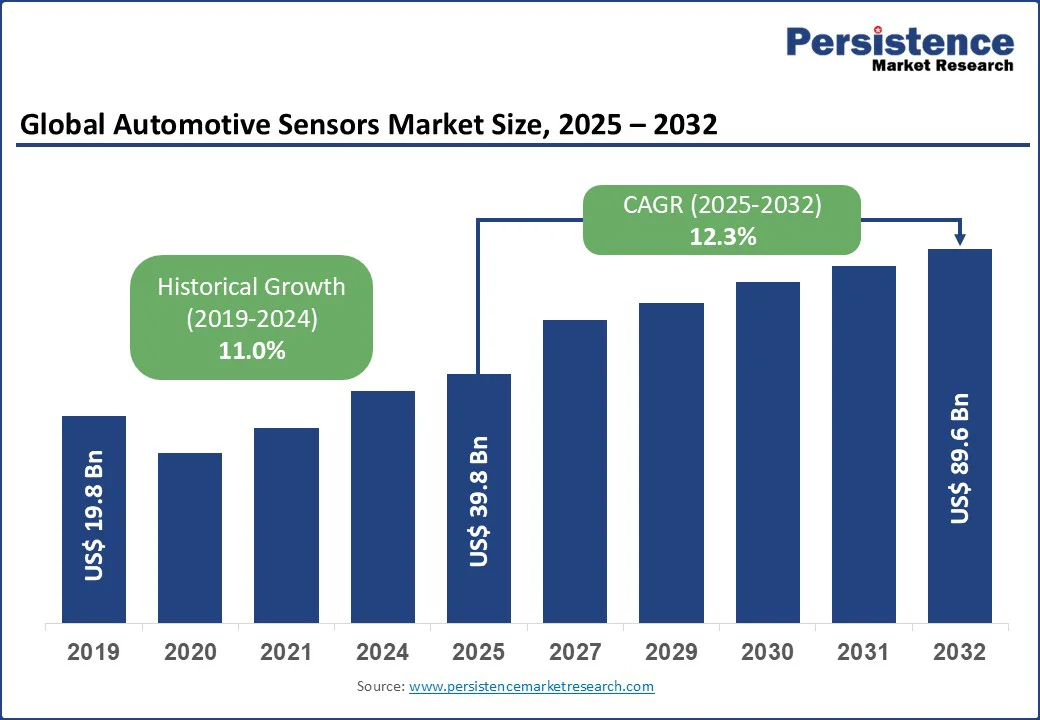

The global automotive sensors market size is likely to be valued at US$ 39.8 Bn in 2025 and expected to reach at US$ 89.6 Bn by 2032, growing at CAGR of 12.3% during 2025 - 2032.

The rise in demand for vehicle sensors, auto sensors, and smart sensors that enhance vehicle performance, safety, and efficiency triggers need for automotive sensors and components. Advancements in MEMS-based sensors, AI-enabled smart sensing, and IoT connectivity are transforming vehicle performance and diagnostics. The rapid shift toward connected cars and autonomous vehicles, along with increased sensor adoption in emerging markets, offers significant growth opportunities.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Automotive Sensors Market Size (2025E) |

US$ 39.8 Bn |

|

Market Value Forecast (2032F) |

US$ 89.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

11.0% |

The automotive sensors market is propelled by the surge in electric vehicle (EV) adoption and advancements in autonomous driving technologies, significantly boosting demand for vehicle sensors, auto sensors, and smart sensors. In 2025, global EV sales reached 18 Mn units, reflecting a 35% year-on-year growth, driving 20% growth in sensor integration in electric vehicles. EVs require advanced MEMS automotive sensors and engine control sensors for battery management, thermal regulation, and power efficiency, with 60% of EVs integrating vehicle speed sensors for optimized performance.

Autonomous driving, particularly Level 3 and above, relies heavily on automotive LiDAR sensors for autonomous vehicles, enhancing safety and security systems in vehicles. The IoT in automotive industry, with 40% of vehicles equipped with connected vehicle sensors, supports intelligent automotive sensing solutions for real-time data processing, reducing accident rates by 15%. Stricter emission regulations, such as Euro 7, reduced CO2 emissions by 15%, boosting automotive engine management sensors for compliance.

Robert Bosch GmbH reported 15% revenue growth in 2025 from smart car sensors, driven by connected car technology and ADAS applications. The global push for net-zero emissions by 2050, with US$ 1.2 Tn in EV investments by 2030, positions future automotive sensing solutions for sustained growth across powertrain and chassis applications, particularly in passenger cars.

The automotive sensors market faces significant challenges due to the high development costs and persistent supply chain disruptions, impacting smart car sensors and sensor technology in smart vehicles. Developing automotive LiDAR sensors for autonomous vehicles costs between US$ 50,000 and US$ 200,000 per unit, limiting scalability for smaller manufacturers and increasing production costs by 20%. The complexity of integrating MEMS automotive sensors into connected vehicle sensors requires 30% higher R&D investment, particularly for ADAS applications.

Supply chain disruptions, particularly semiconductor shortages, affected 30% of global sensor production, delaying intelligent automotive sensing solutions delivery by 20–25%. These shortages impacted vehicle speed sensors and engine control sensors, with 40% of automotive OEMs reporting production delays. In emerging markets, 25% of manufacturers faced challenges sourcing safety and security systems in vehicles, slowing adoption of automotive safety and performance sensors. These constraints disproportionately affect light commercial vehicles and heavy commercial vehicles, where cost sensitivity is higher, limiting market expansion in price-sensitive regions.

Advancements in IoT in automotive industry and 5G connectivity present significant opportunities for the automotive sensors market, driving demand for connected car technology, smart sensors, and future automotive sensing solutions. In 2025, 50% of new vehicles globally integrated 5G-enabled connected vehicle sensors, enhancing ADAS functionality by 30% through faster data transmission and real-time analytics.

Emerging markets, particularly in Asia Pacific, with US$ 200 Bn in EV and smart city infrastructure investments in 2025, offer significant potential for sensor integration in electric vehicles and automotive safety and performance sensors. The adoption of Vehicle-to-Everything (V2X) communication, with 20% penetration in 2025, enhances intelligent automotive sensing solutions, enabling predictive maintenance and reducing downtime by 25%. NXP Semiconductors reported 12% growth in 2025 from smart car sensors for 5G application. These advancements, coupled with government incentives for smart mobility, position the market for expansion in passenger cars and light commercial vehicles, particularly in urbanized regions.

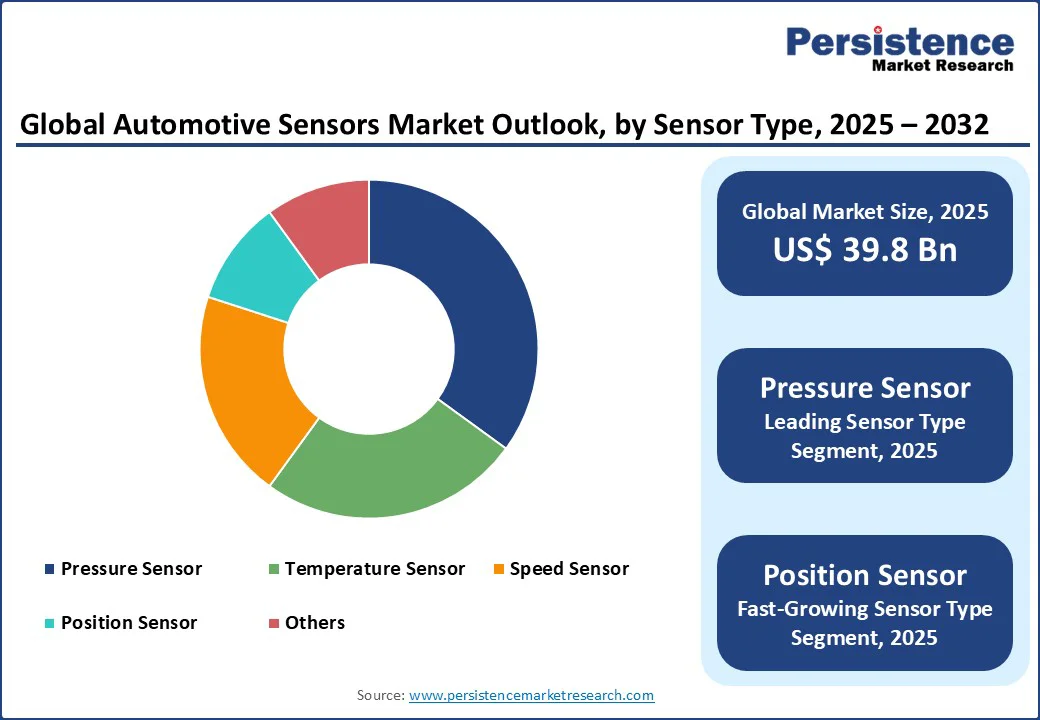

Pressure sensors hold a 30% market share in 2025, driven by engine control sensors and automotive engine management sensors. They ensure optimal fuel injection and tire pressure monitoring, reducing emissions by 10%. Their dominance is attributed to 50% integration in passenger cars, supporting safety and security systems in vehicles. With increasing adoption in electric vehicles (EVs) for thermal and battery management, pressure sensors are positioned as a cornerstone of next-generation mobility solutions.

Position sensors fueled by automotive LiDAR sensors for autonomous vehicles. they enhance intelligent automotive sensing solutions for ADAS, enabling precise positioning for autonomous navigation and lane-keeping systems. The integration of position sensors in intelligent automotive sensing solutions enhances real-time data processing, enabling smooth manoeuvring, obstacle detection, and predictive control.

Powertrain commands a 35% market share in 2025, driven by automotive engine management sensors. it relies on engine control sensors and MEMS automotive sensors for fuel efficiency and emission control, reducing CO2 emissions by 12%. Passenger cars account for 60% of powertrain sensor demand. Passenger cars and commercial vehicles both rely heavily on these sensors for engine diagnostics, transmission control, and emission management.

ADAS is fueled by automotive LiDAR sensors for autonomous vehicles. it supports safety and security systems in vehicles and connected vehicle sensors. These sensors enable precise object detection, collision avoidance, and adaptive cruise control, forming the backbone of safety and automation in modern vehicles. ADAS also incorporates connected vehicle sensors that facilitate vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, ensuring real-time data exchange for improved road safety.

Passenger cars hold a 60% market share in 2025, driven by connected car technology and sensor integration in electric vehicles. They rely on smart car sensors for enhanced user experience, with 40% of EVs integrating intelligent automotive sensing solutions. The rise of IoT-enabled cars and demand for safety features such as collision detection and lane departure warnings accelerate sensor deployment in passenger vehicles.

Light commercial vehicles (LCVs), fueled by automotive safety and performance sensors. They support intelligent automotive sensing solutions for fleet management. With the rise of e-commerce and last-mile delivery services, LCVs are being equipped with advanced telematics and sensor systems for load monitoring, tire pressure management, and driver assistance to reduce operational risks.

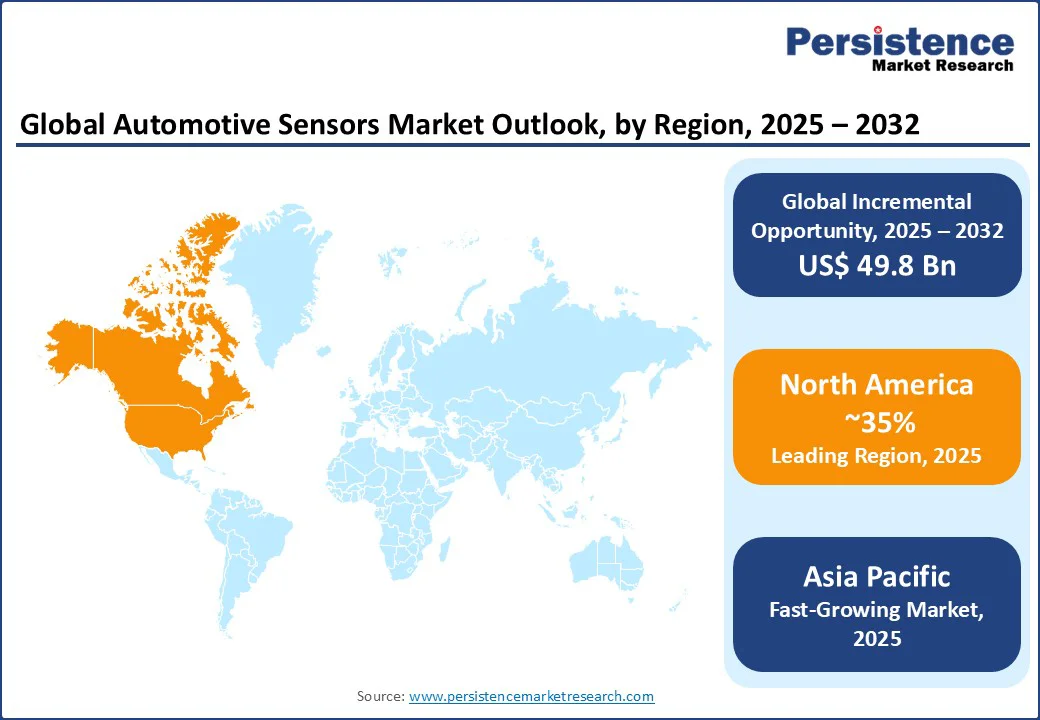

North America holds a 35% global market share in 2025, valued at US$ 13.93 Bn, with the U.S. leading due to its advanced automotive ecosystem and EV adoption. The U.S. market, is expected to generate a high revenue, driven by connected car technology and automotive LiDAR sensors for autonomous vehicles. In 2025, 40% of U.S. vehicles adopted smart sensors for ADAS, supported by 30% growth in EV sales, reaching 6 Mn units.

Regulatory mandates, such as NHTSA’s safety standards, increased safety and security systems in vehicles adoption by 25%, boosting vehicle speed sensors and engine control sensors. Robert Bosch GmbH holds a 15% regional share, leveraging automotive engine management sensors for powertrain efficiency. The U.S.’s US$ 100 Bn investment in autonomous driving R&D by 2025, drives future automotive sensing solutions, particularly in passenger cars. California’s EV incentives, covering 50% of new vehicle sales, enhance sensor integration in electric vehicles.

Europe accounts for a 30% global share, valued at US$ 11.94 billion in 2025, led by Germany, the UK, and France, driven by stringent emission regulations and EV adoption. Germany’s market grows at a CAGR of 12.2%, generating US$ 4.78 Bn, propelled by engine control sensors and MEMS automotive sensors. The automotive sector, contributing €2 Tn to the economy, saw 50% of manufacturers adopt vehicle speed sensors, driven by Euro 7 regulations reducing CO2 emissions by 15%.

The UK market growth is driven by connected vehicle sensors, with 40% of vehicles adopting ADAS systems. France’s market grows at 10%, fueled by sensor technology in smart vehicles, with €500 Mn in EV subsidies in 2025. Continental AG leads with intelligent automotive sensing solutions, capturing 12% of the market, driven by safety and security systems in vehicles for exhaust and chassis applications.

Asia Pacific is expected to witness fastest-growth with a CAGR of 13.5%, led by China, Japan, and India, driven by EV production and smart city initiatives. China holds a 50% regional share, generating US$ 6.76 Bn, fueled by US$ 300 Bn in EV and infrastructure investments, boosting sensor integration in electric vehicles. In 2025, 60% of Chinese EVs adopted automotive safety and performance sensors. India’s market driven by 25% growth in passenger cars, with 35% adoption of smart car sensors for logistics.

Government initiatives such as Make in India, with US$ 50 Bn in automotive investments, enhance connected car technology. Japan’s market sees 12% growth, with 30% adoption of future automotive sensing solutions for autonomous driving. Denso Corporation captures 10% of the regional market with smart sensors.

The global automotive sensors market is highly competitive, with Robert Bosch GmbH, Continental AG, Denso Corporation, Infineon Technologies AG, NXP Semiconductors, STMicroelectronics, Honeywell, Analog Devices, Inc., Texas Instruments Incorporated, ON Semiconductor, and Sensata Technologies, Inc. focusing on vehicle sensors, auto sensors, and smart sensors. Companies leverage automotive LiDAR sensors for autonomous vehicles and engine control sensors to gain market share. Strategic R&D investments in connected car technology and partnerships drive future automotive sensing solutions, addressing safety and security systems in vehicles and IoT in automotive industry needs.

The automotive sensors market is projected to reach US$ 39.8 Bn in 2025, driven by vehicle sensors and smart sensors.

EV sales, reaching 18 Mn units in 2025, and autonomous driving technologies fuel sensor integration in electric vehicles and ADAS.

The automotive sensors market grows at a CAGR of 12.3% from 2025 to 2032, reaching US$ 89.6 Bn by 2032.

Advancements in IoT in automotive industry and 5G connectivity, with 50% vehicle adoption, offer potential for connected car technology.

Key players include Robert Bosch GmbH, Continental AG, Denso Corporation, Infineon Technologies AG, and NXP Semiconductors.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Sensor Type

By Application

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author