ID: PMRREP11776| 191 Pages | 31 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

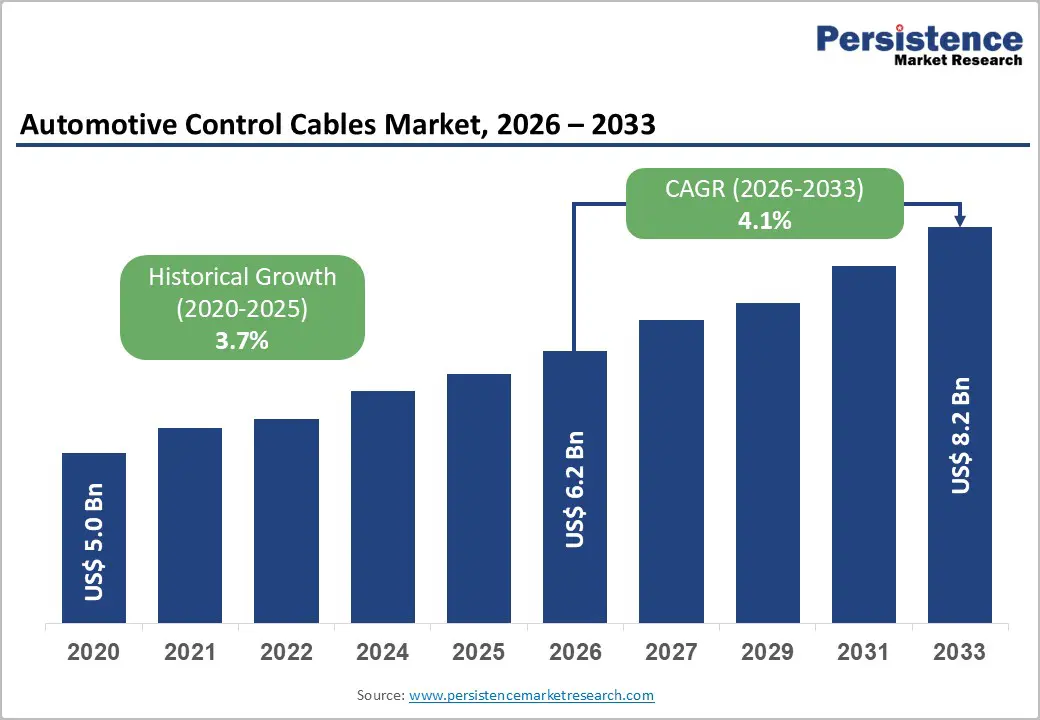

The global automotive control cables market size is likely to be valued at US$ 6.2 billion in 2026, and is projected to reach US$ 8.2 billion by 2033, growing at a CAGR of 4.1% during the forecast period 2026 - 2033.

Market expansion is being supported by sustained global vehicle production volumes and continued reliance on mechanical actuation systems in cost-sensitive vehicle categories. Passenger vehicles, entry-level commercial vehicles, and two-wheelers are continuing to incorporate cable-based systems due to their affordability, ease of maintenance, and proven reliability. Rapid fleet expansion in emerging economies is further strengthening demand, particularly across Asia Pacific and Latin America, where urban mobility growth is remaining strong. Despite the gradual rise of electrified powertrains, automotive control cables are continuing to play a critical role in throttle, clutch, brake, and gear actuation across internal combustion engine vehicles and hybrid electric vehicles (EVs). Mechanical systems are remaining relevant in applications where electronic alternatives would increase cost and complexity without delivering proportional value.

Regulatory authorities are continuing to enforce stricter safety and durability standards, which are increasing original equipment manufacturer (OEM) demand as well as replacement demand in the aftermarket. As vehicle parc sizes are expanding globally, replacement cycles are supporting stable recurring revenue streams.

| Key Insights | Details |

|---|---|

| Automotive Control Cables Market Size (2026E) | US$ 6.2 Bn |

| Market Value Forecast (2033F) | US$ 8.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.7% |

According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached approximately 93.5–94 million units in 2024, confirming full recovery from pandemic disruptions. Global vehicle sales also increased to around 95 million units, reflecting improving demand across regions. Production momentum continued into 2025, with global output exceeding 68.7 million units in the first nine months, representing 4% year-on-year growth. Passenger cars recorded the strongest expansion, with production rising 6%, reinforcing their role as the largest cable-consuming segment. Although recovery remains uneven geographically, overall production volumes remain structurally high. This sustained scale directly supports OEM demand for automotive control cables. The expanding global vehicle parc further strengthens aftermarket replacement demand.

Alongside production recovery, cost efficiency and operational reliability continue to reinforce the relevance of mechanical actuation systems. According to data published by SIAM and ACEA, over 65% of vehicles sold across India, Southeast Asia, and Africa prioritize mechanical actuation due to affordability and ease of maintenance. Mechanical control cables deliver dependable performance under demanding conditions such as dust, moisture, and temperature variation. Global safety regulations also emphasize mechanical fail-safe redundancy, particularly in braking and transmission systems. This regulatory focus sustains the use of brake and clutch control cables even in semi-electronic architectures. These factors ensure resilient demand for the automotive control cables market.

The increasing adoption of electronic throttle control and shift-by-wire systems presents a structural restraint for the automotive control cables market, particularly in premium passenger vehicles. According to industry data, over 40% of new premium vehicles in Europe have transitioned to partial or full electronic actuation. While this shift does not immediately eliminate mechanical cables, it steadily reduces cable content per vehicle, especially in high-end models. As electronic architectures gain wider acceptance, traditional control cable penetration weakens in technologically advanced segments. This transition introduces long-term demand moderation risks for conventional cable manufacturers. OEM design priorities increasingly favor software-driven actuation over mechanical solutions.

Raw material price volatility continues to exert pressure on cost structures across the automotive control cable supply chain. Control cables depend heavily on steel wire, polymer coatings, and aluminum components, all of which are sensitive to energy costs and geopolitical disruptions. World Steel Association data indicates double-digit steel price fluctuations between 2021 and 2024, reflecting sharp rises during 2021–2022 followed by pronounced corrections through 2023–2024. These price swings directly affect component margins and procurement planning. Smaller suppliers with limited hedging capabilities face greater margin compression. As a result, pricing stability and profitability remain constrained across the market.

Two wheelers continue to represent the dominant mode of personal mobility in Asia Pacific, accounting for over 55% of registered vehicles, according to OICA data. These vehicles rely almost entirely on mechanical throttle, clutch, and brake control cables, creating a large and recurring demand base. In parallel, the rapid expansion of last-mile delivery and urban logistics is driving steady growth in light commercial vehicle fleets. Both vehicle categories are highly cable-intensive and cost-sensitive, making them well aligned with mechanical actuation systems. This combination supports scalable OEM demand as well as high-volume aftermarket consumption. These trends create a structurally attractive growth opportunity for control cable manufacturers.

In addition, aftermarket replacement demand and supply-chain localization are reinforcing long-term opportunity visibility. Control cables are wear-prone components and typically require multiple replacements over a vehicle’s lifecycle. According to the U.S. Bureau of Transportation Statistics, the average vehicle age exceeded 12.5 years in 2023, significantly increasing replacement volumes. At the same time, OEMs are increasingly localizing component sourcing to reduce logistics risk and improve cost control. Government-backed localization initiatives, including “Make in India” and ASEAN manufacturing policies, are encouraging domestic production. This shift enables regional suppliers to enter OEM programs while improving margins through lower transport and tariff exposure.

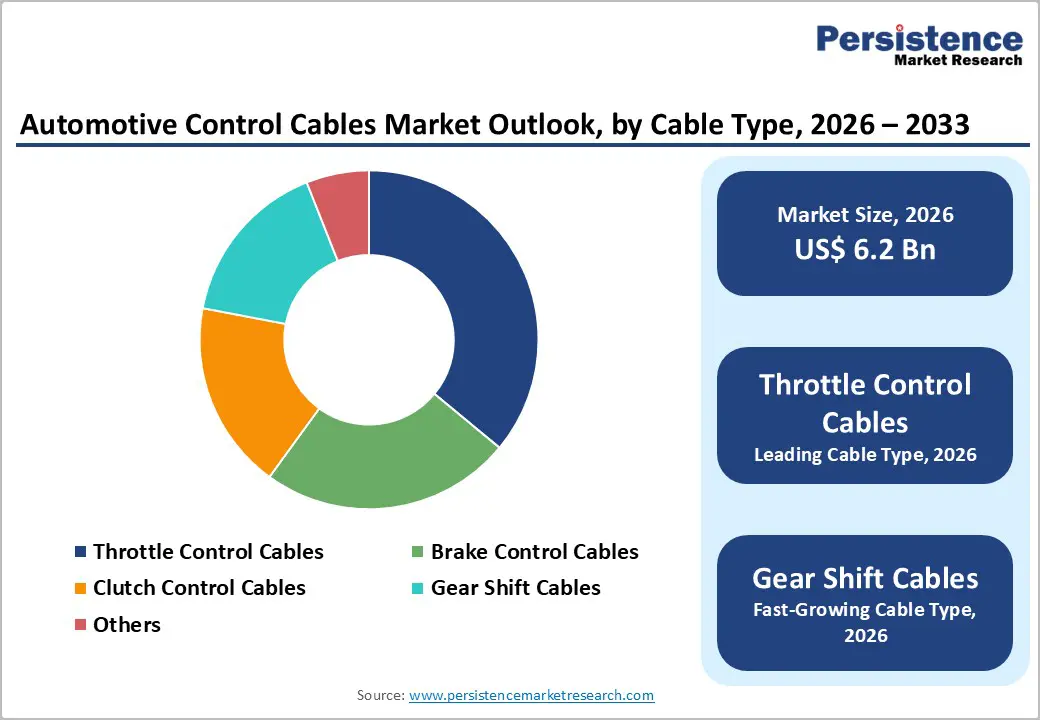

Throttle control cables are expected to be the leading cable type, projected to represent about 36% of the revenue share in 2026, supported by wide applicability across two wheelers, passenger cars, and commercial vehicles. Their essential role in throttle actuation for IC and hybrid vehicles sustains strong OEM integration and recurring aftermarket demand. Enhanced durability requirements also reinforce adoption across cost?sensitive and mainstream platforms. Remsons Industries secured a significant contract with Stellantis NV covering control cable supply for multiple vehicle platforms, highlighting ongoing demand for mechanical throttle and related systems. Throttle cables continue to serve core actuation functions in conventional vehicle powertrains. Their reliability under varied operating conditions further cements their market leadership in 2026.

Gear shift cables are anticipated as the fastest?growing cable type, with an estimated CAGR of 4.8% through 2033, driven by rising adoption in compact passenger vehicles and light commercial trucks. Manual and automated manual transmissions in cost-sensitive markets still rely on mechanical shift solutions, supporting growth. Enhanced modular designs and durability improvements support lifecycle performance, attracting OEM preference. For instance, Ficosa International SA formed a strategic partnership with Balkrishna Industries to co?develop mechanical control cable solutions tailored for rugged vehicle platforms. This collaboration combines automotive systems know?how with material engineering expertise. These developments reinforce gear shift cables’ appeal as practical, high?performance actuation components. The segment’s growth reflects evolving engineering priorities in key vehicle applications.

Passenger cars are likely to command roughly 52% of the automotive control cables market revenue share in 2026 due to high production volumes and multiple mechanical cable integration per vehicle. Mechanical control cables continue to serve throttle, clutch, brake, and transmission functions, even as premium models incorporate selective electronic actuation. Recurring replacement cycles further boost aftermarket demand. Aptiv PLC and DURA Automotive Systems announced a collaboration to advance lightweight control cable assemblies for passenger car platforms, reflecting continued OEM focus on durable mechanical actuation solutions. Strong reliability and cost efficiency sustain passenger cars as the primary revenue driver. Replacement and OEM demand reinforce long-term market stability. Passenger cars anchor both global OEM and aftermarket growth.

Two wheelers are forecast as the fastest?growing vehicle segment, with an estimated CAGR of 5.0% through 2033. Urbanization, affordability, and fuel efficiency are key growth drivers. Nearly all two wheelers rely on mechanical throttle, clutch, and brake cables, insulating the segment from significant electronic substitution trends. HI?LEX Corporation’s collaboration with Hyundai Motor Company to develop high-load brake and clutch cables also supports two-wheeler and light commercial vehicle platforms, showcasing scalable OEM opportunities. This structural reliance ensures rapid and sustained growth. The segment offers strong potential for both OEM penetration and recurring aftermarket revenue.

North America continues to be a mature and stable market for automotive control cables, led by the United States, supported by a large vehicle parc and extended vehicle lifecycles that drive consistent replacement demand for automotive control cables. Regulatory oversight from the National Highway Safety Traffic Administration (NHTSA) ensures strict performance and safety standards, fostering demand for durable actuation solutions. Innovation focuses on corrosion-resistant materials and enhanced durability under extreme operating conditions. A notable development was Toyota Battery Manufacturing North Carolina commencing EV battery pack production, reinforcing localized component manufacturing and supply chain capabilities. Investments continue in aftermarket distribution networks rather than expanding OEM production. Replacement cycles in aging fleets ensure sustained relevance of mechanical cables. North America remains a key contributor to the global automotive control cable ecosystem.

Despite being a mature market, growth is moderate, as electronic actuation gains traction in premium vehicle segments. However, robust aftermarket and retrofit demand for mechanical components sustains supplier revenue. Focus on advanced materials, maintenance-friendly designs, and corrosion resistance continues. Nearshoring and tariff-driven strategic adjustments enhance supply chain resilience. Suppliers are prioritizing distribution efficiency and partnerships to capture aftermarket opportunities. Replacement and legacy vehicle fleets remain significant revenue sources. This balance ensures North America’s mechanical cable demand continues steadily.

The automotive control cables market landscape in Europe is shaped by regulatory harmonization under European Union (EU) frameworks, ensuring mechanical control systems maintain safety-critical redundancy. Key hubs include Germany, France, Italy, Spain, and the U.K., which provide strong OEM and supplier networks. Sustainability and lightweight material mandates influence component innovation and production practices. Europe’s battery manufacturing expansion included multiple gigafactory announcements, supporting local EV and hybrid powertrain production while reinforcing mechanical component supply chains. Mechanical cables remain relevant in braking, throttle, and clutch systems despite rising electronic adoption. OEMs continue investing in recyclable and lightweight cable designs. Europe’s regulatory environment drives a focus on durable, high-quality mechanical actuation solutions.

Steady replacement cycles in aging fleets support consistent demand for mechanical cables. While premium vehicle segments adopt electronic actuation, safety-critical applications continue to rely on traditional control cables. Investments in sustainable materials, energy-efficient production, and modular cable solutions sustain the mechanical component ecosystem. Suppliers maintain a balance between legacy mechanical systems and electrified architectures. Localized production reduces logistics costs and enhances responsiveness. Innovation in materials and durability further strengthens OEM confidence. Europe remains a stable and innovation-driven market for automotive control cables.

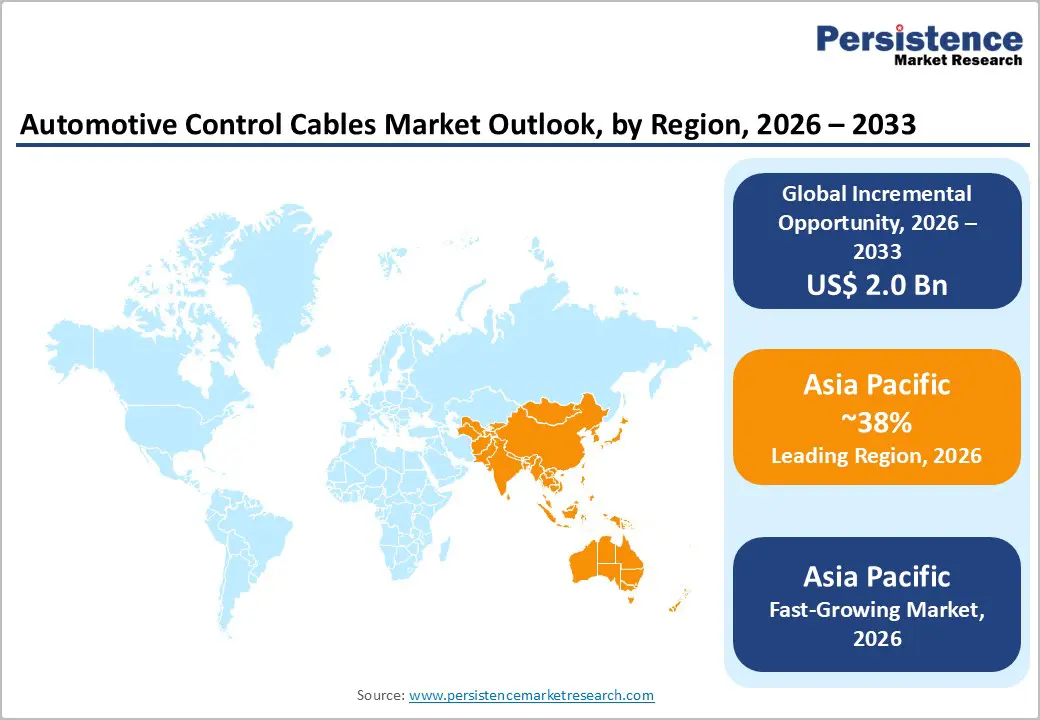

Asia Pacific is projected to dominate with roughly 38% of the automotive control cables market share in 2026. Expanding at an approximate 2026-2033 CAGR of 4.6%, the market here driven by rapidly expanding vehicle production, increasing two?wheeler and light commercial vehicle demand, and supportive government policies across multiple countries. The region’s manufacturing scale and cost efficiencies attract both regional and global OEMs, reinforcing supply chain localization. A major recent industry development is Vietnamese automaker VinFast’s opening of a US$ 500 million EV manufacturing facility in Tamil Nadu, India, designed to serve South Asia and export markets, demonstrating strong investment confidence in the region’s vehicle production capabilities. Automechanika Jakarta, a major automotive trade show, is set to debut in 2026 through a cooperation between Messe Frankfurt and the Indonesian Automotive Parts & Components Industries Association, creating an international platform for industry networking and supply chain expansion across Southeast Asia.

Government initiatives further reinforce this trajectory. ASEAN nations are implementing EV incentives and local content requirements that encourage vehicle assembly and parts manufacturing within the region, accelerating OEM investment and capacity building. In South Korea, authorities announced plans to boost EV subsidies in 2026 and expand policy finance support for automotive parts suppliers, helping firms navigate global tariff pressures and invest in component production. These policy frameworks and investment flows support strong regional vehicle output and enhance aftermarket ecosystems, including for mechanical control cables. Urbanization and rising vehicle ownership continue to broaden the vehicle parc, further extending replacement demand.

The global automotive control cables market structure is moderately consolidated, with leading players such as Yazaki Corporation, Sumitomo Electric, TI Automotive, HI?LEX Corporation, and Nexteer Automotive controlling a significant share of global revenue. These companies leverage strong OEM relationships and robust R&D capabilities to maintain leadership in cable design, durability, and high-volume production. Innovations include lightweight assemblies, corrosion-resistant coatings, and modular cable designs for passenger cars, two-wheelers, and commercial vehicles. Their scale and technical expertise allow rapid adoption of new materials and performance improvements. Long-term contracts with global OEMs reinforce their market dominance.

Regional and niche suppliers, including Ficosa International, Dura Automotive Systems, and Furukawa Electric, focus on specialized segments or geographic strongholds, such as light commercial vehicles or aftermarket solutions. Barriers such as OEM certification, high capital investment, and strict safety standards limit new entrants. Strategic collaborations, joint ventures, and acquisitions are enabling major players to expand technologically and geographically. Emerging software-enabled vehicle diagnostics and quality monitoring allow smaller suppliers to integrate into OEM supply chains. This dynamic ensures steady innovation while maintaining market concentration.

The global automotive control cables market is projected to reach US$ 6.2 billion in 2026.

Suring vehicle production, growing two-wheeler and light commercial vehicle demand, and ongoing replacement requirements for mechanical actuation systems are driving the market.

The market is poised to witness a CAGR of 4.1% from 2026 to 2033.

The expansion of two-wheeler and light commercial vehicle markets, aftermarket replacement demand, and localized manufacturing incentives are key opportunities.

Yazaki Corporation, Sumitomo Electric, TI Automotive, HI‑LEX Corporation, Nexteer Automotive, Dura Automotive Systems, and Ficosa International are some of the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Cable Type

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author